SQSAVE QUANTITATIVE AI ALGORITHMS DOING WELL IN THE CURRENT VOLATILITY

5 April 2025

Roller Coaster for Investment Markets

As we alluded to in our commentary dated 10th March 2025, markets were rocked by significant market volatility – now, further stoked by the announcement of new tariffs by the U.S. administration.

On the negative side:

▶ The S&P 500 declined by 5.8%, and the Nasdaq Composite fell 8.2% from February levels.

▶ Asian equities experienced significant outflows, the highest in at least 15 years. Japan's Nikkei 225 dropped sharply, closing near an eight-month low on March 31st.

▶ European markets (EURO STOXX 50) experienced a 3.8% decline in March.

On the positive side:

▶ Gold surged past $3,000 per ounce on March 14th and 17th, reflecting its safe-haven appeal.

▶ India's Sensex rose 6.3% in March, to chart a 5.34% gain for the fiscal year ending in March.

Market Risk Outlook

▶ The Cboe Volatility Index (VIX) surged to 26.5 on April 3rd, near historical bear markets.

SqSave Investment Performance

During increased volatility, SqSave algorithms manages portfolio Max Drawdown (click here to learn more). For traditional investment managers, this is tricky. You will have to grapple with massive information overload and human emotions of greed and fear – all in real time (read our SqSave Insight dated 9th Mar 2020). That’s why we designed SqSave to be quantitatively AI-driven.

With more than 5 years’ track record, SqSave can look back with confidence to the future.

The current situation reminds us quantitatively, of how SqSave’s algorithms managed the past global high-risk situations (before we knew about it) – as presented in our SqSave Insight articles below.

▶ 2020 (Shhh!!! My SqSave Portfolio Seems to Know Something About Gold- SqSave Insight dated 10th July 2020)

▶ 2022 (Compare Ai-Driven Vs Human-Driven Investment Decisions – SqSave Insight dated 28th Mar 2022).

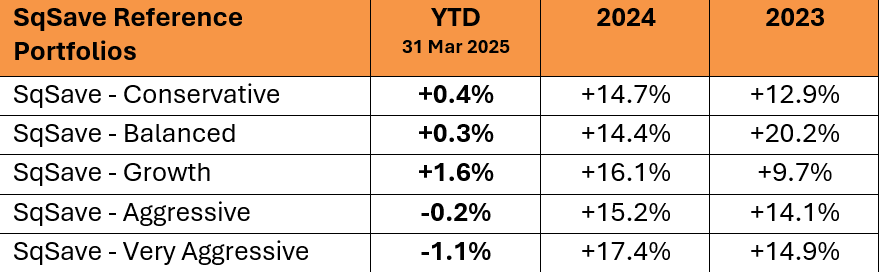

Our SqSave algorithms manages Max Drawdown – especially for the lower risk portfolios. This can be seen in our latest YTD 31st March 2025 returns for the lower risk portfolios, which are positive despite the heightened volatility.

As expected, our higher risk portfolios remain relatively more exposed to volatile assets compared to lower risk portfolios.

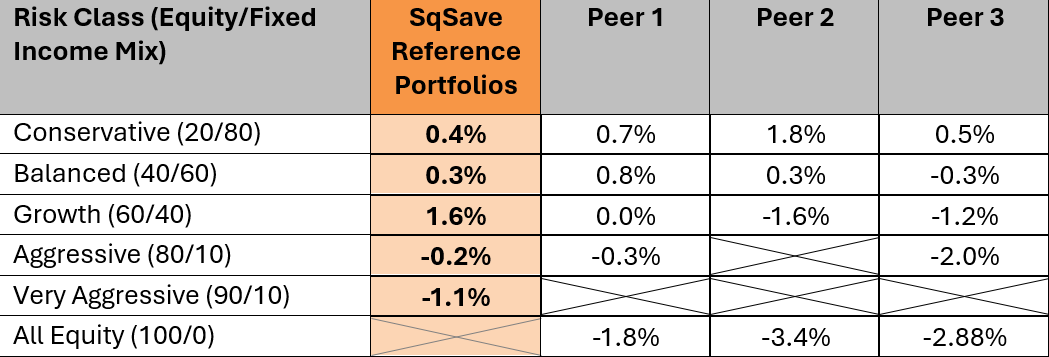

While we do not emphasise short term returns, it is worthy to note that SqSave has mostly outperformed the competitor peers’ corresponding portfolio risk classes that we track.

Outlook

The global investment landscape has entered a period of pronounced uncertainty, marked by the escalation of trade tensions.

In early April 2025, the U.S. administration announced sweeping tariffs, including a universal 10% tariff on all imports and higher rates for specific countries: 54% on Chinese goods, 24% on Japanese products, and 20% on European Union exports. These measures have raised the average U.S. tariff rate to 22.5%, the highest since 1909. China has vowed countermeasures, urging the U.S. to cancel the latest tariffs.

Impact:

▶ On April 3, 2025, major U.S. stock indices experienced their worst day since 2020, with the Dow Jones Industrial Average dropping nearly 1,700 points and the S&P 500 declining by almost 5%.

▶ Gold prices surged amid geopolitical tensions, reaching $3,089.58 per ounce on March 31, 2025.

▶ International supply chains face margin pressures due to increased costs.

▶ Yields may rise as inflationary pressures mount from higher consumer prices.

SqSave Automated Asset Allocation

Our SqSave algorithms are performing as designed, focused on diversification to manage volatility. SqSave portfolios have higher allocations to Gold and alternative assets, more than human investment managers typically do.

Our portfolios have performed relatively well versus traditional unit trust managers and our peers. See our Conservative and Very Aggressive allocations below:

At SqSave, our quantitative algorithms guide us forward, through measured diversification and a long-term perspective in navigating the current market environment. As we watch the tariff war unfold, stop letting greed and fear drive your investment decisions. It’s time you use our data driven SqSave AI investment approach.

Sincerely,

SqSave Investment Team

Disclaimer

The contents herein are intended for informational purposes only and do not constitute an offer to sell or the solicitation of any offer to buy or sell any securities to any person in any jurisdiction. No reliance should be placed on the information or opinions herein or accuracy or completeness, for any purpose whatsoever. No representation, warranty or undertaking, express or implied, is given as to the information or opinions herein or accuracy or completeness, and no liability is accepted as to the foregoing. Past performance is not necessarily indicative of future results. All investments carry risk and all investment decisions of an individual remain the responsibility of that individual. All investors are advised to fully understand all risks associated with any kind of investing they choose to do. Hypothetical or simulated performance is not indicative of future results. Unless specifically noted otherwise, all return examples provided in our websites and publications are based on hypothetical or simulated investing. We make no representations or warranties that any investor will, or is likely to, achieve profits similar to those shown, because hypothetical or simulated performance is not necessarily indicative of future results.

More Articles more

Stayed Focused While Riding The Current Volatility

Team SqSave

As seasoned investors know, volatility is the source of investment gains. But that’s only half the story. Volatility is also the source of investment losses.

Read more

Conservative Portfolio Delivers 14% Return, Outperforming Peers Over the Past Year

Team SqSave

Despite the usual market fluctuations, we at SqSave are pleased to announce that we have continued to outperform both our benchmarks and competitors over the past year.

Read more

2024: SQSAVE INVESTMENT RETURNS BEAT ITS PEERS

Team SqSave

We are happy to share that SqSave’s investment algorithms have outperformed in 2024, with three key observations outlined below.

Read more