2024: SQSAVE INVESTMENT RETURNS BEAT ITS PEERS

15 January 2025

We are happy to share that SqSave’s investment algorithms have outperformed in 2024, with three key observations outlined below.

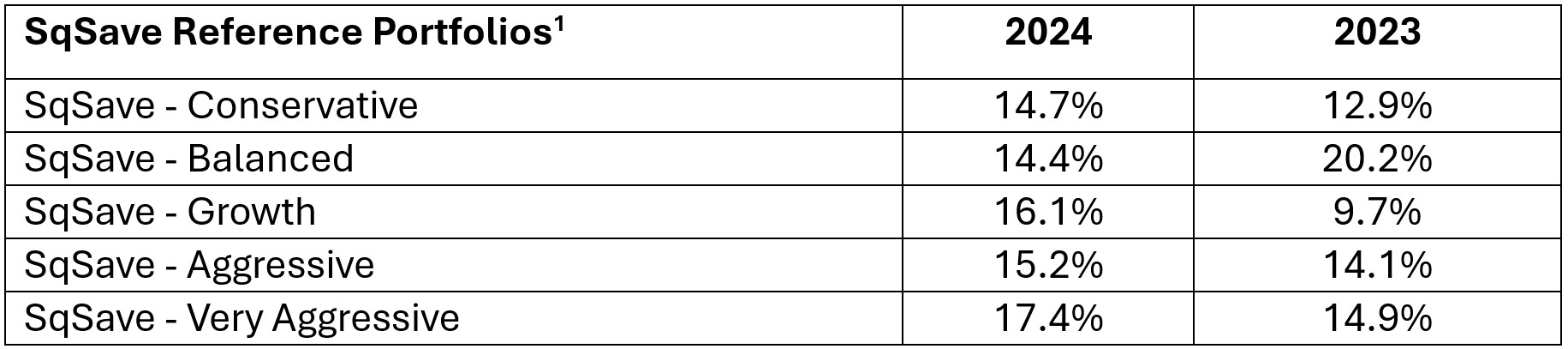

(1) SqSave Performed Well in 2024

For the calendar year ended 31 Dec 2024, all SqSave reference portfolios performed well, across all 5 risk categories – with annual returns ranging from 14% to over 17%.

1 Portfolio returns are inclusive of ETF expense ratios and net of SqSave management fees. SqSave uses AI to design and manage diversified investment portfolios for each investor. Because SqSave is not an investment fund, there is no single return measure. Instead, every SqSave investor has his/her own investment performance as each investor is managed separately by our SqSave AI. As investors can withdraw and top-up any time, investment returns will be affected by individual investor decisions. Hence, SqSave uses reference portfolios which are actual managed portfolios, without any withdrawals or top-ups interference, to measure investment performance.

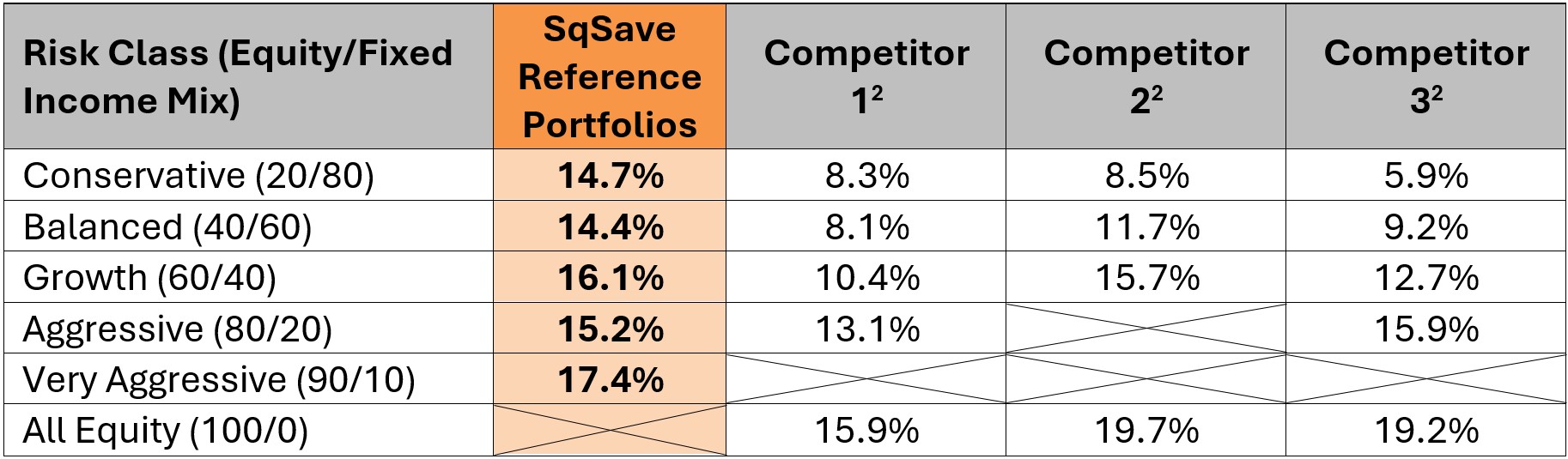

(2) SqSave Beat Almost Every Peer Competitor in 2024

For 2024, SqSave beat all its peer competitors – based on comparable risk categories.

2 Source: All returns are estimates compiled from external investments held

(3) SqSave Performing as Designed to Protect the Downside

Notably, SqSave did much better than its peer competitors for the lower risk portfolios. This reflects the strength of SqSave’s investment algorithm design.

Looking Ahead with Key Investment Lessons

- Investment Returns are derived from taking Investment Risks

At SqSave, we advocate true investing with a clear focus on the risk you want to take. - Adopt a longer time horizon: Markets go up and down. That’s inevitable. Our experience shows that true investing needs at least one year to ride out the markets’ normal fluctuations. Trying to squeeze returns in a short time is trading , not truly investing; where the aim is to ride out the inevitable risks that arise over time.

- Invest regularly: Do not time the markets. Invest even when the markets are down. Markets do eventually go up. Regular investing means you tend to buy low and sell high.

- Avoid human emotions: As a general guiding principle, most individuals inherently agree that investing must be objective. It should not be driven by greed and fear.

Market Outlook for 2025

After two fairly strong years of equity market returns, some recent choppiness has arisen in the new year. This is owing partly to a sharp runup in US Treasury bond yields leaving some investors anxious over near-term implications for equities. It also comes as some pundits view overall US equity valuations as stretched, though no strong historical context exists for an imminent mean reversion of equity valuations amidst such conditions.

While uncertainty prevails ahead of the start of the Trump 2.0 US presidency, US economic conditions remain relatively supportive of growth remaining near historical long-term trends for this year. As such we remain confident of our algorithm’s ability to offer opportunities for continued reasonable returns across all reference portfolio risk levels.

We designed SqSave using quantitative methods to address the above lessons. As a Singapore home-grown and MAS regulated investment fintech, our SqSave investment results speak for themselves. Join our data-driven investment community at SqSave.com, to reap similar benefits from our algorithmically derived and long-term oriented approach to investing.

Yours sincerely,

Investment Team

SqSave

SqSave.com is the regulated digital investment service operated by Pivot Fintech (201716150D) which holds a Capital Markets Services licence (CMS100806) regulated by the Monetary Authority of Singapore

Disclaimer

The contents herein are intended for informational purposes only and do not constitute an offer to sell or the solicitation of any offer to buy or sell any securities to any person in any jurisdiction. No reliance should be placed on the information or opinions herein or accuracy or completeness, for any purpose whatsoever. No representation, warranty or undertaking, express or implied, is given as to the information or opinions herein or accuracy or completeness, and no liability is accepted as to the foregoing. Past performance is not necessarily indicative of future results. All investments carry risk and all investment decisions of an individual remain the responsibility of that individual. All investors are advised to fully understand all risks associated with any kind of investing they choose to do. Hypothetical or simulated performance is not indicative of future results. Unless specifically noted otherwise, all return examples provided in our websites and publications are based on hypothetical or simulated investing. We make no representations or warranties that any investor will, or is likely to, achieve profits similar to those shown, because hypothetical or simulated performance is not necessarily indicative of future results.

More Articles more

Investment Outlook 2025

Team SqSave

SqSave’s reference portfolios demonstrated robust performance throughout 2024, consistently outperforming benchmarks and competitors across various portfolio categories.

Read more

November’s Performance: SqSave Algorithms Deliver Another Good Month

Team SqSave

September concluded with a recovery in returns across all risk categories for the SqSave reference portfolios.

Read more

Evolution of SqSave’s AI-Driven Strategy

Team SqSave

Over the past five years, our investment algorithm has undergone continuous improvement.

Read more