November’s Performance: SqSave Algorithms Deliver Another Good Month

5 December 2024

Overview

November was a standout month for SqSave GlobalSave Reference Portfolios, surpassing or closely matching both peers and benchmarks. This marks the second consecutive month of outperformance since transitioning to Model Development (MD)9 in August, following key algorithm updates.

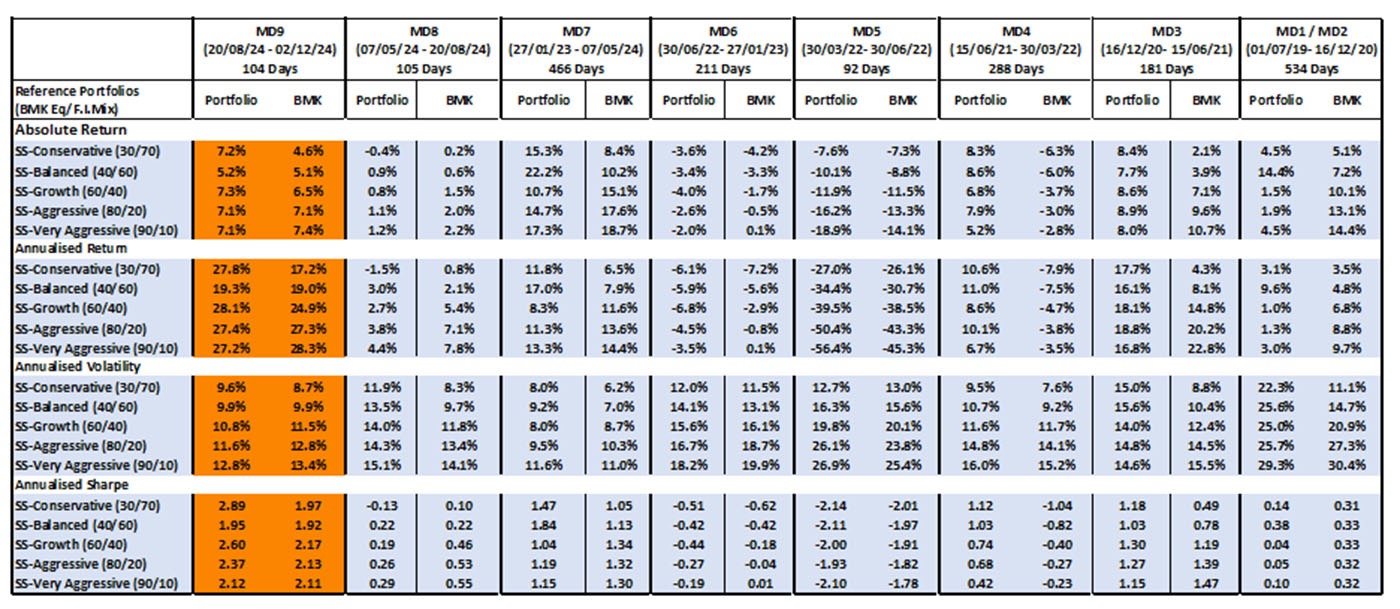

Evolving for Stronger Performance - Five Years, Nine Algorithm Upgrades

Since GlobalSave’s launch, we have rolled out 9 algorithm upgrades progressively to enhance risk adjusted returns. While earlier iterations were for all portfolio risk categories, recent changes were directed at improving our higher-risk portfolios. Our lower-risk portfolios (Conservative and Balanced) have delivered consistent outperformance from day one, with annualised returns of 6.4% and 7.2%, easily beating their benchmarks of 1.4% and 2.5%. These portfolios have also consistently outpaced their comparable peers, with minimal adjustments.

MD9 Update for Better Sharpe Ratios

Our August 2024 MD9 upgrade introduced precise upper limits for individual ETFs, improved portfolio control, and expanded investments into emerging markets and alternatives with evidence of strong long-term return potential.

Consistent Outperformance, Enhanced Sharpe Ratios

MD9 represents our most robust algorithm yet, surpassing earlier models (MD8 and prior) with stronger performance, better risk management, and greater efficiency. The results so far of this latest refinement, albeit still early, demonstrate SqSave’s continuous commitment to manage risk while delivering consistent long-term returns.

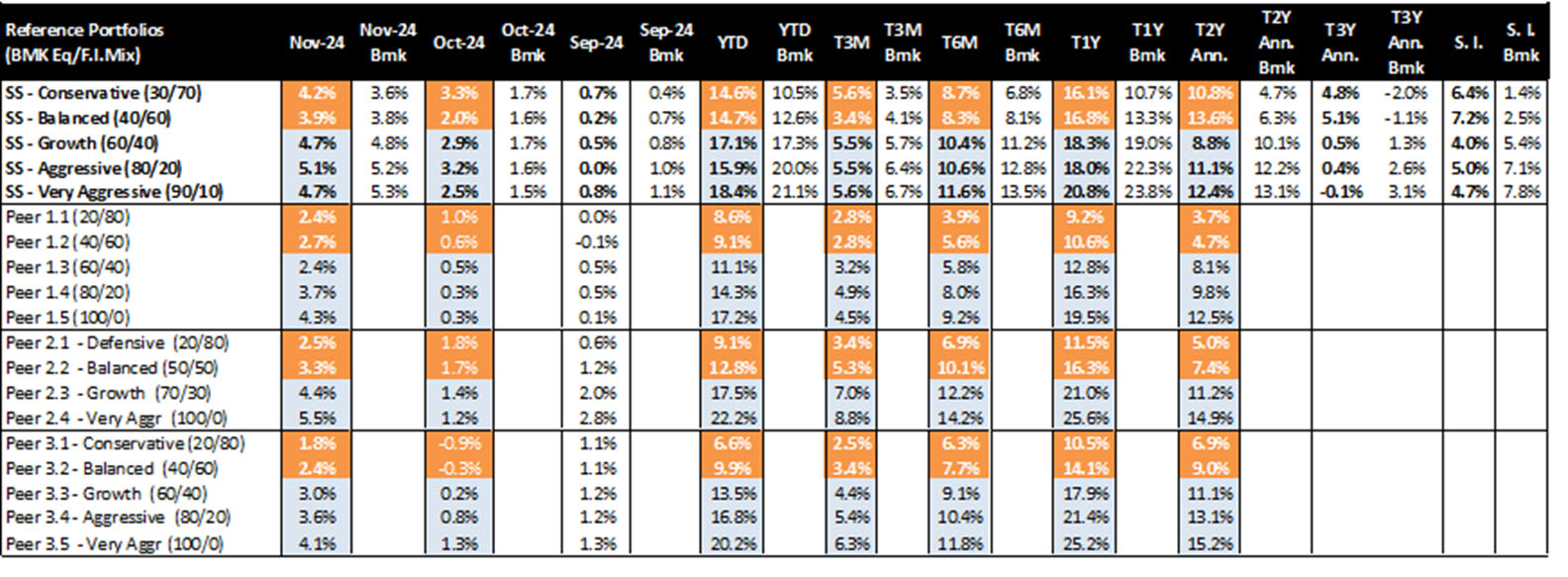

November Performance Highlights -Consistent Outperformance

In November, all our GlobalSave reference portfolios outperformed their peers, with one exception; our highest-risk portfolio vs. one comparable peer. This could be explained by our lower equity allocation vs. the peer (90% versus their 100%). Monthly returns for the GlobalSave Portfolios ranged from 3.9% to 5.1%.

Longer-Term Performance

See our latest revised Full Performance Table Below.

SqSave GlobalSave Reference Portfolio Returns (SGD terms as of 30 November 2024)

Note:

1. Portfolio returns are inclusive of ETF expense ratios and net of SqSave management fees. SqSave uses AI to design and manage diversified investment portfolios for each investor. Because SqSave is not an investment fund, there is no single return measure. Instead, every SqSave investor has his/her own investment performance as each investor is managed separately by our SqSave AI. As investors can withdraw and top-up any time, investment returns will be affected by individual investor decisions. Hence, SqSave uses reference portfolios which are actual portfolios managed on an ongoing basis, without any interference with withdrawals or top-ups, to measure investment performance.

2. Performance numbers for peers are estimates.

3. Abbreviations: SS: SqSave, Bmk: Benchmark, Eq: Equity, F.I.: Fixed Income, YTD: Year-to-Date, Ann: Annualised, S.I.: Since Inception (data reflects performance since July 2019). T3M, T6M, T1Y, T2Y, and T3Y denote three-month, six-month, one-year, two-year, and three-year terms, respectively.

Key Drivers of Success - Energy, Tech, Gold, and FX

This month’s strong performance was mainly driven by key sectors, including Energy, Technology, Gold, and Foreign Exchange (FX).

Looking Ahead - Adapting to Changing Market Conditions

Following recent dynamic shifts in ETF weights, particularly after Trump’s victory in the U.S. Presidential Election, the algorithm continues to favour a tilt into positions benefiting from a stronger USD (i.e. WisdomTree USD Bullish Fund -USDU).

For our tailored reference portfolios (i.e. those created by SqSave clients with an assumed initial minimum investment of SGD15,000) our algorithm is also indicating slight reductions to gold and silver exposure while increasing allocations to floating-rate bonds and short-term treasuries.

These strategic moves may reflect the algorithm’s data-driven approach, anticipating a stronger U.S. economy and potential changes in monetary policy that could lead to higher bond yields. The reduced emphasis on gold and silver signals an aim to mitigate the impact of a stronger dollar, while the increased focus on floating-rate bonds hints at protection against possible rising yields across both short and longer-term maturing US Treasury bonds. With these shifts in mind, we remain confident that our data-driven strategies will continue to yield positive outcomes in the months ahead.

This Christmas - Grow Your Money

As Christmas approaches, give yourself and your loved ones the ultimate gift—financial growth, just in time for the season.

Invest more into your GlobalSave Portfolios and you may watch your wealth grow while celebrating.

For those seeking a more stable fixed deposit-like return option, our SqSave MoneyBox offers a minimum 4.5% p.a. return leading up to Christmas and into the new year!

Don’t miss out! Start your journey to a memorable Christmas now!

Yours sincerely

Investment Team

SqSave

SqSave.com is the regulated digital investment service operated by Pivot Fintech (201716150D) which holds a Capital Markets Services licence (CMS100806) regulated by the Monetary Authority of Singapore

Disclaimer

The contents herein are intended for informational purposes only and do not constitute an offer to sell or the solicitation of any offer to buy or sell any securities to any person in any jurisdiction. No reliance should be placed on the information or opinions herein or accuracy or completeness, for any purpose whatsoever. No representation, warranty or undertaking, express or implied, is given as to the information or opinions herein or accuracy or completeness, and no liability is accepted as to the foregoing. Past performance is not necessarily indicative of future results. All investments carry risk and all investment decisions of an individual remain the responsibility of that individual. All investors are advised to fully understand all risks associated with any kind of investing they choose to do. Hypothetical or simulated performance is not indicative of future results. Unless specifically noted otherwise, all return examples provided in our websites and publications are based on hypothetical or simulated investing. We make no representations or warranties that any investor will, or is likely to, achieve profits similar to those shown, because hypothetical or simulated performance is not necessarily indicative of future results.

More Articles more

Evolution of SqSave’s AI-Driven Strategy

Team SqSave

Over the past five years, our investment algorithm has undergone continuous improvement.

Read more

SqSave Algorithms have Outperformed Despite US Election Uncertainty

Team SqSave

Despite the uncertainty over the US election outcome, and the escalating wars in the Middle East and Ukraine, our SqSave Reference Portfolios have beaten our reference benchmarks and outperformed the tracked competitors in October 2024.

Read more

September Rebound: Fed's Influence Prevails

Team SqSave

September concluded with a recovery in returns across all risk categories for the SqSave reference portfolios.

Read more