SqSave Algorithms have Outperformed Despite US Election Uncertainty

4 November 2024

Overview

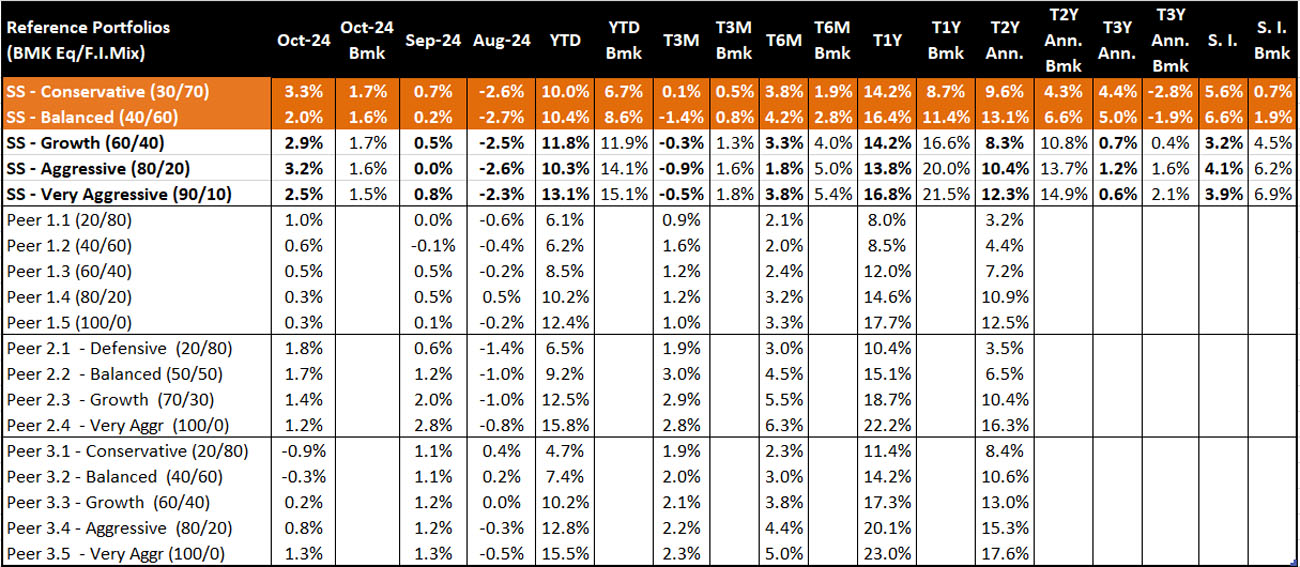

Despite the uncertainty over the US election outcome, and the escalating wars in the Middle East and Ukraine, our SqSave Reference Portfolios have beaten our reference benchmarks and outperformed the tracked competitors in October 2024.

SqSave Reference Portfolio Returns (SGD terms as of 31 October 2024)

Note:

1. Portfolio returns are inclusive of ETF expense ratios and net of SqSave management fees. SqSave uses AI to design and manage diversified investment portfolios for each investor. Because SqSave is not an investment fund, there is no single return measure. Instead, every SqSave investor has his/her own investment performance as each investor is managed separately by our SqSave AI. As investors can withdraw and top-up any time, investment returns will be affected by individual investor decisions. Hence, SqSave uses reference portfolios which are actual portfolios managed on an ongoing basis, without any interference with withdrawals or top-ups, to measure investment performance.

2. Performance numbers for peers are estimates.

3. Abbreviations: SS: SqSave, Bmk: Benchmark, Eq: Equity, F.I.: Fixed Income, YTD: Year-to-Date, Ann: Annualised, S.I.: Since Inception (data reflects performance since July 2019). T3M, T6M, T1Y, T2Y, and T3Y denote three-month, six-month, one-year, two-year, and three-year terms, respectively.

Performance Highlights for October

In October, our Conservative, Growth, and Aggressive Reference Portfolios each delivered exceptional returns of +2.9% or above.

The Conservative Reference Portfolio led with a remarkable +3.3% return, significantly outperforming our benchmark of 1.7%. Similarly, the Aggressive Reference Portfolio achieved a strong return of +3.2%., while the Growth Reference Portfolio posted +2.9%., both exceeding their respective benchmarks of 1.6% and 1.7%. Meanwhile, the Balanced and Very Aggressive Reference Portfolios also performed well, with returns of +2.0% and +2.5% respectively, both comfortably surpassing their benchmarks of 1.6% and 1.5% respectively.

Key Drivers of Success

This month’s performance was bolstered by three primary drivers: Gold, Technology, and Foreign Exchange (FX).

Peer Performance Analysis

In contrast, our Peer Portfolios significantly lagged this month, with Peer 3.1 recording the worst performance at -1.9%. Even the best-performing Peer 2.1 managed only +1.8%, notably lower than our lowest-performing Balanced Portfolio's +2.0% return for the month. We remain assured of our investment algorithms which differentiate SqSave from our competitors.

Conservative & Balanced Reference Portfolios

Our lower-risk Reference Portfolios continue to be our star performers, consistently beating benchmarks and peers in both short term and long term. Since 2019, the Conservative and Balanced Reference Portfolios have delivered impressive annualized returns of +5.6% and +6.6%, respectively. These returns substantially outperform the benchmarks of annualized 0.7% and 1.9%, respectively.

Data available for up to 2 years show that our lower-risk Reference Portfolios significantly outperform our peers. Over this period, our Conservative and Balanced Reference Portfolios achieved impressive annualized returns of +10% and +13%, respectively. In contrast, peer portfolios averaged annualized returns of +3% and +6%, except for Peer 3, which recorded returns of +8% and +11%. These results underscore the effectiveness of our differentiated algorithms’ approach to risk management and portfolio construction.

High-Risk Reference Portfolios Exhibit Remarkable Resilience

While the higher-risk portfolios have modestly underperformed the peers and benchmarks over the longer term, we have made significant enhancements to the algorithms. We are encouraged by October’s results with the high-risk portfolios outperforming both benchmarks and peers. For detailed information, please refer to the table at the beginning of this article.

Looking Ahead

Despite the highly uncertain US presidential election campaign, market sentiment remains cautiously optimistic. We believe that past Election Day, there will be more clarity and investor confidence. With the widely anticipated US Fed modest 0.25% rate cut, and lower rates for the foreseeable future, the probability of good investment returns and market stability is high.

However, the risks ahead include whether there is general acceptance of the US election results, the risk of intensifying global conflicts, and the unsustainable US debt problem.

As our SqSave algorithms have proven, they continue to perform well in crisis. We remain optimistic about the future and are confident that our strategic approach will continue to yield positive outcomes in the months ahead.

Conclusion

With the holidays approaching, there's no better time to invest in your future and potentially win rewards that could brighten the season for you and your loved ones. Don’t wait! Your path to a memorable holiday starts here!

Yours sincerely

Investment Team

SqSave

SqSave.com is the regulated digital investment service operated by Pivot Fintech (201716150D) which holds a Capital Markets Services licence (CMS100806) regulated by the Monetary Authority of Singapore

Disclaimer

The contents herein are intended for informational purposes only and do not constitute an offer to sell or the solicitation of any offer to buy or sell any securities to any person in any jurisdiction. No reliance should be placed on the information or opinions herein or accuracy or completeness, for any purpose whatsoever. No representation, warranty or undertaking, express or implied, is given as to the information or opinions herein or accuracy or completeness, and no liability is accepted as to the foregoing. Past performance is not necessarily indicative of future results. All investments carry risk and all investment decisions of an individual remain the responsibility of that individual. All investors are advised to fully understand all risks associated with any kind of investing they choose to do. Hypothetical or simulated performance is not indicative of future results. Unless specifically noted otherwise, all return examples provided in our websites and publications are based on hypothetical or simulated investing. We make no representations or warranties that any investor will, or is likely to, achieve profits similar to those shown, because hypothetical or simulated performance is not necessarily indicative of future results.

More Articles more

September Rebound: Fed's Influence Prevails

Team SqSave

September concluded with a recovery in returns across all risk categories for the SqSave reference portfolios.

Read more

Seize the Investment Opportunity as Interest Rates Soften

Team SqSave

In our 8th Aug 2024 feature article “Now is the Time for Hard-Headed Investing”, we advocated the need to remove emotions from investing.

Read more

August Market Storm: Yen Carry Trade, AI Corrections, and Recession Fears

Team SqSave

August unfolded with a dramatic market sell-off, beginning with the Market Fallout on August 5th, when Japan’s Nikkei 225 tumbled by 12.4%, triggering sharp declines across most other global equity markets.

Read more