Seize the Investment Opportunity as Interest Rates Soften

19 September 2024

In our 8th Aug 2024 feature article “Now is the Time for Hard-Headed Investing”, we advocated the need to remove emotions from investing. Our data-driven analysis shows that market crashes or corrections typically recover with positive returns within 12 to 36 months.

August Market Turmoil: Global Equity Sell-Off and a Spike in Volatility (VIX)

August was a turbulent month for investors. Disappointing US economic data, coupled with Japan’s interest rate hike by its hawkish central bank, triggered a sudden unwinding of the carry trade, where cheap Japanese yen borrowing is used to purchase higher-yielding assets. US manufacturing data for July fell well below expectations, while the jobs report showed the smallest payroll increase in over three years.

The 3-month moving average of the unemployment rate exceeded its lowest level from the prior 12 months, triggering the Sahm rule of thumb, which suggested a looming US recession.

By the end of August 2024, further disappointing data helped fuel market rebounds, driven by expectations of policy easing from the US Federal Reserve (Fed).

Such is the fickle market sentiment in the short term! The lesson is to navigate with a medium to longer term investment time horizon. Avoid emotion and timing the markets.

Expect a Peak in Interest Rates

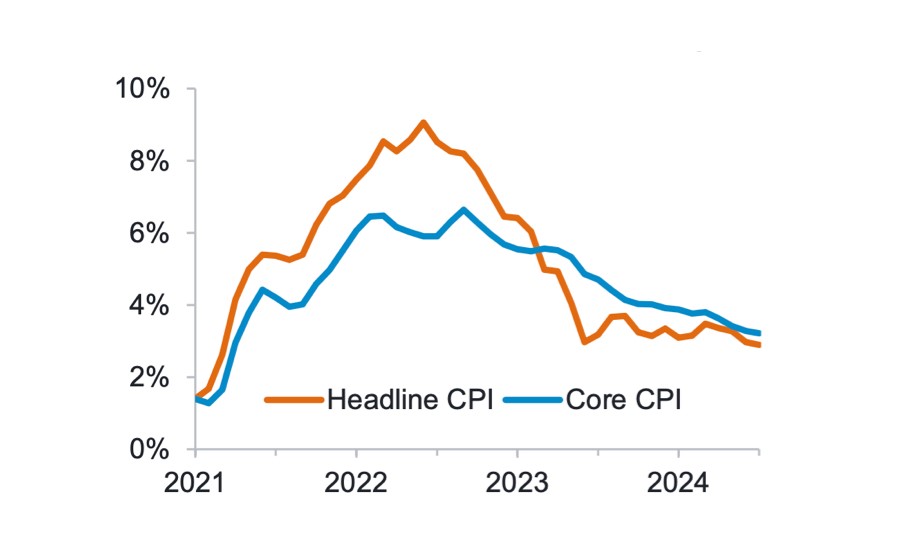

Looking ahead, corporate fundamentals remain strong. Fears about a US recession appear exaggerated. US GDP growth is slowing while inflation is retreating, falling below 3% for the first time since March 2021.

Against this backdrop, it makes sense why the Fed initiated its first Fed Funds rate cut since 2020 at the just held September Federal Open Market Committee (FOMC) meeting , boosting earnings prospects and supporting equities as a key asset class.

In conjunction with this move, the US Dollar may continue to weaken in the months ahead unless geopolitical risks ramp up. Ahead of potential volatility from the November US elections, gold continues to be a way to diversify for our global-centric investment approach.

In early September 2023, the European Central Bank (ECB) cut rates again as inflation in the Euro area eased.

China has been cutting rates in response to weak consumer demand, excess production capacity, and deflation. While exports remain strong, any signs of weakness pose a potential risk. Though China’s battered equity valuations are relatively low, the tough macro-outlook favours developed market equities and other emerging markets.

Invest Smarter with a Medium to Longer Term Investment Time Horizon

In conclusion, the loosening of interest rates offers you a good opportunity to invest. However, we advise a hardheaded data approach without human emotion. Most importantly, investment is not gambling or speculating. You need to take a medium to long-term time horizon of at least one year to ride out the fickle market ups and downs.

At SqSave, we take a data-driven approach to global asset allocation using our medium to long-term proprietary quant-AI methods. Experience the world of smart investing using our technology that allows anyone, anywhere and anytime to start, with as little as one dollar!

Yours sincerely

SqSave Investment Team

Investment Brand of PIVOT Fintech Pte. Ltd. (UEN 201716150D)

Monetary Authority of Singapore, Capital Markets Services Licence (CMS100806)

SqSave is the regulated digital investment service operated by Pivot Fintech – a Licenced Fund Management Company regulated by the Monetary Authority of Singapore.

Disclaimer

The contents herein are intended for informational purposes only and do not constitute an offer to sell or the solicitation of any offer to buy or sell any securities to any person in any jurisdiction. No reliance should be placed on the information or opinions herein or accuracy or completeness, for any purpose whatsoever. No representation, warranty or undertaking, express or implied, is given as to the information or opinions herein or accuracy or completeness, and no liability is accepted as to the foregoing. Past performance is not necessarily indicative of future results. All investments carry risk and all investment decisions of an individual remain the responsibility of that individual. All investors are advised to fully understand all risks associated with any kind of investing they choose to do. Hypothetical or simulated performance is not indicative of future results. Unless specifically noted otherwise, all return examples provided in our websites and publications are based on hypothetical or simulated investing. We make no representations or warranties that any investor will, or is likely to, achieve profits similar to those shown, because hypothetical or simulated performance is not necessarily indicative of future results.

More Articles more

August Market Storm: Yen Carry Trade, AI Corrections, and Recession Fears

Team SqSave

August unfolded with a dramatic market sell-off, beginning with the Market Fallout on August 5th, when Japan’s Nikkei 225 tumbled by 12.4%, triggering sharp declines across most other global equity markets.

Read more

NOW IS THE TIME FOR HARD-HEADED INVESTING!

Team SqSave

On August 5, 2024, Japan's stock market plummeted over 12%—its biggest single-day decline since the infamous October 20, 1987, "Black Monday" global stock market crash.

Read more

From Fed Decisions to Tech Earnings: The Ripple Effect on Wall Street

Team SqSave

July has demonstrated the ripple effects of major financial events on the stock market, highlighted by the Federal Reserve's interest-rate decision and earnings results from major tech companies in the "Magnificent Seven."

Read more