NOW IS THE TIME FOR HARD-HEADED INVESTING

8 August 2024

GLOBAL MARKET VOLATILITY SPIKES AMIDST RENEWED UNCERTAINTY

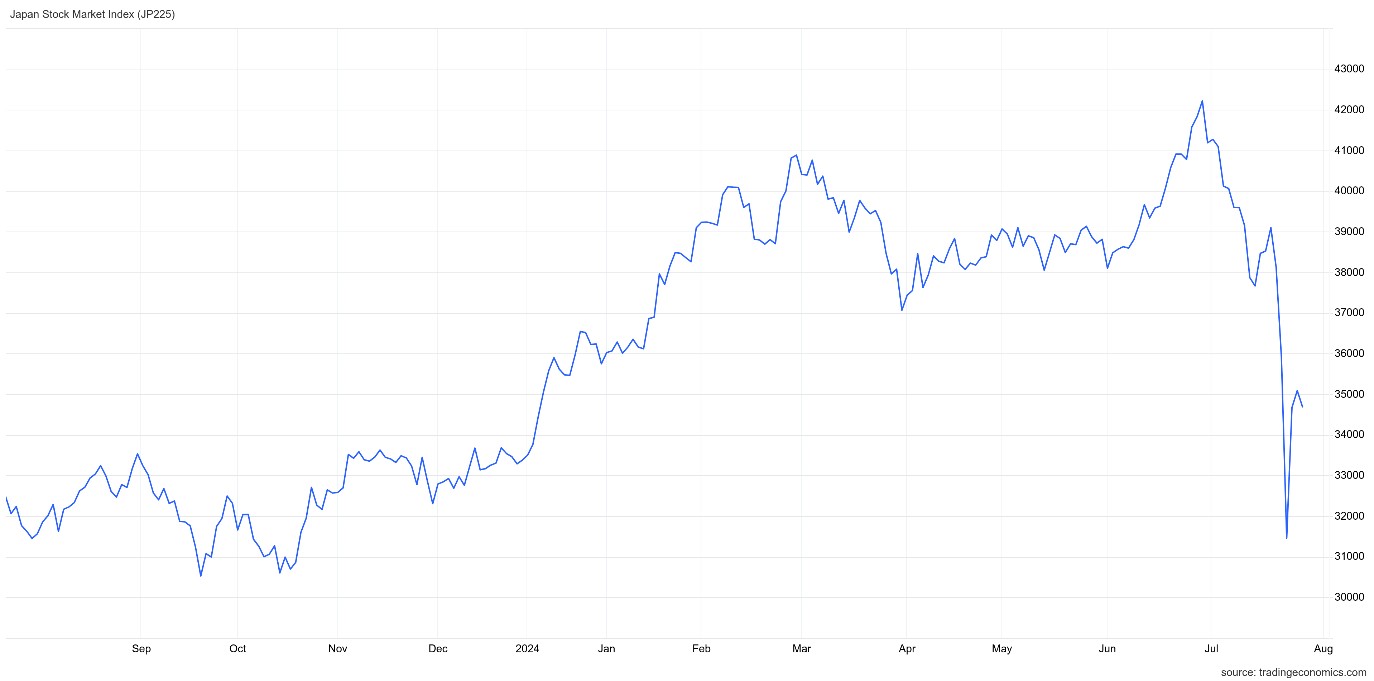

On August 5, 2024, Japan's stock market plummeted over 12%—its biggest single-day decline since the infamous October 20, 1987, "Black Monday" global stock market crash. Unsurprisingly, this Japanese stock market rout caused ripples across world stock markets, bursting the AI hype and sending the USA Nasdaq into a sharp correction.

As of now, we are still watching events unfold. However, it is timely to guide our investors on how to separate volatile emotion from hard-headed investing.

What can you do to manage your investing during rising risks?

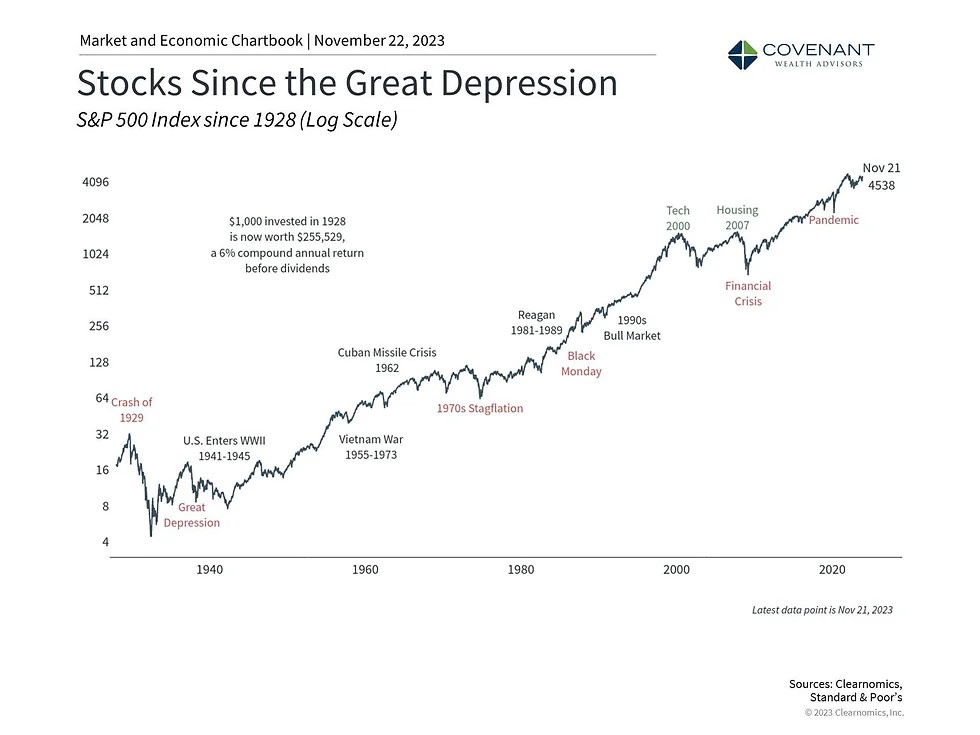

Market crashes and turning points are difficult to predict. Based on our quantitative research, every market crash or correction is followed by recovery and positive returns within 12 to 36 months

Hence, the ability to ride out such volatility is essential. Diversification is also paramount. But how?

Avoid Timing the Markets

Investing requires understanding longer-term trends. Data shows that taking a 1-year to a 3-year time horizon in investing helps avoid the mistake of "Buy high, sell low."Invest Regularly with Discipline

Our data shows that market crashes and corrections allow us to invest when prices are low. With an unemotional approach to investing, you are likely to "Buy low, sell high”.Diversify

It’s hard to diversify if you cannot keep up with global markets 24/7.Money Not Enough

It’s also hard to diversify when you don’t have millions of dollars to spread across safe and risky assets.Cash is an Asset

Holding cash is an option, but the returns are not likely to beat inflation.Avoid Investing with Borrowed Money

Doing so multiplies your losses when markets fall, leading to a likely "Buy high, sell low" outcome forced upon you by large, unexpected market falls. Many investors have been burned after being lured into opening stock trading accounts with margin lending.

At SqSave:

Avoid Timing the Markets

Just deposit your monies, and SqSave’s automated investing algorithms will do their work, whether markets are rising or falling. Invest when markets are down.Invest Regularly with Discipline

Our SqSave algorithms have no emotions. Deposit monies into your SqSave account anytime 24/7. Better still, set up internet banking instructions to deposit regularly into your chosen SqSave risk-managed portfolio.Diversify

Our SqSave algorithms never sleep, even as markets open and close from Japan to the USA. Our quantitative data-driven approach can make millions of calculations per second. That’s why we call it artificial intelligence.Money Not Enough? Solved!

SqSave’s quantitative engine offers a globally diversified portfolio from ONE Dollar! That’s priced less than a cup of kopi at our coffeeshop!Cash is an Asset

SqSave knows that some prefer cash investing like our MoneyBox which currently offers an attractive 5% p.a. promotional return (T&Cs apply).Avoid Investing with Borrowed Money

At SqSave, your investment portfolios have no complex products and do not use margin techniques. Just pure cash investing.

Invest with SqSave and sleep better for the long term!

Yours sincerely

SqSave Investment Team

Investment Brand of PIVOT Fintech Pte. Ltd. (UEN 201716150D)

Monetary Authority of Singapore, Capital Markets Services Licence (CMS100806)

SqSave is the regulated digital investment service operated by Pivot Fintech – a Licenced Fund Management Company regulated by the Monetary Authority of Singapore.

Disclaimer

The contents herein are intended for informational purposes only and do not constitute an offer to sell or the solicitation of any offer to buy or sell any securities to any person in any jurisdiction. No reliance should be placed on the information or opinions herein or accuracy or completeness, for any purpose whatsoever. No representation, warranty or undertaking, express or implied, is given as to the information or opinions herein or accuracy or completeness, and no liability is accepted as to the foregoing. Past performance is not necessarily indicative of future results. All investments carry risk and all investment decisions of an individual remain the responsibility of that individual. All investors are advised to fully understand all risks associated with any kind of investing they choose to do. Hypothetical or simulated performance is not indicative of future results. Unless specifically noted otherwise, all return examples provided in our websites and publications are based on hypothetical or simulated investing. We make no representations or warranties that any investor will, or is likely to, achieve profits similar to those shown, because hypothetical or simulated performance is not necessarily indicative of future results.

More Articles more

From Fed Decisions to Tech Earnings: The Ripple Effect on Wall Street

Team SqSave

July has demonstrated the ripple effects of major financial events on the stock market, highlighted by the Federal Reserve's interest-rate decision and earnings results from major tech companies in the "Magnificent Seven."

Read more

RE-ASSESSING RISKS AHEAD OF THE 2024 USA PRESIDENTIAL ELECTION

Team SqSave

We entered 2024 knowing that elections form the key global theme. Half the world’s population will go to the polls. What will it mean for investors?

Read more

STRONG & CONSISTENT SMART BETA INVESTMENT PERFORMANCE

Team SqSave

In June 2024, all our SqSave reference portfolios (“portfolios”) beat their underlying benchmarks and referenced peers after we aligned our higher risk portfolio quantitative algorithms closer to our highly successful lower-risk algorithms.

Read more