STRONG & CONSISTENT SMART BETA INVESTMENT PERFORMANCE

13% One-Year Return for Conservative Portfolio!

2 July 2024

Latest Strong Monthly Investment Performance Proving Algorithm Effectiveness

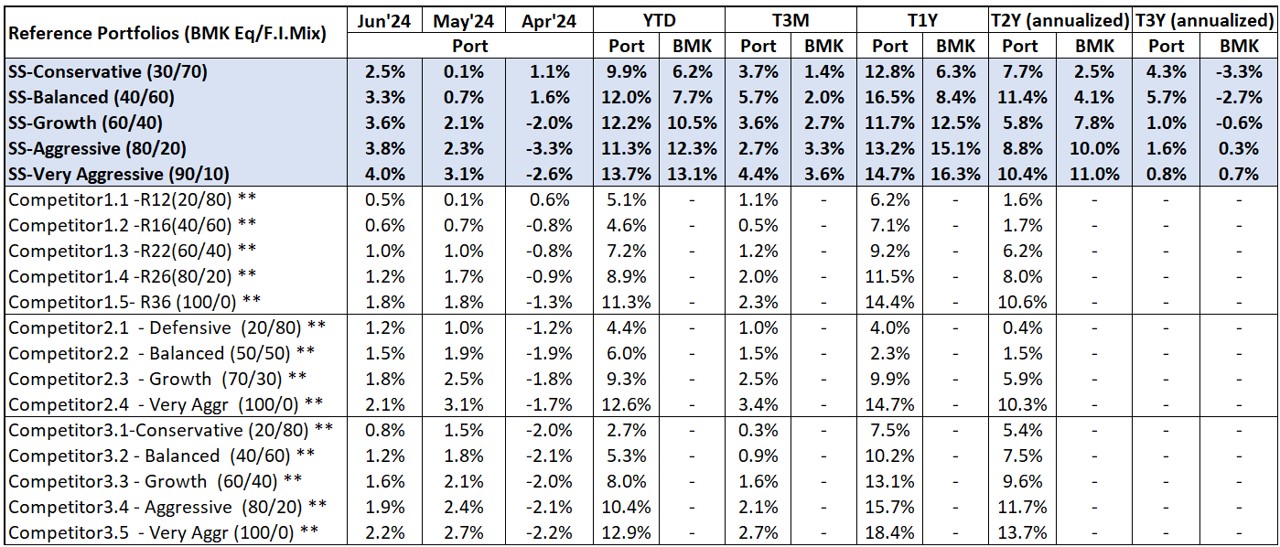

In June 2024, all our SqSave reference portfolios (“portfolios”) beat their underlying benchmarks and referenced peers after we aligned our higher risk portfolio quantitative algorithms closer to our highly successful lower-risk algorithms. During April to June 2024, the same portfolios also beat both peers and benchmarks.

SqSave Reference Portfolios Returns (SGD terms as of 30 Jun 2024)*

*Inclusive of ETF expense ratios and net of SqSave management fees. SqSave uses AI to design and manage diversified investment portfolios for each investor. Because SqSave is not an investment fund, there is no single return measure. Instead, every SqSave investor has his/her own investment performance as each investor is managed separately by our SqSave AI. As investors can withdraw and top-up any time, investment returns will be affected by individual investor decisions. Hence, SqSave uses reference portfolios which are actual portfolios managed on an ongoing basis, without any interference with withdrawals or top-ups, to measure investment performance.

** Performance numbers for peers are estimates. Abbreviations: BMK: Benchmark, Port: Portfolio, Eq: Equity and F.I.: Fixed Income.

YTD Performance Beat All Tracked Peers

For Jan to Jun 2024, all our SqSave portfolios beat all referenced peers. We achieved this significantly for our two lowest-risk Conservative and Balanced portfolios. This is on top of an outstanding quantitative investment performance in 2023.

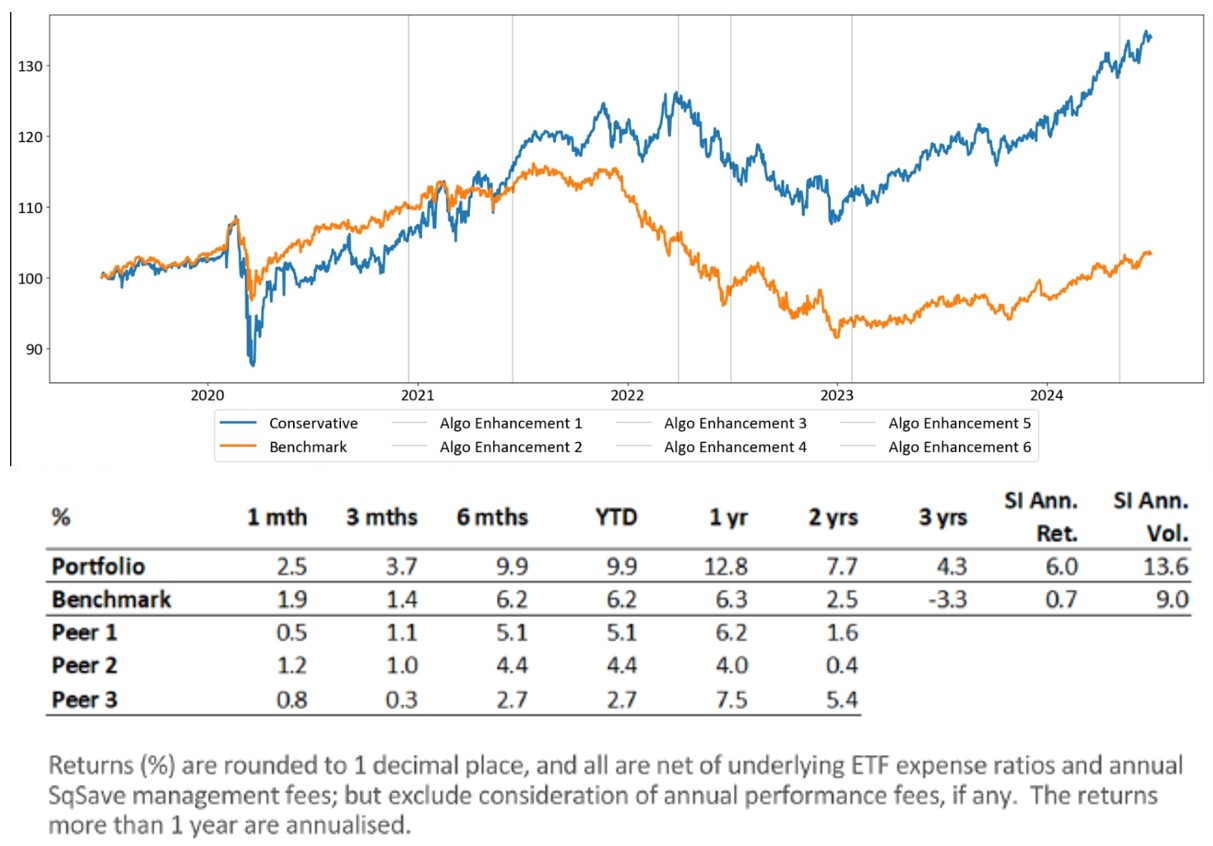

Conservative Portfolio 1-Year Returns at 13%, Twice the Rate of Peers

Our peers averaged 6% return for the trailing 1-year period, much lower than our Conservative portfolio which achieved 13%. We attribute this to our lower-risk algorithms managing drawdowns as designed. We have been observing the insights generated by our algorithms which taught us quite a bit in hindsight about human emotions versus disciplined and unbiased smart beta investing.

Click here for more details about the Conservative portfolio.

Performance (%) Over Past 5 Years to 30 Jun 2024

Outperformed over 3-Year Time Horizon

All 5 SqSave portfolios outperformed benchmarks across three years, underscoring the sustained long-term design of our quantitative investment approach.

Looking Forward

Our algorithms have done well in past actual market events, notably during Covid and ahead of the Russian invasion As the only digital peer to publish our investment performance monthly, we will continue our disciplined smart-beta quantitative approach for unbiased and consistent asset allocation.

SqSave - Your Trusted Investment Partner

The problem is “people say they invest but are mostly gambling”. Login for an unbiased and disciplined quantitative AI-driven investment journey. It’s time you enjoy SqSave.com – Smart Investing for Anyone, Anywhere, Anytime!

Yours sincerely

Victor Lye, BBM CFA CFP

Founder & CEO, Pivot Fintech

SqSave is the regulated digital investment service operated by Pivot Fintech – a Licenced Fund Management Company regulated by the Monetary Authority of Singapore.

Disclaimer

The contents herein are intended for informational purposes only and do not constitute an offer to sell or the solicitation of any offer to buy or sell any securities to any person in any jurisdiction. No reliance should be placed on the information or opinions herein or accuracy or completeness, for any purpose whatsoever. No representation, warranty or undertaking, express or implied, is given as to the information or opinions herein or accuracy or completeness, and no liability is accepted as to the foregoing. Past performance is not necessarily indicative of future results. All investments carry risk and all investment decisions of an individual remain the responsibility of that individual. All investors are advised to fully understand all risks associated with any kind of investing they choose to do. Hypothetical or simulated performance is not indicative of future results. Unless specifically noted otherwise, all return examples provided in our websites and publications are based on hypothetical or simulated investing. We make no representations or warranties that any investor will, or is likely to, achieve profits similar to those shown, because hypothetical or simulated performance is not necessarily indicative of future results.

More Articles more

Warren Buffett Likes ETFs not Unit Trusts — And So Should You!

Team SqSave

When Warren Buffett, arguably the most successful investor in history, speaks, smart investors listen. Buffett's investment wisdom is legendary, and he has consistently outperformed the market for many years during his investment career.

Read more

S&P500 Hits Record High…“Sell in May & Go Away”? We Don’t Think So!

Team SqSave

The S&P 500 has maintained its strong momentum into May 2024, continuously breaking new highs. By end-May, the S&P 500 achieved an impressive 11% return, a performance level typically expected over an entire year.

Read more

Algorithmic Adjustments Showing Early Signs of Efficacy

Team SqSave

In May, we made strategic adjustments to the algorithms for our higher risk portfolios.

Read more