S&P500 Hits Record High…“Sell in May & Go Away”? We Don’t Think So!

8 June 2024

The S&P 500 has maintained its strong momentum into May 2024, continuously breaking new highs. By end-May, the S&P 500 achieved an impressive 11% return, a performance level typically expected over an entire year.

Should we heed the popular saying among investors: "Sell in May and Go Away"? This adage claims that the stock market tends to underperform in May, and investors should exit the market.

Let us share our insights. The current May 2024 market dynamics is unique. The S&P 500's continuous ascent is driven by AI-related technological advancements and better-than-expected economic indicators. Hence, we believe this folklore adage might not be the best approach this year.

With elevated markets, investors are understandably concerned about whether it might be time to sell off investments and secure gains before potential downturns. Afterall, the stock market can be volatile. Not long ago in 2022, fears of a prolonged bear market took centre stage as the S&P 500 tumbled 19% that year.

Debunking the "Sell in May" Adage

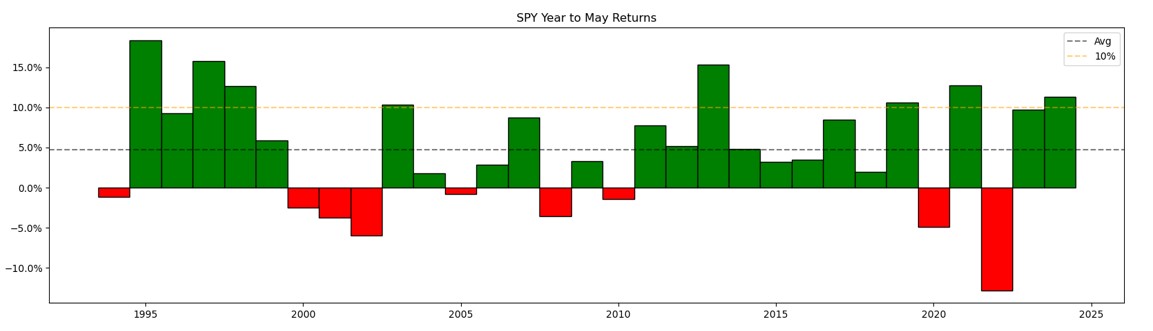

To be objective about the "Sell in May" adage, we examine the S&P 500's performance over more than 30 years (shown below).

Source: Yahoo Finance

An in-depth analysis reveals that the average percentage change to the end of May over these 31 years is approximately 4.68%. This figure alone challenges the validity of the "Sell in May" adage. We share four key observations:

1) Consistent Positive Returns

The average 4.68% return suggests that the market has generally performed well by the end of May. This contradicts the "Sell in May" adage.

2) Significant Gains

There have been eight years with returns exceeding 10% by the end of in May. For instance, 1995 (+18%), 1997 (+16%), 2013 (+15%), and 2021 (+13%) illustrate that significant profits can be realized during this period, challenging the rationale for exiting the market.

3) Negative Outliers vs Longer-Term Upward Trend

While some years, like 2002 (-6%) and 2022 (-13%), show negative returns, these are outliers rather than the norm. The overall trend remains positive, indicating that the market's long-term growth potential outweighs short-term fluctuations.

4) Long-Term Investment Perspective

The data reinforces that staying invested is more advantageous than attempting to time the market based on seasonal trends. The "Sell in May" adage fails to account for broader economic factors and market dynamics, which often drive growth regardless of the season.

Managing Risks and Staying Invested

Understandably, investors may feel anxious about whether it is time to lock in gains amid the market's elevated levels. The inherent volatility of the stock market makes such decisions challenging. For those concerned about market risks, diversifying investments through a portfolio of ETFs that encompass fixed income, equity, and alternative assets is a prudent strategy. This is where SqSave GlobalSave portfolios come into play. Our AI-driven Investment approach helps mitigate the risks associated with individual investments while maintaining broad market exposure.

Final Thoughts

While market fluctuations are inevitable and predicting short-term movements is demanding, historical data shows that staying invested over the long term typically proves more beneficial than attempting to time the market. The robust performance of the S&P 500 in May 2024 reinforces the idea that a diversified, long-term investment strategy is often the best course of action.

At SqSave, we remain committed to helping our clients navigate these complexities with data-driven insights and strategic investment advice. The exceptional performance of the S&P 500 this May is a testament to the potential rewards of staying invested and the importance of adapting strategies to current market conditions.

Yours sincerely

SqSave Investment Team

Disclaimer

The contents herein are intended for informational purposes only and do not constitute an offer to sell or the solicitation of any offer to buy or sell any securities to any person in any jurisdiction. No reliance should be placed on the information or opinions herein or accuracy or completeness, for any purpose whatsoever. No representation, warranty or undertaking, express or implied, is given as to the information or opinions herein or accuracy or completeness, and no liability is accepted as to the foregoing. Past performance is not necessarily indicative of future results. All investments carry risk and all investment decisions of an individual remain the responsibility of that individual. All investors are advised to fully understand all risks associated with any kind of investing they choose to do. Hypothetical or simulated performance is not indicative of future results. Unless specifically noted otherwise, all return examples provided in our websites and publications are based on hypothetical or simulated investing. We make no representations or warranties that any investor will, or is likely to, achieve profits similar to those shown, because hypothetical or simulated performance is not necessarily indicative of future results.

More Articles more

Algorithmic Adjustments Showing Early Signs of Efficacy

Team SqSave

In May, we made strategic adjustments to the algorithms for our higher risk portfolios.

Read more

April Market Insights & Performance Overview

Team SqSave

April proved challenging for investors, with most financial assets experiencing declines, with notable exception of USD spot gold (+4.2%, source: LBMA), reflecting market’s resurgent pre-occupation with inflation.

Read more

HARNESSING THE POWER OF REGULAR INVESTING AMID MARKET VOLATILITY

Team SqSave

One of the most obvious and predictable facets of investing, especially when aiming for high returns, is the unpredictability and uncertainty of such returns, otherwise reflected as volatility.

Read more