HARNESSING THE POWER OF REGULAR INVESTING AMID MARKET VOLATILITY

25 April 2024

One of the most obvious and predictable facets of investing, especially when aiming for high returns, is the unpredictability and uncertainty of such returns, otherwise reflected as volatility.

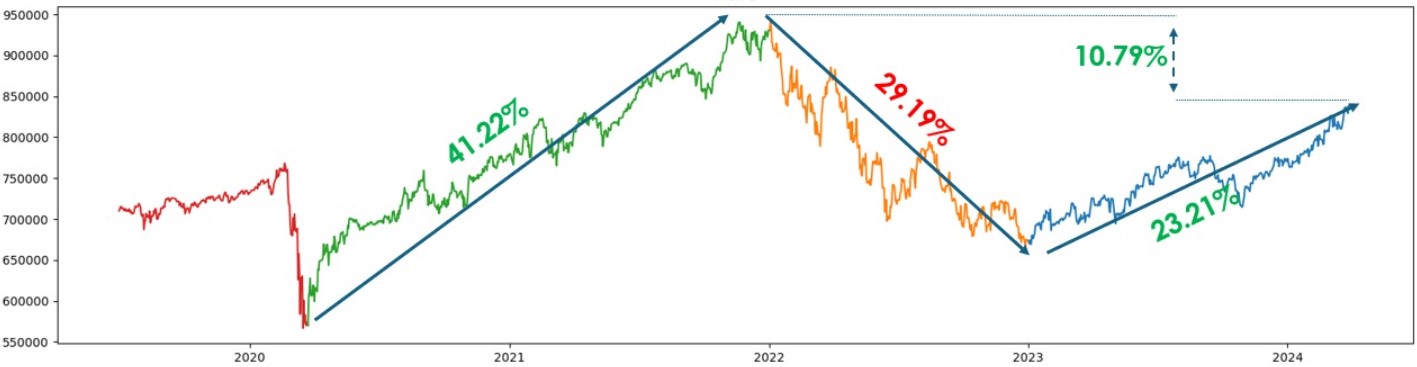

To illustrate, let us review the broad performance trend of our Very Aggressive SqSave reference portfolio, showing typical market ups and downs over a long-term investing journey.

As can be seen in Illustration 1 below, returns experienced can be quite different depending on your investment starting point. If you had a crystal ball prompting you to invest at the depths of the COVID pandemic crash in March 2020, you could have rejoiced in the 41% rally that ensued through October 2021, spurred on by swift global central banks’ drastic interest rate cuts.

Illustration 1 – Very Aggressive Reference Portfolio Performance (1 June 2019 to 31 March 2024)

Conversely, you would have suffered an initial 29% set-back if you randomly started investing in March 2022, just before the US Federal Reserve initiated its series of 11 rate hikes in its battle against rampant inflation. This unsettling period was compounded by reverberations from Russia’s February 24 invasion of Ukraine in 2022.

Without the benefit of hindsight, many investors trying to “time” the market might have bailed out amidst this market malaise, only to lose out on the subsequent recovery from 2023. This shows just how unpredictable markets can be, with the rally enduring despite ongoing geopolitical tensions, albeit as inflation has moderated, leading to a 25% gain in the Very Aggressive portfolio up to end-March 2024.

Regular Monthly Investing vs. Lump Sum Investment Approach

Against this backdrop of such vastly different investment experiences, how is a typical investor able to achieve any meaningful chance of success? Luckily, there is one tried and tested approach, known as Regular Investing, which offers such a solution.

When Regular Investing is applied, our Very Aggressive reference portfolio was able to ride through the challenges of market drawdowns to achieve commendable returns.

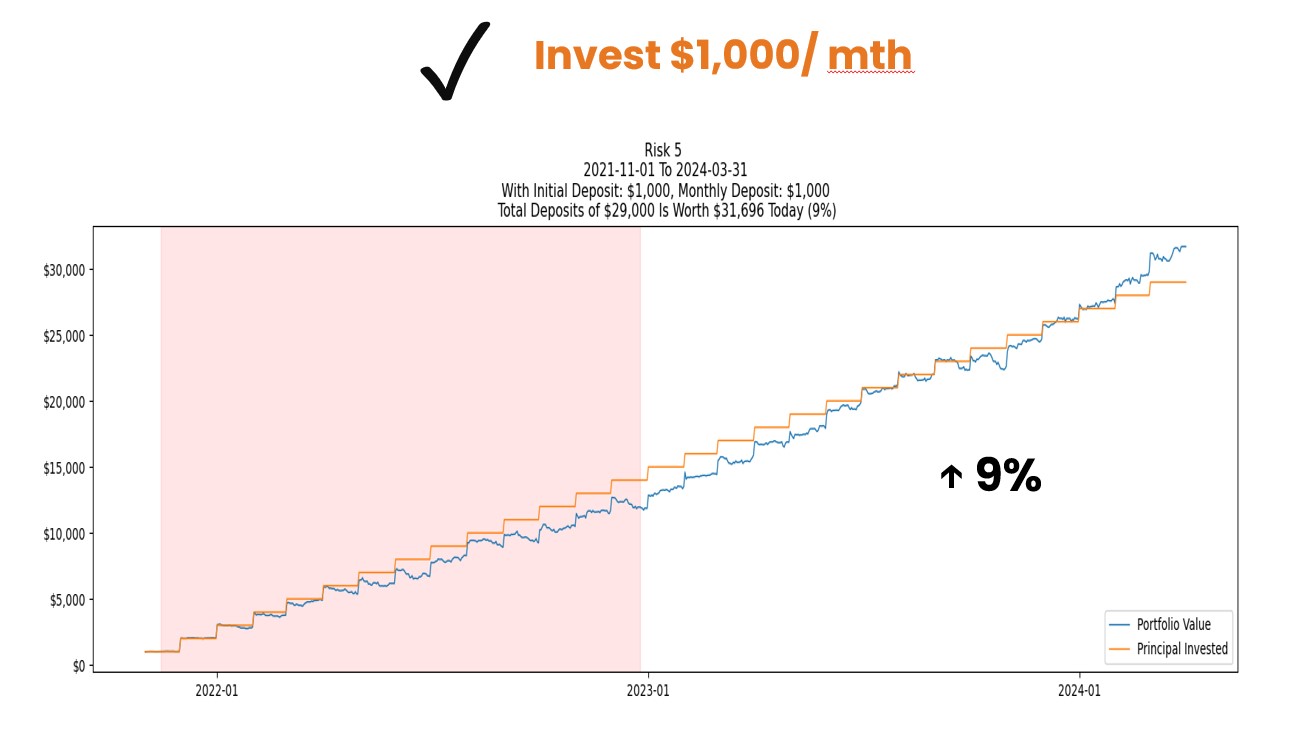

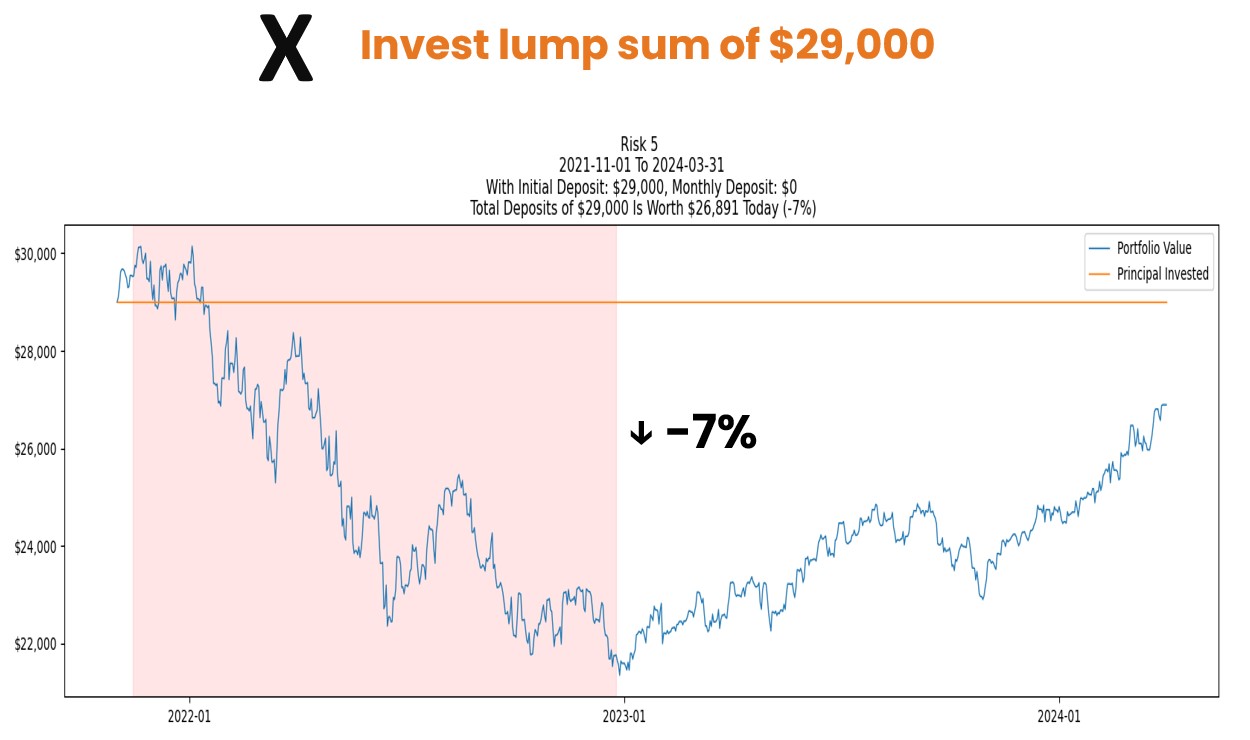

To prove the merits of Regular Investing, we compare two strategies over the same 29-month investment period (starting with the worst part of the above turbulent market period, November 2021) ending March 2024:

(A) Regular Investing S$1,000/month for 29 months (S$29,000 in total).

Versus

(B) One-time lump sum investment of S$29,000

(A) Regular Investing with S$1,000/month deposits for 29 months ($29,000 in total) resulted in a 9% overall gain, as shown in Illustration 2 below.

Illustration 2

Conversely, those who adopted the strategy (B) One-time lump sum investment of S$29,000, suffered a loss of 7% over the same period, as seen in Illustration 3 below.

Illustration 3

Our analysis clearly shows the resilience and efficacy of Regular Investing in navigating market volatility. We share the reasons below.

Smoothing Returns Through Dollar-Cost Averaging

By investing a fixed amount at regular intervals, investors practice dollar-cost averaging, a strategy that smooths out the impact of market fluctuations. This disciplined approach ensures that investors buy more shares when prices are low and fewer shares when prices are high, leading to a more consistent and predictable investment journey.

Harnessing the Power of Compounding

Regular Investing harnesses the incredible power of compounding, where returns on investments generate additional returns over time. As each monthly contribution compounds, the growth potential magnifies exponentially, laying the foundation for long-term wealth accumulation.

Maintaining Financial Discipline

Regular Investing fosters financial discipline by encouraging consistent saving and investing habits. By committing to invest a fixed amount each month, investors cultivate a mindset of prudence and perseverance, resisting the temptation to make impulsive decisions based on short-term market movements.

Resilience in Adversity

The most remarkable aspect achieved through Regular Investing is the resilience demonstrated in the face of adversity. Despite the unprecedented challenges posed by the COVID-19 pandemic, interest rates and geopolitical tensions, those who remained steadfast in their commitment to Regular Investing emerged stronger and more financially secure.

As the charts illustrate, the path of Regular Investing may not always be smooth sailing, but it offers a steady course towards long-term financial prosperity. So, whether you are navigating through market downturns or riding the waves of market upswings, remember the timeless wisdom of Regular Investing:

"It is NOT about timing the market but time in the market that truly matters."

Conclusion

We need to recognise the virtues of Regular Investing in an unpredictable world. By embracing a disciplined approach, harnessing the power of compounding, and maintaining unwavering financial discipline, investors can chart a course towards a brighter, more prosperous future.

Yours sincerely

SqSave Investment Team

Disclaimer

The contents herein are intended for informational purposes only and do not constitute an offer to sell or the solicitation of any offer to buy or sell any securities to any person in any jurisdiction. No reliance should be placed on the information or opinions herein or accuracy or completeness, for any purpose whatsoever. No representation, warranty or undertaking, express or implied, is given as to the information or opinions herein or accuracy or completeness, and no liability is accepted as to the foregoing. Past performance is not necessarily indicative of future results. All investments carry risk and all investment decisions of an individual remain the responsibility of that individual. All investors are advised to fully understand all risks associated with any kind of investing they choose to do. Hypothetical or simulated performance is not indicative of future results. Unless specifically noted otherwise, all return examples provided in our websites and publications are based on hypothetical or simulated investing. We make no representations or warranties that any investor will, or is likely to, achieve profits similar to those shown, because hypothetical or simulated performance is not necessarily indicative of future results.

More Articles more

Stellar 1st Quarter Investment Performance

Team SqSave

We are pleased that our reference SqSave portfolios outperformed both benchmarks and competitors in the first quarter of 2024.

Read more

February 2024 Performance Review: A Cautiously Optimistic Outlook

Team SqSave

In February, our portfolios showcased robust performance, standing out as leaders amongst our competitors – a testament to the resilience of our investment approach despite market uncertainties.

Read more

Strategic Investment Perspectives Amid Market Volatility: Outlook for the Next 3 to 6 Months

Team SqSave

The year 2024 stands as a pivotal period marked by transformative changes. The unfolding events are not only intriguing for us to observe but likely to be chronicled by historians.

Read more