Algorithmic Adjustments Showing Early Signs of Efficacy

5 June 2024

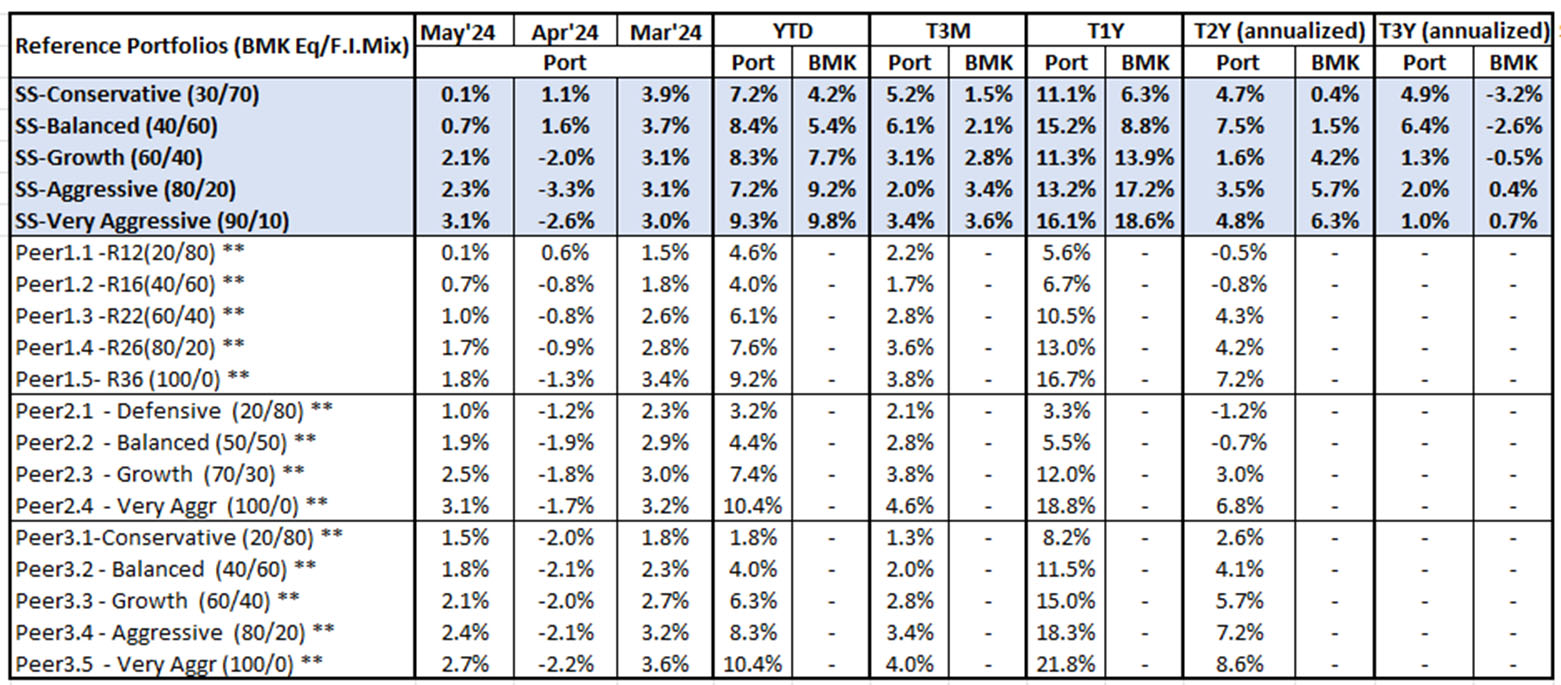

In May, we made strategic adjustments to the algorithms for our higher risk portfolios. This was done to improve alignment with the algorithms used for our lower risk portfolios. Our lower risk reference portfolios have consistently outperformed their benchmarks and comparable peers since inception, enhancing our long-term competitive performance standing.

Short-Term Performance and Algorithm Focus

We observed early indications of our algorithm enhancement efforts bearing fruit as our higher risk reference portfolios outperformed or kept pace with comparable peers’ portfolios. Notably, the SqSave Very Aggressive portfolio rose 3.1%, versus our peers’ average return of 2.5% last month. Despite the lower-risk reference portfolios marginally underperforming peers in May due to our AI algorithm's overweight position in the SPDR Gold Shares ETF, aimed at hedging geopolitical, US currency, and interest rate risks, we maintain confidence in our AI-driven algorithm’s tactical positioning. Its focus on long-term stability over short-term gains means that some variance in performance may occur during periods of rapid market fluctuations compared to short-term-focused strategies.

1-Year Performance Overview: Surpassing Benchmarks

For the 1-year period, SqSave's lower-risk reference portfolios performed exceptionally well, surpassing both peers and benchmarks by a considerable margin. Our higher-risk reference portfolios maintained a comparable performance level to both peers and benchmarks.

3-Year Performance Overview: Reliable Outperformance

Under all risk categories, our reference portfolios’ performance over the past three years has reliably outperformed benchmarks, underscoring the success of our long-term methodology.

SqSave Reference Portfolios Returns

(SGD terms as of 31 May 2024)*

*Inclusive of ETF expense ratios and net of SqSave management fees. SqSave uses AI to design and manage diversified investment portfolios for each investor. Because SqSave is not an investment fund, there is no single return measure. Instead, every SqSave investor has his/her own investment performance as each investor is managed separately by our SqSave AI. As investors can withdraw and top-up any time, investment returns will be affected by individual investor decisions. Hence, SqSave uses reference portfolios which are actual portfolios managed on an ongoing basis, without any interference with withdrawals or top-ups, to measure investment performance.

** Performance numbers for peers are estimates. Abbreviations: BMK: Benchmark, Port: Portfolio, Eq: Equity and F.I.: Fixed Income

Looking Ahead

At SqSave, we prioritize credibility and a shared vision of financial growth beyond mere numbers. As we enter June, our quantitative investment team diligently monitors your portfolios, navigating market dynamics with confidence in our AI-driven strategies. Leveraging our machine’s perfect memory, we generate enduring returns for our investors while minimizing downside volatility. Continuously analyzing market movements, we fine-tune our strategies, allowing you to focus on other aspects of your life.

SqSave - Your Trusted Partner

We recognize that investing is a long-term journey, and our mission is to be your trusted partner every step of the way. If you have not yet invested with SqSave, there's no better time than now. Join us on this unparalleled journey of AI-based portfolio management. With SqSave's track record and expertise, you can achieve greater financial success. Reach out today, and let's embark on this journey together.

Yours sincerely

SqSave Investment Team

Disclaimer

The contents herein are intended for informational purposes only and do not constitute an offer to sell or the solicitation of any offer to buy or sell any securities to any person in any jurisdiction. No reliance should be placed on the information or opinions herein or accuracy or completeness, for any purpose whatsoever. No representation, warranty or undertaking, express or implied, is given as to the information or opinions herein or accuracy or completeness, and no liability is accepted as to the foregoing. Past performance is not necessarily indicative of future results. All investments carry risk and all investment decisions of an individual remain the responsibility of that individual. All investors are advised to fully understand all risks associated with any kind of investing they choose to do. Hypothetical or simulated performance is not indicative of future results. Unless specifically noted otherwise, all return examples provided in our websites and publications are based on hypothetical or simulated investing. We make no representations or warranties that any investor will, or is likely to, achieve profits similar to those shown, because hypothetical or simulated performance is not necessarily indicative of future results.

More Articles more

April Market Insights & Performance Overview

Team SqSave

April proved challenging for investors, with most financial assets experiencing declines, with notable exception of USD spot gold (+4.2%, source: LBMA), reflecting market’s resurgent pre-occupation with inflation.

Read more

HARNESSING THE POWER OF REGULAR INVESTING AMID MARKET VOLATILITY

Team SqSave

One of the most obvious and predictable facets of investing, especially when aiming for high returns, is the unpredictability and uncertainty of such returns, otherwise reflected as volatility.

Read more

Stellar 1st Quarter Investment Performance

Team SqSave

We are pleased that our reference SqSave portfolios outperformed both benchmarks and competitors in the first quarter of 2024.

Read more