April Market Insights & Performance Overview

3 May 2024

April proved challenging for investors, with most financial assets experiencing declines, with notable exception of USD spot gold (+4.2%, source: LBMA), reflecting market’s resurgent pre-occupation with inflation. The S&P 500 and Nasdaq Composite both saw declines of 4.2% and 4.4% respectively this month, their first since October 2023. Contributing factors included persistently high inflation, mixed earnings reports, and escalating tensions in the Middle East, all heightening market volatility.

Yet, amidst this turmoil, our AI-Quant strategy has emerged as a beacon of resilience, propelling our lower-risk reference portfolios to unparalleled heights. These portfolios stand as a testament to our unwavering commitment to excellence, consistently surpassing industry benchmarks and leaving all peer portfolios, including those with higher risk profiles, trailing in their wake. Such remarkable achievements underscore the unparalleled effectiveness of our approach, fortified by strategic investments such as the SPDR Gold Shares ETF. Join us on this journey of redefining excellence in portfolio management, as we pave the way to financial success with our unmatched expertise.

While our high-risk reference portfolios encountered their own set of challenges amidst sector drawdowns in the US market, aligning with their inherently higher risk exposure, we remain steadfast in our commitment to optimization. Through ongoing recalibration efforts, we are strategically reducing sector emphasis within these portfolios, aligning them more closely with the successful strategies employed by our lower-risk algorithms. With diligence and foresight, we are poised to navigate the evolving market landscape and secure optimal outcomes for our valued investors.

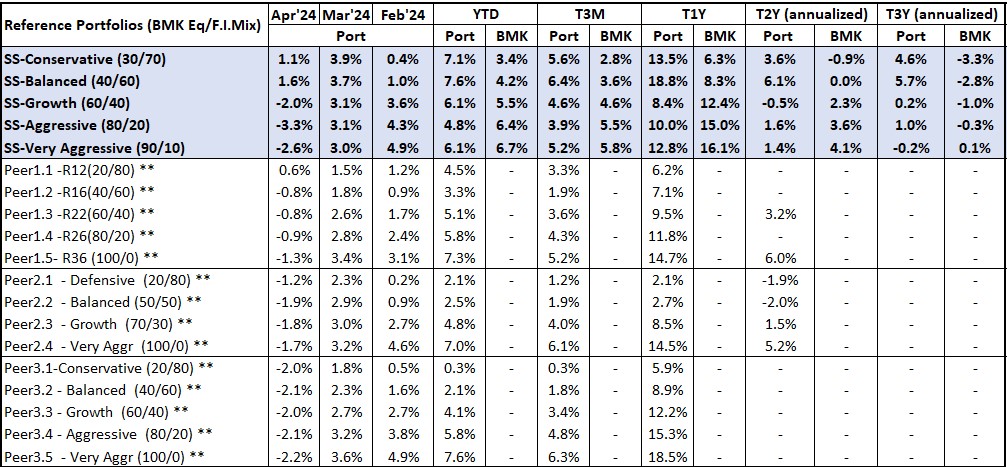

SqSave Reference Portfolios Returns

(SGD terms as of 30 Apr 2024)*

*Inclusive of ETF expense ratios and net of SqSave management fees. SqSave uses AI to design and manage diversified investment portfolios for each investor. Because SqSave is not an investment fund, there is no single return measure. Instead, every SqSave investor has his/her own investment performance as each investor is managed separately by our SqSave AI. As investors can withdraw and top-up any time, investment returns will be affected by individual investor decisions. Hence, SqSave uses reference portfolios which are actual portfolios managed on an ongoing basis, without any interference with withdrawals or top-ups, to measure investment performance.

** Performance numbers for competitors are estimates. Abbreviation: BMK: Benchmark and Port: Portfolio.

1-Year Performance Overview: Beating Benchmarks

In the past trailing one-year period, SqSave's low-risk reference portfolios demonstrated exceptional performance, surpassing both peers and benchmarks by a considerable margin. Remarkably, they even rivalled or exceeded the performance of our peers' high-risk portfolios. Our higher-risk ones tracked peers closely, except for the Very Aggressive Reference Portfolio, which underperformed due to its lower equity weight compared to its peers.

3-Year Performance Overview: Consistent Outperformance

Our three-year trailing performance consistently outperformed benchmarks across all risk categories, highlighting the effectiveness of our long-term approach.

Investment Strategy: Long-term Focus Amidst Uncertainty

At SqSave, our approach transcends short-term gains, instead focusing on our machine-driven asset allocation engine to strategically steer through investment risks over the medium to long term. We remain vigilant in tracking market dynamics, particularly in response to inflation and potential interest rate shifts, all in line with our unwavering commitment to Smart Investing principles.

Emphasizing Regular Investing

In times of uncertainty, emotional reactions can impede investment decisions. Our approach prioritizes rational decision-making and effective risk management. We advocate for regular investments over attempting to time the market, emphasizing stability over short-term gains. Our recent blog post, "Harnessing the Power of Regular Investing Amid Market Volatility", reinforces the notion that disciplined regular investing beats market timing.

Future Plans: Recalibrating for Success

Looking ahead, we firmly believe that the proactive enhancements will not only fortify our portfolios but also position them strategically to excel in the prevailing "higher for longer" market conditions and deliver enduring returns to our investors.

Yours sincerely

SqSave Investment Team

Disclaimer

The contents herein are intended for informational purposes only and do not constitute an offer to sell or the solicitation of any offer to buy or sell any securities to any person in any jurisdiction. No reliance should be placed on the information or opinions herein or accuracy or completeness, for any purpose whatsoever. No representation, warranty or undertaking, express or implied, is given as to the information or opinions herein or accuracy or completeness, and no liability is accepted as to the foregoing. Past performance is not necessarily indicative of future results. All investments carry risk and all investment decisions of an individual remain the responsibility of that individual. All investors are advised to fully understand all risks associated with any kind of investing they choose to do. Hypothetical or simulated performance is not indicative of future results. Unless specifically noted otherwise, all return examples provided in our websites and publications are based on hypothetical or simulated investing. We make no representations or warranties that any investor will, or is likely to, achieve profits similar to those shown, because hypothetical or simulated performance is not necessarily indicative of future results.

More Articles more

HARNESSING THE POWER OF REGULAR INVESTING AMID MARKET VOLATILITY

Team SqSave

One of the most obvious and predictable facets of investing, especially when aiming for high returns, is the unpredictability and uncertainty of such returns, otherwise reflected as volatility.

Read more

Stellar 1st Quarter Investment Performance

Team SqSave

We are pleased that our reference SqSave portfolios outperformed both benchmarks and competitors in the first quarter of 2024.

Read more

February 2024 Performance Review: A Cautiously Optimistic Outlook

Team SqSave

In February, our portfolios showcased robust performance, standing out as leaders amongst our competitors – a testament to the resilience of our investment approach despite market uncertainties.

Read more