SqSave’s F.A.M.E

[Factor Analytics Machine Learning Engine]

Victor Lye, CFA CFP®, Founder & CEO

Yi-Chen Chia, CFA CAIA FRM, Head of Quant & AI Investment

Contents

Section 1: Introduction

Section 2: Pivot’s Factor Modelling with Machine Learning Analytics

Section 3: Portfolio Optimization on Pivot’s Factor Model

Section 4: Personalized Solution – Dynamic Advisory and Rebalancing

Section 1: Introduction

In the last 5 years, robo-adviser platforms have emerged across the globe. Most of them feature:

- Easy online access via digital platform (web and mobile)

- Low cost advisory / consultant fees and investment transaction fees

- Automated tax harvesting and tax deferred benefits (applicable to the USA market)

- Globally diversified portfolios based on traditional asset allocation approaches

- Automatic rebalancing in response to market price and asset allocation changes

For the most part, robo-adviser platforms look broadly similar in the following ways.

(1) USA-centric Portfolio Asset Allocation

Many robo-advisers use Exchange Traded Funds (ETFs”) which track US market indices covering big to small cap stocks or US industry sectors such as financials, technology, consumer staples, utilities and so on. By contrast, these same robo-advisers allocate only a small proportion of assets to international or emerging markets.

(2) Human Managed Portfolios

Most robo-adviser platforms offer 5 to 30 pre-assembled portfolios. Each or a group of these preassembled portfolios are linked to a set number of pre-labelled risk buckets, e.g., low risk, moderate risk and high risk in the simplest presentation. Through a risk profiling shopfront process, the individual client is classified into one of the pre-labelled risk buckets together with others. The pre-assembled investment portfolio linked to that risk bucket is then assigned to that individual client.

(3) Constant Rebalancing Rule

Several robo-adviser platforms use the constant – mix rebalancing technique. Let’s imagine that if a portfolio is pre-assembled with 50% in Equity and 50% in Bonds. Then, let’s say that the equity market is in a bull phase and equity asset prices rise in general such that the portfolio asset allocation shifts to 60% in Equity and 40% in Bonds. The subsequent rebalancing rule is to sell 10% in Equity and buy 10% in Bonds to achieve the optimization, that is, by shifting back to the original asset allocation.

At PIVOT, we decided to do better. Compared with most other robo-adviser platforms, we use a proprietary AI-driven method called F.A.M.E. – or Factor Analytics Machine Learning Engine, to drive personalized, dynamic and real-time global investment portfolio construction and the subsequent rebalancing forward to a superior risk-adjusted portfolio.

This whitepaper outlines how our F.A.M.E. methodology analyzes different investment markets without human bias, drives portfolio optimization based on factor model analyses, and executes dynamic rebalancing separately for each and every client, and not as a group risk-labelled bucket. And as an innovative fully AI-driven digital investment manager, we do this for each and every client – whether the invested amount is one dollar or one million. Our F.A.M.E. methodology works 24/7 as the global investment markets turn and does not discriminate.

Section 2: Pivot’s Factor Modelling with Machine Learning Analytics

Factor Modelling is a financial model that employs single or multiple factors in its calculations to explain market phenomena and/or equilibrium asset prices. The factor model can be used to explain or estimate the probable asset price/volatility of either an individual security or a portfolio of securities. This is traditionally executed using linear regression modelling with Least-Squares Fit to minimize the cost function and enhance forecasting accuracy.

Single-Factor Model

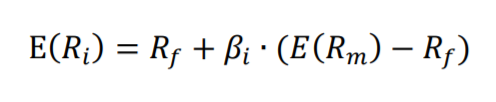

In traditional finance theory, CAPM (Capital asset Pricing Model) is viewed as a single factor model which describes the relationship between systematic risk and expected return for assets with the formula:

where:

is the expected return for single capital asset (stocks, indices, bonds, etc).

is the risk free rate.

is the estimated return of markets.

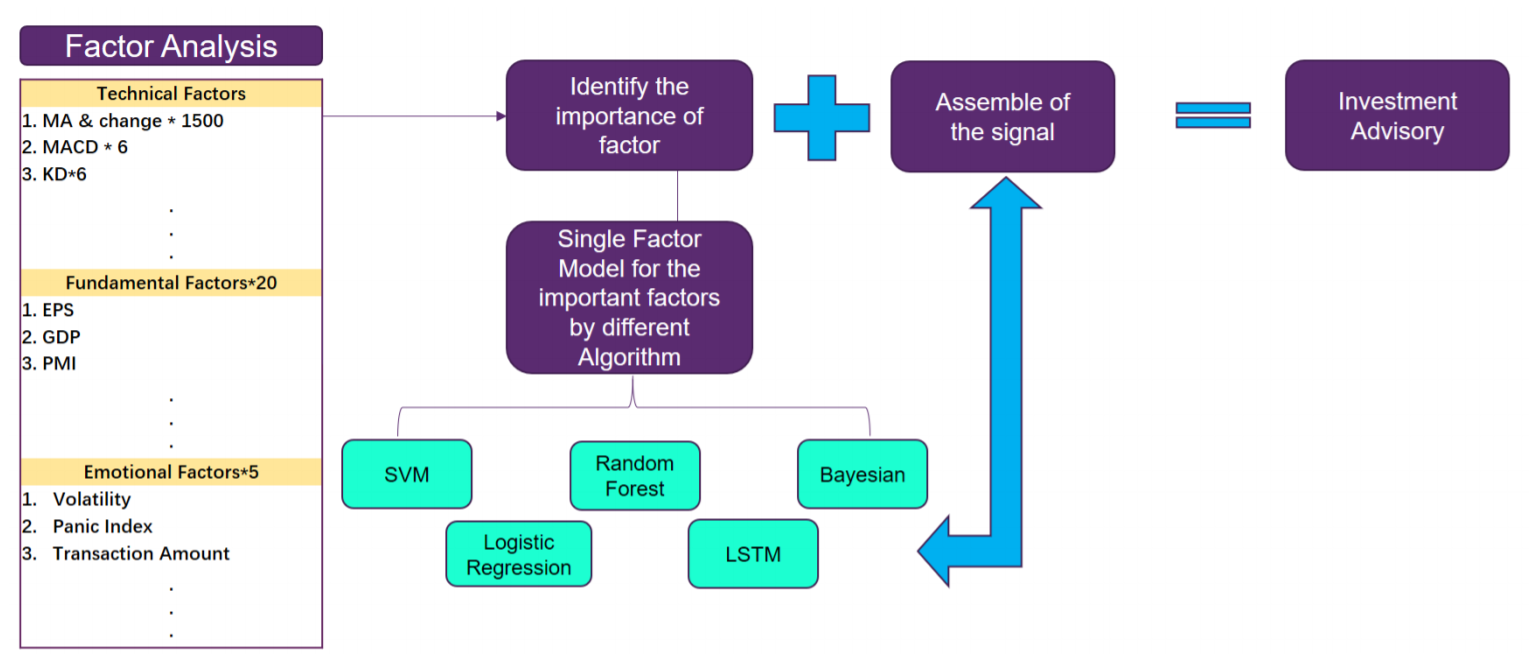

However, instead of using the global return as a predictor, we may choose several distinct factors as predictors - such as PMI, EPS or 20 Days Moving Averages to forecast the impact on the underlying asset price behaviour

Multi-Factor Model

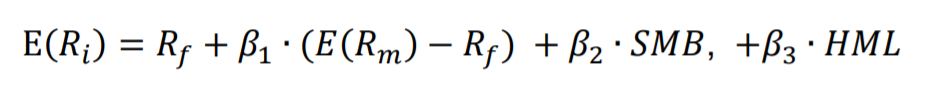

Unlike the single factor model which uses only one variable to describe the future returns of a portfolio or stock, the Multi-Factor Model incorporates more information as part of the decision science. For example, the Fama–French model uses three variables: (1) market risk; (2) outperformance of small versus big companies; and (3) outperformance of high book/market value versus low book/market value securities.

The Fama-French three factor model can be formulated as:

where:

stands for Small (Market Cap) minus Big Cap

stands for High (Book to Market) minus Low

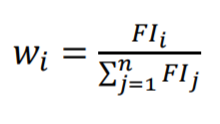

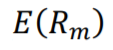

PIVOT’s F.A.M.E. Algorithm

In the last 5 years, robo-adviser platforms have emerged across the globe. Most of them feature:

- Suitability

- Scientific Logic

- Accuracy

With the PIVOT F.A.M.E. algorithm structured in the following steps:

- Calculate the importance of factors by using Feature Engineering. PIVOT derives the most significant factors across different time periods (90 days, 180 days, 10 years, etc)

- Assess the Market Forecasts via the Single Factor Model using different algorithms (Classification Model)

B1. Logistic Regression: In statistics, the logistic model is used to model the probability of a certain classification such as Bull / Bear/ Neutral of a single asset

B2. Support Vector Machine: Support Vector Machine (SVM) is primarily a classifier method that performs classification tasks by constructing hyperplanes (via using different Kernal functions) in a multidimensional space that separates cases of different class labels.

B3. Decision Tree and Random Forest: A decision tree is a decision support tool that uses a tree-like model of decisions and their possible consequences, whereas the Random Forest method consists of a large number of individual decision trees that operate as an ensemble. Each individual tree in the Random Forest spits out a class prediction and the class with the most votes becomes our model’s prediction.

- Assemble the results via step (B) into final estimation for each specific factor

C1. Equal Weights

C2. Historical Accuracy Rate

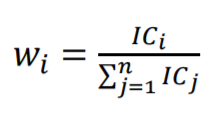

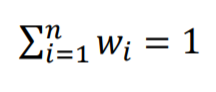

C3. Historical Information Correlation (IC):

C4. Max IC:

and

C5. Neighborhood Component Analysis:

- By timing the weight of a factor and its estimation assembled in step (C), we get the expectation value

using probability theory (i.e., get the significance contribution of a single factor) and when we sum up the

values among all factors, it gives us the final result of the estimation for the specified asset.

Section 3: Portfolio Optimization on Pivot’s Factor Model

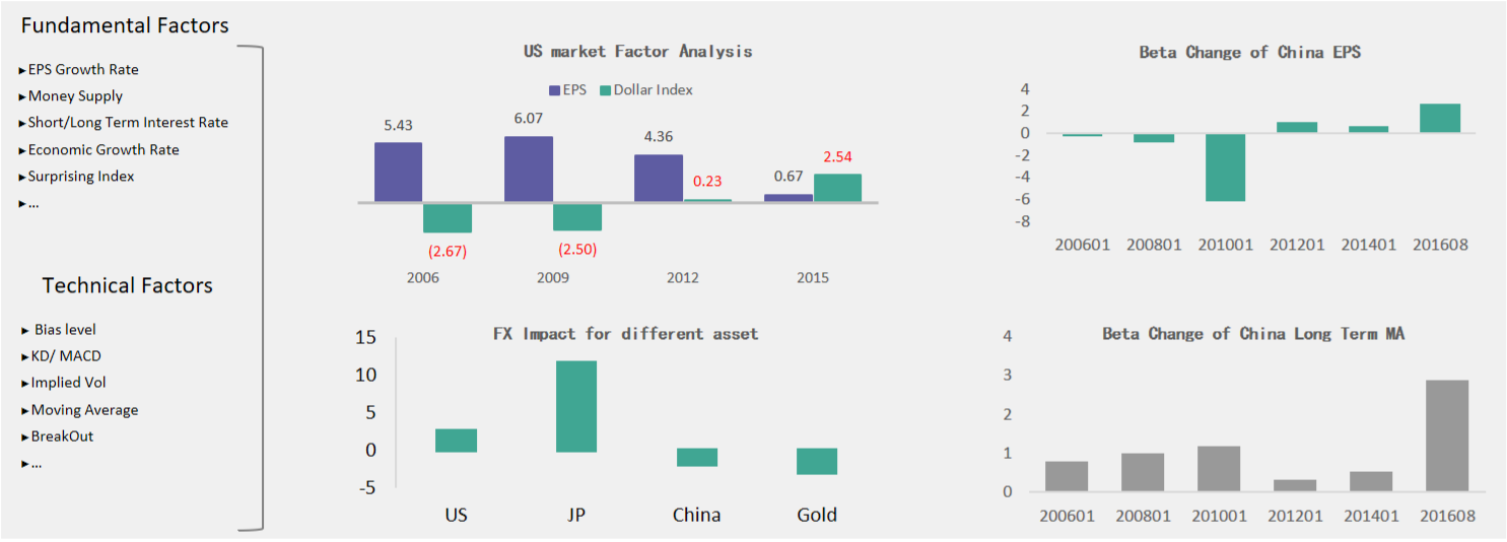

The F.A.M.E. model can be used to estimate different asset class in different timing. Hence, it can generate a trading signal for long / short decisions, or it could change the parameter settings in traditional asset allocation theory.

The most popular allocation methods are MPT (https://en.wikipedia.org/wiki/Modern_portfolio_theory) and Risk Parity (https://en.wikipedia.org/wiki/Risk_parity) methods, where MPT focused on Return / Risk Optimization and Risk Parity use equally-weighted risk contributions.

In MPT, we can use the advisory provided by F.A.M.E. to uplift the Lower Bound (if the estimation is bull) and decrease the Upper Bound (if the estimation is bearish) as the parameter adjustment and for Risk-Parity, we could either adjust the forecasted risk of each asset or change the numerator from 1 to the ML score of the asset.

Here is an example to show how F.A.M.E. works on the Markowitz model & Risk Parity model to improve the performance of the Singapore Straits Times stock index (STI), a capitalizationweighted stock market index that is regarded as the benchmark index for the Singapore stock market.

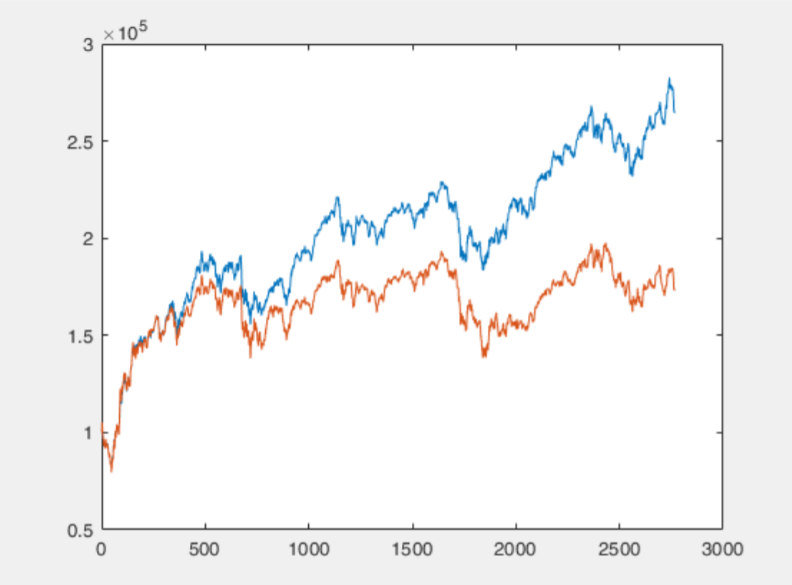

Method 1 – Machine Learning ML Enhanced Frontier Allocation

By applying the Factor Model to change the UB (Upper Bound) / LB (Lower Bound) settings of the 30 component stocks, we get the result shown on the right.

Back Testing: 2009 to 2019 Aug

- Return: The new enhanced

portfolio

generates 164% total

return while STI

generated 73%.

- Risk: The maximum drawdown of new

enhanced portfolio is 20.67% since 2009

while the STI maximum drawdown is up

to 28.45%

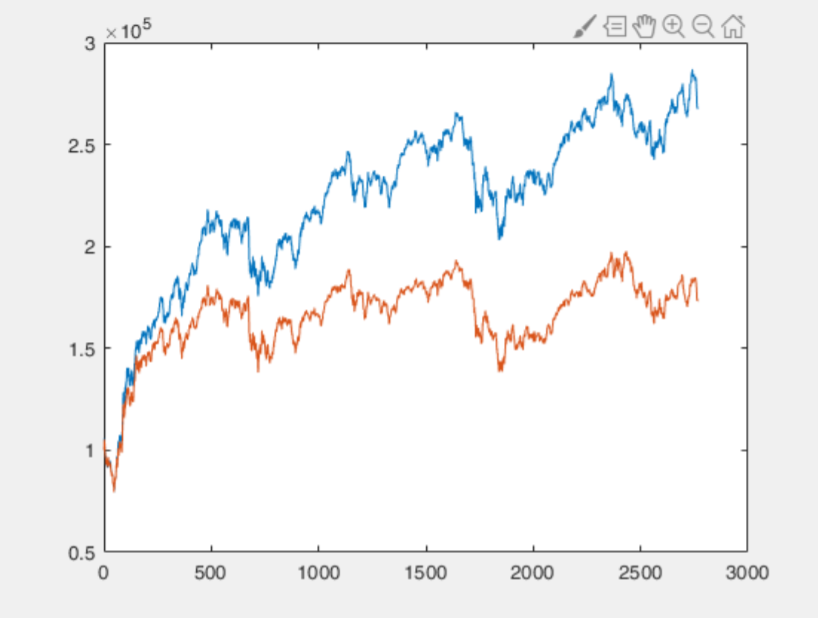

Method 2 – Machine Learning ML enhanced Risk-Neutral Allocation

By applying the Factor Model and changing the numerator of risk parity for each asset class from 1 to the ML generated scores, the new allocation is deemed to be positively correlated to the ML scores and negatively correlated to volatility.

Back Testing : 2009 to 2019 Aug

- Return: The new enhanced

portfolio will

generate 167% total returns while the STI

generated

73%.

- Risk: The maximum drawdown of the new enhanced portfolio is 24.79% since 2009 while the STI over the same timeline generated a maximum drawdown up to 28.45%.

Section 4: Personalized Solution – Dynamic Advisory and Rebalancing

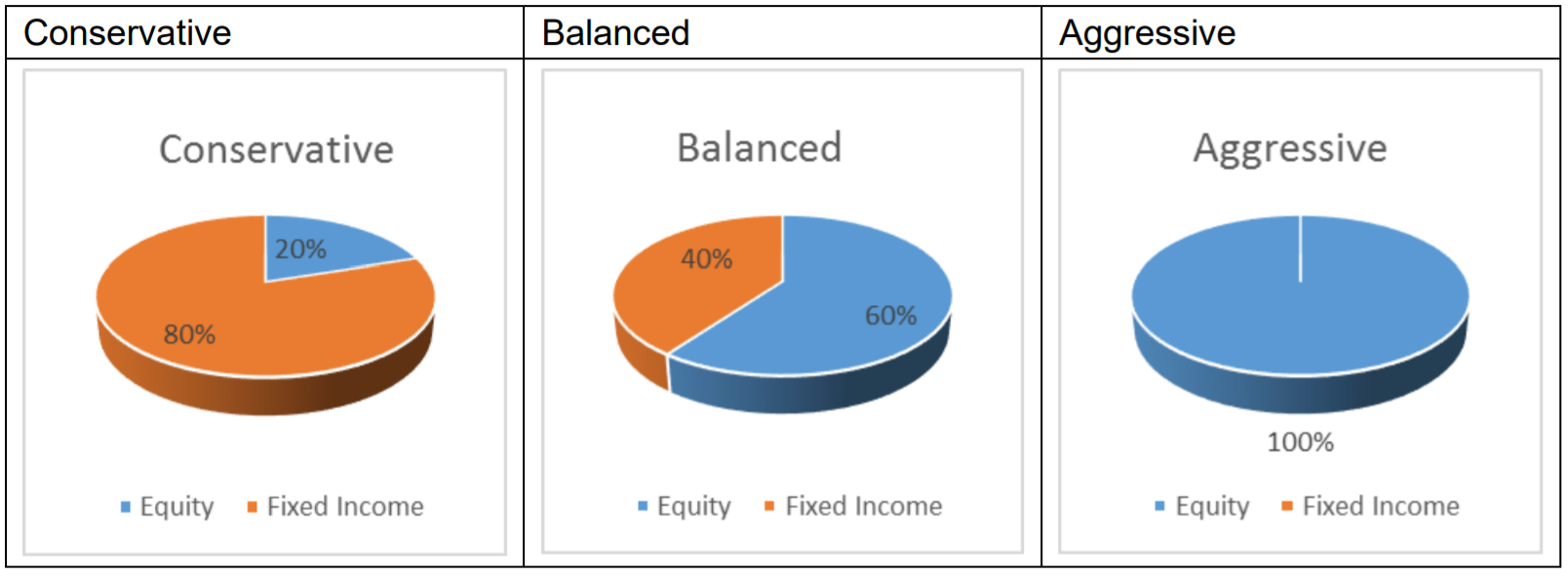

In the wealth management business, most of the advisory provided is based on predetermined modules (e.g., matching reference portfolios to different risk tolerance levels). A simple way to fix the reference portfolios is by way of a range of asset allocations

Our F.A.M.E. algorithm, however, combines both customer characteristics such as Risk Tolerance, Age, Investment Time Horizon and Market Conditions when an investor is seeking a recommended asset allocation. The customer characteristics will affect the parameter settings of the Debt/Equity Ratio, Investment Asset Class Coverage and UB/LB for each asset class.

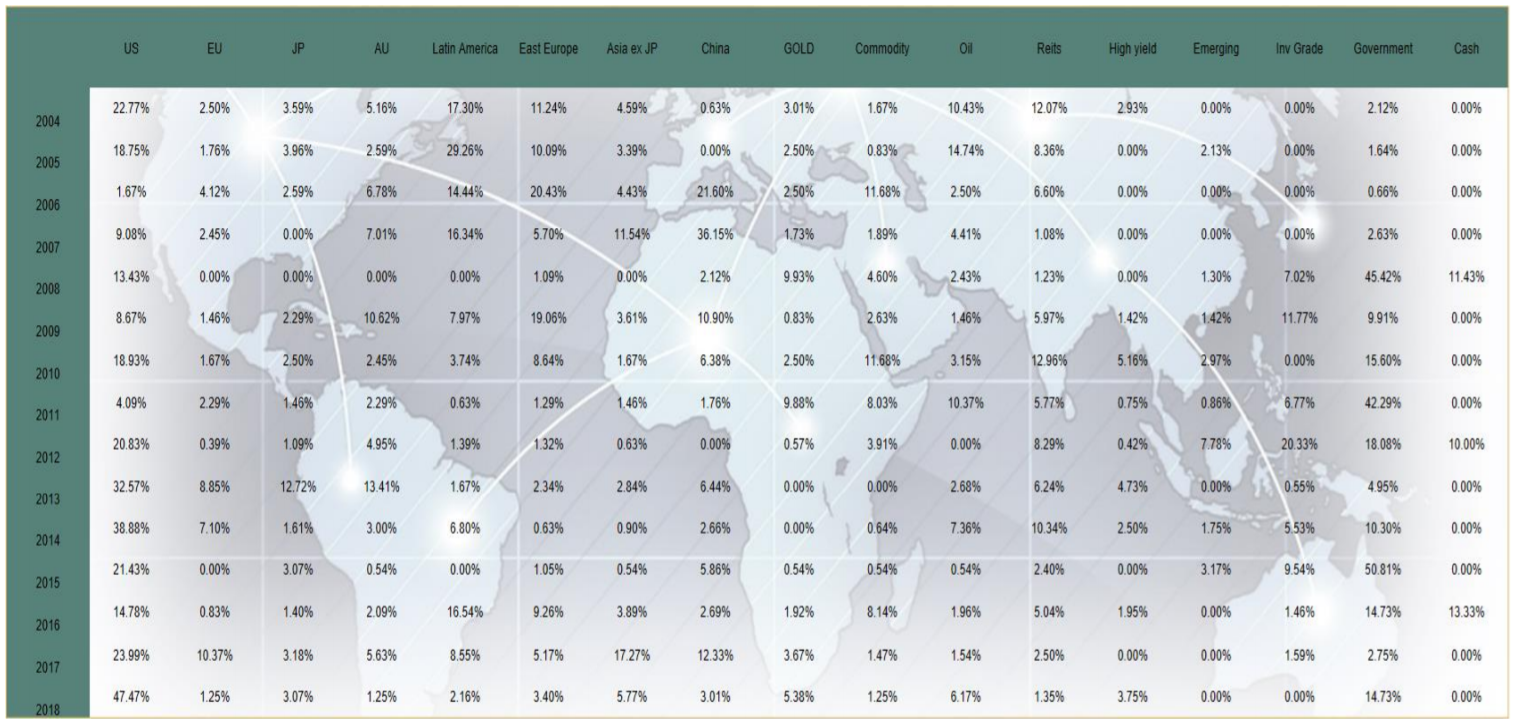

- Investment Coverage: Through analytics, PIVOT shortlisted different sets of ETFs to facilitate global asset

allocations broadly divided into:

- Developed Country Equity: US, EU, Australia, Singapore, Japan

- Emerging Market Equity: Asia ex Japan, BRICs, Malaysia

- Alternatives: Gold, Oil, Commodity, REITS, Currency

- Fixed Income: Emerging Market Bonds, High yield Bonds, Corporate Bonds, Government Bonds (on different duration)

- Advantages of Dynamic Asset Allocation & Rebalancing: Dynamic asset allocation and rebalancing help to position the appropriate market exposure for each different asset class. To formulate the overall investment strategy, the F.A.M.E. model must consider several factors including portfolio deviation and client holdings, market conditions, transaction costs (including transaction fees and transaction time lags) for rebalancing.

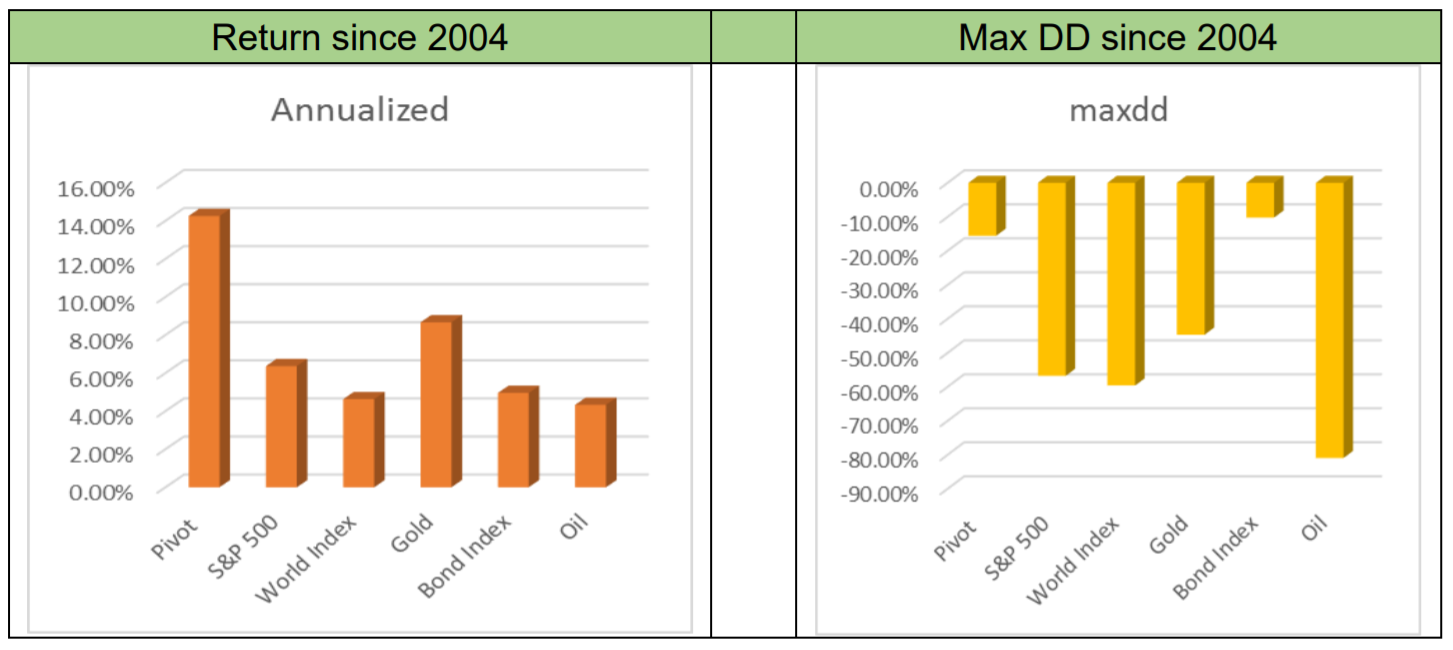

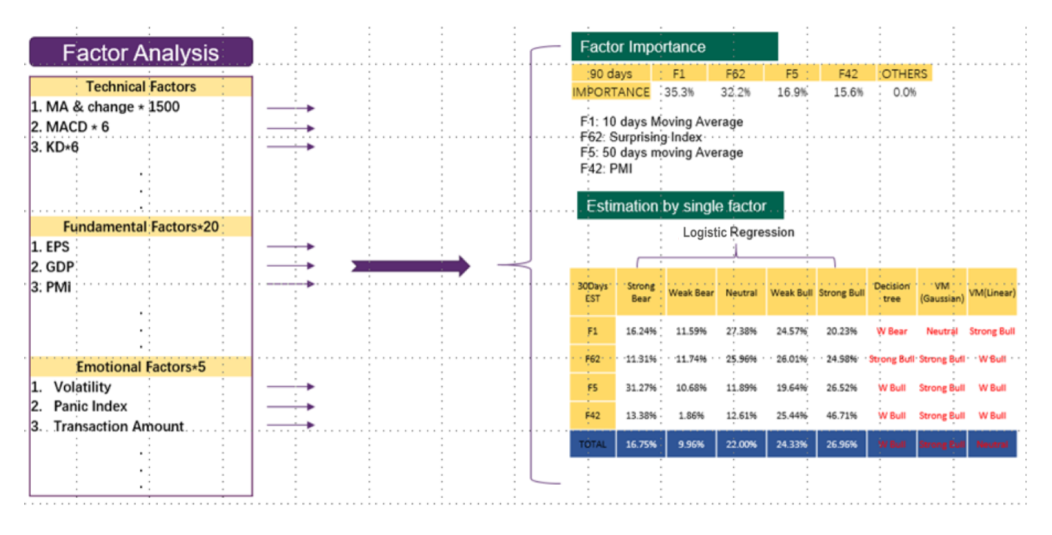

With the Dynamic Asset Allocation and Rebalancing function, F.A.M.E. helps to control the downside risks versus major market indices so the client will not panic during any black-swan event.

Examples of Risk Control under Panic Market Conditions

- 2008: The global market dropped more than 50% due to high inflation and Lehman Brother’s credit crisis while Pivot’s portfolio only suffered a drawdown of around 15% by shifting asset allocation towards US government bonds.

- 2018: The global market dropped more than 20% because of the US/China trade war while Pivot’s portfolio showed better wealth protection, dropping by only 10% in NAV

More Articles more

What You Should Know About Unit Trusts

April 18, 2019 | Victor Lye, CFA CFP®

Not everyone has the same gung-ho risk attitude. Yet there is a fear of losing out when you hear boasts from people who say how much money they made from investing. Read more

Why Replace The Human Investment Manager?

May 21, 2019 | Victor Lye, CFA CFP®

When investors ask me what I do, I cheekily tell them that I intend to replace their human investment manager. Read more

Smart Investing with Global Diversification at SqSave

Jun 13, 2019 | Victor Lye, CFA CFP®

Internet social media has shifted the

way news or facts are delivered and

perceived – with profound implications

for the way we should invest.

Read more