RE-ASSESSING RISKS AHEAD OF THE 2024 USA PRESIDENTIAL ELECTION

18 July 2024

We entered 2024 knowing that elections form the key global theme. Half the world’s population will go to the polls. What will it mean for investors? At this halfway mark, we review the global electoral situation and the USA electoral implications of the latest shocking attempted assassination of USA presidential candidate and former president Donald Trump.

Global Election Surprises amidst an Anti-Incumbency Theme

- India: In an upset, the incumbent lost its parliamentary majority. Poll after poll had predicted a big victory.

- United Kingdom: The scale of the Conservatives’ defeat was historic. While the Labour Party’s big majority is seen as a return to more stable and centrist government, the significance of alternative political parties getting their highest vote shares and seats ever indicates a fragmentation of the UK’s political landscape.

- France: The near win by France’s right-wing National Rally Party caught everyone off guard. The parliamentary outcome is fragmented. French politics is in a state of flux.

- South Africa: The African National Congress lost its post-apartheid majority for the first time.

The anti-incumbency theme is driven by population segments that feel disenfranchised by traditional politics over hot-button issues such as inflation, immigration, national identity, and security. The stark reality and disconnect between politics and economics are that while financial markets look forward to slower inflation, voters still see groceries costing a third more than a few years ago. Going forward, the challenge will be to address these issues in a way that fosters inclusivity and unity rather than division.

Entering a Period of High Stakes

The November 2024 USA Presidential election is besotted by heightened political tension and a sharply divided electorate. Such political volatility can significantly impact market sentiment and investment strategies. A lesson from France post-election is that although the lack of parliamentary consensus and heightened risks of longer-term challenges have caused French and Italian bond spreads to widen and French stocks to falter, European stocks and credit spreads have stayed resilient.

With the attempted assassination of Donald Trump still raw in people’s minds, he is likely to win a second term. A second Trump term will see a flurry of changes and activities. We believe that trade and tariffs will see quick impacts, escalating global economic conflicts. Market volatility will likely rise due to uncertainty.

Renewed Inflation Stress

In the USA, Donald Trump’s tax cuts enacted in 2017 will expire at the end of 2025. A second Trump term will likely see an extension or more cuts, which will spur the stock markets. But risks will include inflation and debt sustainability. Tighter immigration controls will pile pressure on wages and inflation.

Stronger USD

We see the USD strengthening with a Trump win, more from other major currencies being undermined by antagonistic US trade policy rather than the core allure of the USD.

Higher Bond Yields

Long-dated U.S. bond yields are likely to rise with expectations that a Trump win will drive up government debt and stoke inflation.

Market Volatility May Rise Post-Sep 2024

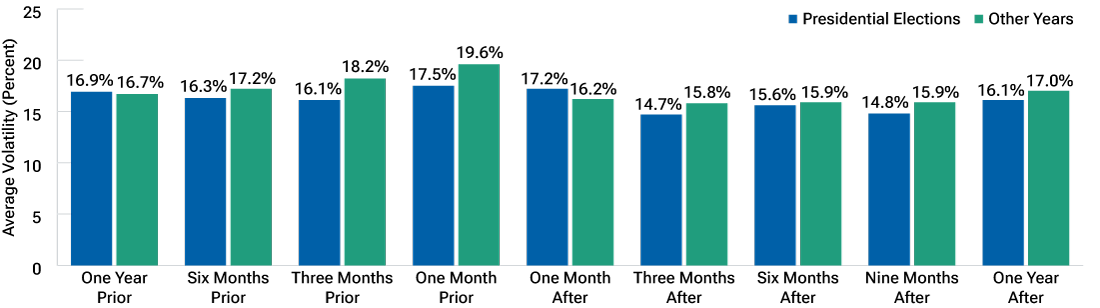

A study by T. Rowe Price found that in presidential election years, the average level of market volatility was at its highest in the one month and three months prior to voting day.

As we approach the November 2024 US Presidential Election, market volatility may pick up from September 2024. The potential risks include:

- Increased Political Uncertainty: Will Biden step down? A closely contested election could lead to prolonged political uncertainty, affecting market stability.

- Policy Shifts: If Trump wins, there will be significant changes in fiscal, regulatory, and trade policies, all generating increased uncertainty.

- Social Unrest: No matter who wins, will the deeply polarized political environment lead to social unrest, further unsettling markets? Any political violence may heighten concern about US instability and push investors into haven assets, such as gold.

Conclusion: Diversification Remains Paramount

From an investment perspective, the 2024 electoral surprises have been neutral or even pro-market. However, even if returns remain intact, volatility is likely to rise. As it stands, markets are already struggling with stretched valuations and concentration risks driven by the hype over artificial intelligence stocks. As of mid-2024, tech stocks account for approximately 27-30% of the total market capitalization of the S&P 500.

Investors must recognize the need for diversification to mitigate risks. The 2024 elections, both in the USA and globally, add layers of political uncertainty that could impact markets. By staying informed and diversifying portfolios, investors can better manage risks and capitalize on opportunities in a complex and evolving market environment.

Smart Investing with SqSave

SqSave uses quantitative methods to navigate the complexity of diversification which is beyond human capabilities. With its unbiased, unemotional and objective approach to optimising potential returns for the pre-defined acceptable risk, SqSave is Smart Investing for Anyone, Anywhere, Anytime!

Yours sincerely

Victor Lye, BBM CFA CFP

Founder & CEO

Investment Brand of PIVOT Fintech Pte. Ltd. (UEN 201716150D)

Monetary Authority of Singapore, Capital Markets Services Licence (CMS100806)

SqSave is the regulated digital investment service operated by Pivot Fintech – a Licenced Fund Management Company regulated by the Monetary Authority of Singapore.

Disclaimer

The contents herein are intended for informational purposes only and do not constitute an offer to sell or the solicitation of any offer to buy or sell any securities to any person in any jurisdiction. No reliance should be placed on the information or opinions herein or accuracy or completeness, for any purpose whatsoever. No representation, warranty or undertaking, express or implied, is given as to the information or opinions herein or accuracy or completeness, and no liability is accepted as to the foregoing. Past performance is not necessarily indicative of future results. All investments carry risk and all investment decisions of an individual remain the responsibility of that individual. All investors are advised to fully understand all risks associated with any kind of investing they choose to do. Hypothetical or simulated performance is not indicative of future results. Unless specifically noted otherwise, all return examples provided in our websites and publications are based on hypothetical or simulated investing. We make no representations or warranties that any investor will, or is likely to, achieve profits similar to those shown, because hypothetical or simulated performance is not necessarily indicative of future results.

More Articles more

STRONG & CONSISTENT SMART BETA INVESTMENT PERFORMANCE

Team SqSave

In June 2024, all our SqSave reference portfolios (“portfolios”) beat their underlying benchmarks and referenced peers after we aligned our higher risk portfolio quantitative algorithms closer to our highly successful lower-risk algorithms.

Read more

Warren Buffett Likes ETFs not Unit Trusts — And So Should You!

Team SqSave

When Warren Buffett, arguably the most successful investor in history, speaks, smart investors listen. Buffett's investment wisdom is legendary, and he has consistently outperformed the market for many years during his investment career.

Read more

S&P500 Hits Record High…“Sell in May & Go Away”? We Don’t Think So!

Team SqSave

The S&P 500 has maintained its strong momentum into May 2024, continuously breaking new highs. By end-May, the S&P 500 achieved an impressive 11% return, a performance level typically expected over an entire year.

Read more