August Market Storm: Yen Carry Trade, AI Corrections, and Recession Fears

3 September 2024

August unfolded with a dramatic market sell-off, beginning with the Market Fallout on August 5th, when Japan’s Nikkei 225 tumbled by 12.4%, triggering sharp declines across most other global equity markets. This turmoil was driven by several key factors:

Unravelling the Carry Trade

Traders who borrowed low-cost Yen (i.e. at low interest rates) to invest in higher-yielding investment securities were blindsided by an unexpected rate hike from the Bank of Japan announced on 31st July. The resulting surge in the Yen’s value forced these traders to liquidate their investments to repay their borrowings, intensifying market instability.

AI Hype Deflating

The once-soaring valuations of AI-related stocks have begun to correct, reflecting a more measured view of the technology’s near-term financial prospects.

Recession Fears

Mounting concerns over a potential global recession have further stoked market anxiety, deepening the sell-off amid fears of a delayed US Federal Reserve interest rate cut.

By the end of the month, major US market indices like the S&P 500 and Dow Jones Industrials had recovered, but the journey was anything but smooth.

August Performance Review: SqSave Portfolios Show Resilience

In August, our GlobalSave Reference portfolios navigated through notable market volatility. The U.S. dollar's 3% decline vs. the Singapore dollar, due to our assets being USD-denominated, was a key factor. For example, while the bond focused ETFs in our reference portfolios showed modest increases on a USD basis in the past month, they fell by 1-2% in SGD adjusted terms, influencing overall performance. Gold remained steady, providing stability. Conversely, our represented equity-oriented ETFs achieved modest gains ranging from 1-4% in SGD terms, though this was not enough to fully offset the declines in other areas. Despite these challenges, our reference portfolios demonstrated some durability, with overall performance adjusting marginally by -2.3% to -2.7% across various risk levels.

Lower-Risk Reference Portfolios Maintain Competitive Edge

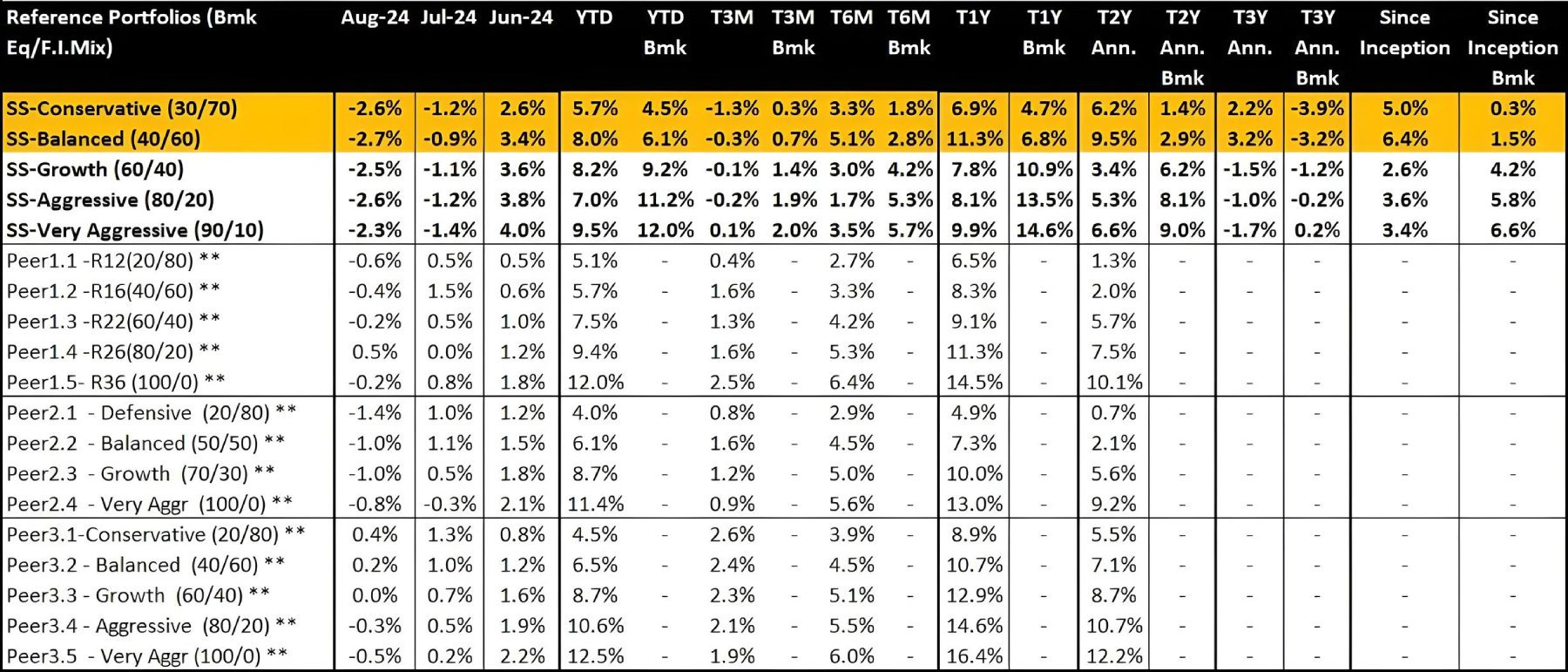

Conservative Portfolio (30/70)

In August, the reference portfolio experienced a -2.6% return. However, it has achieved a solid 5.7% performance year-to-date. Over the past year, it has outperformed both its peers and the benchmark with a 6.9% return. Its 2-year annualised return stands at a notable 6.2%, versus available comparable peers' returns ranging from 1.3% to 5.5% p.a. and its benchmark's 1.4% p.a. Since inception, the portfolio has delivered an impressive 5.0% annualised return, significantly surpassing the benchmark’s 0.3% p.a., highlighting its effective strategy in navigating volatility.

Balanced Portfolio (40/60)

The Balanced Reference Portfolio posted a -2.7% return for August but still retains an 8.0% year-to-date return, surpassing its peers and its benchmark’s 6.1% return. Over the past year, it outperformed peers with an 11.3% return compared to their comparable portfolios ranging from 7.3% to 10.7% and its benchmark's 6.8%. Its 2-year annualised return stands at 9.5%, significantly outperforming the peers’ average return of 3.7% and the benchmark's 2.9%. Since inception, the portfolio has delivered an annualised return of 6.4%, compared to its benchmark’s 1.5%, illustrating its effective balance of risk and reward.

Higher-Risk Reference Portfolios Demonstrate Notable Resilience

Growth Portfolio (60/40)

Despite a -2.5% return in August, the Growth Portfolio has achieved an 8.2% year-to-date gain and a 7.8% return over the past year.

Aggressive Portfolio (80/20)

The Aggressive Portfolio saw a -2.6% return in August but has delivered a 7% year-to-date performance. Its one-year return stands at 8.1%, with a 2-year annualised return of 5.3%. Since inception, the portfolio has achieved a return of 3.6%.

Very Aggressive Portfolio (90/10)

August’s -2.3% return contrasts with a solid 9.5% year-to-date gain and a 9.9% 1-year return. The 2-year annualised return is 6.6%.

Overall, SqSave’s portfolios reflect a well-structured approach to managing risk and capturing returns, reinforcing our commitment to delivering value through disciplined, data-driven investment strategies.

SqSave Reference Portfolios Returns (SGD terms as of 31 August 2024)*

*Inclusive of ETF expense ratios and net of SqSave management fees. SqSave uses AI to design and manage diversified investment portfolios for each investor. Because SqSave is not an investment fund, there is no single return measure. Instead, every SqSave investor has his/her own investment performance as each investor is managed separately by our SqSave AI. As investors can withdraw and top-up any time, investment returns will be affected by individual investor decisions. Hence, SqSave uses reference portfolios which are actual portfolios managed on an ongoing basis, without any interference with withdrawals or top-ups, to measure investment performance.

** Performance numbers for peers are estimates.

*** Abbreviations: SS: SqSave, Bmk: Benchmark, Eq: Equity, F.I.: Fixed Income, YTD: Year-to-Date, Ann: Annualised, and T3M, T6M, T1Y, T2Y, and T3Y denote three-month, six-month, one-year, two-year, and three-year terms, respectively.

**** Since Inception: Data reflects performance since July 2019.

Enhancements in GlobalSave Portfolios for Future Performance

Our investment approach involves rigorous AI-driven quantitative analysis, utilizing insights from past performance to continuously refine and enhance our strategies. In response to the current volatile environment in August, we have optimised our algorithms for all five GlobalSave portfolios to improve their performance. This includes incorporating new ETFs with low correlations to equities and adjusting the balance between equity and fixed income weights. We anticipate that the results of these modifications will start to become evident in the coming months.

Looking Ahead

As we approach September, key events such as the forthcoming US Federal Reserve meeting just after mid-month and critical economic data releases are set to influence market direction. While potential interest rate cuts might provide some relief, the broader market’s reaction will be crucial. The mixed performance across asset classes and ongoing volatility underscores the essential role of diversification in managing risk during turbulent times, particularly within our 5 GlobalSave portfolios.

By remaining calm and focused, investors can better navigate short-term market fluctuations while staying aligned with their long-term financial goals. As Warren Buffett wisely advises, "Be fearful when others are greedy and greedy when others are fearful." Now is a time to consider investing strategically to capitalise on opportunities and continue progressing towards your financial objectives.

Discover Stability in Volatile Times with MoneyBox

Amidst market volatility, we understand that some clients may seek a stable and attractive investment alternative. That's why we're offering an impressive 5% p.a. return on MoneyBox, surpassing current market rates! (T&Cs apply). Explore the opportunity here.

Conclusion

At SqSave, we’re committed to being there for you through every market shift. Our team is dedicated to providing the stability and guidance you need to stay on track with your financial goals. Your trust is our priority, and we’re here to support you every step of the way.

Yours sincerely

Investment Team

SqSave

SqSave.com is the regulated digital investment service operated by Pivot Fintech – a Licenced Fund Management Company regulated by the Monetary Authority of Singapore.

Disclaimer

The contents herein are intended for informational purposes only and do not constitute an offer to sell or the solicitation of any offer to buy or sell any securities to any person in any jurisdiction. No reliance should be placed on the information or opinions herein or accuracy or completeness, for any purpose whatsoever. No representation, warranty or undertaking, express or implied, is given as to the information or opinions herein or accuracy or completeness, and no liability is accepted as to the foregoing. Past performance is not necessarily indicative of future results. All investments carry risk and all investment decisions of an individual remain the responsibility of that individual. All investors are advised to fully understand all risks associated with any kind of investing they choose to do. Hypothetical or simulated performance is not indicative of future results. Unless specifically noted otherwise, all return examples provided in our websites and publications are based on hypothetical or simulated investing. We make no representations or warranties that any investor will, or is likely to, achieve profits similar to those shown, because hypothetical or simulated performance is not necessarily indicative of future results.

More Articles more

NOW IS THE TIME FOR HARD-HEADED INVESTING!

Team SqSave

On August 5, 2024, Japan's stock market plummeted over 12%—its biggest single-day decline since the infamous October 20, 1987, "Black Monday" global stock market crash.

Read more

From Fed Decisions to Tech Earnings: The Ripple Effect on Wall Street

Team SqSave

July has demonstrated the ripple effects of major financial events on the stock market, highlighted by the Federal Reserve's interest-rate decision and earnings results from major tech companies in the "Magnificent Seven."

Read more

RE-ASSESSING RISKS AHEAD OF THE 2024 USA PRESIDENTIAL ELECTION

Team SqSave

We entered 2024 knowing that elections form the key global theme. Half the world’s population will go to the polls. What will it mean for investors?

Read more