September Rebound: Fed's Influence Prevails

4 October 2024

Overview

September concluded with a recovery in returns across all risk categories for the SqSave reference portfolios. Performance for the month was shaped by three key drivers: Gold, Technology, and FX. Gold made a strong contribution, boosting overall portfolio performance, while Technology faced headwinds, leading to relative underperformance. Additionally, the USD/SGD FX rate saw a decline of 1.37%.

These mixed performances resulted in relatively modest overall return increases for most reference portfolios. However, our unwavering commitment to disciplined, data-driven strategies ensures that our clients remain well-positioned for long-term success.

Lower-Risk Reference Portfolios Showcase Continued Strength

Our lower-risk portfolios were among the better risk adjusted performers, with admirable returns last month; leaving year to date, 1 year and 2 year returns consistently above its benchmark and most comparable peer portfolio returns.

Conservative Portfolio (30% Equity /70% Fixed Income)

Short-Term Performance

In September, the portfolio achieved a monthly return of +0.7%, outperforming Peer 1's flat performance and Peer 2's +0.6%, though it lagged Peer 3, showing aa return of +1.1%. Over the past six months, the Conservative Portfolio has also significantly outperformed Peer 1 and Peer 2, although Peer 3 maintained a slight advantage.

1-3 Year and Since Inception Performance

The Conservative Portfolio has consistently outperformed Peer 1 and Peer 2 over the past year, delivering a strong return of +7.7%. Although Peer 3 also achieved higher returns over this time frame, the Conservative Portfolio’s performance remained competitive.

Over the two-year period, the Conservative Portfolio far out-paced Peers 1 and 2 by over 5% annually. It also outperformed Peer 3’s +6.0%. with an admirable return of +6.6%.

Since inception, the Conservative Portfolio has exceeded the benchmark by +4.7% annually, showcasing its effectiveness to generate strong consistent performance for investors over time.

Balanced Portfolio (40% Equity /60% Fixed Income)

Short-Term Performance

Although the Balanced Portfolio faced mild underperformance compared to its peers in the short term, it has achieved a commendable year-to-date return of +8.2%. This outpaces Peer 1’s +5.6%, Peer 2’s +7.3%, and Peer 3’s +7.7%. These year-to-date results underscore the portfolio's overall strength and ability to generate positive returns in a competitive landscape.

1-3 Year and Since Inception Performance

In the past year, the SS-Balanced Portfolio has achieved a robust return of +11.5%, surpassing its peers—Peer 1 at +8.2%, Peer 2 at +8.6%, and Peer 3 at +10.0%—while demonstrating its ability to deliver strong results.

Over two years, the portfolio’s annualized return of +9.7% significantly outperformed all peers, with Peer 1 at +2.0%, Peer 2 at +2.7%, and Peer 3 at +7.7%. Furthermore, the three-year annualized return of +3.2%, exceeding its benchmark of -3.0%.

Finally, since inception, the Balanced Portfolio has realized a return of +6.3%, greatly surpassing its benchmark of +1.6%. This consistent outperformance underscores the portfolio's strength and reliability over time.

High-Risk Reference Portfolios Exhibit Remarkable Endurance

Although the higher-risk portfolios have modestly underperformed their peers, we have made enhancements to the algorithm to improve future performance and capitalize on emerging opportunities.

Growth Portfolio (60% Equity /40% Fixed Income)

The Growth Portfolio recorded a return of 0.5% for the month of September, consistent with Peer 1's performance. Year-to-date, the portfolio has delivered a commendable 8.7%, showcasing its competitive positioning against Peer 1 at 8.0% and Peer 3 at 10.0%.

While the Growth Portfolio experienced some return fluctuations in the three- and six-month periods, it has demonstrated resilience and remains a solid choice for investors seeking growth. Over the past year, the portfolio achieved a return of 8.4%, outperforming Peer 1, thereby continuing to highlight its potential for sustainable growth.

Aggressive Portfolio (80% Equity /20% Fixed Income)

In September 2024, the Aggressive Portfolio achieved a zero return, aligning with its strategic focus on capital preservation during market fluctuations. Year-to-date, the portfolio has delivered a still respectable 6.9%, while allowing maintaining a past year return of 8.1%. Additionally, it demonstrates strong performance with its two-year annualized return of 5.2%, showcasing effectiveness in delivering value over time.

Very Aggressive Portfolio (90/10)

For the month of September, the Very Aggressive Portfolio achieved a 0.8% return, showcasing resilience in a fluctuating market. Year-to-date, the portfolio has delivered a commendable 10.4%, resulting in an return of 10.8% over the past year. Additionally, it demonstrates strong performance with its two-year annualized return of 7.0%, highlighting its effectiveness in providing value over time.

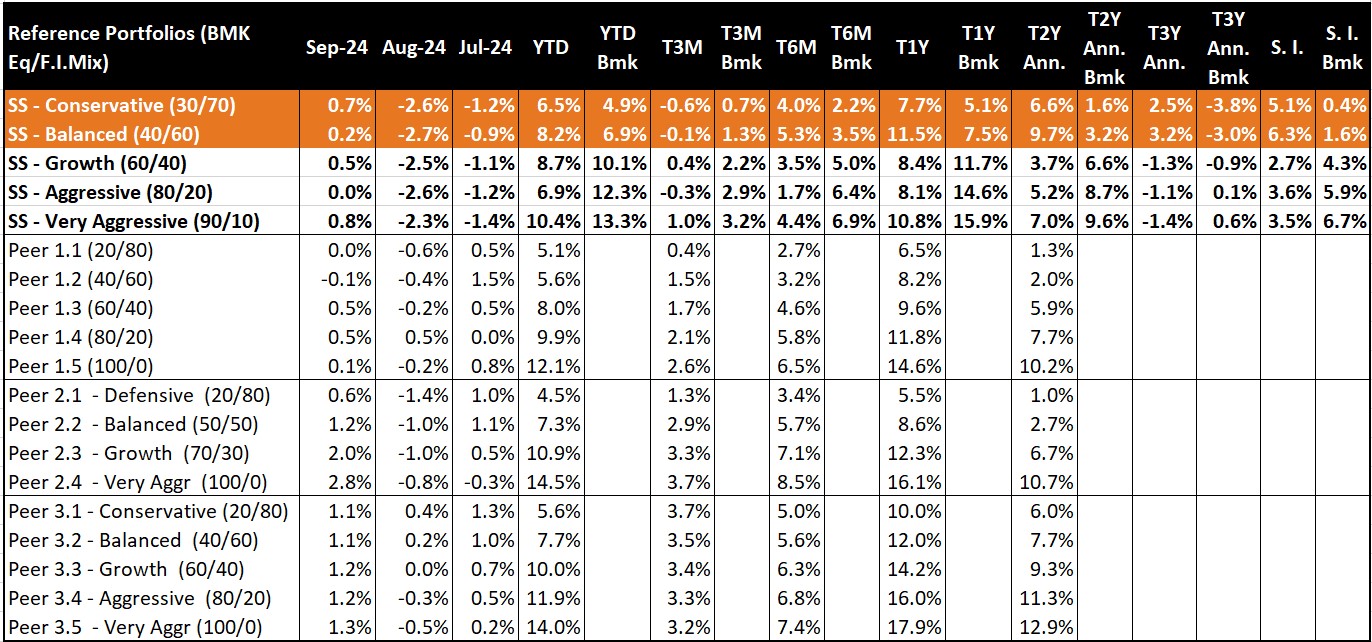

SqSave Reference Portfolio Returns (SGD terms as of 30 September 2024)

Note:

1. Portfolio returns are inclusive of ETF expense ratios and net of SqSave management fees. SqSave uses AI to design and manage diversified investment portfolios for each investor. Because SqSave is not an investment fund, there is no single return measure. Instead, every SqSave investor has his/her own investment performance as each investor is managed separately by our SqSave AI. As investors can withdraw and top-up any time, investment returns will be affected by individual investor decisions. Hence, SqSave uses reference portfolios which are actual portfolios managed on an ongoing basis, without any interference with withdrawals or top-ups, to measure investment performance.

2. Performance numbers for peers are estimates.

3. Abbreviations: SS: SqSave, Bmk: Benchmark, Eq: Equity, F.I.: Fixed Income, YTD: Year-to-Date, Ann: Annualised, S.I.: Since Inception (data reflects performance since July 2019). T3M, T6M, T1Y, T2Y, and T3Y denote three-month, six-month, one-year, two-year, and three-year terms, respectively.

Looking Ahead

The Federal Reserve's recent decision to lower interest rates, combined with promising inflation indicators, sets the stage for potential gains in both fixed income and equities, assuming the economy remains on stable footing without slipping into recession. This shift typically fosters a growth-friendly environment, as reduced borrowing costs can eventually invigorate economic activity and investment. Nonetheless, with geopolitical tensions heightened by the ongoing Israel-Iran conflict, investors should remain vigilant, balancing the promise of favourable market conditions with the underlying uncertainties of the current global landscape.

Invest in GlobalSave Portfolios with a Long-Term Perspective

At SqSave, we recognize that every investor has unique risk profiles and financial goals. That is why we offer a range of investment solutions, from conservative to very aggressive, tailored to meet your needs. With our AI-powered portfolios providing global asset diversification, you can start growing your wealth today—beginning with just one dollar. Ready to take the first step? Start here.

Prefer Cash?

Our MoneyBox currently offers an enticing promotional return of 5% p.a. (T&Cs apply). Explore the opportunity here.

Conclusion

We're with you every step of the way, ensuring you have the right investment solutions to meet your unique needs and goals.

Yours sincerely

Investment Team

SqSave

SqSave.com is the regulated digital investment service operated by Pivot Fintech (201716150D) which holds a Capital Markets Services licence (CMS100806) regulated by the Monetary Authority of Singapore

Disclaimer

The contents herein are intended for informational purposes only and do not constitute an offer to sell or the solicitation of any offer to buy or sell any securities to any person in any jurisdiction. No reliance should be placed on the information or opinions herein or accuracy or completeness, for any purpose whatsoever. No representation, warranty or undertaking, express or implied, is given as to the information or opinions herein or accuracy or completeness, and no liability is accepted as to the foregoing. Past performance is not necessarily indicative of future results. All investments carry risk and all investment decisions of an individual remain the responsibility of that individual. All investors are advised to fully understand all risks associated with any kind of investing they choose to do. Hypothetical or simulated performance is not indicative of future results. Unless specifically noted otherwise, all return examples provided in our websites and publications are based on hypothetical or simulated investing. We make no representations or warranties that any investor will, or is likely to, achieve profits similar to those shown, because hypothetical or simulated performance is not necessarily indicative of future results.

More Articles more

Seize the Investment Opportunity as Interest Rates Soften

Team SqSave

In our 8th Aug 2024 feature article “Now is the Time for Hard-Headed Investing”, we advocated the need to remove emotions from investing.

Read more

August Market Storm: Yen Carry Trade, AI Corrections, and Recession Fears

Team SqSave

August unfolded with a dramatic market sell-off, beginning with the Market Fallout on August 5th, when Japan’s Nikkei 225 tumbled by 12.4%, triggering sharp declines across most other global equity markets.

Read more

NOW IS THE TIME FOR HARD-HEADED INVESTING!

Team SqSave

On August 5, 2024, Japan's stock market plummeted over 12%—its biggest single-day decline since the infamous October 20, 1987, "Black Monday" global stock market crash.

Read more