Evolution of SqSave’s AI-Driven Strategy

4 December 2024

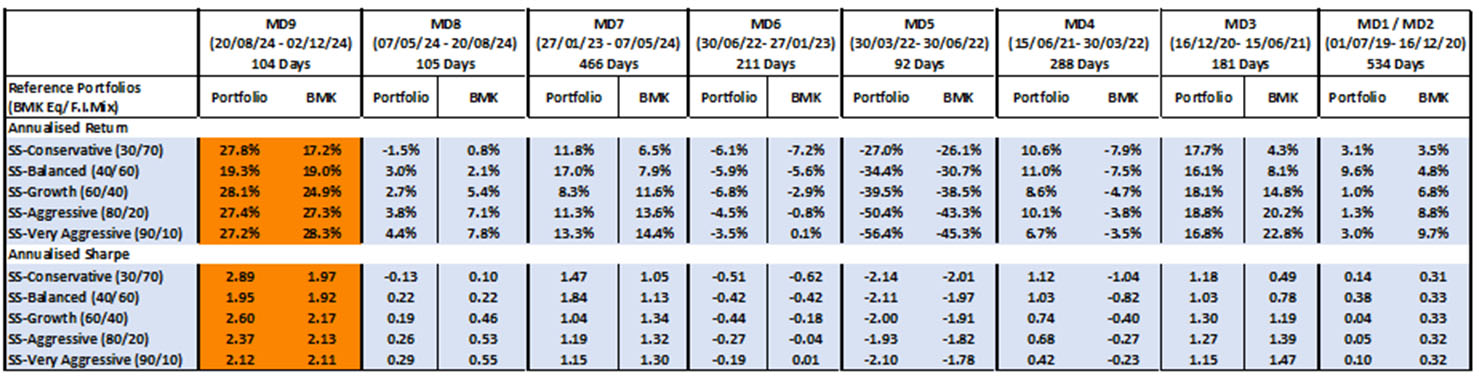

Over the past five years, our investment algorithm has undergone continuous improvement. Driven by quantitative research, data testing and validation, each update is monitored and reviewed for delivering good risk-adjusted returns over time. Today, we’re encouraged that our latest version is not only exceeding expectations, albeit based on early results so far, but is also displaying better optimised reward-to-risk ratios.

Smarter, Faster, and More Adaptive Portfolios

At PIVOT Fintech, we use Artificial Intelligence (AI) and Machine Learning (ML) to improve how investment portfolios are traditionally managed. Our Dynamic Asset Allocation Strategy (DAAS) combines long-term Strategic Asset Allocation (SAA) with Tactical Asset Allocation (TAA), adapting daily to market conditions. Unlike traditional strategies that rebalance a few times a year, our AI-driven approach updates asset weights dynamically, eliminating the need for human intervention.

This real-time adaptability allows our portfolios to align with individual investor needs, considering factors like risk tolerance, age, and investment goals. While our focus remains on achieving steady long-term returns, we also prioritise protecting against losses by setting clear limits on individual asset and equity allocations. This two-pronged approach ensures diversification, resilience, and an improved ability to navigate unpredictable markets.

The Journey of Innovation: How Our Algorithm Has Evolved

Each iteration of our algorithm has introduced meaningful enhancements, designed to address investor needs and market challenges:

MD1/MD2: Introduced our AI/ML-powered Strategic Asset Allocation, built on Markowitz’s Modern Portfolio Theory (MPT).

MD3: Added tactical asset allocation techniques, optimising portfolios using real-time market data and three key investor dimensions: time horizon, risk, and age.

MD4: Improved the balance of risk and reward by refining equity and fixed-income allocation limits, helping portfolios consistently outperform benchmarks.

MD5: Tailored risk constraints for each portfolio, offering more flexibility while expanding our ETF selection to include key sectors like Technology (XLK), Financials (XLF), and Energy (XLE).

MD6: Enhanced downside risk protection for higher-risk portfolios by implementing dynamic hedging and frequent rebalancing, balancing growth opportunities with reduced correlation risk.

MD7: Broadened sector diversification by expanding ETF options, including Canadian equities and a USD bullish fund (USDU), while improving downside risk management.

MD8: Focused on managing concentration risk by refining allocation boundaries and shifting to more diversified investments, for better portfolio stability.

MD9: Introduced precise upper limits for individual ETFs, improved portfolio control, and expanded investments into emerging markets and alternatives with evidence of strong long-term return potential.

Driving Growth, Managing Risk, and Staying Ahead

With each update, our algorithm continues to adapt, becoming smarter, more resilient, and better aligned with market realities. These enhancements help our portfolios achieve investors’ evolving goals while staying focused on delivering good risk-adjusted returns.

Thank you for trusting us on this journey. We remain committed to growing your investments responsibly and effectively.

Yours sincerely

Investment Team

SqSave

SqSave.com is the regulated digital investment service operated by Pivot Fintech (201716150D) which holds a Capital Markets Services licence (CMS100806) regulated by the Monetary Authority of Singapore

Disclaimer

The contents herein are intended for informational purposes only and do not constitute an offer to sell or the solicitation of any offer to buy or sell any securities to any person in any jurisdiction. No reliance should be placed on the information or opinions herein or accuracy or completeness, for any purpose whatsoever. No representation, warranty or undertaking, express or implied, is given as to the information or opinions herein or accuracy or completeness, and no liability is accepted as to the foregoing. Past performance is not necessarily indicative of future results. All investments carry risk and all investment decisions of an individual remain the responsibility of that individual. All investors are advised to fully understand all risks associated with any kind of investing they choose to do. Hypothetical or simulated performance is not indicative of future results. Unless specifically noted otherwise, all return examples provided in our websites and publications are based on hypothetical or simulated investing. We make no representations or warranties that any investor will, or is likely to, achieve profits similar to those shown, because hypothetical or simulated performance is not necessarily indicative of future results.

More Articles more

SqSave Algorithms have Outperformed Despite US Election Uncertainty

Team SqSave

Despite the uncertainty over the US election outcome, and the escalating wars in the Middle East and Ukraine, our SqSave Reference Portfolios have beaten our reference benchmarks and outperformed the tracked competitors in October 2024.

Read more

September Rebound: Fed's Influence Prevails

Team SqSave

September concluded with a recovery in returns across all risk categories for the SqSave reference portfolios.

Read more

Seize the Investment Opportunity as Interest Rates Soften

Team SqSave

In our 8th Aug 2024 feature article “Now is the Time for Hard-Headed Investing”, we advocated the need to remove emotions from investing.

Read more