Investment Outlook 2025

24 December 2024

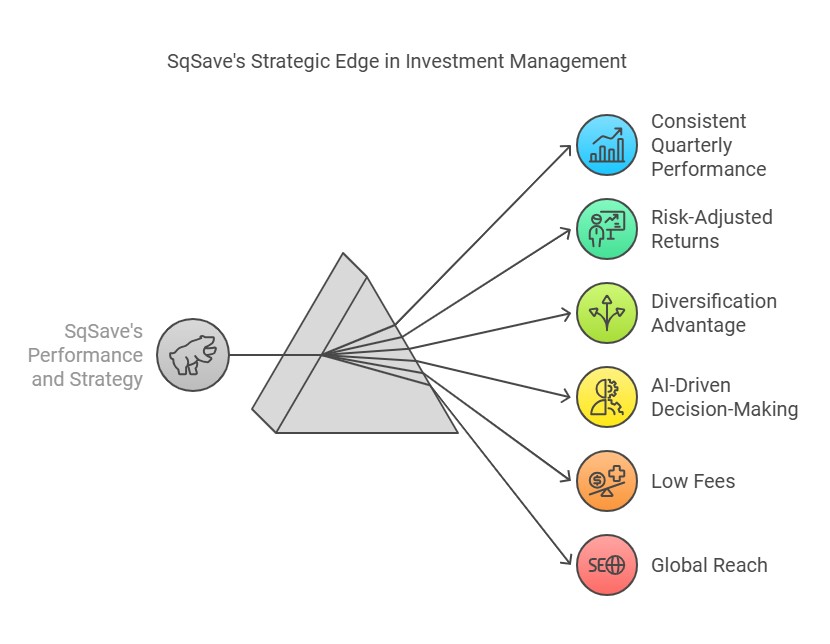

SqSave’s reference portfolios demonstrated robust performance throughout 2024, consistently outperforming benchmarks and competitors across various portfolio categories.

Clearly, SqSave’s globally diversified portfolios benefited from its AI-driven allocation strategies.

Key Performance Metrics in 2024

- Consistent Quarterly Performance

- SqSave's lower-risk portfolios consistently outpaced competitors during periods of market volatility.

- Risk-Adjusted Returns

- SqSave consistently delivered higher Sharpe ratios compared to its peers, indicating better risk-adjusted performance.

- Diversification Advantage

- SqSave’s AI asset allocation algorithms achieved broader diversification across small-cap equities and alternative assets.

Competitive Differentiators

AI-Driven Decision-Making: SqSave’s algorithms adapt quickly to market shifts, optimizing portfolio adjustments.

Low Fees: SqSave’s competitive fee structure is more attractive compared to traditional wealth management and robo-advisors.

Global Reach: SqSave’s globally diversified approach has tapped into investment opportunities in emerging markets and sectors beyond traditional geographies.

What’s Likely in 2025

A favorable U.S. economic growth outlook for 2025 paired with Donald Trump’s tax cuts and deregulatory initiatives could boost the prospects of U.S. stocks even further.

U.S.- China tensions will, meanwhile, drive further competition for resources including copper as the two countries compete for a competitive edge in AI. New import tariffs imposed by Trump could worsen the situation.

Ageing global populations are also on course to push up labour costs, keeping inflation high, in a situation that could also be made worse by new Trump era limits on immigration.

The election of Republican nominee Donald Trump means there will likely be fewer Federal Reserve interest-rate cuts over the next 13 months than had been expected, economists said Wednesday.

On the interest rate front, the combination of existing high debt levels and additional fiscal spending means the Fed will probably lower expectations of future rate cuts. Recently, the Federal Reserve indicated cutting the benchmark interest rate to a range of 3.25%-3.5% by the end of 2025 from the current level of 4.75%-5%.

There will be lingering concerns about inflation under President Trump’s agenda in 2025 of tariffs. We don’t see inflation surging, but inflation may be stubborn at a 2.5% annual rate, which is above the Fed’s 2% target.

Overall, we anticipate continued strength in U.S. stocks, particularly in sectors benefiting from AI advancements and potential policy shifts under the new administration.

With expectations of monetary policy easing, certain fixed-income investments, such as municipal bonds and actively managed short-term bond funds, are attractive options.

Navigating Global Investment Turbulence

Remember, market volatility is the basis of investment returns. Market disappointments over rising inflation, the uncertain path of US interest rates, and the risk of a stronger US dollar can impact investment returns in 2025.

As such, investors must be smarter about how they diversify and manage risks.

The global economy is undergoing significant transformations due to factors like AI, geopolitical changes, and demographic shifts. Investors must focus on long-term themes and maintain portfolio resilience amidst these changes.

In this evolving landscape, SqSave's AI-driven, diversified investment approach is well-positioned to adapt to market dynamics and capitalize on emerging opportunities.

By using SqSave’s automated investing technology, investors can sit back and let SqSave’s data-driven engine stay abreast of macroeconomic trends and discover strategies that align with their risk tolerance and investment objectives.

Yours sincerely

Investment Team

SqSave

SqSave.com is the regulated digital investment service operated by Pivot Fintech (201716150D) which holds a Capital Markets Services licence (CMS100806) regulated by the Monetary Authority of Singapore

Disclaimer

The contents herein are intended for informational purposes only and do not constitute an offer to sell or the solicitation of any offer to buy or sell any securities to any person in any jurisdiction. No reliance should be placed on the information or opinions herein or accuracy or completeness, for any purpose whatsoever. No representation, warranty or undertaking, express or implied, is given as to the information or opinions herein or accuracy or completeness, and no liability is accepted as to the foregoing. Past performance is not necessarily indicative of future results. All investments carry risk and all investment decisions of an individual remain the responsibility of that individual. All investors are advised to fully understand all risks associated with any kind of investing they choose to do. Hypothetical or simulated performance is not indicative of future results. Unless specifically noted otherwise, all return examples provided in our websites and publications are based on hypothetical or simulated investing. We make no representations or warranties that any investor will, or is likely to, achieve profits similar to those shown, because hypothetical or simulated performance is not necessarily indicative of future results.

More Articles more

November’s Performance: SqSave Algorithms Deliver Another Good Month

Team SqSave

September concluded with a recovery in returns across all risk categories for the SqSave reference portfolios.

Read more

Evolution of SqSave’s AI-Driven Strategy

Team SqSave

Over the past five years, our investment algorithm has undergone continuous improvement.

Read more

SqSave Algorithms have Outperformed Despite US Election Uncertainty

Team SqSave

Despite the uncertainty over the US election outcome, and the escalating wars in the Middle East and Ukraine, our SqSave Reference Portfolios have beaten our reference benchmarks and outperformed the tracked competitors in October 2024.

Read more