STAYED FOCUSED WHILE RIDING THE CURRENT VOLATILITY

10 March 2025

Feb 2025 - Surge in Market Volatility

As seasoned investors know, volatility is the source of investment gains. But that’s only half the story. Volatility is also the source of investment losses.

The ultimate requirement is to diversify enough knowing your own risk tolerance - so that you don’t throw up during the turbulence! That’s what our SqSave algorithms are designed to do.

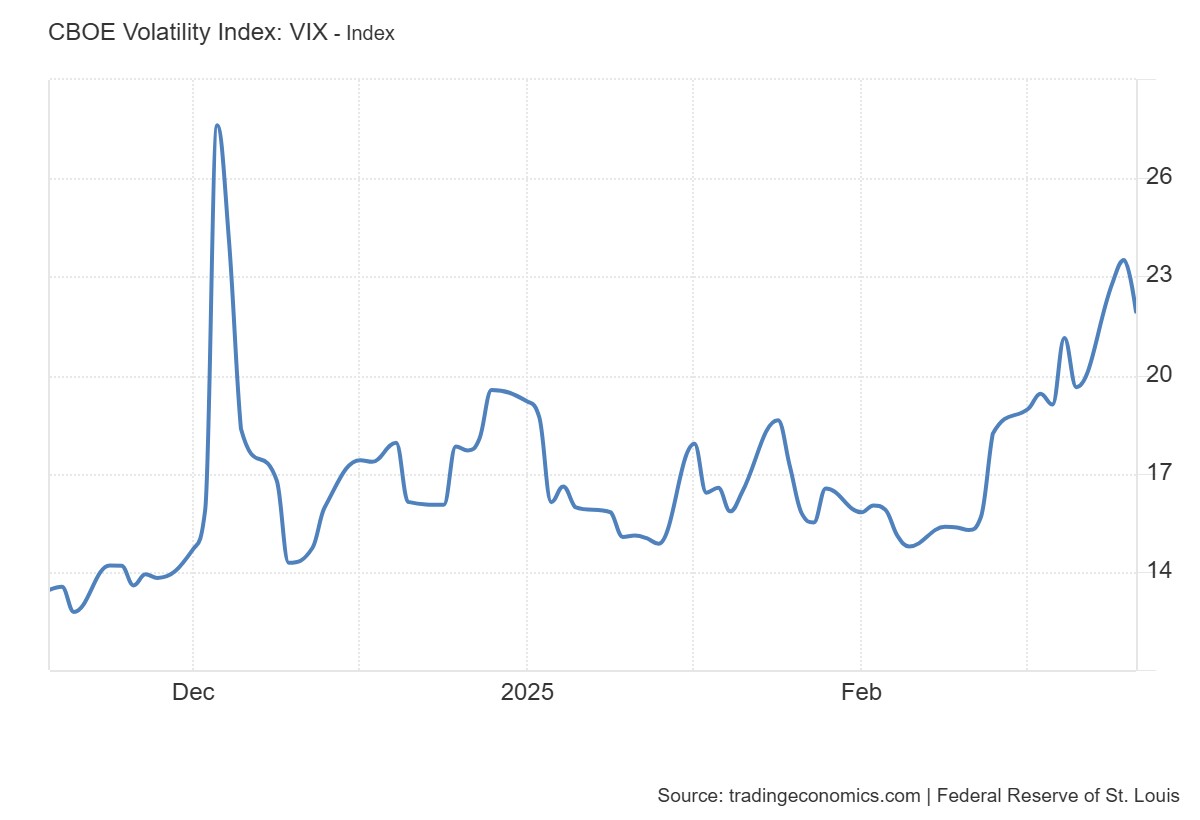

Mathematically, our SqSave algorithms track and measure volatility as investment risk. In the short term, risk has risen dramatically. This can be proxied by the VIX index (Cboe Volatility Index), a real-time market index that measures the expected volatility of the S&P 500 over the next 30 days. It is often referred to as the "fear gauge" because it reflects investor sentiment and market risk.

In Feb 2025, the VIX surged to reach its highest level since mid-December 2024, driven by factors such as new tariff announcements affecting major trading partners.

SqSave Investment Performance

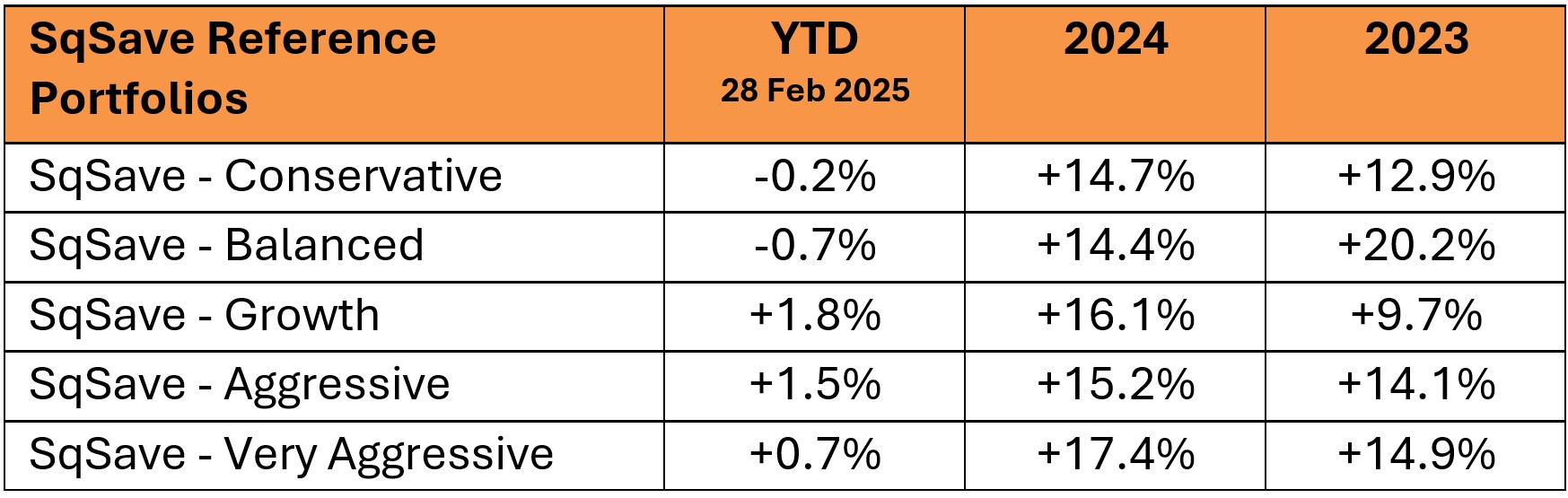

The surge in volatility affected SqSave’s short-term investment performance – resulting in negative returns for the month of Feb 2025 - for the lower risk SqSave reference portfolios. The negative returns are mainly due to the SqSave algorithm’s exposure to India and the US tech sector. Both these asset classes underperformed in Feb 2025. Nonetheless, we are comfortable with the asset allocation set by our algorithms – and expect the higher cash allocations to be deployed in March 2025 when asset prices have fallen.

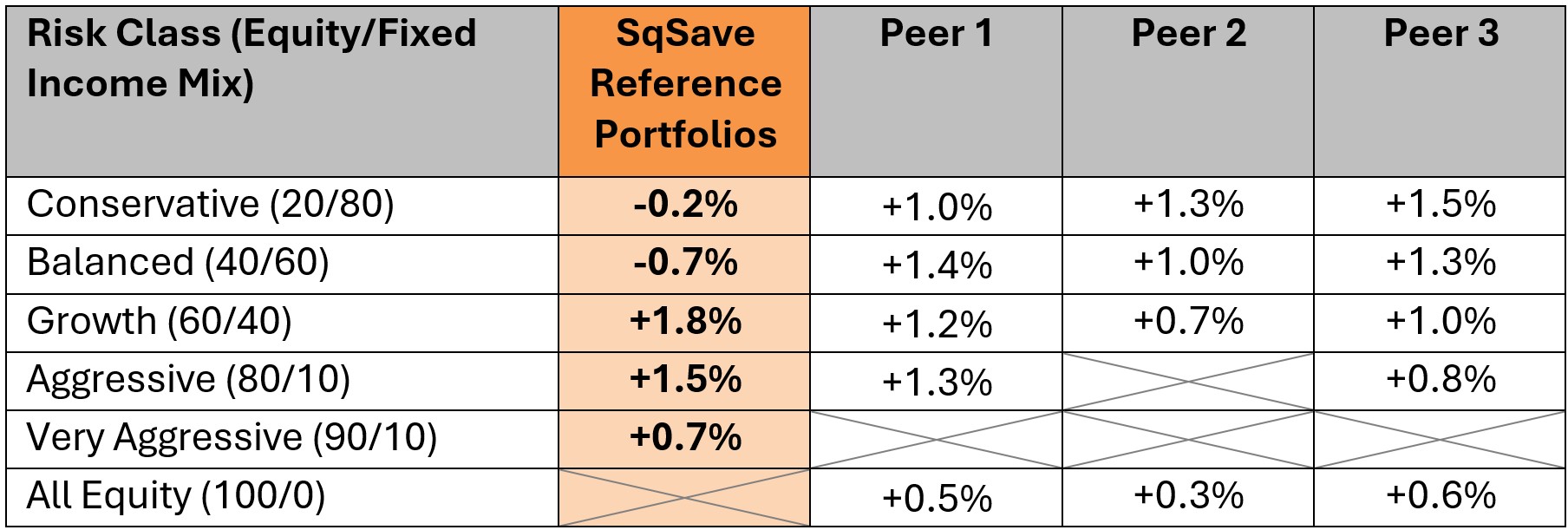

What stands out is that the higher-risk SqSave reference portfolios did rather well despite the higher volatility. In terms of what we said at the outset of this report, our algorithms achieved an outcome on the positive end of the risk-return conundrum.

It is also good to note that our Growth / Aggressive / Very Aggressive SqSave reference portfolios outperformed the competitor peers’ corresponding risk classes that we track.

Navigating the Investment Volatility Ahead

At SqSave, we will continue to monitor the following key factors:

- USA Inflation & Federal Reserve Policy

- The data announced in Feb 2025 for January CPI showed a +2.9% yoy rise in inflation, above expectations of +2.7%. Notably, core inflation remained sticky at +3.2%. Markets reacted negatively, with S&P 500 declining -4.1% over the month, while 10-year Treasury yields rose to +4.6%, its highest level since late 2024.

- We need to watch the tension between the Trump Administration and the US Fed. The US Fed has said that it will watch what the Trump Administration does before deciding on its interest rate policy. Meanwhile, the US Fed has kept interest rates steady at 4.75%-5.00%, signalling unlikely rate cuts in the near term, citing persistent inflationary pressures. Instead, the Trump Administration prefers to see rates fall towards 3%, and the US Treasury Secretary has stated that there will be limited issuance of Treasuries to force rates down. This tug-of-war bears watching.

- Geopolitical Tensions

- Escalating Middle East tensions has led to higher oil prices, with Brent crude surging to $95 per barrel, its highest level since 2022.

- Safe-haven assets like gold benefited, with prices climbing to $2,150 per ounce, while equity markets in Europe and Asia experienced significant outflows.

- Our SqSave algorithm exposure to Gold is well above what traditional human fund managers would tolerate. We believe the high gold allocation is good downside risk hedging for our SqSave portfolio.

- China’s Economic Stimulus

- China announced a 2 trillion yuan ($280 billion) stimulus package to revive its struggling economy, focusing on infrastructure, green energy, and consumer subsidies.

- But economic data remains weak, with the Shanghai Composite Index falling -3.5% in February, reflecting skepticism about the stimulus measures.

- India’s Strong Growth Momentum

- While Indian investment markets have underperformed, India’s fundamentals are good with Q4 2024 GDP growth at +7.2% year-over-year, driven by robust domestic consumption and infrastructure spending.

- The Nifty 50 Index fell 5.9% in February, buffeted by slowdown in earnings growth from the financial and technology sectors, although some recent economic data point to a possible return of stability.

- We believe that SqSave’s current algorithm asset allocation to India will deliver results in the next few months.

Investment Outlook for the Next 6 to 9 Months

The global economy is expected to remain uneven, with the USA and India showing resilience, while China and Europe face headwinds.

Central banks, particularly the Fed and ECB, are likely to maintain a cautious stance, with rate cuts delayed until late 2025 unless inflation shows sustained moderation.

The U.S. tech sector remains a key driver of innovation and growth, with strong demand for artificial intelligence (AI), cloud computing, and semiconductor technologies. However, elevated valuations and rising interest rates pose risks.

Emerging markets, particularly India, could outperform due to strong growth fundamentals. India’s growth story remains compelling, supported by structural reforms, a young population, and increasing foreign investment.

Over the next 6 to 9 months, we will focus on quality, diversification, and staying attuned to critical geopolitical and policy developments. We are satisfied with our SqSave algorithms but will deploy the high cash allocations for the Conservative and Balanced portfolios to take advantage of the lower asset prices.

Sincerely,

SqSave Investment Team

Disclaimer

The contents herein are intended for informational purposes only and do not constitute an offer to sell or the solicitation of any offer to buy or sell any securities to any person in any jurisdiction. No reliance should be placed on the information or opinions herein or accuracy or completeness, for any purpose whatsoever. No representation, warranty or undertaking, express or implied, is given as to the information or opinions herein or accuracy or completeness, and no liability is accepted as to the foregoing. Past performance is not necessarily indicative of future results. All investments carry risk and all investment decisions of an individual remain the responsibility of that individual. All investors are advised to fully understand all risks associated with any kind of investing they choose to do. Hypothetical or simulated performance is not indicative of future results. Unless specifically noted otherwise, all return examples provided in our websites and publications are based on hypothetical or simulated investing. We make no representations or warranties that any investor will, or is likely to, achieve profits similar to those shown, because hypothetical or simulated performance is not necessarily indicative of future results.

More Articles more

Conservative Portfolio Delivers 14% Return, Outperforming Peers Over the Past Year

Team SqSave

Despite the usual market fluctuations, we at SqSave are pleased to announce that we have continued to outperform both our benchmarks and competitors over the past year.

Read more

2024: SQSAVE INVESTMENT RETURNS BEAT ITS PEERS

Team SqSave

We are happy to share that SqSave’s investment algorithms have outperformed in 2024, with three key observations outlined below.

Read more

Investment Outlook 2025

Team SqSave

SqSave’s reference portfolios demonstrated robust performance throughout 2024, consistently outperforming benchmarks and competitors across various portfolio categories.

Read more