Conservative Portfolio Delivers 14% Return, Outperforming Peers Over the Past Year

17 February 2025

Overview

Despite the usual market fluctuations, we at SqSave are pleased to announce that we have continued to outperform both our benchmarks and competitors over the past year. This strong performance builds on the positive momentum we've maintained since our key adjustments to the algorithm last year.

Short-term Performance and Algorithm Effectiveness

Our recent algorithm enhancements are delivering strong results. While some of our reference portfolios underperformed relative to peers and benchmarks in January 2025, they have still significantly outpaced them over the past three months. This underscores the long-term focus of our algorithms and reinforces the importance of looking beyond short-term fluctuations to appreciate sustained, strategic growth.

Conservative 1-Year Performance Soars at 14%, Surpassing Peers' 8%

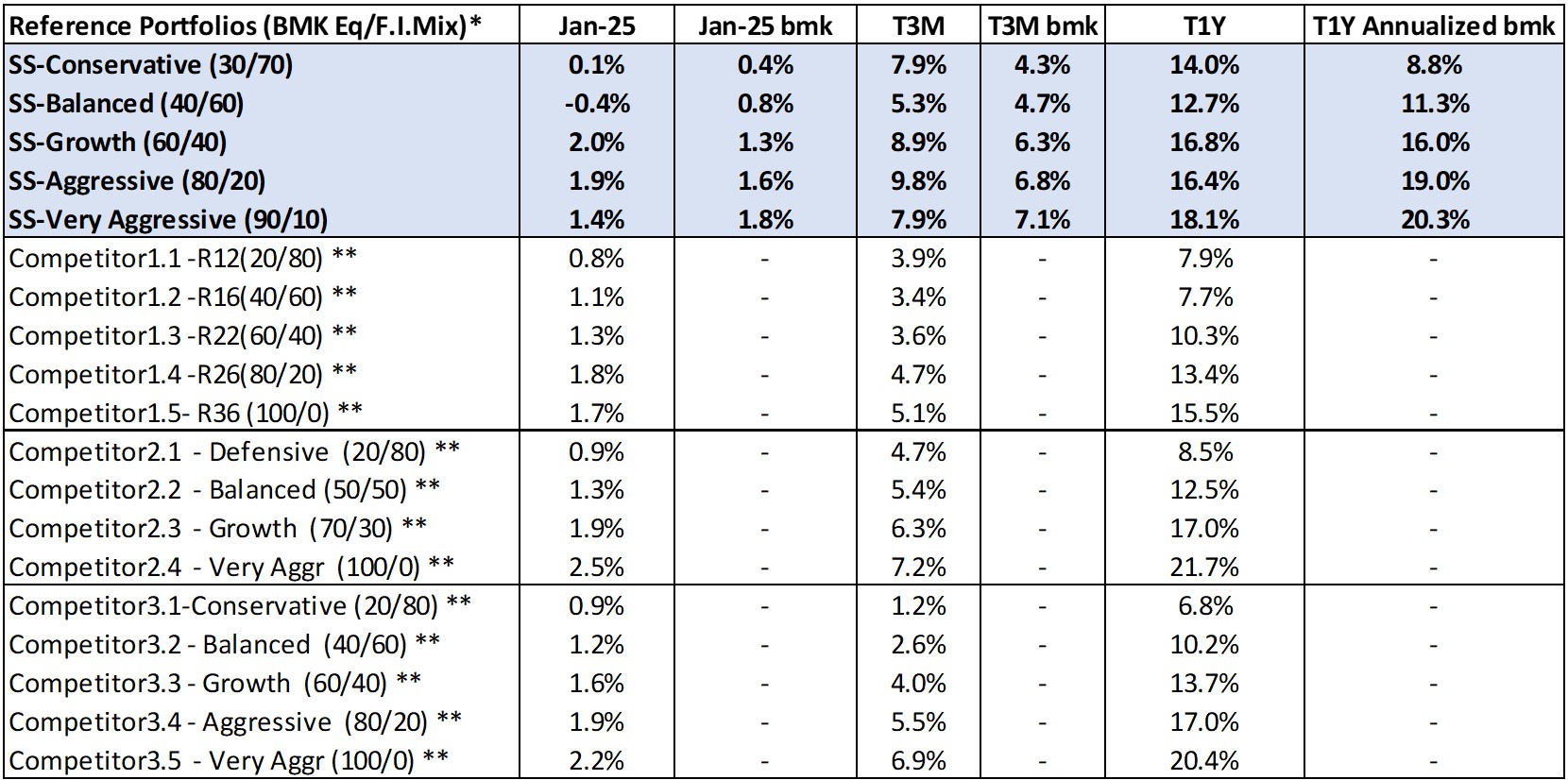

Over the past year, our reference portfolios outperformed almost all our peers. Notably, our Conservative Reference Portfolio achieved an impressive 14% return, more than doubling the 8% average return of the referenced competitors. This significant performance gap highlights our ability to successfully navigate various market conditions and maintain a strong competitive edge.

SqSave Reference Portfolios Returns

(SGD terms as of 31 January 2025)*

*Inclusive of ETF expense ratios and net of SqSave management fees. SqSave uses AI to design and manage diversified investment portfolios for each investor. Because SqSave is not an investment fund, there is no single return measure. Instead, every SqSave investor has his/her own investment performance as each investor is managed separately by our SqSave AI. As investors can withdraw and top-up any time, investment returns will be affected by individual investor decisions. Hence, SqSave uses reference portfolios which are actual portfolios managed on an ongoing basis, without any interference with withdrawals or top-ups, to measure investment performance.

** Performance numbers for peers are estimates. Abbreviations: BMK: Benchmark, Port: Portfolio, Eq: Equity and F.I.: Fixed Income.

Looking Forward

Looking ahead in the market, the outlook for investors remains positive, though still uncertain. Despite potential volatility, there will continue to be opportunities for solid investments. Periods of low volatility, market pullbacks, and dips, along with possible decreases in inflation and interest rates, may provide favourable entry points. Even with ongoing geopolitical tensions and fluctuating economic factors, strategic investors are advised to stay informed, prepare for potential market shifts, and leverage these movements to optimize their investment strategies.

SqSave - Your Trusted Partner

Get in touch with us today, and let's start this journey toward financial success together. If you haven’t partnered with SqSave yet, now is the perfect time to do so. With SqSave’s proven expertise and track record, you can optimize your investment returns. Join us in our exceptional approach to AI-driven portfolio management.

Yours sincerely

SqSave Investment Team

Disclaimer

The contents herein are intended for informational purposes only and do not constitute an offer to sell or the solicitation of any offer to buy or sell any securities to any person in any jurisdiction. No reliance should be placed on the information or opinions herein or accuracy or completeness, for any purpose whatsoever. No representation, warranty or undertaking, express or implied, is given as to the information or opinions herein or accuracy or completeness, and no liability is accepted as to the foregoing. Past performance is not necessarily indicative of future results. All investments carry risk and all investment decisions of an individual remain the responsibility of that individual. All investors are advised to fully understand all risks associated with any kind of investing they choose to do. Hypothetical or simulated performance is not indicative of future results. Unless specifically noted otherwise, all return examples provided in our websites and publications are based on hypothetical or simulated investing. We make no representations or warranties that any investor will, or is likely to, achieve profits similar to those shown, because hypothetical or simulated performance is not necessarily indicative of future results.

More Articles more

2024: SQSAVE INVESTMENT RETURNS BEAT ITS PEERS

Team SqSave

We are happy to share that SqSave’s investment algorithms have outperformed in 2024, with three key observations outlined below.

Read more

Investment Outlook 2025

Team SqSave

SqSave’s reference portfolios demonstrated robust performance throughout 2024, consistently outperforming benchmarks and competitors across various portfolio categories.

Read more

November’s Performance: SqSave Algorithms Deliver Another Good Month

Team SqSave

September concluded with a recovery in returns across all risk categories for the SqSave reference portfolios.

Read more