Covid-19: Has Fear Run Ahead of Markets?

March 9, 2020

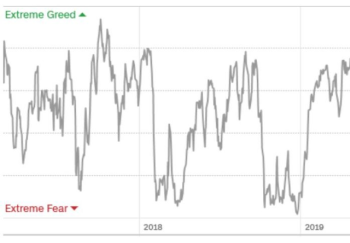

Greed & Fear…

In all my investing experience, greed and fear are the driving forces behind buying and selling decisions. Yet, I realized that it is when there is excessive greed that we buy (fixated on unrealized profit and reluctant to sell) and when there is excessive fear that we sell (no holding power or reluctant to buy). This investing pattern is similar to gambling.

…data & AI to improve investment outcomes

In 2016, when I decided to leverage artificial intelligence (AI) to improve investment outcomes, I was already looking for the next black swan event. Based on my human experience, investment markets experienced sudden sharp corrections every 10 to 11 years. For example, the 1987 Oct crash, the 1997 Asian Financial Crisis, the 2008 Global Financial Crisis, and now the Covid-19 Crisis.

Between these big movements were bouts of market volatility, such as the 1991-92 US recession, the dotcom bust of 2000 and Euro Debt crisis which peaked in 2010-2012, to name a few.

Looking at market crises in context

For those who lived through these crises, it will be useful to compare and contrast our memories during and after each depressing experience. In short, the comparison is similarly of dread and fear as we witness markets gyrating wildly and falling. The contrast is that every crisis of fear gave way to recovery of hope within 2 to 3 years.

What strikes me is that all the crises have moved from being local to more global - due to the growth in international capital flows, and now, internet connectivity and intertwined global supply chains.

Let’s examine the current Covid-19 Crisis. Without doubt, it is global. As in the past, there is now widespread fear – which threatens to overcome sensibility and data-driven evidence. Otherwise, how do we explain the brawls over toilet paper?

The impact of Covid-19

The Covid-19 epidemic is becoming a global pandemic. Global markets have taken a tumble. The S&P 500 index of US companies fell by 11.5% in the week commencing 24 Feb 2020, the worst week since the 2007-2009 Global Financial Crisis.

The economic impact is already more severe than SARS or MERS. In 2003, SARS infected about 8,000 people and killed 774, taking USD 50 billion off the global economy. In 2015, MERS infected 200 people and killed 38, and cost the global economy USD 8.5 billion.

To be clear, the Covid-19 outbreak has been in the media spotlight since its December 2019 discovery in China. Yet, in recent days, we see a rachet up in Covid-19 concerns in the Western hemisphere. In early March, the World Health Organization has declared COVID-19 a public health emergency citing a mortality rate of 3.4%.

We are witnessing cracks in public health systems and political structures across the globe, with health workers bearing the brunt, proliferation of fake news, racism, hoarding, and even political leaders in denial playing the blame game.

It is easily forgotten how China bought time for the world to prepare when it undertook draconian containment measures in the form of “quarantine by decree” – hard for any country to follow – at great cost to its own economy.

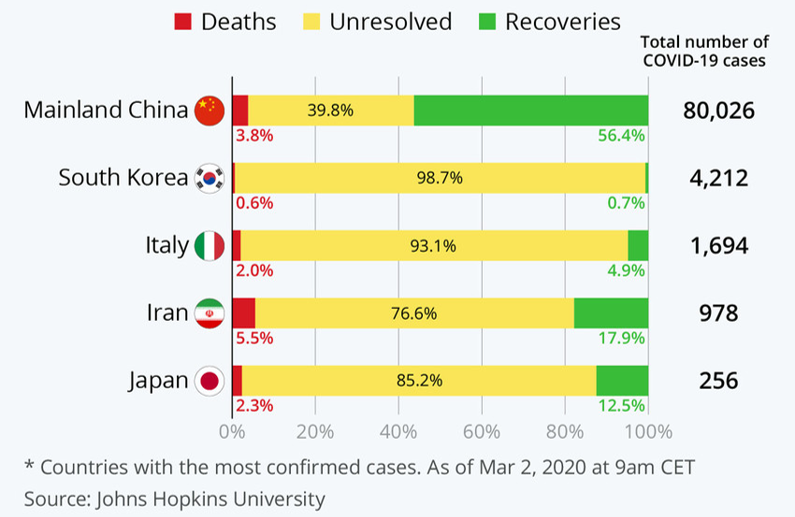

China has done a commendable job. The data shows a slowdown in the Covid-19 spread within China. But the outbreak has spread to South Korea, Iran, Italy, and now possibly in the USA.

By 1 Mar 2020, the number of new cases outside China exceeded the cases in China.

As of 1 Mar 2020, China is still the main caseload with the total number of confirmed COVID-19 cases at 80,565 (3,015 deaths) and 14,768 confirmed cases (267 deaths) in the rest of the world.

COVID-19 CASES

Source: Statista

Looking ahead, there may be the first vaccine test, but a safe and effective vaccine may only be available in 2021 – assuming the genetic makeup of the virus does not change. In the interim, Covid-19 has to be contained. In Africa, the WHO has set up 40 testing labs across 35 countries (from zero) to achieve early Covid-19 detection and control.

Covid-19 Fears in Overdrive…

It is likely for Covid-19 to go endemic if not pandemic. As the number infected is most likely under-reported due to lack of test kits and similar symptoms to the prevalent flu, overall Covid-19 death rates are likely to be lower than actual. Bear in mind that data from many countries is not reliable due to poor testing, political incompetence and uncertain clinical definitions of symptoms.

Alarming data may in fact be less cause for alarm. Like Singapore, infected cases in South Korea shot up because over 70,000 people were tested. In contrast, Japan and Thailand did fewer than 2,000 tests. The lack of testing is even more alarming in the USA. In Indonesia, there were until recently, no cases.

So far, the Covid-19 data shows high concentration of cases, as in Wuhan (China), Daegu (South Korea) and Lombardy (Italy). This suggests that containment and effective contact tracing are critical in fighting Covid-19.

Positioning for Recovery

Covid-19 is less fatal than SARS and MERS with a fatality rate of 0.9%, versus Flu’s 0.1%. Covid-19 seems more lethal for people with pre-existing conditions or over 60 years of age.

Examining market reactions for past ‘viral scares’, the same patterns are being repeated. Using 10 Year Treasury yields as proxy for risk deleveraging, the peak panic lasted 30-40 days in the past 5 viral scares. Arguably, the market selloff may be exacerbated by deleveraging and margin calls.

Data during the past virus scares point to sharp recoveries over a span of 9 months. For example, during the SARS crisis, the HK market saw a 70% rebound over 9 months. During the H1N1 virus scare, US stocks recovered close to 70% in 9 months.

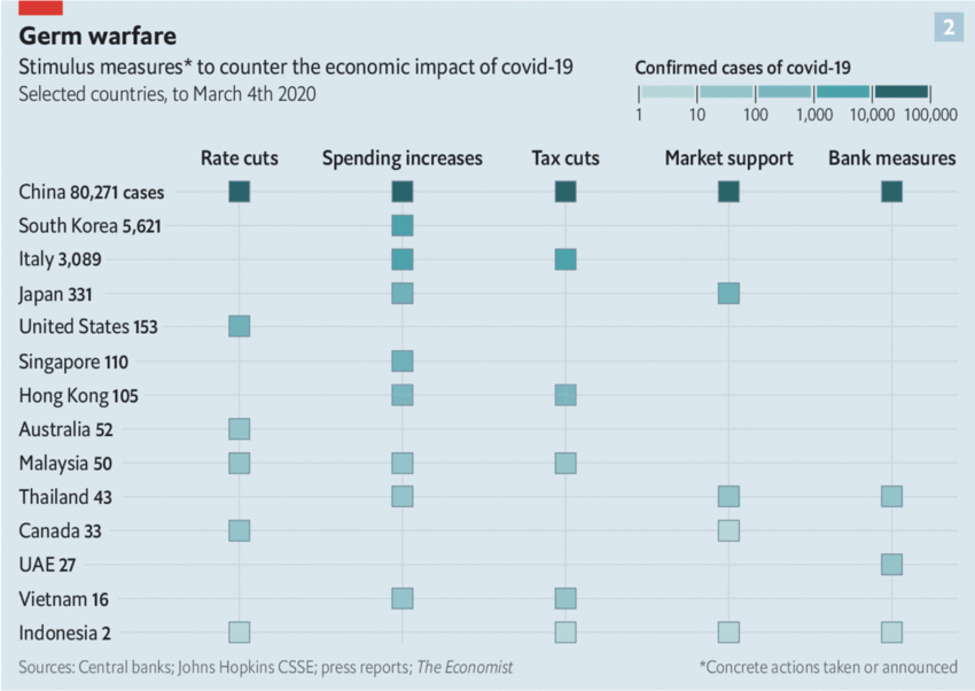

Nonetheless, the economic cost of Covid-19 will be very high due to the multiplier effect of consumer demand and international travel collapsing. In response, various governments are resorting to fiscal spending and monetary easing.

The likelihood of a global recession has led central banks to slash interest rates at a pace not seen since the Global Financial Crisis of 2007-2009. On 3 Mar 2020, the US Federal Reserve lowered its policy rate by 0.5 percentage points, two weeks ahead of its monetary-policy meeting. Central banks in Australia, Canada and Indonesia have also cut rates. The European Central Bank and the Bank of England are expected to follow.

Economic stimulus measures in response to Covid-19

Source: The Economist

Conclusion

We continue to watch Covid-19 unfold. As I said at the outset, we need to recognize the greed and fear that drive our investment decisions. Fear currently dominates. Therefore, I see an opportunity for recovery in the next 9 months.

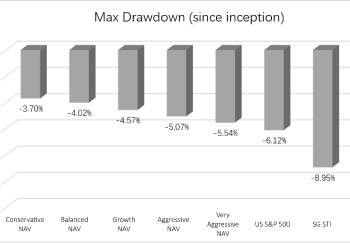

Instead of human emotion limiting calls, I am confident of our data driven SqSave AI investment approach. Our SqSave portfolios have seen higher allocations to cash assets and alternative assets such as real estate and gold. The sharpest market drop since the Global Financial Crisis has just occurred. Though our SqSave portfolio performance is impacted, we stay the course and continue to apply our SqSave AI approach for better investment outcomes, as long as you are comfortable with the risks you are taking. We are.

Disclaimer

The contents herein are intended for informational purposes only and do not constitute an offer to sell or the solicitation of any offer to buy or sell any securities to any person in any jurisdiction. No reliance should be placed on the information or opinions herein or accuracy or completeness, for any purpose whatsoever. No representation, warranty or undertaking, express or implied, is given as to the information or opinions herein or accuracy or completeness, and no liability is accepted as to the foregoing.

More Articles more

How Covid-19 Affects Investment Strategy

Team SqSave

As with any flu outbreak, the spread of

corona virus infections will peak & slow

down. But what about our

investments?

Read more

SqSave portfolios are doing fine despite Covid-19

Team SqSave

Despite the world fighting the Covid-19 outbreak, SqSave's portfolios are still showing positive

performance. Our investments are well-diversified across global markets.

Read more

Market Update Mar 2020

Team SqSave

Major benchmark indices such as the Dow, S&P 500 and Nasdaq had the worst week since the Global Financial Crisis of October 2008.

Read more