SqSave portfolios are doing fine

despite Covid-19

February 25, 2020

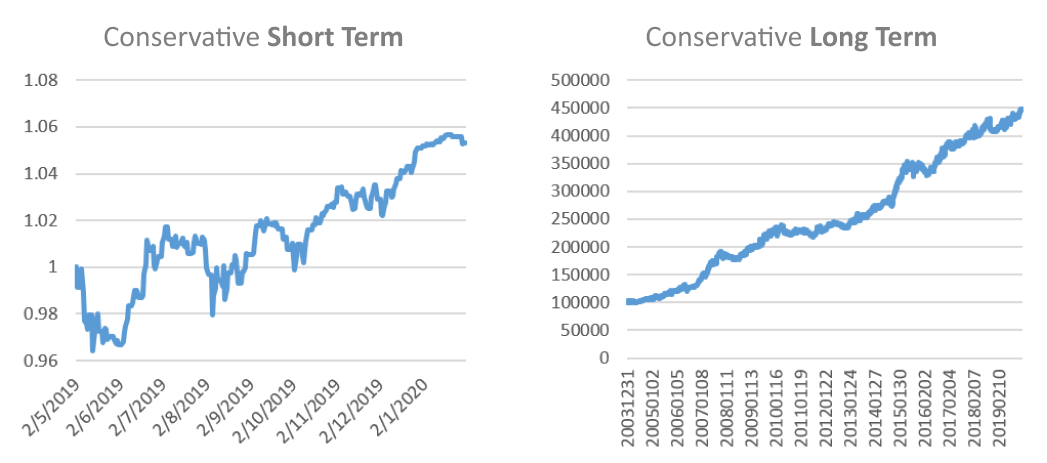

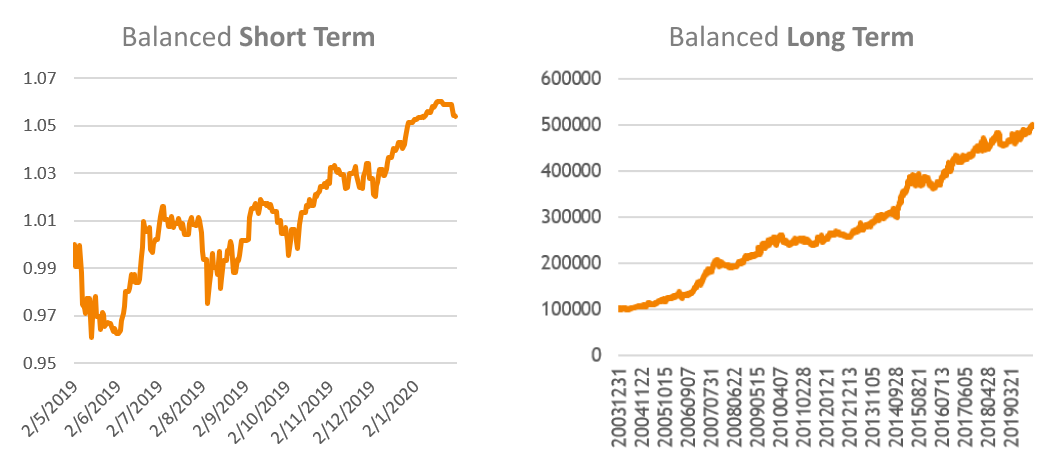

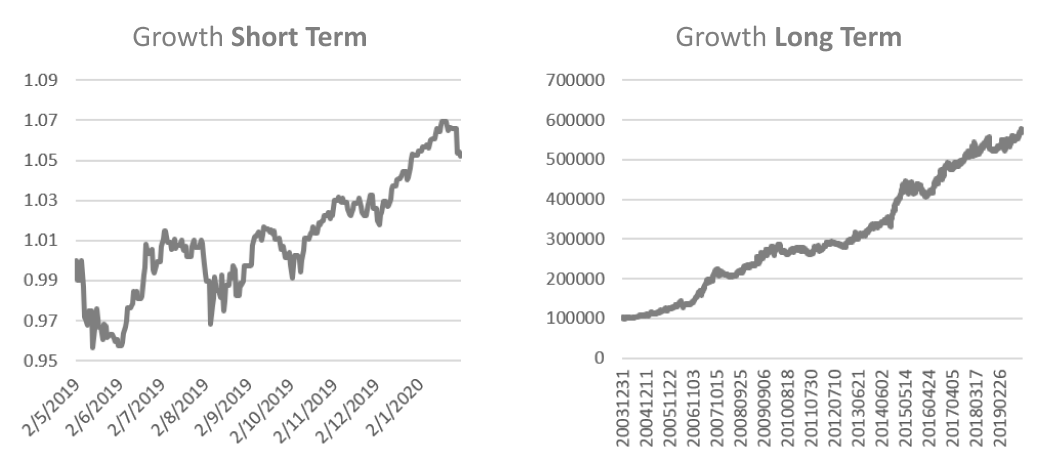

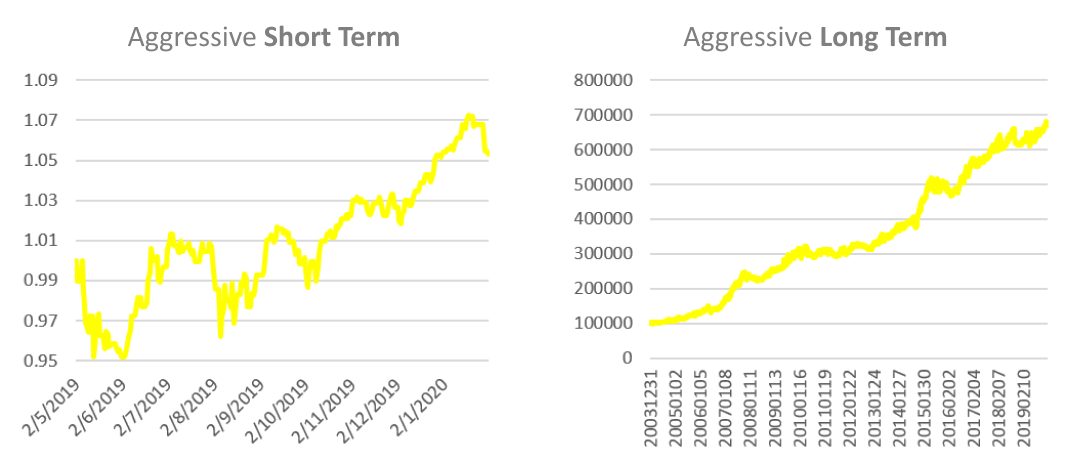

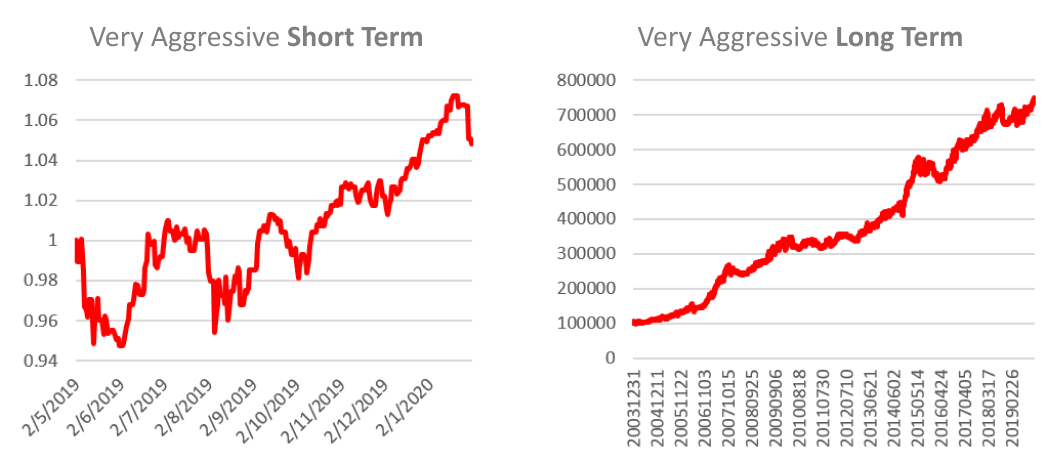

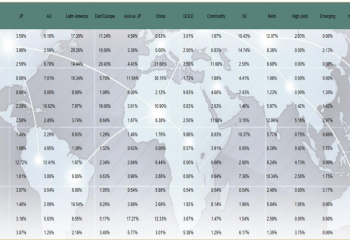

Despite the world fighting the Covid-19 outbreak, SqSave's portfolios are still showing positive performance. Our investments are well-diversified across global markets; mainly allocated to US REITS, US stocks, and China A-shares.

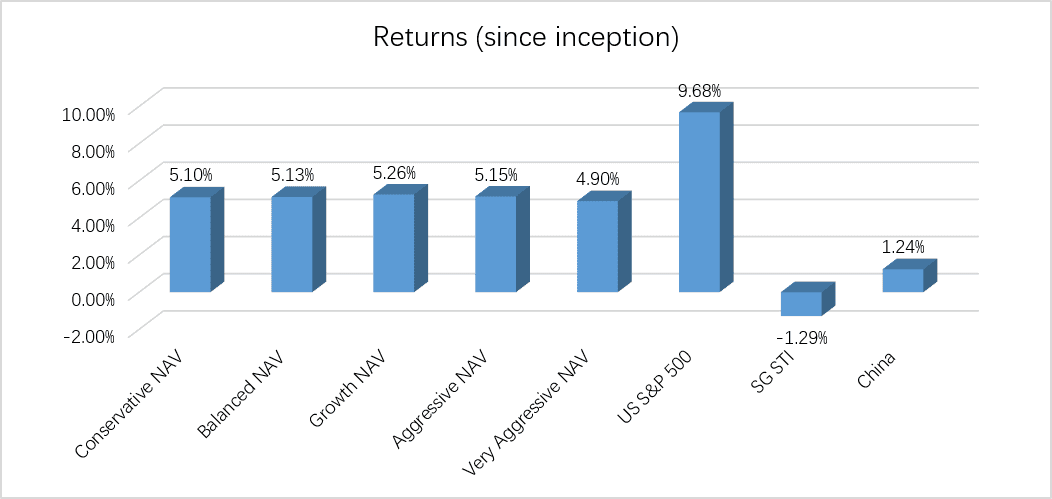

The drop in China market is offset by the strong growth in the US market, resulting in the portfolio only gaining around 5% since May 2019, as per SqSave's 5 reference portfolios representing different risk types, i.e. conservative, balanced, growth, aggressive and very aggressive.

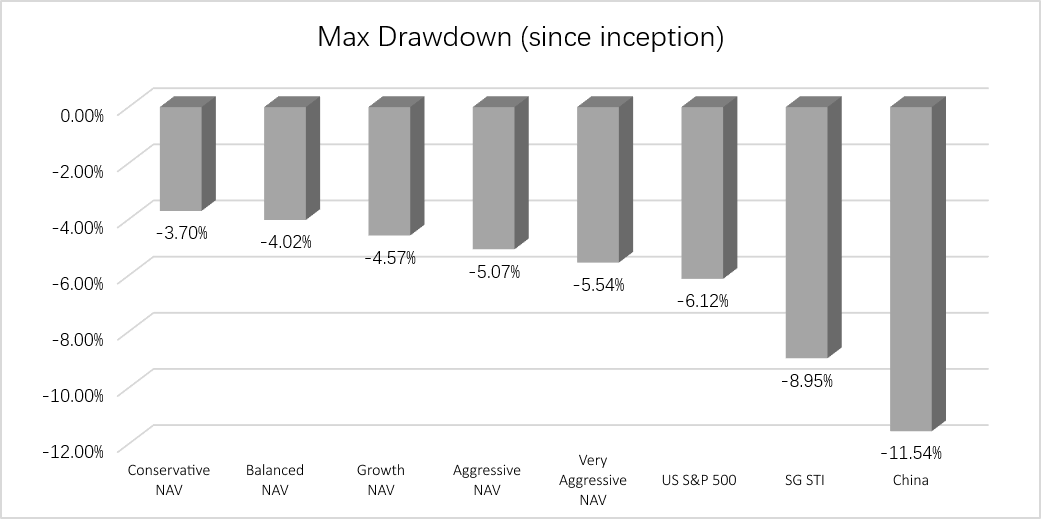

Although the returns do not beat the S&P 500, PIVOT excels in risk-control. SqSave's portfolios have lower volatility and max drawdown, as compared to the major indices.

The following charts show that SqSave's AI-driven portfolio is not a return-chasing portfolio, where it may expose the clients to serious risks. We are oriented towards risk-adjusted returns. Our algorithm has been tested for over 16 years, so our clients can safely hold their portfolios regardless of occurrences of black swan events.

DISCLAIMER: Back-tested, hypothetical or simulated performance data -- not indicative of future results. All investments carry risk. We do not guarantee the accuracy or completeness of such information. If in doubt, please consult a professional financial adviser.

More Articles more

SqSave’s Factor

Analytics Machine

Learning Engine

Team SqSave

Factor Modelling is a financial model

that employs single or multiple factors

in its calculations to explain market

phenomena and/or equilibrium...

Read more

Stop Paying for Bad Performance

Team SqSave

In the investment world, those who

have more money pay the lowest

fees. Those who have less money to

invest - pay much more. It’s painful to

see how these small investors are...

Read more

How Covid-19 Affects Investment Strategy

Team SqSave

As with any flu outbreak, the spread of

corona virus infections will peak & slow

down. But what about our

investments?

Read more