Doubling Down on Peers: Conservative Portfolio Achieves 13% One-Year Return

2 July 2024

In our relentless pursuit of excellence, we have strategically refined the algorithms governing our higher-risk portfolios. These enhancements, implemented in May, were designed to align more closely with the highly successful algorithms used in our lower-risk portfolios. This alignment has consistently led to outperforming benchmarks and peers, strengthening our long-term competitive edge.

Short-term Performance and Algorithm Effectiveness

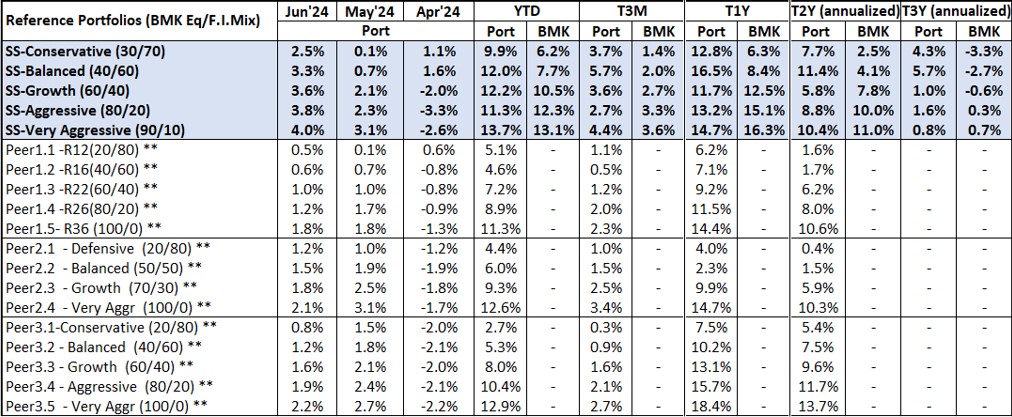

Our recent algorithm enhancements are already delivering promising results. In June, all five of our reference portfolios outperformed both peers and benchmarks. Additionally, over the past three months, our reference portfolios have also demonstrated exceptional performance, consistently surpassing both peers and benchmarks. This ongoing success highlights the robustness and reliability of our investment algorithms.

Year-to-Date Performance: Robust Returns

Year-to-date, four out of our five reference portfolios have outperformed their benchmarks. The only exception was the aggressive reference portfolio, which marginally underperformed the benchmark. Notably, our lower-risk portfolios — the Conservative and Balanced Reference portfolios — have significantly outperformed peers by a substantial margin. This strong showing across various risk categories emphasizes the strength and versatility of our AI-driven investment strategies.

Conservative 1-Year Performance Soars at 13%, Surpassing Peers' 6%

For the 1-year period, our reference portfolios have consistently outperformed two of our peers. Leading this success, our Conservative Reference Portfolio registered an impressive 13% return, effectively more than doubling the competitors' 6% average return. This outstanding performance difference underscores our ability to navigate diverse market conditions effectively and maintain a competitive edge.

Reliable Outperformance: 3-Year Performance

Our reference portfolios have reliably outperformed benchmarks across all risk categories over the past three years. This sustained long-term outperformance underscores the success of our investment methodology and our commitment to delivering enduring value to our clients.

SqSave Reference Portfolios Returns

(SGD terms as of 30 Jun 2024)*

*Inclusive of ETF expense ratios and net of SqSave management fees. SqSave uses AI to design and manage diversified investment portfolios for each investor. Because SqSave is not an investment fund, there is no single return measure. Instead, every SqSave investor has his/her own investment performance as each investor is managed separately by our SqSave AI. As investors can withdraw and top-up any time, investment returns will be affected by individual investor decisions. Hence, SqSave uses reference portfolios which are actual portfolios managed on an ongoing basis, without any interference with withdrawals or top-ups, to measure investment performance.

** Performance numbers for peers are estimates. Abbreviations: BMK: Benchmark, Port: Portfolio, Eq: Equity and F.I.: Fixed Income.

Looking Forward

Entering the latter half of 2024, our quantitative investment team maintains strong belief in our AI-driven approaches. Harnessing our machine's flawless memory, we deliver consistent returns for investors while mitigating downside volatility.

Looking ahead in the market, the future for investors remains promising, albeit uncertain. Despite potential volatility, opportunities for solid investments will persist. Periods of minimal volatility, pullbacks, and dips, combined with potential decreases in inflation and interest rates, could present advantageous entry points. Even amidst a contentious presidential election and rising costs of everyday goods, strategic investors are encouraged to stay informed, brace for potential fluctuations, and capitalize on market movements to optimize their investment strategies.

SqSave - Your Trusted Partner

Contact us today, and let's embark on this journey together towards financial success. If you haven't yet partnered with SqSave, seize this opportunity now. With SqSave's proven track record and expertise, you can maximize your investment returns. Join us on our exceptional path of AI-driven portfolio management.

Yours sincerely

SqSave Investment Team

Disclaimer

The contents herein are intended for informational purposes only and do not constitute an offer to sell or the solicitation of any offer to buy or sell any securities to any person in any jurisdiction. No reliance should be placed on the information or opinions herein or accuracy or completeness, for any purpose whatsoever. No representation, warranty or undertaking, express or implied, is given as to the information or opinions herein or accuracy or completeness, and no liability is accepted as to the foregoing. Past performance is not necessarily indicative of future results. All investments carry risk and all investment decisions of an individual remain the responsibility of that individual. All investors are advised to fully understand all risks associated with any kind of investing they choose to do. Hypothetical or simulated performance is not indicative of future results. Unless specifically noted otherwise, all return examples provided in our websites and publications are based on hypothetical or simulated investing. We make no representations or warranties that any investor will, or is likely to, achieve profits similar to those shown, because hypothetical or simulated performance is not necessarily indicative of future results.

More Articles more

Warren Buffett Likes ETFs not Unit Trusts — And So Should You!

Team SqSave

When Warren Buffett, arguably the most successful investor in history, speaks, smart investors listen. Buffett's investment wisdom is legendary, and he has consistently outperformed the market for many years during his investment career.

Read more

S&P500 Hits Record High…“Sell in May & Go Away”? We Don’t Think So!

Team SqSave

The S&P 500 has maintained its strong momentum into May 2024, continuously breaking new highs. By end-May, the S&P 500 achieved an impressive 11% return, a performance level typically expected over an entire year.

Read more

Algorithmic Adjustments Showing Early Signs of Efficacy

Team SqSave

In May, we made strategic adjustments to the algorithms for our higher risk portfolios.

Read more