INVESTMENT PERFORMANCE SWAMPED BY THE TIDE OF UNCERTAINTY

8 May 2025

Trump’s “Liberation Day” – For Whom?

On April 2, 2025, U.S. President Trump announced a sweeping set of tariffs during a Rose Garden speech, dubbing that day, "Liberation Day", a "Declaration of Economic Independence". Trump implemented a 10% baseline tariff on all imports and higher "reciprocal" tariffs on countries with significant trade surpluses with the U.S., such as China (34%), the European Union (20%), and Taiwan (32%).

China retaliated by imposing a 125% tariff on U.S. goods, leading to a significant drop in Chinese cargo shipments to the U.S. – this is no longer a tariff war. It is breaking all trade between the U.S. and China. Is this sustainable?

We think not. Economic sense must – ultimately - return to replace the U.S. unilateral political lunacy. As investors, we need to be patient and ride this roller coaster carefully.

The "Liberation Day" tariffs have led to significant economic disruptions, both domestically and internationally. While some measures have been temporarily paused, the long-term effects on global trade and economic stability remain uncertain.

We believe that this “Liberation Day” has backfired on the U.S. – no longer seen as a reliable strategic partner by long-time allies. This will accelerate the dismantling of the USD as the world’s reserve currency. Trump’s action has spurred the longer term realignment of global trade into blocs, blocs which ultimately will exclude the U.S. – at least monetarily in the currency side of global trade. More non-U.S. trade will happen in non-U.S. dollars, and this only chips away at the pedestal on which the overwhelmingly crippling U.S. debt sits. It’s “Liberation Day” for the rest of the world.

How Markets Reacted

In April 2025, global financial markets experienced significant turbulence following Trump's "Liberation Day." The immediate reaction was a sharp sell-off across major indices:

- The S&P 500 plunged over 10.5% within two trading days, marking one of its steepest declines since the 2020 pandemic-induced crash.

- The Dow Jones Industrial Average dropped more than 4,500 points, while the Nasdaq Composite fell nearly 6%, entering bear market territory.

- U.S. stocks losing $6.6 trillion in value over two days, the largest two-day loss in history. This is on the back of an already volatile March 2025.

On April 9, Trump partially paused the massive new tariffs, but a 10% tariff on nearly every nation remained in effect. The additional "reciprocity" tariffs were only paused for 90 days, not cancelled. This pushes market volatility like a can down the road.

Markets recovered, coupled with strong corporate earnings—where about 75% of S&P 500 companies exceeded profit expectations. A robust April jobs report showing 177,000 jobs added, helped stabilize investor sentiment. By the end of April, the S&P 500 had narrowed its monthly loss to 0.76%, and the Nasdaq Composite posted a modest gain of 0.9%.

Despite the rebound, volatility remained elevated. The Cboe Volatility Index (VIX), often referred to as Wall Street's "fear gauge," spiked to levels not seen since 2020, reflecting ongoing investor anxiety over trade policies and potential economic repercussions.

In summary, April 2025 was characterized by extreme market volatility triggered by unexpected trade policy announcements. While markets showed resilience and recovered much of their losses by month's end, the episode underscored the sensitivity of global financial systems to abrupt policy shifts and the importance of strategic diversification in investment portfolios.

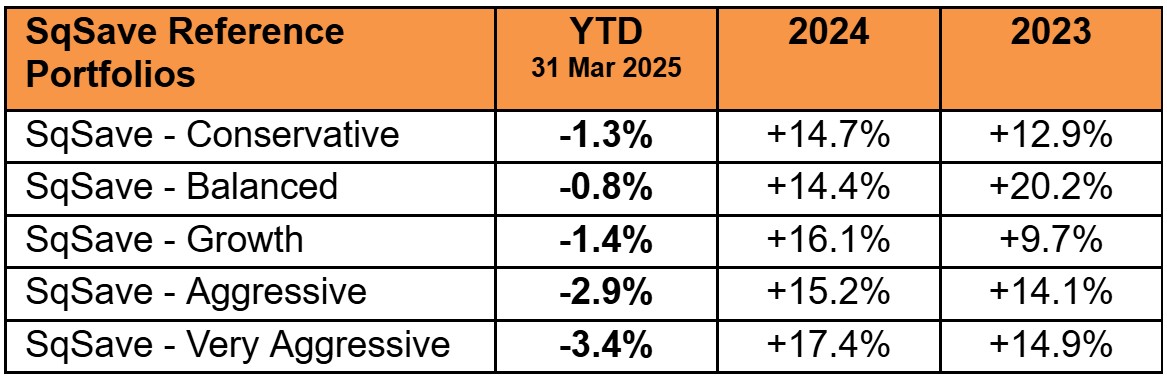

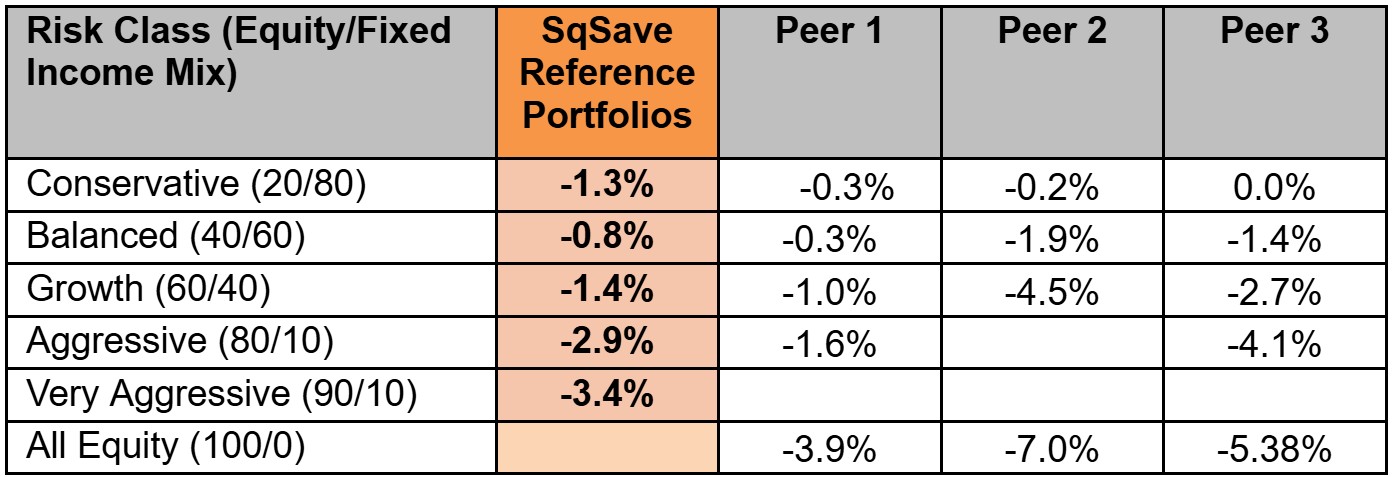

SqSave Investment Performance

Not surprising, Trump’s tariff war has affected SqSave’s performance adversely. All portfolios are in the red for YTD 30th April 2025.

SqSave has also generally underperformed the peers on a YTD basis after the April fallout.

Outlook

As we had shared at end-March 2025, the global investment landscape has entered a period of pronounced uncertainty, marked by the escalation of trade tensions. We will be watching the following factors carefully:

- Trade Tensions: The sweeping U.S. tariffs and retaliatory measures from China and other trade partners have reintroduced global stagflation risks—higher prices with slower growth.

- Market Volatility: April saw one of the largest drawdowns since 2020, reminding investors of policy risk and fragility in pricing.

- Monetary Policy: Central banks, especially the Fed, are caught between controlling inflation and supporting growth, likely keeping rates elevated.

- Corporate Resilience: Despite macro headwinds, many S&P 500 companies beat earnings forecasts, showing underlying profitability strength.

- Currency Shifts: The USD remains strong short-term, but regional blocs (ASEAN, China) are pushing for non-dollar trade settlements, which could weaken long-term USD dominance.

Sincerely,

SqSave Investment Team

Disclaimer

The contents herein are intended for informational purposes only and do not constitute an offer to sell or the solicitation of any offer to buy or sell any securities to any person in any jurisdiction. No reliance should be placed on the information or opinions herein or accuracy or completeness, for any purpose whatsoever. No representation, warranty or undertaking, express or implied, is given as to the information or opinions herein or accuracy or completeness, and no liability is accepted as to the foregoing. Past performance is not necessarily indicative of future results. All investments carry risk and all investment decisions of an individual remain the responsibility of that individual. All investors are advised to fully understand all risks associated with any kind of investing they choose to do. Hypothetical or simulated performance is not indicative of future results. Unless specifically noted otherwise, all return examples provided in our websites and publications are based on hypothetical or simulated investing. We make no representations or warranties that any investor will, or is likely to, achieve profits similar to those shown, because hypothetical or simulated performance is not necessarily indicative of future results.

More Articles more

SQSAVE QUANTITATIVE AI ALGORITHMS DOING WELL IN THE CURRENT VOLATILITY

Team SqSave

As we alluded to in our commentary dated 10th March 2025, markets were rocked by significant market volatility – now, further stoked by the announcement of new tariffs by the U.S. administration.

Read more

Stayed Focused While Riding The Current Volatility

Team SqSave

As seasoned investors know, volatility is the source of investment gains. But that’s only half the story. Volatility is also the source of investment losses.

Read more

Conservative Portfolio Delivers 14% Return, Outperforming Peers Over the Past Year

Team SqSave

Despite the usual market fluctuations, we at SqSave are pleased to announce that we have continued to outperform both our benchmarks and competitors over the past year.

Read more