INVESTMENTS AS A MEANINGFUL GIFT FOR A FRIEND OR A LOVED ONE!

July 27, 2021

Wouldn’t it be good to teach the virtue of sharing or saving instead of spending?

Why not give an investment portfolio to friends and family instead of buying the usual gifts?

Now, you can Gift-a-Portfolio to friends and family right from the comfort of your home!

SqSave has developed its Gift-a-Portfolio feature to allow SqSave account holders to invest any amount into a new investment portfolio, and gift it to someone you choose. With this meaningful gift, you can encourage your friends and loved ones to start investing early with your gifted portfolio.

Too expensive compared to conventional gifts?

Not at all! SqSave’s Gift-a-Portfolio allows you to set an investment gift amount starting from ONE Dollar! And managed using SqSave’s proprietary AI-driven algorithms at a very low cost.

This low entry investment sum makes SqSave a perfect start for new entrants to investing unlike traditional investment products which would require at least a thousand dollars to even start and high fees to pay.

SqSave charges a flat 0.50% management fee and only earns a performance fee if SqSave generates a positive return. And the performance fee is only payable if the return is higher than the previous time that the performance fee was charged – called a “high watermark” feature.

What is inside the Gift-a-Portfolio?

SqSave Gift-a-Portfolio is a well-diversified investment portfolio across the world. And you can get this from ONE Dollar.

Is it safe?

All investments have risks. The key is to manage the risks. At SqSave, we use proprietary AI-driven data techniques to manage investment risks. Our SqSave system manages the risks on both the upside and downside to squeeze out decent risk-adjusted returns based on the risk setting chosen.

SqSave is regulated by the Monetary Authority of Singapore and measures are taken to safekeep your assets with approved custodian banks and securities firms. Even if something untoward happens to SqSave, your monies and investments are kept separate from SqSave and remain your assets.

How has SqSave performed?

SqSave was founded with a vision to make investing a breeze for those who are too busy, too confused or too scared to start an investment portfolio. We developed a robust AI system that has proven itself through the Covid-19 pandemic crash in 2020. SqSave has shown that data and AI analytics can make a difference in navigating choppy markets with discipline and without emotions. To create the algorithm, we have trawled through years of investment data to create an intelligent, automated investment platform.

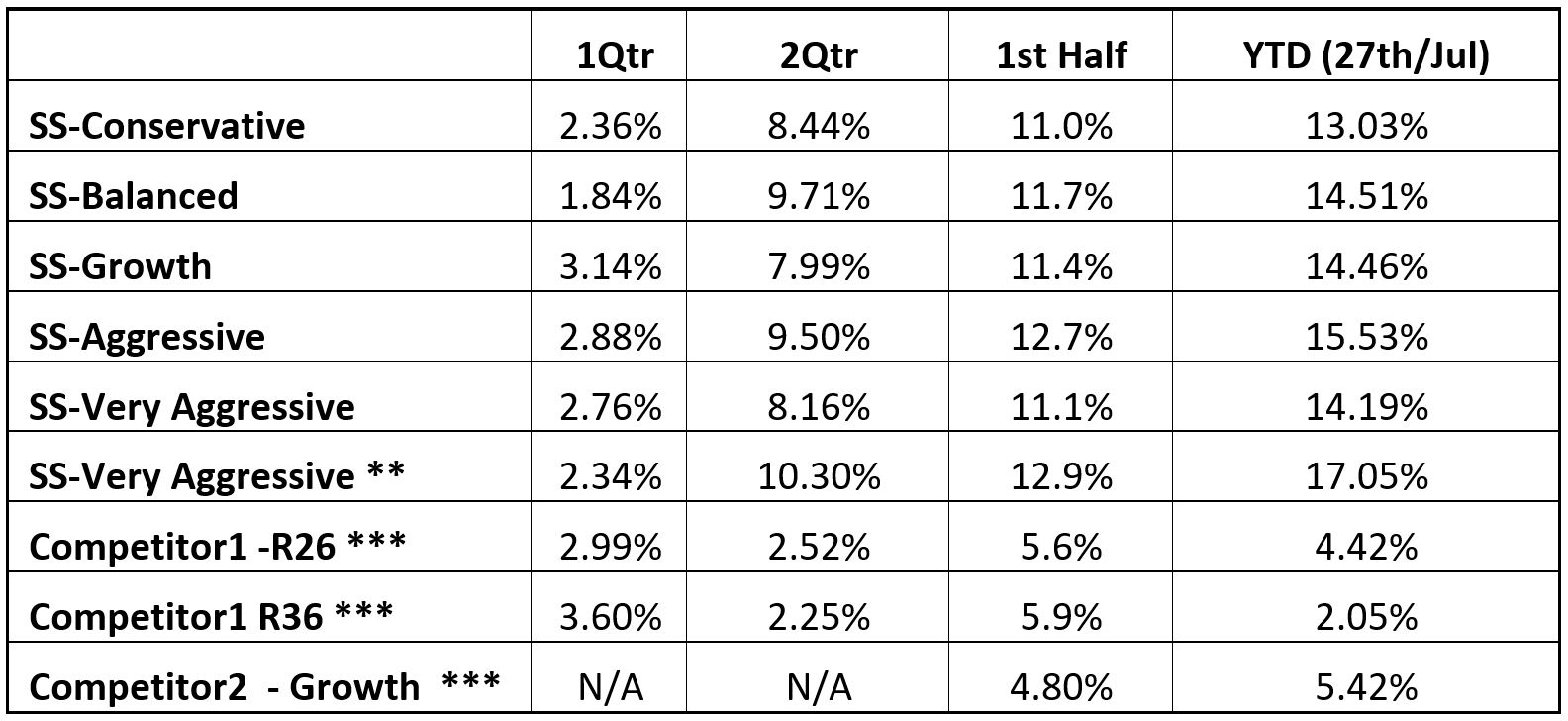

SqSave is not a unit trust or mutual fund. It is a separate managed account. This means each client has your own portfolio. As such, there is no single performance number. The actual performance will depend on when you started the SqSave investment, how often you top up or withdraw and how our SqSave AI rebalances your portfolio based on your risk setting. Nonetheless, see my recent blog on the performance of actual reference portfolios based on different risk settings to offer a guide as to how our SqSave AI algorithms are doing. The table is reproduced here.

SqSave Latest Performance in 2021 (SGD terms)*

Source: SqSave, Saxo Capital Markets

Figures are all inclusive of ETF expense ratios and net of SqSave management fees.

* SqSave uses AI to design and manage diversified investment portfolios for each investor. Because SqSave is not an investment fund, there is no single return measure. Instead, every SquirSqSaveelSave investor has his/her own investment performance as each investor is managed separately by our SqSave AI. As investors can withdraw and top-up any time, investment returns will be affected by individual investor decisions. Hence, SqSave uses reference portfolios which are actual portfolios managed on an ongoing basis, without any interference with withdrawals or top-ups, to measure investment performance.

** This portfolio is tailor-made, for investors contributing a minimum initial SGD15,000 investment capital to a single goal.

*** Performance numbers for competitors are estimates.

What’s special about SqSave?

SqSave is the only fully automated AI-driven online asset management service in Singapore. No human intervention is needed to manage the investments daily.

The fully digital customer interface is user-friendly and features a gamification algorithm to assess the risk-reward psychometrics to automatically recommend an investment portfolio risk setting. Each SqSave account holder has full flexibility to set up as many investment portfolios as desired - called “goals”. Once the goal is funded, the SqSave AI algorithm takes over and invests the money 24/7 in a globally diversified portfolio of exchange traded funds (ETFs).

Because SqSave is fully automated, the fees are substantially lower than other traditional investment vehicles.

How do I Gift-a-Portfolio?

Well, first you must be a SqSave client. Open an account online at www.sqsave.com in minutes and remit enough cash into your SqSave account to fund your gift.

Select the Gift-a-Portfolio feature, input the name and contact details of your intended recipient, the amount you wish to gift and your preferred delivery date.

Next, decide the investment risk setting. If you are giving a Gift-a-Portfolio to someone younger, you can consider higher risk settings such as “Very Aggressive”. A younger person simply has more time to ride out market volatility to build investment returns. But if you prefer the lower end of the risk scale, you can select “Conservative”. Remember, investment returns come from higher risk exposure – but will need a longer time to navigate the inevitable market fluctuations.

As SqSave targets medium to long term returns – rather than to speculate, we would recommend that you set a minimum investment period (or “lock-up”) to allow your gift to ride the market over time to squeeze out returns. Afterall, you are giving an investment gift that can grow – and not just cold cash which may be spent or eroded by inflation.

That’s it. On your chosen delivery date, SqSave will inform your recipient that you have generously sent a “Gift-a-Portfolio”. The recipient has 14 calendar days to accept and claim your gift.

Once your gift is claimed, the investment ownership is transferred to your recipient, subject to the minimum investment period you have set. SqSave then manages the investment for your recipient.

What are you waiting for?

Help your friends or family members start a conversation about prudent financial planning by investing early and reap the power of compounding returns!

You can also use SqSave’s Gift-a-Portfolio to tap the power of AI-driven investing and support micro-philanthropy to benefit others!

Welcome to Smart Investing for Anyone, Anywhere, Anytime!

Yours sincerely

Victor Lye BBM CFA CFP®

Founder & CEO

* SqSave uses AI to design and manage diversified investment portfolios for each investor. Because SqSave is not an investment fund, there is no single return measure. Instead, every SqSave investor has his/her own investment performance as each investor is managed separately by our SqSave AI. As investors can withdraw and top-up any time, investment returns will be affected by individual investor decisions. Hence, SqSave uses reference portfolios which are actual portfolios managed on an ongoing basis, without any interference with withdrawals or top-ups, to measure investment performance.

Disclaimer

The contents herein are intended for informational purposes only and do not constitute an offer to sell or the solicitation of any offer to buy or sell any securities to any person in any jurisdiction. No reliance should be placed on the information or opinions herein or accuracy or completeness, for any purpose whatsoever. No representation, warranty or undertaking, express or implied, is given as to the information or opinions herein or accuracy or completeness, and no liability is accepted as to the foregoing. Past performance is not necessarily indicative of future results. All investments carry risk and all investment decisions of an individual remain the responsibility of that individual. All investors are advised to fully understand all risks associated with any kind of investing they choose to do. Hypothetical or simulated performance is not indicative of future results. Unless specifically noted otherwise, all return examples provided in our websites and publications are based on hypothetical or simulated investing. We make no representations or warranties that any investor will, or is likely to, achieve profits similar to those shown, because hypothetical or simulated performance is not necessarily indicative of future results.

More Articles more

SqSave ONE Dollar Portfolios: +16% & +22% in 13 mths!

Team SqSave

Over many years of investing experience, I realised that we are after all, human. Instead of really investing, we are mostly speculating and timing the markets.

Read more

SQSAVE: +11% to +13% IN FIRST HALF 2021

Team SqSave

In our end-May 2021 blog, we talked about being disciplined and quantitative, instead of following traditional investment folklore. Data proves it is better to stay invested instead of timing markets. That’s why we created SqSave AI to track markets 24/7.

Read more

MY SQSAVE PORTFOLIO: +35% in 25 months

Team SqSave

Last night, someone who had read my blog dated 2 April 2021 asked about my SqSave portfolio…

Read more