SqSave ONE Dollar Portfolios: +16% & +22% in 13 mths!

Jul 1, 2021

Invest smarter at SqSave! Even from ONE Dollar!

Over many years of investing experience, I realised that we are after all, human. Instead of really investing, we are mostly speculating and timing the markets.

With AI becoming democratized, I decided to use the power of AI and global diversification to help anyone invest, from anywhere and at any time.

Not only that, I designed SqSave to start investing from ONE Dollar that we can help the unbanked millions, and those badly served with expensive financial products.

In May 2020, we invested ONE Dollar in two actual SqSave portfolios.

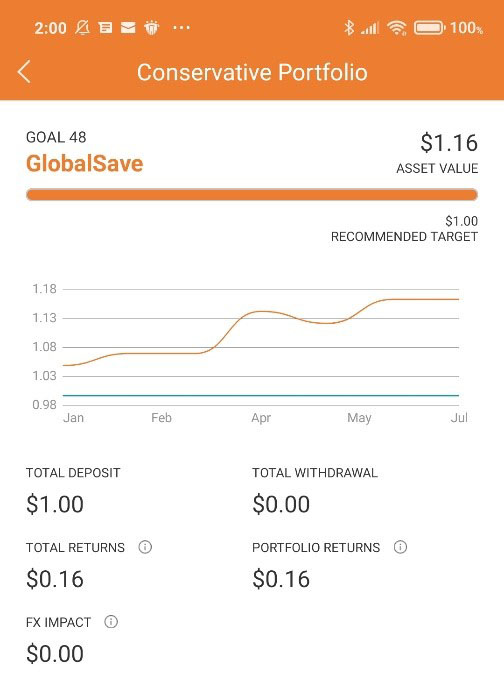

(1) SqSave: Conservative

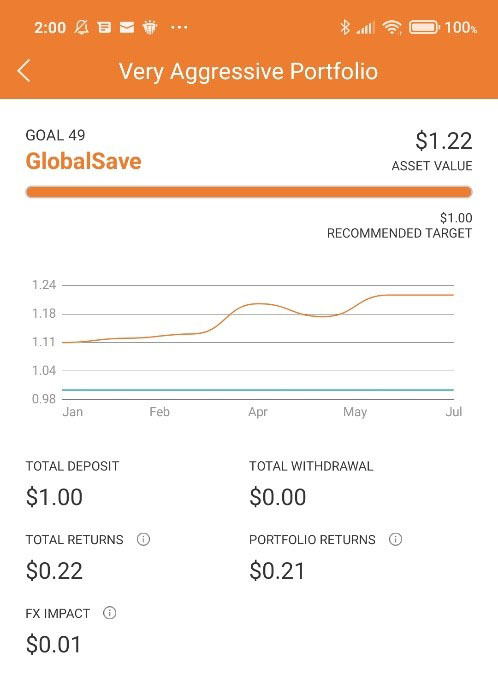

(2) SqSave: Very Aggressive

By end-June 2021, the portfolios rose +16% and +22% respectively*. Not bad for 13 months!

SqSave (Conservative) 18 May 2020 to 30 June 2021

From $1.00 to $1.16

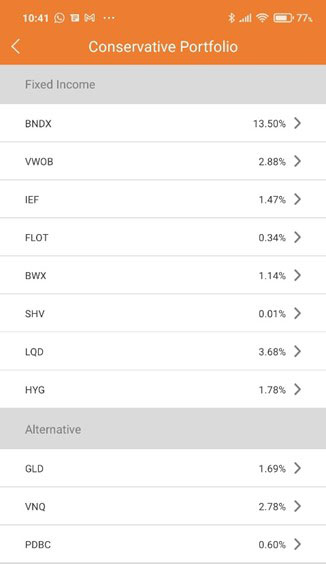

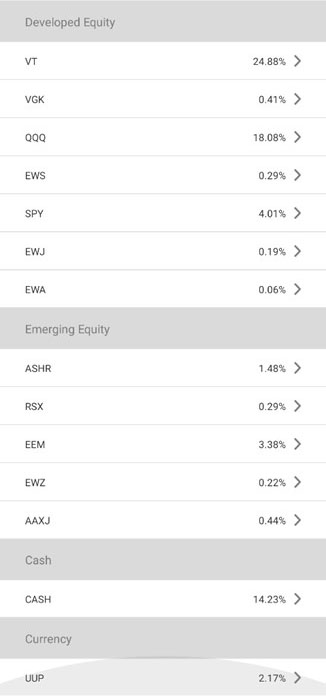

Portfolio Holdings

Well diversified across 25 asset classes!

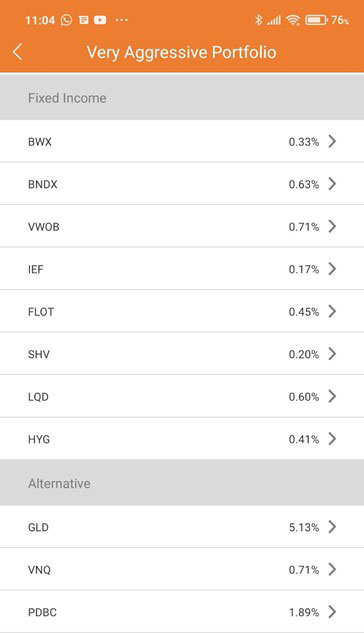

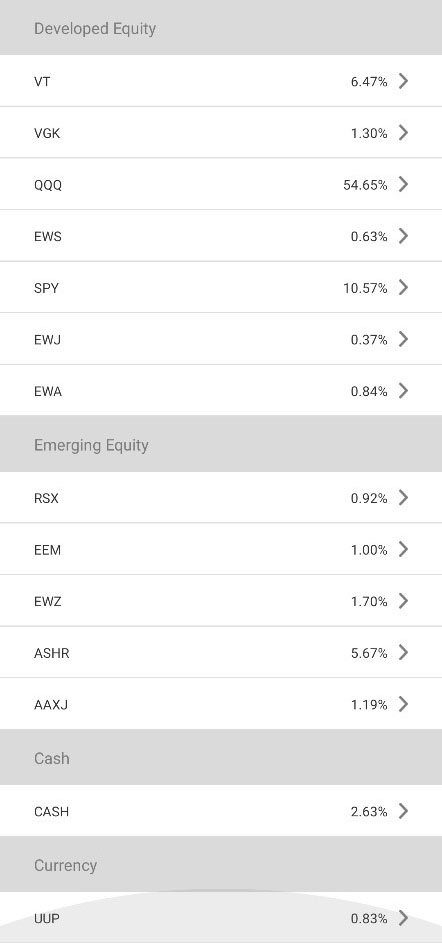

SqSave (Very Aggressive) 18 May 2020 to 30 June 2021

From $1.00 to $1.22

Portfolio Holdings

Well divesified across 25 asset classes!

SqSave enables you to invest in small sums…

Doing this regularly, you can build a nest egg. Simply start early and capture the “Power of Compounding”! Kids should invest early too! That’s why SqSave introduced a KidSave investment goal that allows you to set aside money and invest for your kids.

With SqSave AI, it is possible to Invest Smarter! Sign-up at www.sqsave.com today!

Regards,

Victor Lye BBM CFA CFP®

Founder & CEO

* SqSave uses AI to design and manage diversified investment portfolios for each investor. Because SqSave is not an investment fund, there is no single return measure. Instead, every SqSave investor has his/her own investment performance as each investor is managed separately by our SqSave AI. As investors can withdraw and top-up any time, investment returns will be affected by individual investor decisions. Hence, SqSave uses reference portfolios which are actual portfolios managed on an ongoing basis, without any interference with withdrawals or top-ups, to measure investment performance.

Disclaimer

The contents herein are intended for informational purposes only and do not constitute an offer to sell or the solicitation of any offer to buy or sell any securities to any person in any jurisdiction. No reliance should be placed on the information or opinions herein or accuracy or completeness, for any purpose whatsoever. No representation, warranty or undertaking, express or implied, is given as to the information or opinions herein or accuracy or completeness, and no liability is accepted as to the foregoing. Past performance is not necessarily indicative of future results. All investments carry risk and all investment decisions of an individual remain the responsibility of that individual. All investors are advised to fully understand all risks associated with any kind of investing they choose to do. Hypothetical or simulated performance is not indicative of future results. Unless specifically noted otherwise, all return examples provided in our websites and publications are based on hypothetical or simulated investing. We make no representations or warranties that any investor will, or is likely to, achieve profits similar to those shown, because hypothetical or simulated performance is not necessarily indicative of future results.

More Articles more

SQSAVE: +11% to +13% IN FIRST HALF 2021

Team SqSave

In our end-May 2021 blog, we talked about being disciplined and quantitative, instead of following traditional investment folklore. Data proves it is better to stay invested instead of timing markets. That’s why we created SqSave AI to track markets 24/7.

Read more

MY SQSAVE PORTFOLIO: +35% in 25 months

Team SqSave

Last night, someone who had read my blog dated 2 April 2021 asked about my SqSave portfolio…

Read more

GLOBAL VACCINATION CHALLENGE & GROWING INTEREST IN CRYPTO ASSETS

Team SqSave

As we closed the first week of June, the leading USA exchanges were boosted by better-than-expected jobs data. The flagship Dow Jones Industrial Average (DJIA) and S&P 500 hovered around recent record highs while the Nasdaq Composite which had experienced a tech selloff recovered.

Read more