Anyone Can Enjoy Smart Investing – Starting From One Dollar

August 31, 2020

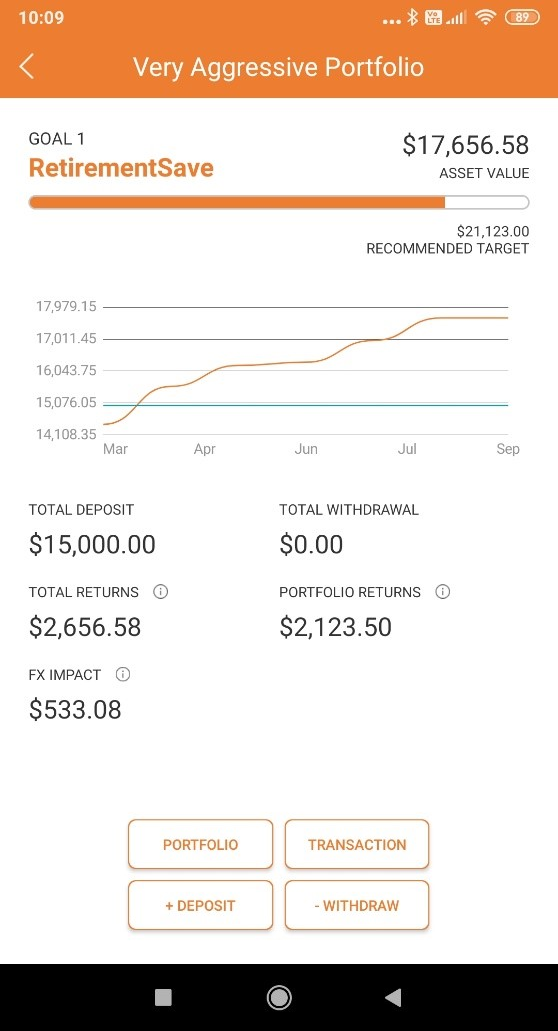

My SqSave Portfolio

As Founder, I was the first SqSave client. My SqSave portfolio was funded with SGD 15,000 on 1 June 2019. There was then – no knowing what lay ahead. And as we all know, Covid became global news in Jan 2020.

As you may have read in my blog. My SqSave portfolio passed the Covid crash test.

In Nov 2019 when I was sharing how SqSave works, some seasoned investors were surprised to see a very high allocation (over 10%) to Gold within my SqSave portfolio. One cynical investor remarked that there was something wrong. Indeed, I must concede that as a human investment manager for years, I had never allocated so much to Gold. Yet I trusted my SqSave portfolio, and as you already may know, Gold went on in 2020 to hit record highs.

As of 31 Aug 2020, my original capital of SGD 15,000 has reached SGD 17,656 for a gain of 17.7 per cent over 15 months! That’s roughly 14.2 per cent annualised!

And if you check out my last blog just a fortnight ago – when my portfolio was SGD 17,163 (on 18 Aug 2020), it means my SqSave portfolio has risen another 2.9 per cent in two weeks!

A One Dollar Global Portfolio? Yes!

I designed SqSave with the power of AI and using global diversification to help anyone invest, from anywhere and at any time.

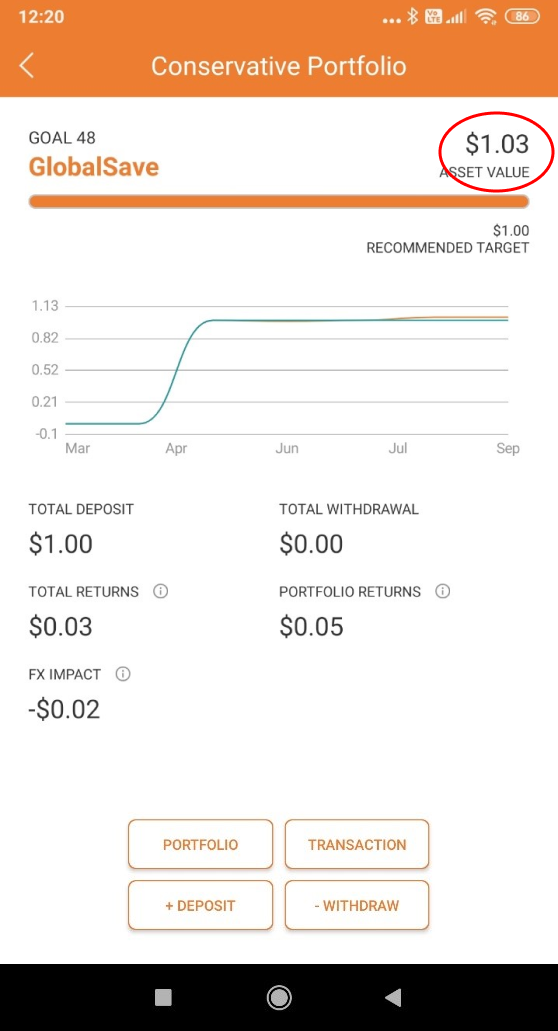

I wish to show you ONE DOLLAR global portfolios which I created in May 2020 at the extreme ends of our risk ratings:

- Conservative

- Very Aggressive

As of 31 Aug 2020, my original capital of SGD 1 (ONE) returned 3 per cent (in 4 months) for an annualized gain of 9 per cent!

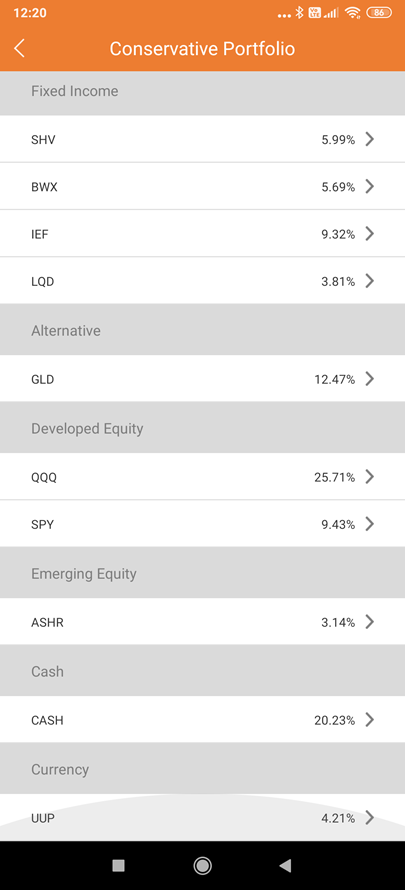

And if you check out the portfolio allocation, it is well diversified!

Net Asset Value

Portfolio Allocation

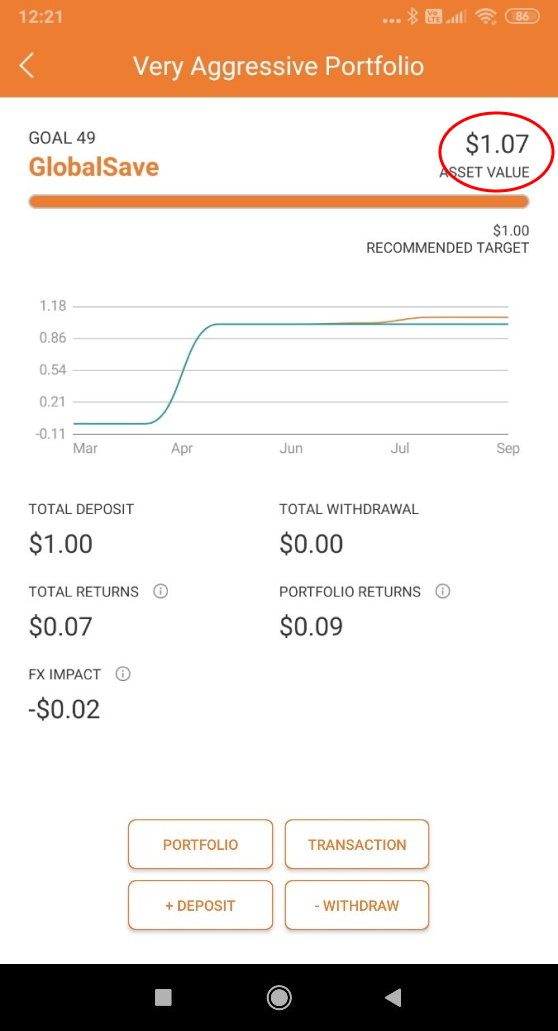

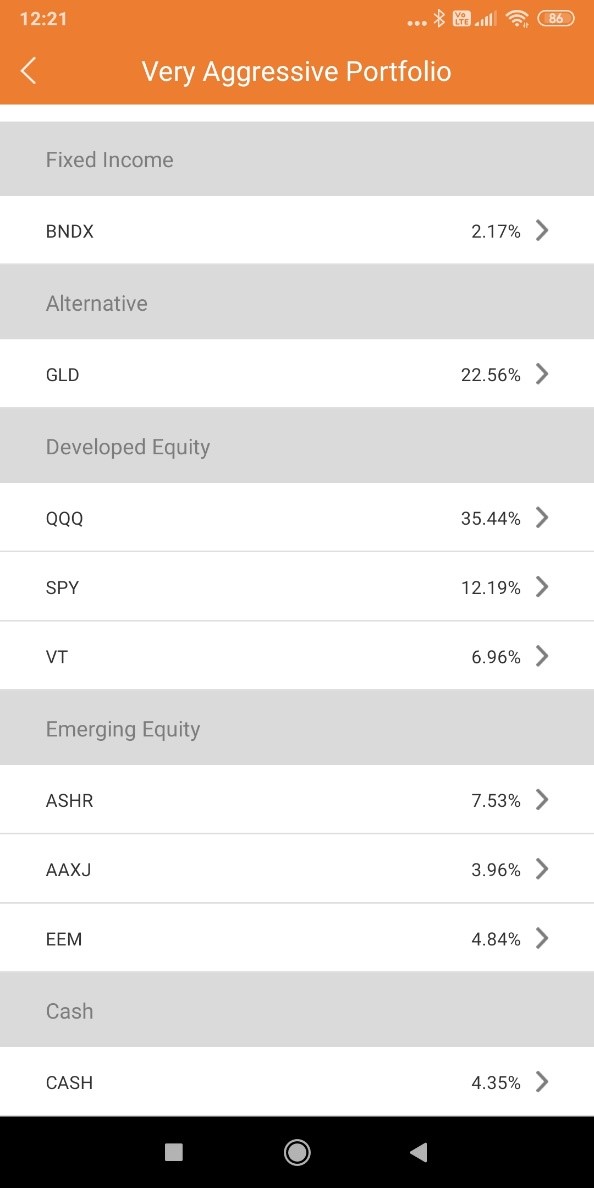

Now, let’s check out the ONE dollar VERY AGGRESSIVE portfolio I created in May 2020.

As of 31 Aug 2020, the return is 7 per cent (in 4 months) or 21 per cent annualised!

Net Asset Value

Portfolio Allocation

Now, I do not want to do short term comparisons. I would rather show you the truth that investments are inherently volatile. But as long as you choose the suitable risk rating and stick to a clear investment time horizon of at least one year, you should be able to tolerate the volatility – and carry on your daily activities without peering at your investment value every day. Save that for your trading account or trying your luck at gambling products.

We are Smart Investors, not gamblers. Smart investing is possible now with SqSave! Sign-up now at www.sqsave.com

Download our SqSave app from the Apple or Google Play stores.

Until the next blog or webinar, take care and stay healthy! Remember, Health is Wealth!

Disclaimer

The contents herein are intended for informational purposes only and do not constitute an offer to sell or the solicitation of any offer to buy or sell any securities to any person in any jurisdiction. No reliance should be placed on the information or opinions herein or accuracy or completeness, for any purpose whatsoever. No representation, warranty or undertaking, express or implied, is given as to the information or opinions herein or accuracy or completeness, and no liability is accepted as to the foregoing. Past performance is not necessarily indicative of future results. All investments carry risk and all investment decisions of an individual remain the responsibility of that individual. All investors are advised to fully understand all risks associated with any kind of investing they choose to do. Hypothetical or simulated performance is not indicative of future results. Unless specifically noted otherwise, all return examples provided in our websites and publications are based on hypothetical or simulated investing. We make no representations or warranties that any investor will, or is likely to, achieve profits similar to those shown, because hypothetical or simulated performance is not necessarily indicative of future results.

More Articles more

Time to Take Stock of Investing (no pun intended)

Team SqSave

Since our launch, we had a decent ride managing market risks using our machine learning AI engine. The Covid crash showed that our system is crash-proof.

Read more

Glad that SqSave is Navigating Smartly Amidst this Crisis

Team SqSave

Two weeks since I wrote about SqSave’s bold allocation to Gold in my portfolio (and yours too, if you are a SqSave client), Gold continues to rise.

Read more

Shhh!!! My SqSave Portfolio Seems to Know Something About Gold

Team SqSave

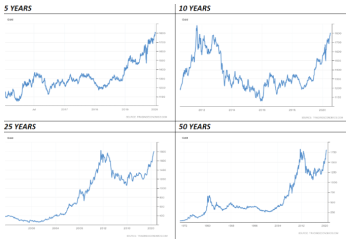

5-Year chart shows that gold is suddenly doing well in June 2019. 10-Year chart shows that gold is now back to its previous peak seen in Aug 2011.

Read more