AI Driven Investing - Confidence In Uncertainty

9 June 2025

Navigating Amidst Cross-Currents and Waves of Uncertainty

In May 2025, we saw markets caught between optimism and uncertainty, under the weight of conflicting macroeconomic currents.

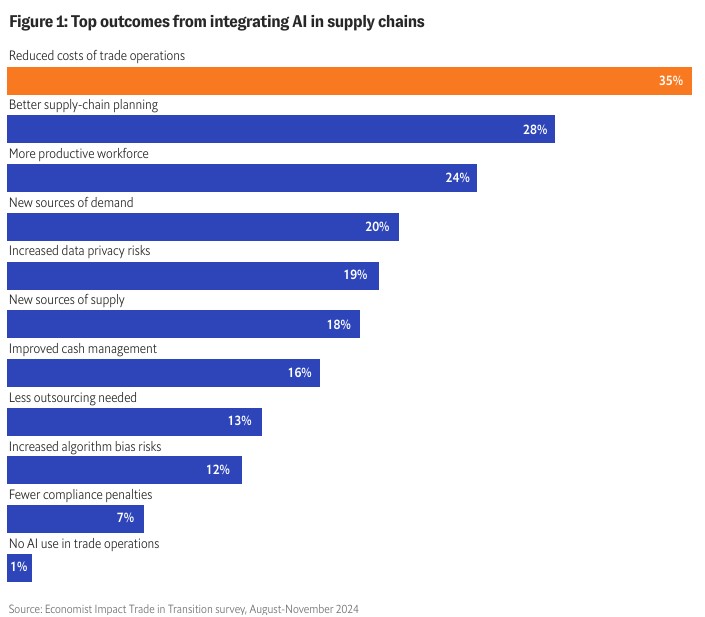

Global sentiment is optimistic that AI—especially generative AI and automation—will boost productivity, reduce costs, and offset labour shortages. The IMF and OECD have highlighted AI as a long-term economic tailwind, though benefits may be uneven across industries and countries. In equities, AI-related sectors (semiconductors, cloud, robotics) continue to attract strong investor interest despite broader market caution.

Despite optimism around AI-driven productivity gains and improving supply chain dynamics, investor sentiment was dampened by persistent inflation stickiness in developed markets and cautious central bank tones.

Meanwhile, global trade tensions and slower growth forecasts are making investors tread carefully.

SqSave Investment Performance

Despite this, SqSave portfolios stayed the course — holding steady while peers stumbled.

2025 YTD Returns at 31st May 2025

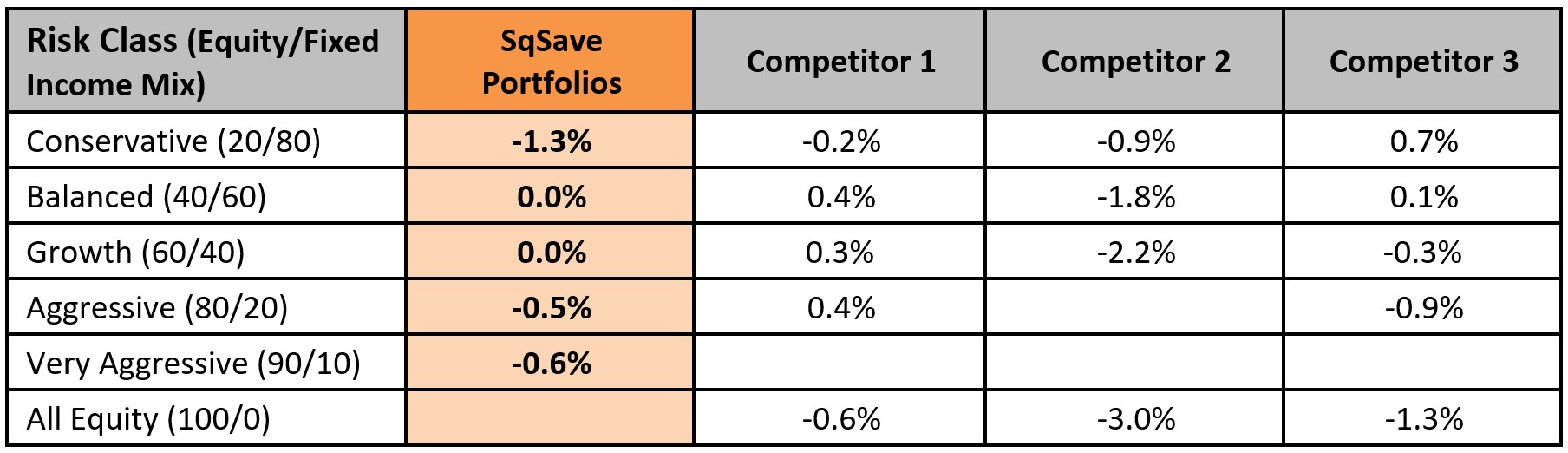

Despite the muted returns, SqSave continued to demonstrate a competitive advantage over most major peers, particularly in higher risk-managed portfolios:

- Growth (60/40) and Balanced (40/60) portfolios closely matched or beat top competitors’ comparable portfolios, outperforming managers who suffered from higher equity drawdowns or overly defensive allocations.

- In the Very Aggressive class, SqSave (-0.6%) matched Competitor 1 and outperformed others who reported deeper losses of up to -3.0%.

- While the Conservative (20/80) portfolio is at –1.3% YTD, it’s important to view this in context. After a strong 2024 return of +14.7%, some cooling was expected—especially with 2025 bringing renewed market headwinds like renewed inflation worries (induced by Trump’s wave of global tariffs), interest rate uncertainty, and bond market volatility.

- In this climate, the Conservative (20/80) portfolio’s cautious positioning is doing what it’s designed to do: preserve capital and manage downside risk in turbulent periods. Short-term softness reflects temporary rate-driven pressures on fixed income assets, not structural weakness.

These results showcase the AI algorithm’s defensive rebalancing and its risk-adjusted posture, reflecting deliberate preservation over performance in a roller-coaster type market.

In this environment, SqSave portfolios delivered a relatively stable performance YTD, navigating the turbulence with discipline.

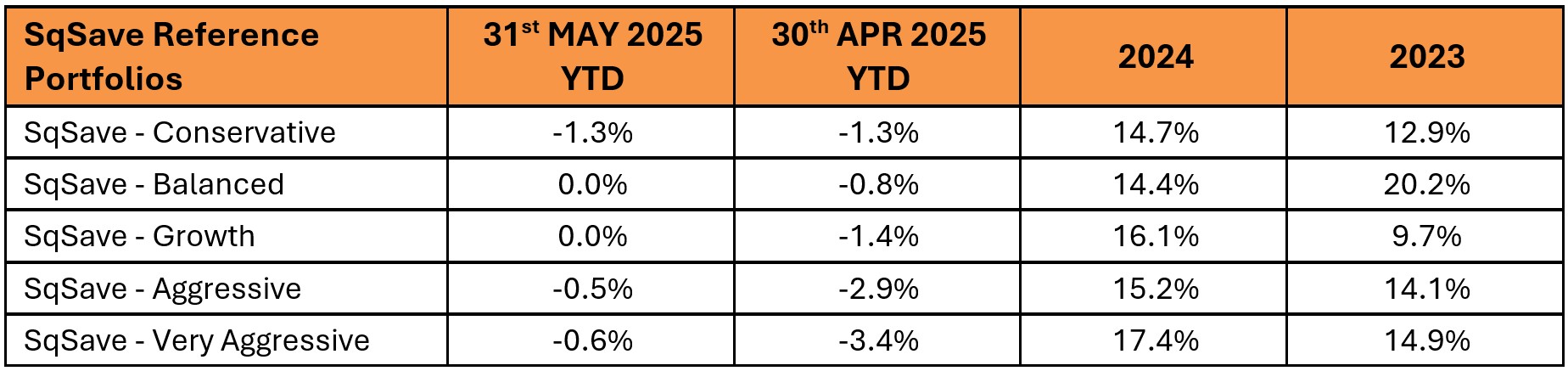

May marked a meaningful turning point for SqSave portfolios, with all strategies showing a clear rebound from April’s broader market volatility.

The Balanced portfolio recovered from –0.8% YTD in April to break even at 0.0%, while the Growth portfolio climbed from –1.4% also to 0.0% YTD — a full 1.4% improvement.

Even the Aggressive and Very Aggressive portfolios staged strong comebacks, improving by 2.4% and 2.8% respectively. This sharp month-on-month recovery reflects how SqSave’s AI models are efficiently & effectively positioned to ride the market’s rebound without overreaching on risk.

The Conservative portfolio, while holding steady at –1.3% YTD, remained consistent—absorbing rate-related headwinds with minimal fluctuation. In a market marked by shifting macro signals and cautious investor sentiment, such stability is valuable.

Collectively, these results reinforce how SqSave’s portfolios are built to not only withstand turbulence but to adjust dynamically across risk levels, capturing upside when markets recover while minimizing downside when they retreat.

An Economic Snapshot

- Slower Growth Ahead – OECD cuts global 2025 forecast growth to 2.9%, its weakest since COVID, with U.S. GDP projected to slow to 1.5% amid escalating tariffs.

- Inflation Still Sticky – U.S. CPI held at 2.3% YoY in May, unchanged from April.

- Europe Cuts Rates – First ECB cut to 2% since 2019 - signals further modest easing; eurozone gaining strength.

- U.S. Fed Stays Cautious – Expected rate cuts pushed to late 2025 or beyond.

- Trade Tensions Return – US-driven tariffs and policy shifts cooling investor appetite, trade barriers continue to dampen business confidence and investment flows.

Outlook

Global growth remains sluggish amid ongoing tariff tensions with diverging central bank policies. Yet, SqSave portfolios continue to demonstrate disciplined, risk-aware and round-the-clock management —delivering steady performance through uncertainty.

As macro winds shift, our AI-driven engine remains primed and tactically adjusted for resilience and opportunity - ready to PIVOT as clearer economic signals take shape.

Confidence amidst uncertainty—that’s the power of AI-driven investing.

Sincerely,

SqSave Investment Team

Disclaimer

The contents herein are intended for informational purposes only and do not constitute an offer to sell or the solicitation of any offer to buy or sell any securities to any person in any jurisdiction. No reliance should be placed on the information or opinions herein or accuracy or completeness, for any purpose whatsoever. No representation, warranty or undertaking, express or implied, is given as to the information or opinions herein or accuracy or completeness, and no liability is accepted as to the foregoing. Past performance is not necessarily indicative of future results. All investments carry risk and all investment decisions of an individual remain the responsibility of that individual. All investors are advised to fully understand all risks associated with any kind of investing they choose to do. Hypothetical or simulated performance is not indicative of future results. Unless specifically noted otherwise, all return examples provided in our websites and publications are based on hypothetical or simulated investing. We make no representations or warranties that any investor will, or is likely to, achieve profits similar to those shown, because hypothetical or simulated performance is not necessarily indicative of future results.

Note:

1. SqSave Reference Portfolio returns presented above are all inclusive of ETF expense ratios and net of SqSave management fees. SqSave uses AI to design and manage diversified investment portfolios for each investor. Because SqSave is not an investment fund, there is no single return measure. Instead, every SqSave investor has his/her own investment performance as each investor is managed separately by our SqSave AI. As investors can withdraw and top-up any time, investment returns will be affected by individual investor decisions. Hence, SqSave uses reference portfolios which are actual portfolios managed on an ongoing basis, without any interference with withdrawals or top-ups, to measure investment performance.

2. Performance numbers presented above for peers are estimates only.

More Articles more

INVESTMENT PERFORMANCE SWAMPED BY THE TIDE OF UNCERTAINTY

Team SqSave

On April 2, 2025, U.S. President Trump announced a sweeping set of tariffs during a Rose Garden speech, dubbing that day, "Liberation Day", a "Declaration of Economic Independence".

Read more

SQSAVE QUANTITATIVE AI ALGORITHMS DOING WELL IN THE CURRENT VOLATILITY

Team SqSave

As we alluded to in our commentary dated 10th March 2025, markets were rocked by significant market volatility – now, further stoked by the announcement of new tariffs by the U.S. administration.

Read more

Stayed Focused While Riding The Current Volatility

Team SqSave

As seasoned investors know, volatility is the source of investment gains. But that’s only half the story. Volatility is also the source of investment losses.

Read more