What the Russia-Ukraine Crisis Means For Savvy Investors

Feb 24, 2022

Saddened by the Russia-Ukraine conflict…

After months of brazen military build on the Ukraine borders, the Russia-Ukraine standoff has moved from words to aggressive actions. We hope war and conflict can be averted. But that is not to be.

This blog is not about the complex mix of geopolitics and history underlying the long simmering Russia-Ukraine situation that is now boiling over. The genesis of Ukraine and its intertwined history with Russia, Poland, Austria-Hungary and other historical powers, including the early tribal conquest periods by the Huns and Mongols as well as the two world wars – are useful to understanding the current tensions.

In this blog, we seek insights into what this latest global crisis means for savvy investors. Even then, our hearts, prayers and thoughts go out to the people of Ukraine and others caught in the crossfire.

Implications for the global economy and investment markets…

Markets will worry about dire global consequences if the Russia-Ukraine conflict spirals into a direct confrontation between Russia and NATO. There are larger interests at play including the expansion of NATO towards the Russian border and the US disdain for the Nord Stream 2 gas pipeline from Russia to Germany.

Economically, Ukraine is a major grain exporter and much of Russian gas is piped through Ukraine to get to Western Europe. There are inflationary implications if the Ukraine conflict adds to the current global supply bottlenecks, especially in food and energy.

But as a crisis, what does it mean to investors?

There have been repeated cycles of crisis and heightened market volatility in the last 100 years. The same lesson over and over is that if we invest with emotions, we are likely to buy high and sell low.

Let’s clear our minds with some facts.

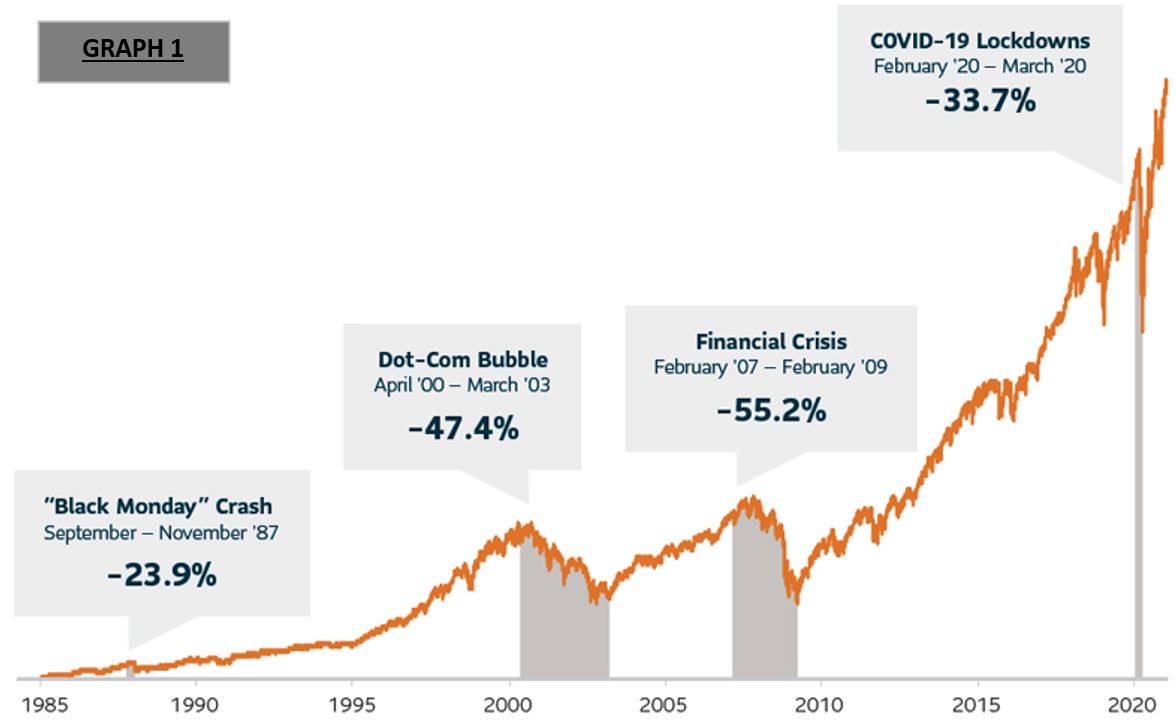

Fact 1: It’s not about “Timing the Markets”, but about “Time IN the Markets”. Time smooths out corrections and market crashes as evidenced in GRAPH 1.

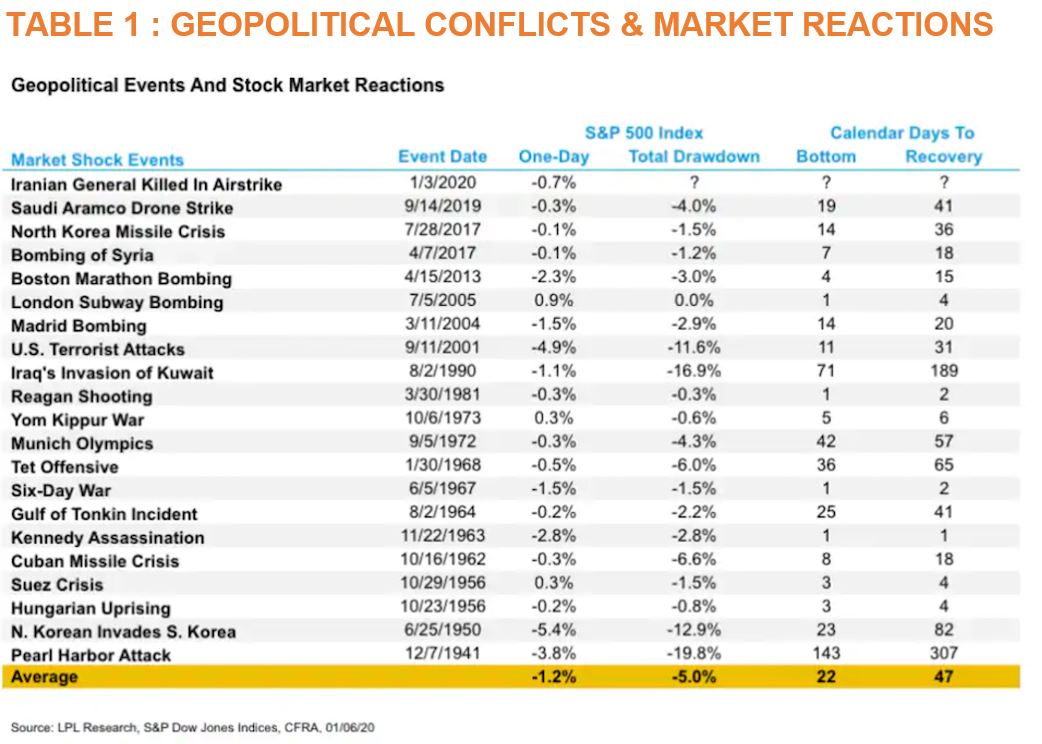

Fact 2: Markets recover even after a major conflict as shown in TABLE 1.

The Russian-Ukraine Conflict offers a window to invest…

When we launched SqSave in late 2019, little did we know then that after a few months, our machine learning AI algorithms would be battle-tested by the Covid-19 pandemic. We shared the experience in our blog dated 9 March 2020 “Covid-19: Has Fear Run Ahead of Markets?” where we highlighted that the intense fear and the Feb 2020 Covid-19 market crash offered a good investment opportunity. It turned out to be right, as supported by past crises. Invest when there is fear.

Like the Covid-19 and other past crises, the current Ukraine conflict is another window to define yourself as a shrewd investor when there is fear or a crowd investor when there is greed all around. Read our blog dated 30 March 2020 “Covid-19: A Chance to Define Your Investment Behaviour”.

Use AI-driven investment algorithms work for you 24/7 without emotions…

SqSave applies machine learning techniques to the Nobel Prize winning Markowitz Modern Portfolio Theory with our proprietary parameters to seek the highest probable return for a given risk level chosen. It is not an “alpha” returns maximising system. SqSave is a dynamic asset allocation system that combines alpha and beta. Our focus is not short term, but medium to longer term. Hence, SqSave sees this situation as a financial opportunity.

Conclusion

Stay invested to reap better returns…

Remember, the source of returns is volatility. All investments carry risks. At SqSave, we use data and AI-driven methods to manage that risk through portfolio diversification. SqSave helps you decide the risk you can tolerate, and once you decide, SqSave focuses on finding a portfolio combination with higher probable returns for the risk you set. SqSave knows that for the risk you set, there is potential gain and loss.

Greed and fear drive human investment decisions…

As we watch the Russian-Ukraine conflict unfold, we need to recognize that fear currently dominates. Therefore, we see an opportunity for investing with potential returns in the next 9-12 months.

Invest without human emotions…

Our data driven SqSave AI investment approach is unbiased with recent higher allocations into Gold in January 2022 – and reduced fixed income exposure – especially for the lower risk portfolios. This will help cushion the impact of the Russian-Ukraine conflict.

Even if your investment portfolio performance is impacted, the facts suggest that we should stay the course for better investment outcomes. Key is to ensure you are comfortable with the investment risk setting you have chosen.

Be a Smart Investor…

Pick a one-to-three-year investment time horizon. Set the investment risk to match your risk tolerance. You can easily do that using our SqSave Risk Profiler. Take advantage of SqSave’s machine learning AI which has proven its outperformance – beating other competing digital investment platforms.

Join the world of Smart Investing today at SqSave!

Regards

SqSave Quantitative AI Investment Team

Disclaimer

The contents herein are intended for informational purposes only and do not constitute an offer to sell or the solicitation of any offer to buy or sell any securities to any person in any jurisdiction. No reliance should be placed on the information or opinions herein or accuracy or completeness, for any purpose whatsoever. No representation, warranty or undertaking, express or implied, is given as to the information or opinions herein or accuracy or completeness, and no liability is accepted as to the foregoing. Past performance is not necessarily indicative of future results. All investments carry risk and all investment decisions of an individual remain the responsibility of that individual. All investors are advised to fully understand all risks associated with any kind of investing they choose to do. Hypothetical or simulated performance is not indicative of future results. Unless specifically noted otherwise, all return examples provided in our websites and publications are based on hypothetical or simulated investing. We make no representations or warranties that any investor will, or is likely to, achieve profits similar to those shown, because hypothetical or simulated performance is not necessarily indicative of future results.

More Articles more

SqSave AI seems to know something’s happening

Team SqSave

The Jan 2022 market correction resulted in the SqSave AI algorithms rebalancing the various reference portfolios.

Read more

SqSave ONE Dollar Reference Portfolios

Team SqSave

As SqSave offers global portfolios from as low as ONE Dollar, we showcase the ONE Dollar portfolios below.

Read more

SqSave Reference Portfolios riding out short term volatility

Team SqSave

Volatile start to 2022 for both equity and bond markets

Read more