Sharp Recovery Since the Covid-19 Crash

April 14, 2020

Fear still lingers as the world continues to grapple with Covid-19

As the Covid-19 pandemic continues to unfold, there is no shortage of viral-inspired opinions, home remedies, political jockeying, finger pointing, xenophobia and the like. With India joining the global list of nations adopting variations of a lockdown, the jury is still out if we can bring Covid-19 under control.

But we still have to live on…

But one thing continues. It’s to live. It’s your personal choice how you react to things that come your way. At SqSave, we will focus on the markets using the lens of a smart investor. And SqSave needs to say again, many who say they invest, are actually gambling (or trading). At SqSave, we do not focus on day-to-day or week-to-week movements. SqSave focuses on risk-adjusted returns using portfolios personalized to your chosen risk profile.

How the markets have behaved since the crash in March 2020…

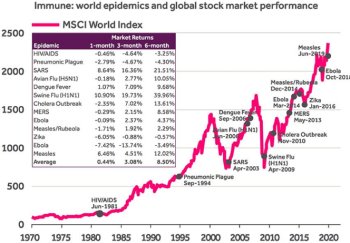

When the Covid-19 finally crashed the markets in March 2020, I sort of tried to explain to you – based on fears and tears over the last 3 decades that this is an investment opportunity of a lifetime, assuming you intend to live on. Read my blog on 2 March 2020 telling you that “Fear Takes Over with Saturation Media Coverage of the COVID-19 Outbreak…” and that “We've been here before”.

Well, it’s not whether it’s right or wrong. It’s really a matter of whether you are a smart investor.

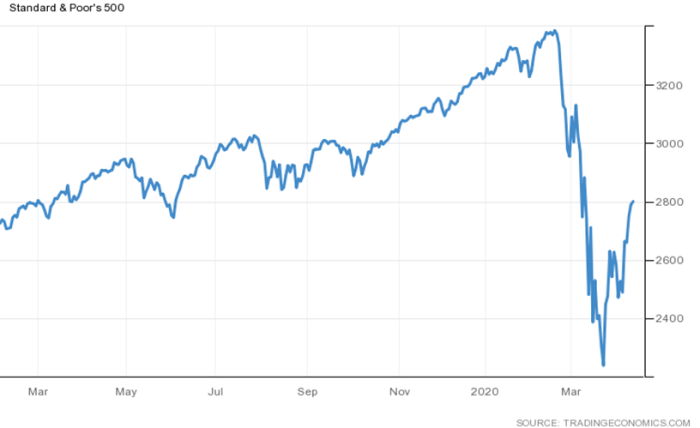

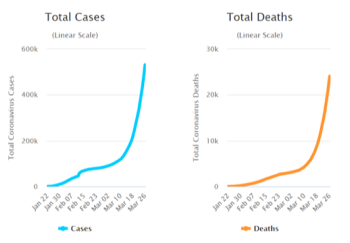

As of 13 April 2020, the data shows that major financial markets have staged a sharp recovery.

The S&P500 rebounded 25% from its low in Mar 2020. Among the reasons are:

- Strong government spending plans (USA’s US$ 2 trillion & Europe’s Euro 500 bn fiscal budgets) which are bigger than the 2008 Global Financial Crisis response.

- The US Federal Reserve announced unlimited QE and added US$ 2.3 trillion in credit support to businesses, state and local governments.

- Human optimism over a slowdown in new infections within Europe and happiness as the lockdown in Wuhan ended.

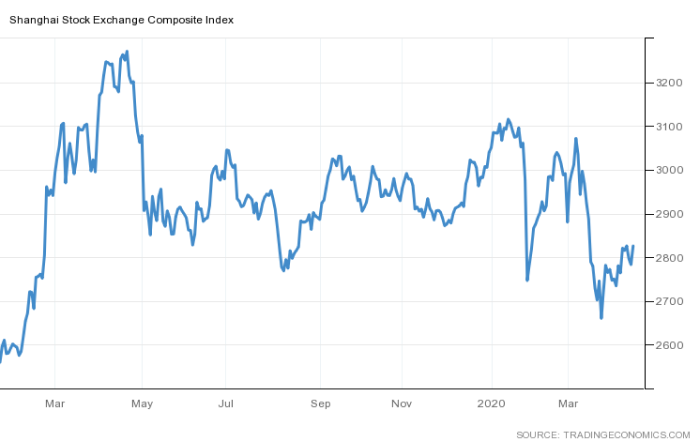

China’s Shanghai Composite closed at its highest since 13th March 2020. Relief as official data showed China's exports and imports fell much less than expected in March. On the biological side, optimism rose as China approved experimental Covid-19 vaccines.

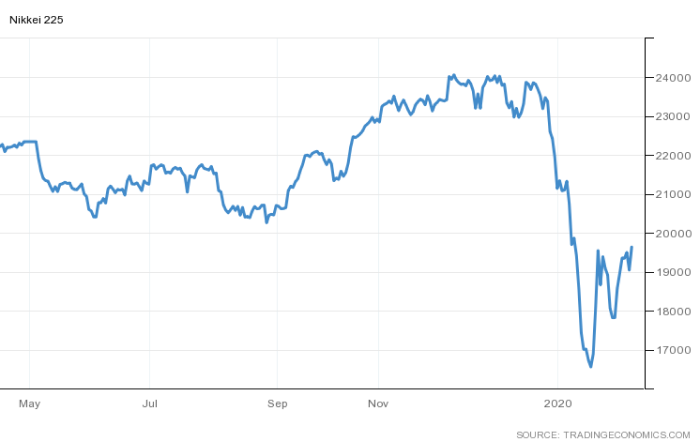

Likewise, Japan’s Nikkei 225 saw its highest close since 10th March. The Korean and Australian bourses also saw significant recoveries since the Covid-19 Crash.

Is this sharp recovery for real?

To be clear, markets are still below where they were before the March Covid-19 crash.

To be clear, it’s still early days for the hope of Covid-19 control. India just started a nationwide lockdown. The effects are quite different from other countries given the large informal economy and poor living conditions. As Singapore’s experience with the sudden infection spike arising from crowding in foreign worker dormitories shows, the risk of rapid-fire infections cannot be underestimated – even as India forces its poor into nooks and crannies. The world will soon find out.

Even as China opens up, Covid-19 infections are on the uptrend due to imported cases. This was also reflected in Singapore’s experience.

To be clear, governments are faster on the draw when it comes to firing fiscal bullets. They have been bold, targeted and rapid – putting cash directly into consumer pockets and flexible credit schemes.

This is to counter the collapse in incomes and cash flow as economic activities are shut down.

It’s human domination for now…

Just as I explained that markets are driven by greed and fear in my blog “Covid-19: Has Fear Run Ahead of Markets?” - the markets are still ruled by sentiment in the short term.

Covid-19 has triggered an unprecedented global lockdown - shutting down both global supply and demand. This shock will last for a few years.

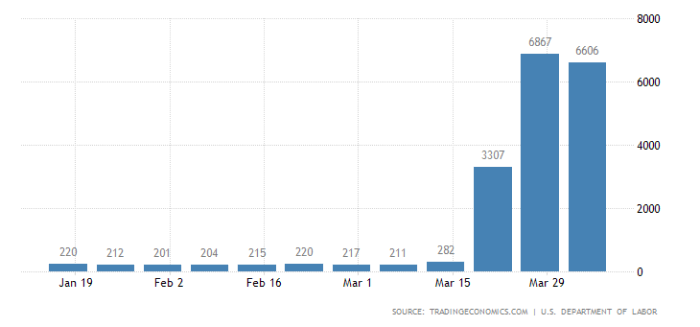

Seemingly, the negative data have been ignored. The expected collapse in economic activity and high unemployment have been forgotten for now. The IMF just declared that the current global recession would be the worst since the 1930s. Eighty percent of jobs are expected to be negatively affected globally. The US unemployment claims rose rapidly toward 10 million in less than two weeks.

But Covid-19 has unleashed global strategic forces…

- Rethink of Fiscal & Monetary Policies

Covid-19 has worsened public debt as governments try to fill the vacuum of collapsed economic activity and consumer income. Interest rates are therefore likely to remain low. However, with high public debt, economic activity may be slow. This adds pressure to the pensions that need to be paid as the baby boomers retire. Will there be more calls for limited or bold versions of “universal basic income”?

- Rise of “Me First” syndrome

I see the risk that a “Me First” objective will result, especially within the European Union – and not surprisingly, in the USA. This will cause a rethink of how countries work with each other. Globalisation may be the real victim of the virus as countries now reconfigure strategically to reduce dependence on others. Large economies with a domestic consumer base will benefit while small economies which depend on global markets may fund protectionism and unilateralism on the rise. EU leaders will face tough challenges keeping the union intact as more embrace Brexit-style directions.

- Acceleration of Digital Adoption

Thanks to Covid-19, some industries especially technology have gained recognition and traction. What a gold mine to own a food ordering and delivery platform. You don’t need to cook and can be a restaurant of choice! “Work from home” (WFH) is not only a new acronym, but a new discovery that many industries have been working “caveman style”. Do we need so much office space post-Covid-19? Think not. eCommerce, Internet, Communications and Technology (ICT), Digital Healthcare, Payments (and Smart Investing) should benefit!

At SqSave, our investment strategy remains unchanged

We use AI machine learning to manage your personal risk exposure versus the predicted returns across a globally diversified portfolio. We are risk-focused - and not in the short term.

Being a fully AI-driven digital investment manager using machine learning AI that works 24/7, our SqSave engine continues to do its boring job of looking for longer-term risk-adjusted returns, no matter what greed and fear suggest.

Stay home. Stay healthy! Stop gambling and start investing smarter!

Disclaimer

The contents herein are intended for informational purposes only and do not constitute an offer to sell or the solicitation of any offer to buy or sell any securities to any person in any jurisdiction. No reliance should be placed on the information or opinions herein or accuracy or completeness, for any purpose whatsoever. No representation, warranty or undertaking, express or implied, is given as to the information or opinions herein or accuracy or completeness, and no liability is accepted as to the foregoing.

More Articles more

Covid-19: Defining Your Investment Experience

Team SqSave

The IMF is forecasting a global recession in 2020. On the bright side, some analysts are forecasting a recovery as early as the third quarter of 2020.

Read more

Is Covid-19 different from the past crisis?

Team SqSave

Yes, Covid-19 is different from the causes of previous crises. There is deliberate policy-induced economic contraction – unlike other crises.

Read more

Getting It Right: Realised and Unrealised Gains/Losses

Team SqSave

In typical gambling behaviour, people are mostly heading for the exits because they have lost everything (including what they won previously).

Read more