SELL IN MAY & GO AWAY?

May 31, 2021

There is a popular saying, "Sell in May and go away”! While we investment folks may call it folklore (no pun intended 😊), SqSave’s investment team takes a quantitative approach to make sense of it.

Market data over many decades suggest low average returns between May and October followed by higher average returns during the winter months.

However, there have been many exceptions due to factors such as business cycles, socio-economic conditions and market sentiment have a large impact on stock market volatility which may invalidate the “Sell in May and go away” strategy. For example, COVID-19 has been a major factor driving stock market volatility. Instead of higher returns between November 2019 and April 2020, markets saw low returns. Hence, the “Sell in May and go away” cannot be regarded as an investment strategy unless more data is analysed.

At SqSave, we believe the start point is to understand investment risk (or volatility). One interesting data point is Chicago Board Options Exchange (CBOE)Volatility Index (VIX), a measure of expected price fluctuations in the S&P 500 Index options over the next 30 days. This “near-term” forward looking VIX is often referred to as the "fear index" and measures “implied volatility”. It is not historical or statistical analysis.

VIX can be considered as an indicator of “investor sentiment” and has been used to predict movements in the S&P 500. When the VIX rises, S&P500 is expected to fall. But as in data analysis, not always.

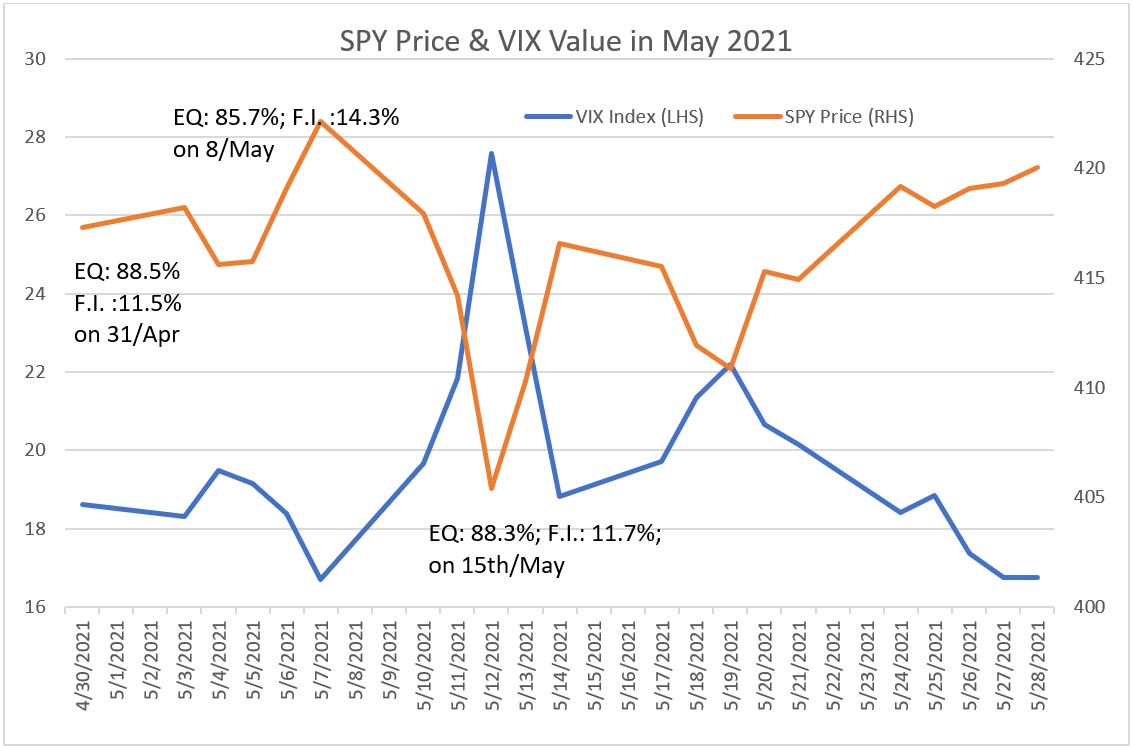

Let’s look at how the S&P 500 behaved in May 2021 versus the VIX in the Chart below.

Data source: Yahoo Finance & PIVOT Fintech Pte Ltd.

We can see that VIX and S&P 500 moved in opposite directions. This suggests that VIX is a useful leading indicator for the direction of the S&P 500 spot market.

In enhancing risk-return at SqSave, we use machine-learning (ML) driven dynamic Tactical Asset Allocation (TAA). So, let us review how our TAA performed.

At end-April 2021, SqSave’s AI asset allocation started with an Equity (EQ)/Fixed Income (FI) ratio of 88.5%:11.5%.

On 8th May 2021, when the S&P 500 reached a peak, the EQ/FI was changed to 85.7%:14.3%, with a reduced EQ weight from end-April.

On 15th May 2021, SqSave’s TAA engine increased allocation to EQ to reach an EQ/FI ratio of 88.3%:11.7% when S&P 500 reached a bottom. The asset allocation changes at these three points in time were well within our SqSave TAA design intent – which is Dynamic Asset Allocation!

Of course, we can hang on to traditional human driven asset allocation decisions instead of using SqSave’s data and AI-driven approaches. However, given heightened volatility and past experience, it is challenging for experienced investment managers to be disciplined and consistent in making asset allocations decisions in real-time while tracking market volatility 24/7.

We need to qualify that this review of SqSave’s TAA is only for one month and too short to draw robust scientific conclusions. Nonetheless, we trust that by sharing this review, there is a better appreciation of how our ML driven TAA works dynamically to manage your SqSave portfolios.

Our continuous review and monitoring of our global investing ML algorithms is key to ensure that SqSave continues to work well in the years ahead. We also continue our R&D to test more advanced data analytics and theoretical breakthroughs which if proven, can benefit our valued clients.

Glad that we did not follow the “Sell in May and go away” sentiment. As we have said many times, don’t be led astray by your emotions or let short-sighted “market noise” dictate your investment decisions. Let SqSave target decent risk-adjusted returns for you on a consistent and long-term basis.

Remember, anyone can participate in our AI global investing approach starting as low as ONE Dollar!

Sign-up now at www.sqsave.com

Regards,

Your SqSave Quantitative AI Team

Victor Lye BBM CFA CFP®, Founder & CEO

Yuan Baosheng PhD, Computational Finance Strategist

* SqSave uses AI to design and manage diversified investment portfolios for each investor. Because SqSave is not an investment fund, there is no single return measure. Instead, every SqSave investor has his/her own investment performance as each investor is managed separately by our SqSave AI. As investors can withdraw and top-up any time, investment returns will be affected by individual investor decisions. Hence, SqSave uses reference portfolios which are actual portfolios managed on an ongoing basis, without any interference with withdrawals or top-ups, to measure investment performance.

Disclaimer

The contents herein are intended for informational purposes only and do not constitute an offer to sell or the solicitation of any offer to buy or sell any securities to any person in any jurisdiction. No reliance should be placed on the information or opinions herein or accuracy or completeness, for any purpose whatsoever. No representation, warranty or undertaking, express or implied, is given as to the information or opinions herein or accuracy or completeness, and no liability is accepted as to the foregoing. Past performance is not necessarily indicative of future results. All investments carry risk and all investment decisions of an individual remain the responsibility of that individual. All investors are advised to fully understand all risks associated with any kind of investing they choose to do. Hypothetical or simulated performance is not indicative of future results. Unless specifically noted otherwise, all return examples provided in our websites and publications are based on hypothetical or simulated investing. We make no representations or warranties that any investor will, or is likely to, achieve profits similar to those shown, because hypothetical or simulated performance is not necessarily indicative of future results.

More Articles more

LATEST! APRIL SQSAVE PERFORMANCE: UP +7.3% TO +8.6%

Team SqSave

Following our first quarter 2021 performance update, SqSave is pleased to see that our Tactical Asset Allocation (TAA) adjustments are delivering good results!

Read more

SQSAVE PORTFOLIOS ARE UP +5.7% TO +7.0% IN FIRST QUARTER 2021

Team SqSave

At SqSave, we use data-driven Artificial Intelligence (AI) and Machine Learning (ML) techniques to optimize portfolio returns within projected risk parameters.

Read more

MY SQSAVE PORTFOLIO: +27% in 22 months (+14% per annum)

Team SqSave

As at end-Mar 2021, my SqSave portfolio is up +27% since June 2019 (or 14% p.a)… Here, you can see that my portfolio which started in June 2019 with just SGD 15,000 is now worth almost SGD 19,000.

Read more