Market Update Aug 2019

Aug 10, 2019

The global risk outlook has risen compared to 3 months ago.

Concerns over global growth remain high amidst trade war fallout fears. Gold touched fresh multiyear highs

while bond yields continue to fall. Negative interest rates threaten wiggle room for policy actions.

Investors need to be prudent and cautious.

Gold traded above USD 1,500 for the first time since 2013 and has gained more than the S&P 500 for YTD2019.

Rush to Safety

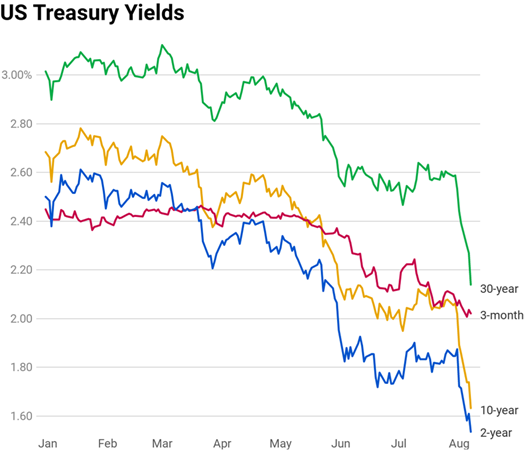

Investors are buying up bonds as global trade war fears loom large. In the USA, 10-year Treasury note yields used to price mortgage rates and auto loans fell to 1.595%, the lowest seen since 2016. The 30-year US Treasury bond hit 2.12%, near the all-time low in 2016.

A popular recession gauge (the spread between the 2-year Treasury yield and the 10-year yield) hit its lowest level since June 2007.

Globally, monetary policy is easing with central banks in India, New Zealand and Thailand surprising markets with aggressive rate cuts.

Negative Yields Loom

As central banks cut rates, negative-yielding debt is ballooning. Negative-yielding government bonds now make up 25% of USD 15 trillion of the global bond market, according to Deutsche Bank. That’s nearly triple what it was in October 2018.

Governments are getting paid to borrow money!

Government debt in Europe and Japan offer zero or negative interest rates against a weak economic outlook. 30-year German government bond rates went negative for the first time ever in August 2019. The monetary situation is compounded by the risk of an uncoordinated fiscal response in Europe.

While there remains a spread between US bond yields and the rest of the world, the US economy could be following the rest of the world towards negative rates. Already, the US Federal Reserve cut rates by 25 basis points for the first time since the 2008 financial crisis in early August 2019.

With the escalation of the US-China Trade War, further Fed Reserve rate cuts are likely. But as the overnight lending rate hovering between 2% and 2.25%, there is not much wiggling room to avoid a recession.

Currency Woes or Wars?

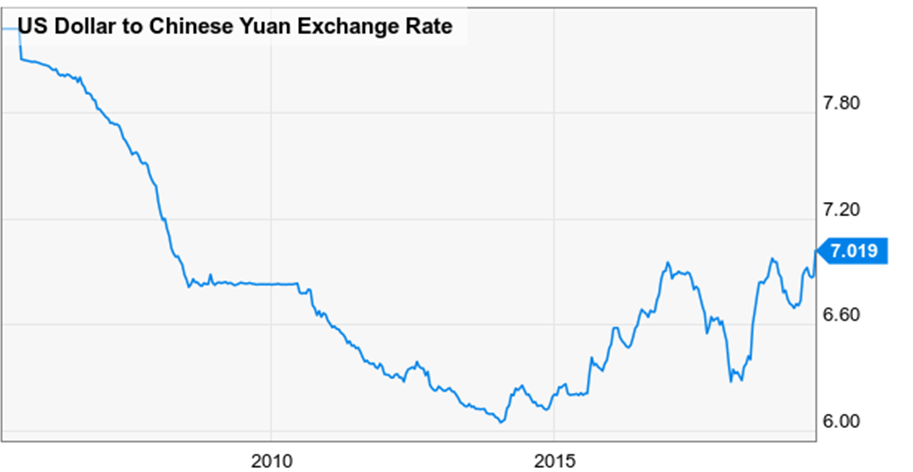

The USA labelled China a “currency manipulator” as the Chinese Yuan fell to its lowest level in more than a decade against the US dollar. Of course, China decried the US accusation and the Yuan stabilised. The US motive is puzzling given that the Chinese Yuan has risen 15% against the US dollar since 2001.

For now, the consensus seems to be the Yuan/US dollar exchange rate of 7 with all eyes on either direction for increased market stress.

Sensible Steps to Take

If you are invested, consider tucking in to reduce risk exposure. If you are not, this is a good opportunity to start building up your exposure.

At SqSave, we use machine learning AI to predicts risks and returnsusing real-time data. We prefer not to cloud our decisions with human emotions as markets face volatility. Our machine learning AI is able to compute faster than any human manager and can recognise patterns which seem random to the human eye. Yet, through all this market noise and chaos, SqSave AI remembers you – individually – in terms of your personal risk appetite always. It does not matter how much you have invested. Our SqSave AI treats you the same – whether you invested $100 or $1 million.

With global investment risk rising, it’s time to start your SqSave portfolio. It’s when markets are trending up that all human investors look smart It’s when markets really become volatile that the forward-looking, disciplined and non-emotional processes make the most long-term sense and better risk-adjusted returns.

More Articles more

Psst! Are you investing, gambling or speculating?

Apr 5, 2019 | Victor Lye, CFA CFP®

Many people say they invest. But they

are really gambling or speculating!

What about you?

Read more

Is Risk Profiling Just Another Questionnaire?

April 11, 2019 | Victor Lye, CFA CFP®

Investing should be about targeting the risks first before chasing returns. I propose three fundamentals to consider. Read more

What You Should Know About Unit Trusts

April 18, 2019 | Victor Lye, CFA CFP®

Not everyone has the same gung-ho risk attitude. Yet there is a fear of losing out when you hear boasts from people who say how much money they made from investing. Read more