Holding Steady in Turbulent Waters

5 December 2025

As of end-October, SqSave portfolios beat every competitor in their risk class from Conservative to Very Aggressive. In a complex environment, our AI didn’t chase. It led.

After months of strong momentum, November brought a sharp change in tone with the largest volatility swing since April creating havoc across global markets. This was triggered by added signs of slowing US growth (particularly its cooling labour market) while the US Fed’s initial hawkish tone reversed into a dovish frenzy by mid-month. Re-escalating global trade concerns over US and China tariff policies and other geopolitical tensions sparking oil price spikes and inflation anxieties also added to the market volatility mix. While other inflation trends showed further easing, investor sentiment was decidedly negative early on, mirroring US consumer sentiment.

Despite this, SqSave portfolios remained relatively resilient. Backed by our disciplined, AI-driven approach, all five reference portfolios maintained a majority of their solid year-to-date (YTD) returns, thereby staying ahead of most peer benchmarks. In uncertain times, our edge remains unchanged: agility, discipline, and data-led decisions.

SqSave Investment Performance

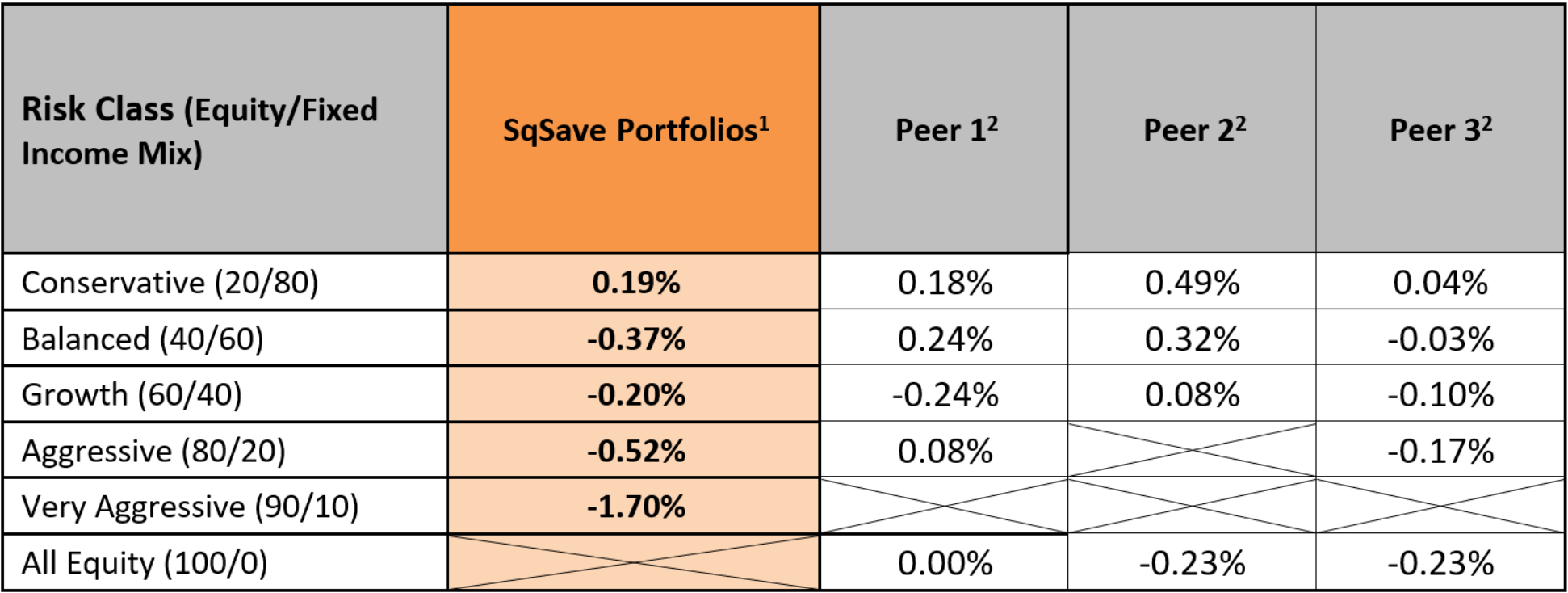

Following a very strong October, SqSave’s higher risk reference portfolios posted modest shortfalls versus its closest comparable peers’ portfolios in the past month, amidst the heightened markets volatility. Notwithstanding, our AI-led and disciplined portfolios are seen as well positioned should volatility re-emerge in the short-term.

Latest 1 Month Returns to 30 November 2025

Even in a month of consolidation, SqSave’s consistency stood out, proving again that success comes not from chasing rallies, but from managing risk intelligently.

These results reflect a disciplined risk posture, with our algorithm reducing overexposure during elevated valuations and focusing on diversification to preserve gains.

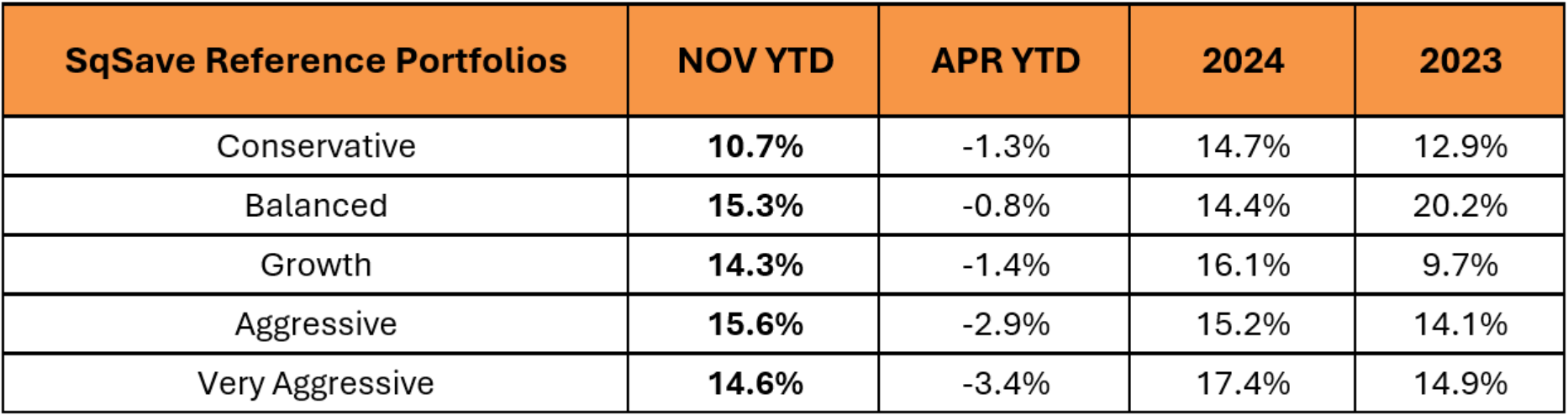

Seven-Month Recovery at a Glance

Despite the softer tone in markets, SqSave continued to maintain its 2025 YTD lead against tracked competitors’ relevant portfolios across multiple risk categories, with only modest setbacks in November.

Latest 2025 Year to Date (YTD) Returns

Note: 2025 YTD returns by indicated month are as at respective month end dates.

All portfolios maintained their double digit gains for the latest YTD period end despite Nov 2025 volatility.

Aggressive (+15.6%) portfolio leads the way. A clear result of SqSave’s AI tilting into equity momentum early and effectively.

Balanced (+15.3%) and Growth (+14.3%) and Very Aggressive (+14.6%) portfolios follow close behind, showing consistent recovery through diversified equity and bond allocations.

Even Conservative, once the hardest hit due to fixed income drags, rebounded nearly 12%, proving that capital preservation doesn’t mean missing the upside.

This seven-month performance arc proves again that SqSave’s AI adapts, pivots, and outperforms with discipline, not emotion.

Investment Environment

Global Growth is slowing: OECD now projects 2.9% for 2025, citing weaker-than-expected output in developed economies.

U.S. Inflation: October CPI rose 2.4% YoY, slightly down from 2.5% in September. Core CPI remains sticky at 2.9%.

Federal Reserve: Shifted from Hawkish to Dovish tones with rate cut expectations for its mid-Dec FOMC meeting shifting from < 30% to well in excess of 80% during November.

Tech & AI: Lofty valuations and doubts over future demand projections justifying Mega caps’ massive AI tilted cap spending sprees sparked sharp selloffs in early Nov. But this gave way to a “buy the dip” mentality to close off the month, as hopes for Fed rescue in the form of added rate cuts, vanquished the negativity, at least temporarily.

Geopolitics & Energy: Renewed tensions in the Middle East and supply worries following Ukraine’s bold strikes on Russian oil refineries contributed to a spike in oil prices, prompting renewed inflation concerns and reinforced defensive positioning in early November.

Outlook

Heading into year-end, markets face a delicate balance.

Inflation is easing, but not yet conquered.

US rates are stable, but leaning towards further, albeit modest policy cuts, as Fed governors have reversed earlier hawkish signals.

Growth is slowing, but not collapsing, as US consumers show signs of hanging on amidst rising personal debt and a cooling labour market.

That’s where SqSave’s advantage shines. Our portfolios don’t guess, they adjust continuously. As new data comes in, our AI engine recalibrates, ensuring portfolios remain aligned with risk, opportunity, and macro conditions.

Whatever December brings, SqSave will be ready.

Sincerely,

SqSave Investment Team

Disclaimer

The contents herein are intended for informational purposes only and do not constitute an offer to sell or the solicitation of any offer to buy or sell any securities to any person in any jurisdiction. No reliance should be placed on the information or opinions herein or accuracy or completeness, for any purpose whatsoever. No representation, warranty or undertaking, express or implied, is given as to the information or opinions herein or accuracy or completeness, and no liability is accepted as to the foregoing. Past performance is not necessarily indicative of future results. All investments carry risk and all investment decisions of an individual remain the responsibility of that individual. All investors are advised to fully understand all risks associated with any kind of investing they choose to do. Hypothetical or simulated performance is not indicative of future results. Unless specifically noted otherwise, all return examples provided in our websites and publications are based on hypothetical or simulated investing. We make no representations or warranties that any investor will, or is likely to, achieve profits similar to those shown, because hypothetical or simulated performance is not necessarily indicative of future results.

Footnotes:

1. Portfolio returns are inclusive of ETF expense ratios and net of SqSave management fees. SqSave uses AI to design and manage diversified investment portfolios for each investor. Because SqSave is not an investment fund, there is no single return measure. Instead, every SqSave investor has his/her own investment performance as each investor is managed separately by our SqSave AI. As investors can withdraw and top-up any time, investment returns will be affected by individual investor decisions. Hence, SqSave uses reference portfolios which are actual portfolios managed on an ongoing basis, without any interference with withdrawals or top-ups, to measure investment performance.

2. Performance numbers for peers are estimates.

More Articles more

Clean Sweep: SqSave Beats Every Competitor Across Every Portfolio

Team SqSave

As of end-October, SqSave portfolios beat every competitor in their risk class from Conservative to Very Aggressive.

Read more

Performance that Leads — Intelligence that Lasts

Team SqSave

As Q3 closed, global markets stayed cautiously optimistic amid sticky inflation, a steady Fed, and a tech-led earnings season that continued to support investor sentiment.

Read more

Results You Can Measure. Discipline You Can Trust

Team SqSave

As we moved through August, markets maintained their cautious optimism.

Read more