Performance that Leads — Intelligence that Lasts

4 October 2025

With five straight months of recovery and a clear winner across all risk bands, SqSave portfolios stand clearly ahead — driven by data, not delay.

As Q3 closed, global markets stayed cautiously optimistic amid sticky inflation, a steady Fed, and a tech-led earnings season that continued to support investor sentiment. Volatility softened, but conviction was still hard to come by.

SqSave’s portfolios didn’t wait for clarity — they created it.

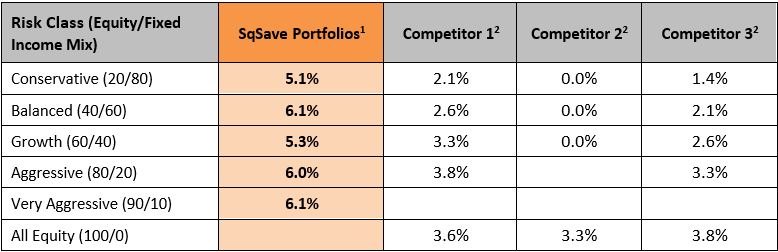

Powered by disciplined and AI-driven rebalancing, all five reference portfolios outperformed their closest comparable peers and own benchmarks in the latest YTD 2025 period by a WIDE margin — from Conservative to Very Aggressive.

In a market still weighing its next move, SqSave delivered what mattered most: leadership through precision.

SqSave September 2025 Investment Performance

September marked a defining moment for 2025. All SqSave reference portfolios outperformed every competitor in their respective risk bands — a rare, clean sweep that showcases the AI engine’s ability to stay adaptive, not reactive.

Latest 1 Month Returns - Sep 2025

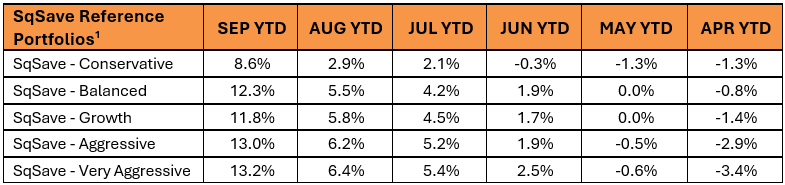

2025 Five-Month Recovery at a Glance

From April’s lows to September’s highs, SqSave reference portfolios have staged a powerful and disciplined recovery. With the exception of Conservative, all portfolios are now showing impressive double-digit YTD 2025 returns, far outpacing their nearest competitors; and showing that AI-powered investing is not just reactive — it’s strategic.

Note: Each set of returns shown above are on year to date (YTD) 2025 basis as at each indicated month's end date. |

• Every SqSave reference portfolio is now showing not just positive but decent YTD 2025 returns with the final quarter yet to play out; fully rebounding from Q2 volatility.

• Very Aggressive and Aggressive portfolios delivered double digit returns of 16.6% & 15.9%, respectively, since end April 2025, demonstrating strong AI-driven positioning.

• Balanced and Growth portfolios delivered turnarounds of 13.1% and 13.2%, since end April 2025 respectively — steady, reliable, and risk-aware.

• Conservative posted an equally impressive 9.9% gain since end April 2025 (despite its lower risk focus) — proving capital protection can still deliver worthwhile growth.

This five-month performance arc is more than a rebound.

It’s proof that SqSave’s AI can pivot, stabilise, and outperform — across any market cycles.

What It Means for Investors

In September, the message was clearer than ever: SqSave’s algorithm delivered!

The AI engine delivered a clean sweep of outperformance across all portfolios versus both reference benchmarks and industry peers, thanks to a strategy built on discipline, not timing.

• Maintaining momentum in equity allocations as earnings and AI-related sectors continued to strengthen,

• Selective fixed-income positioning that preserved capital in an uncertain rate environment, and

• Daily portfolio recalibration, designed to adjust early — not late.

The result: consistent leadership, portfolio by portfolio.

Not reaction. Not luck. Just machine-driven clarity applied with conviction.

Economic Snapshot

• Global Growth: IMF maintains its 3.0% global growth forecast, supported by resilient consumer demand and stable global trade trends.

• U.S. Inflation: CPI for August 2025 held steady at 2.7% YoY, reinforcing the plateau observed over recent months.

• US Federal Reserve: As widely expected, Fed cut Fed Funds interest rate by 0.25% to 4.00%–4.25% in September (after pausing since Dec 2024) — with an added 50bps in cuts expected by year-end; citing recent a elevation in US economic uncertainty, led by a recent lacklustre jobs market.

• Earnings Sentiment: U.S. tech and communication services led earnings strength, buoyed by infrastructure and AI investment.

• AI Optimism: Global investment in AI infrastructure (data centers, chips, software) continued to accelerate, fuelling long-term growth across key innovation sectors.

Outlook

With Q4 now underway, the outlook remains uncertain — but for SqSave, the strategy is clear.

We don’t wait for confirmation.

We respond to data.

And we do it with discipline.

Confidence in uncertainty. Intelligence that scales. That’s the power of AI-driven investing with SqSave.

Sincerely,

SqSave Investment Team

Disclaimer

The contents herein are intended for informational purposes only and do not constitute an offer to sell or the solicitation of any offer to buy or sell any securities to any person in any jurisdiction. No reliance should be placed on the information or opinions herein or accuracy or completeness, for any purpose whatsoever. No representation, warranty or undertaking, express or implied, is given as to the information or opinions herein or accuracy or completeness, and no liability is accepted as to the foregoing. Past performance is not necessarily indicative of future results. All investments carry risk and all investment decisions of an individual remain the responsibility of that individual. All investors are advised to fully understand all risks associated with any kind of investing they choose to do. Hypothetical or simulated performance is not indicative of future results. Unless specifically noted otherwise, all return examples provided in our websites and publications are based on hypothetical or simulated investing. We make no representations or warranties that any investor will, or is likely to, achieve profits similar to those shown, because hypothetical or simulated performance is not necessarily indicative of future results.

Footnotes:

1. Portfolio returns are inclusive of ETF expense ratios and net of SqSave management fees. SqSave uses AI to design and manage diversified investment portfolios for each investor. Because SqSave is not an investment fund, there is no single return measure. Instead, every SqSave investor has his/her own investment performance as each investor is managed separately by our SqSave AI. As investors can withdraw and top-up any time, investment returns will be affected by individual investor decisions. Hence, SqSave uses reference portfolios which are actual portfolios managed on an ongoing basis, without any interference with withdrawals or top-ups, to measure investment performance.

2. Performance numbers for peers are estimates.

More Articles more

Results You Can Measure. Discipline You Can Trust

Team SqSave

As we moved through August, markets maintained their cautious optimism.

Read more

Outperformance, Uploaded.

Team SqSave

As markets built on June’s momentum, July rewarded those who were already positioned — not just reacting.

Read more

This Is Your Sign to Trust Our Algorithm

Team SqSave

As we closed the first half of 2025, July sees signs of calm returning to the markets.

Read more