Encouraging SqSave Performance Since Start of 2023

14 Mar 2023

Market outlook

The recent volatility in the stock market can be attributed to various factors, including persistent inflation, changing interest rate expectations, economic growth worries, earnings results paired with future guidance and evolving geopolitical events. The near-term pace of disinflation (rate of slowdown of inflationary pressures) continues to be a major concern to market players. That is, they know this will have direct implications on the future path of interest rates driven by the US Federal Reserve (Fed).

Rising interest rates can lead to increased borrowing costs for both companies and consumers, impacting future earnings expectations and making bonds more attractive relative to stocks. For how it impacts consumers, look no further than the latest US 30-year fixed mortgage rates, already resuming their recent climb to 14-year highs of 6.5% in February 2023, with threats of ballooning foreclosures looming high.

Figure 1: Average US Fixed Mortgage Rates Historical Chart

Source: Macrotrends.net

Meanwhile, a slew of robust US economic data in recent weeks (i.e. much stronger than expected 517K new jobs in January with little easing of wage inflation, January retail sales up 3.0% m-o-m and higher monthly producer prices) all point to a higher possibility of sticky inflation for longer than earlier expected. Such trends have added pressure on the Fed, as indicated by Chairman Jerome Powell cautioning that the US central bank may need to re-accelerate the pace of interest rate increases if the economy and inflation do not cool sufficiently. This also raises the prospect that rate hikes could extend to a higher level than was recently expected.

More importantly, such outcomes could raise the odds of a prevailing expected soft economic landing morphing into a hard landing (deep recession), compounded by still ever-present global supply chain disruptions. This would lead to negative knock-on effects to corporate profits, which is a fundamental driver of stock market performance.

Against this backdrop, the outlook for the next 3 - 6 months continues to paint a likelihood of continued volatility, at least until or unless economic data and inflation moderates to the Fed’s satisfaction.

SqSave portfolios continues to show good results

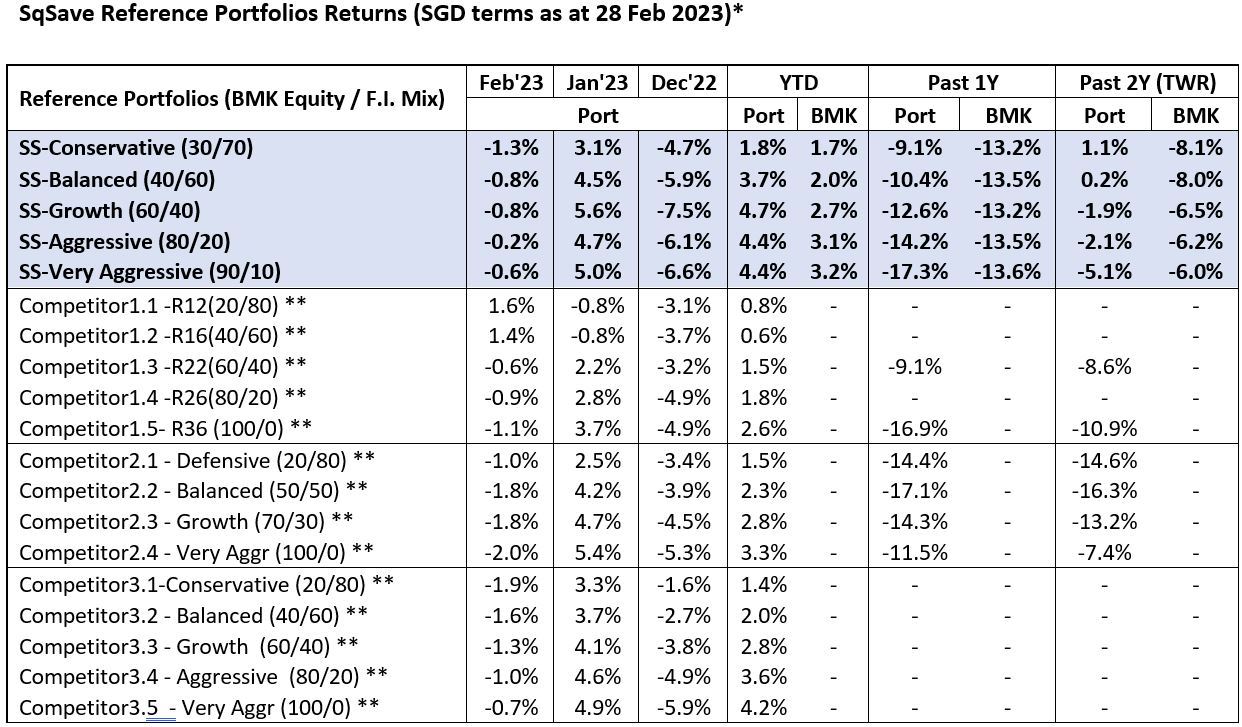

At the end of January, we adjusted our algorithms after a re-review of worthwhile US listed Exchange Traded Fund candidates to include in our universe of selections and further quantitative optimizations. Our revised algorithm appears to have performed well overall, based on year-to-date, trailing one-year, and two-year performance results (see table below).

*Inclusive of ETF expense ratios and net of SqSave management fees. SqSave uses AI to design and manage diversified investment portfolios for each investor. Because SqSave is not an investment fund, there is no single return measure. Instead, every SqSave investor has his/her own investment performance as each investor is managed separately by our SqSave AI. As investors can withdraw and top-up any time, investment returns will be affected by individual investor decisions. Hence, SqSave uses reference portfolios which are actual portfolios managed on an ongoing basis, without any interference with withdrawals or top-ups, to measure investment performance. ** Performance numbers for competitors are estimates. Abbreviations: BMK: Benchmark; Ret: Return, TWR: Time Weighted Return.

Some added noteworthy takeaways from the above performance updates are highlighted below:

- In Feb 2023, all our reference portfolios outperformed competitors, except the 3 lower-risk portfolios which slightly underperformed competitor #1. On a year-to-date 2023 basis, all our portfolios have beaten their benchmarks and competitors with compelling margins.

- Over the latest trailing 2Y period, all our portfolios have beaten their benchmarks and selected comparable competitors’ portfolios (based on available data).

- Over the latest trailing 1Y period, our low-to-mid risk portfolios have beaten their respective benchmarks as well as selected comparable competitors’ portfolios (based on available data). Our Aggressive portfolio has similarly beaten selective competitors’ portfolios as well.

- Over the trailing 2Y period, our reference Conservative and Balanced risk portfolios are managing the downside well with positive returns of 1.1% and 0.2%, respectively, while competitor #2 significantly underperformed with -14.4% and -17.1% for their comparable portfolios.

Yours sincerely

SqSave Investment Team

Disclaimer

The contents herein are intended for informational purposes only and do not constitute an offer to sell or the solicitation of any offer to buy or sell any securities to any person in any jurisdiction. No reliance should be placed on the information or opinions herein or accuracy or completeness, for any purpose whatsoever. No representation, warranty or undertaking, express or implied, is given as to the information or opinions herein or accuracy or completeness, and no liability is accepted as to the foregoing. Past performance is not necessarily indicative of future results. All investments carry risk and all investment decisions of an individual remain the responsibility of that individual. All investors are advised to fully understand all risks associated with any kind of investing they choose to do. Hypothetical or simulated performance is not indicative of future results. Unless specifically noted otherwise, all return examples provided in our websites and publications are based on hypothetical or simulated investing. We make no representations or warranties that any investor will, or is likely to, achieve profits similar to those shown, because hypothetical or simulated performance is not necessarily indicative of future results.

More Articles more

SqSave Portfolios Performed Strongly in January

Team SqSave

Last year, many central banks around the world focused on fighting inflation by implementing rate hikes while guiding investors and the general public about the expected economic impact of their rate hiking campaigns (in their attempts to anchor and gradually reduce future inflation expectations).

Read more

ADOPT A CALM AND DISCIPLINED INVESTING APPROACH

Team SqSave

It’s funny to see human psychology confused about investing and gambling.

Read more

Majority of SqSave’s Portfolios Outperformed Peers over Past 2-Years!

Team SqSave

As we approach the end of calendar 2022, we highlight how our SqSave algorithms have managed the lower risk portfolios under heightened market volatility.

Read more