7 Ways SqSave AI is Revolutionising Investing

Dec 13, 2021

Frequently dubbed one of the "next big things in tech", Artificial Intelligence (AI) applications have significantly evolved. From search engines to money management, AI brings unique solutions and possibilities to the table with its ability to harness vast amounts of data and make inferences about new data – beyond human capabilities.

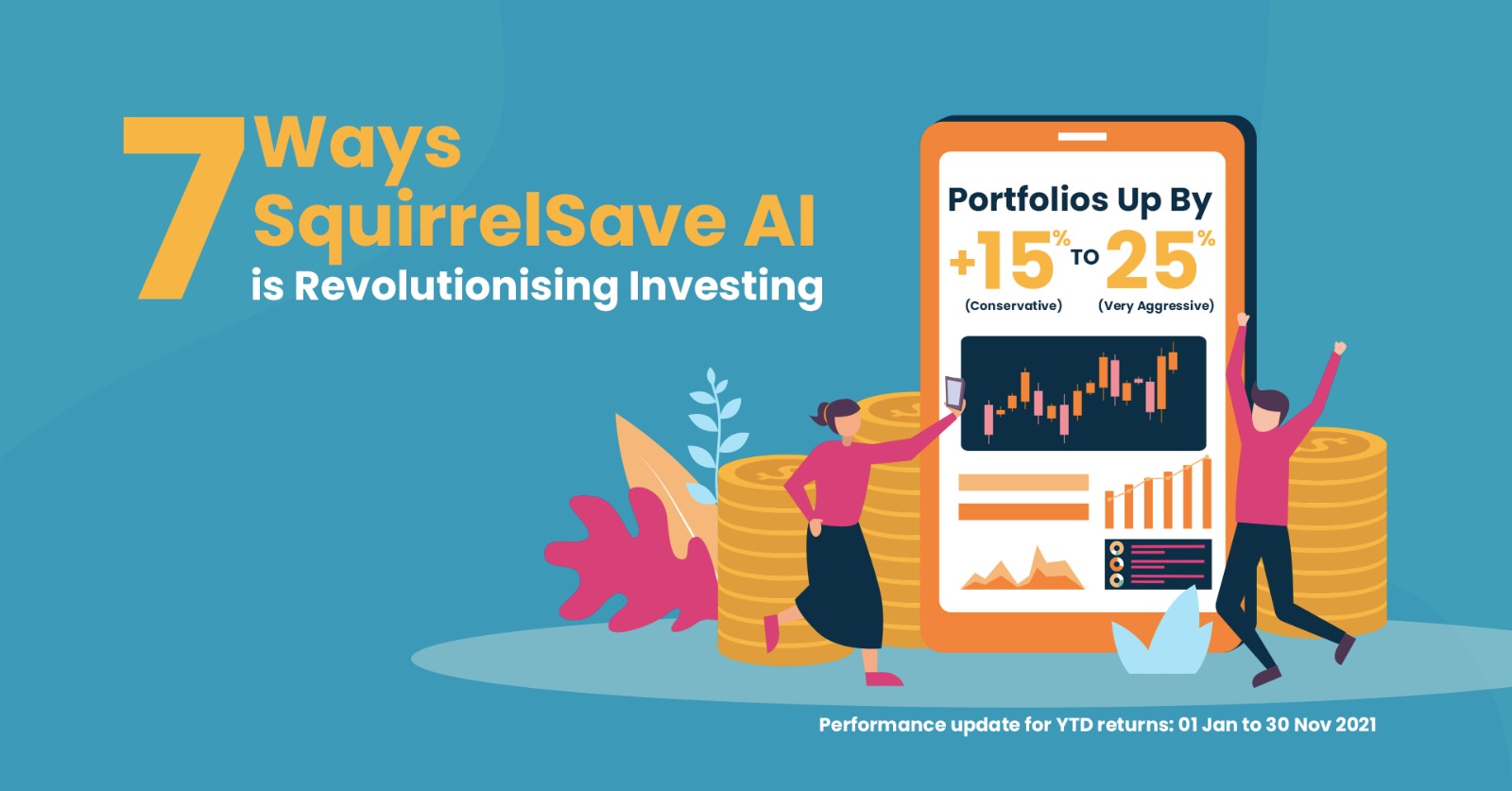

SqSave's proprietary AI investment system has reaped decent returns for our clients, even for investors with low to zero investment knowledge! SqSave achieves these results in 7 ways:

-

Better data, better decisions

A key advantage of SqSave AI is its ability to quickly and efficiently sort through large volumes of data from various sources. Our AI can then recognise, understand and identify patterns from the data, which allows for better interpretations and predictions when it comes to investment decisions. -

No emotions, only wisdom

SqSave AI is not swayed by market sentiments or emotions, relying only on objective data. Any decisions or predictions made by the algorithm rests solely on real-time data analysis, reducing the risk of making a hasty decision based on fear or anxiety. -

On duty, night and day

As research indicates, humans are wired for short bursts of productivity of about 3 to 5 hours a day. Anything beyond might lead to decision fatigue and a lack of focus. That's where SqSave AI's technology comes in. Our AI investment manager works 24/7, 365 days a year, while producing consistent data collection, analysis, and even portfolio rebalancing depending on market fluctuations. -

Diversification across global ETFs

SqSave AI offers a diverse, global portfolio of over 2,000 ETFs (Exchange-traded funds) over a broad range of regions and asset classes. This allows investors to gain exposure to the index without investing entirely in its component stocks (don't put all your eggs in one basket!), therefore reducing risk. -

Beating human fund managers

AI investment managers have outperformed human advisors due to their reliance on objective data and rebalancing portfolios in real-time. This was most evident during the pandemic – 94% of investors felt optimistic about continuing with their AI investment managers compared to just 82% with human counterparts. In fact, SqSave AI recorded a +15% to +25% rise from January to November 2021, higher than our competitors' estimated returns! -

Risk-adjusted, highest probable returns

Our AI harnesses real-time data to make predictions, unlike traditional Robo-advisors that rebalance your portfolio backwards to a historical model portfolio. Combined with SqSave's AI that works round the clock, any adjustments to your portfolio take your set risk appetite into account while pushing for the highest probable returns. -

Gamified risk appetite assessment

Determining your risk appetite can be complex and confusing. That's why we developed the SqSave Risk ProfilerTM – built on our predictive AI that helps determine your risk profile and risk-reward behaviour. Instead of a dry, traditional questionnaire, the game uses behavioural analytics and gamification techniques to assess your risk profile instantly. The result is then applied to your portfolio for smarter investment decisions based on your profile.

Contrary to the downturn that many investment portfolios have seen during the pandemic, SqSavers have enjoyed higher returns because of our unique AI-driven algorithm and investment strategy.

Click here to give the SqSave Risk Profiler a go and begin your smart investment journey with SqSave!

Disclaimer

The contents herein are intended for informational purposes only and do not constitute an offer to sell or the solicitation of any offer to buy or sell any securities to any person in any jurisdiction. No reliance should be placed on the information or opinions herein or accuracy or completeness, for any purpose whatsoever. No representation, warranty or undertaking, express or implied, is given as to the information or opinions herein or accuracy or completeness, and no liability is accepted as to the foregoing. Past performance is not necessarily indicative of future results. All investments carry risk and all investment decisions of an individual remain the responsibility of that individual. All investors are advised to fully understand all risks associated with any kind of investing they choose to do. Hypothetical or simulated performance is not indicative of future results. Unless specifically noted otherwise, all return examples provided in our websites and publications are based on hypothetical or simulated investing. We make no representations or warranties that any investor will, or is likely to, achieve profits similar to those shown, because hypothetical or simulated performance is not necessarily indicative of future results.

More Articles more

SqSave Reference Portfolios Doing Well Despite Headwinds

Delivered +15% to +25% Returns YTD end-Nov 2021

Team SqSave

November saw US equity markets setting new record highs but fell abruptly at month-end due to fears over the emerging Omicron Covid-19 variant, stubbornly high inflation due to global supply constraints and worries about the Federal Reserve’s next steps.

Read more

SqSave ONE Dollar Reference Portfolios

+14% & +19 during Jan-Nov 2021

+21% & +33% in 18 months since May 2020

Team SqSave

We track two actual ONE Dollar SqSave portfolios which started in May 2020.

Read more

Invest in the Best Gift for Your Loved Ones this Christmas

Team SqSave

Gifting season is here! Want more meaning & value from your gift spending? Then get SqSave's Gift-a-Portfolio! Ideal for family, loved ones and friends, SqSave Gift-a-Portfolio grows financial security for life.

Read more