About Us

SqSave is a digital investment manager and the consumer brand of Singapore-incorporated PIVOT Fintech Pte. Ltd. (“PIVOT”) (UEN 201716150D). PIVOT is regulated by the Monetary Authority of Singapore and holds a Capital Market Services Licence (CMS 100806).

SqSave's backers primarily consist of angel investors attracted to the fintech solutions and strong leadership, led by founder Victor Lye, who brings over 25 years of experience in investments, insurance, and healthcare.

SqSave designs personalized investment portfolio(s) matched to your risk profile when you ask for it. We manage your portfolio(s) for you on an on-going basis. You don't have to make any investment decisions. Simply decide how much risk you want to take and how much to invest. We do the rest.

SqSave uses machine learning AI to design and manage globally diversified investment portfolio(s) customized for every investor.

SqSave's investment strategy is based on the investment philosophy of Nobel Prize winning Markowitz's Modern Portfolio Theory ("MPT"). Using the MPT framework, SqSave's proprietary algorithms and statistical models uses real-time data to predict a portfolio diversifed across different investments that generates the highest possible return for the given risk exposure.

SqSave's technology involves training our algorithms to progressively improve their predictive power by using "training data" comprised of actual outcomes, mathematical optimization and data analytics. The algorithms adopt machine learning AI techniques to correct its "mistakes" by comparing its predictions against live data outcomes in real-time, adjusting its computational variables and predicting again, all in rapid succession, without being explicitly programmed to do so. That's machine learning.

Machine learning ("ML") is the science of getting computers to act without being explicitly programmed. ML has become so common that you are already using it. For example, in spam-email filtering, online language translation, self-driving cars, speech recognition, web search, and more. Machine learning algorithms build a mathematical model of sample data, known as "training data", in order to make predictions or decisions without being explicitly programmed to perform the task. Machine learning is closely related to computational statistics, which focuses on making predictions using computers.

SqSave has two main proprietary technologies, namely (i) SqSave Risk Profiler; and (ii) SqSave Digital Asset Allocation System.

Our SqSave Risk Profiler adopts Game Theory which focuses on risk-reward choices and behaviour. We believe that this is an improvement over the traditional questionnaire approach which is not scientifically validated. Moreover, respondents may not understand the technical nature of the questions. Our SqSave Risk Profiler simply requires you to make a series of risk-return decision(s). By analysing the risk you accepted for the desired return, and the sequence of your decisions with respect to the random results, and the actions of others with similar demographics, our SqSave Risk Profiler builds on its AI capability to predict your risk profile.

Our SqSave Digital Asset Allocation System ("DAAS") uses the principles of Nobel Prize winning Markowitz's Modern Portfolio Theory ("MPT") to drive SqSave's proprietary algorithms with real-time data to predict a diversified investment portfolio whose risk-return outcome fits your personal risk profile identified by our SqSave Risk Profiler or as determined by you.

The DAAS involves (i) Data Analytics (ii) Portfolio Accounting System and (iii) Trade Optimisation. Our proprietary Data Analytics system makes sense of real-time data which feeds into our SqSave Portfolio Accounting System to generate the recommended portfolios based on MPT, and the trade orders, as necessary. The Trade Optimisation Module accounts for market friction costs such as execution commissions, fees, bank charges, etc, with the aim of structuring efficient investment decisions to achieve a lower friction cost than if you were to execute the transactions personally.

SqSave focuses on achieving good risk-adjusted returns by predicting market trends across different asset classes to minimize portfolio volatility over the medium to long-term.

SqSave differs from typical "robo-advisers" in two main aspects:

(i) Portfolio design

(ii) Investment management

(i) "Robo-advisers" are typically "digital shopfront, human kitchen" in nature, where investment decisions are ultimately made by human managers. As such, robo-adviser "human kitchens" offer "pre-made" model investment portfolios to match your risk profile. In contrast, SqSave is a “digital shopfront, digital kitchen” system using machine learning AI without human bias. SqSave designs your investment portfolios that matches your risk profile - only when you ask for it - using real-time market data and risk-return predictions.

(ii) When it comes to managing your investments, SqSave is forward-looking. Everyday, SqSave assesses real-time data and predicts several risk-return scenarios that match your personal risk profile. Portfolio rebalancing is done on a "per investor" basis, and only if SqSave predicts that a particular predicted risk-return outcome will be better than your current portfolio. In contrast, typical robo-adviser "human kitchens" rebalance your investments "backwards" to its "pre-made" model portfolios, which may no longer be relevant due to constant changes in market conditions.

Of course! We humans should do what we do better than machines. And let the machines do what humans cannot do better. Our human Squirrels will focus on customer support and making sure things work as planned. Our investment team which designed the algorithms monitor and assess performance everyday to ensure that the overall system works as planned.

SqSave holds a Capital Markets Services license and commenced operations in early 2019. Since then, SqSave's machine learning AI technology, based on the MPT investment framework, has been commercially deployed, showcasing a track record of over five years.

SqSave's technology has been adapted and deployed at various financial institutions across ASEAN.

If you want to invest (grow your savings with a measure of risk over a time frame of over one year), then SqSave will work for you. SqSave harnesses the power of AI to manage your investment risk in real-time with consistency, which is humanly not possible. Humans get emotional, need time out and cannot cope with voluminous data. Machines can do the work consistently without rest, can see patterns that we don't even recognise.

Global investment markets keep moving as one part of the world goes to sleep and another part starts its workday. Tracking investment risks must cover huge volumes of data in real-time, all the time. Computing power has advanced tremendously. Hence, machines can manage risk consistently over the medium to long term. Humans will be affected by emotions and cannot process voluminous data efficiently.

SqSave's investment AI team is led by Victor Lye with over 25 years' leadership experience in investments, insurance and healthcare. He has led research, stockbroking, corporate finance, asset management, private banking, insurance and healthcare. Most of all, he has seen investment cycles since the 1980s. Victor founded SqSave in the belief that machine learning AI is better than traditional investment methods that charge clients too much.

General

If you invested in a mutual fund or unit trust that is actively managed, then you have to decide if the active management of the human manager is worth the fees you are paying. Further, you should assess that the investment management risk is suitable for you.

You should assess your investment objective. If you wish to invest in a diversified global portfolio, then you should seriously consider SqSave.

No. SqSave is not a trading platform nor is SqSave offering trading style investments. Investments require risk management over volatile market cycles. Therefore, time horizon is very important in a proper investing approach. SqSave only accepts investors who are prepared to take more than one year time horizon or longer. In our view, an investor should take preferably at least a three year time horizon to manage risk over the market cycles.

Compared to 20 years ago, investment markets are more globally connected. Companies are now global businesses. Investing globally allows you to access better investment opportunities.

Exchange traded funds (ETFs) are investment funds that are listed and traded on a stock exchange. ETFs cover a broad range of asset classes and can give exposure to specific markets, sectors or investment strategies.

Like mutual funds and unit trusts, your money invested in a specific ETF is pooled with money from other investors in the same ETF, and invested according to the ETF's stated investment objective.

An ETF typically aims to produce a return that tracks or replicates a specific index such as a stock index or commodity index. Such index tracking ETFs are passively managed by ETF managers with fees and charges that are usually lower than those of actively managed investment funds.

Investing in an ETF is done by buying units in the ETF. There is capital gain when the price of the units rises above the price paid for them. ETFs are not principal-guaranteed. Some ETFs pay dividends. ETFs may have complex structures which involve the use of derivatives.

You can learn more about ETFs at www.moneysense.gov.sg

ETFs are useful instruments for asset allocation:

(i) Diversification: You can gain exposure to an index without having to invest in all its component stocks.

(ii) Cost: ETFs tend to have lower fees and charges than actively managed investment funds such as unit trusts. There is also usually no sales charge, although brokerage commissions/transfer taxes will apply as ETFs trade like any other security on a stock exchange.

(iii) Liquidity: As ETFs are traded on a stock exchange, you can buy and sell units of ETFs throughout the trading day.

(iv) Valuation: ETFs prices are readily available on the stock exchange where they are listed, unlike unit trusts where prices are indicative.

For a more complete understanding of ETFs, you can refer to www.moneysense.gov.sg

For portfolio design, SqSave has a risk-return framework with different data-driven categories. For each category, our SqSave DAAS optimises or predicts a portfolio asset allocation everyday using the latest market information. These categories are not necessarily the same everyday as our DAAS uses real-time data to keep our risk-retun models up-to-date 24x7. Rebalancing is not done with reference to market price changes causing a deviation from the orginal (historical) designed portfolio. At SqSave, rebalancing is done with reference to the predicted future portfolio and the current portfolio reflecting real-time market prices. SqSave only rebalances an individual's client portfolio when there is a statistical significance in the deviation between a given investor's market priced portfolio and the predicted optimal portfolio in the relevant category the client belongs to.

Yes, our SqSave Digital Asset Allocation System will design your own personal investment portfolio based on your risk profile, time horizon and age versus the prevailing and predicted (optimised) risk-return scenarios – at the time you ask for a portfolio recommendation.

SqSave DAAS uses data from reputable information providers. The data used include structured data such as fundamental/technical and unstructured data such as measures of market bullishness or bearishness.

SqSave invests in ETFs listed in the USA exchanges.

Compared to other exchanges where ETFs are listed, the USA exchanges offer the most liquid, deepest and widest range of ETFs covering asset classes across the world.

Yes, there is a USA withholding tax of 30 per cent on all dividends paid to non-US citizens/residents. This is the same tax exposure if you were to invest in any dividend paying USA-listed ETFs.

SqCash is a temporary holding account for your monies. When you deposit into SqCash, your monies are held pending allocation to fund a few SqSave investment goals you set up. It gives you the convenience of depositing only once instead of multiple deposits to fund a few investments goals.

No, SqCash is a temporary holding account for your money, pending your investment decision.

Currently, SqSave does not accept joint accounts.

Usually, policies on employee investment restrictions are in place to address insider dealing or conflicts of interest concerns. These may involve dealing restrictions in securities where one has possession of material non-public information concerning such securities, or disclosures/approvals before dealing in securities.

SqSave invests solely in Exchange-traded Funds ("ETFs") using AI-driven technology to execute investment decisions. ETFs are commonly excluded from such restrictions as the employee does not have control over the basket of securities underlying the ETF. While company policies may not distingush ETFs or exempt ETFs from dealing restrictions, it is adviseable to consult your relevant compliance/supervisor before opening your SqSave account.

If needed, SqSave will provide confirmaton in writing that the SqSave account is a discretionary investment management service if your employer/organisation requires one to meet its compliance requirements.

Please contact us at clientservices@sqsave.com if you have further queries.

The purpose of the Customer Knowledge Assessment (CKA) is to assess if you have the knowledge or investment experience to understand the risks and features of “Specified Investment Products” (SIP) - in particular, Exchange Traded Funds (ETFs), before SqSave recommendations are made to you or before your SqSave account is approved/activated.

SqSave does not offer tax advice or tax planning services in our investment portfolios.

Global ETF portfolios invest in ETFs that are listed on USA stock exchanges. Hence, USD funds are required for settlement of such transactions. Accordingly, all non-USD currencies including SGD funds are converted into USD in order to invest.

Is there a cost to any currency conversion to USD for investing in the SqSave Global ETF portfolios?

All foreign currency conversions attract a cost. These currency conversion costs are imposed by third parties. SqSave will work with such third-parties to mitigate these costs. In the case of SqSave's appointed broker, Tiger Brokers (Singapore) Pte. Ltd. has committed to fixing the cost of currency conversion at 40 basis points to be embedded in the applicable FX rate.

No. You are not required to open a Central Depository Account to start investing with SqSave.

The definition of “Accredited Investor” (“AI”) is stipulated by the Singapore Monetary Authority (“MAS”) Section 4A(1)(a) of the Securities and Futures Act, Chapter 289 of Singapore (“SFA”).

- Net personal assets ("NPA") exceed S$2 million (or its equivalent in a foreign currency), but net equity of primary residence capped at S$1 million of the S$2 million thresholds[1] or

- Net financial assets[2] ("NFA") (net of any related liabilities) exceed S$1 million (or is equivalent in a foreign currency); or

- Income in the preceding 12 months is not less than $300,000 (or its equivalent in a foreign currency); or

- A person who holds a joint account with an accredited investor, in respect of dealings through that joint account[3].

[1] An individual's primary residence refers to where the individual lives in most of the time and is to be calculated by deducting any outstanding amounts in respect of any credit facility that is secured by the residence from the estimated fair market value of the residence; and is taken to be the lower of the following:

• the value calculated under paragraph (1);

• S$1 million.

[2] Where "financial asset" means:

• a deposit as defined in section 4B of the Banking Act;

• an investment product as defined in section 2(1) of the Financial Advisors Act, which includes securities, securities-based and other derivatives contracts, collective investment schemes, and life policies; or

• any other asset as may be prescribed by regulations made under section 341 of the Securities and Futures Act; or

[3] If all joint account holders individually qualify and have opted in for AI status, all joint account holders may be treated as an AI in respect of dealings through that joint account. For accounts where one or more joint account holders are non-AI, the joint account may be treated as AI if:

(a) at least one joint account holder is an AI and has opted in to be treated as an AI; and

(b) all joint account holders opt in to be treated as AIs in respect of dealings through the joint account only.

We are required under Singapore law to provide you with certain information before you decide on whether you wish to be treated as an Accredited Investor.

Even if we assess you to be an “Accredited Investor”, you may, but are not obliged to, consent to being treated by us as an Accredited Investor. You may withdraw your consent at any time, upon which we will cease to treat you as an Accredited Investor.

As an accredited investor, you will, among other things, be deemed to have more knowledge and ability to understand and manage the risks of the financial products that you invest in. We can assume that you have a certain level of understanding of financial products and are not obliged to determine your precise level of understanding of such products. We are also allowed to assume that you have sought independent advice prior to purchasing or participating in any financial instrument or investment. In addition, when you hold certain financial instruments or participate in certain activities, you will be afforded fewer statutory protections and remedies than retail investors.

"To be classified as an AI, you must opt-in by choosing the option presented to you in our account opening process to be identified as an “Accredited Investor”. This Accredited Investor Opt-In may be subject to our verification that you meet the prescribed requirements. To be clear, you may choose to be treated as a retail investor and avail yourself of the protection afforded by the relevant statutes such as the Securities and Futures Act (“SFA”) and the Financial Advisers Act (“FAA”).

Alternatively, you may complete and submit our opt-in form to clientservices@sqsave.com

Yes, you can revoke your status as an Accredited Investor at any time simply by giving completing and submitting our “Accredited Investor Opt-In Withdrawal Form” to clientservices@sqsave.com.

Your Accredited Investor Opt-In Withdrawal will take effect upon 7 working days after we receive your duly completed Opt-In Withdrawal Form.

However, subject to any rights, applicable terms and conditions, your account, investments, holdings and/or dealings prior to the Accredited Investor Opt-In Withdrawal becoming effective will not be affected. You can hold on to your existing investments.

Once your Accredited Investor status is revoked, we will not be able to offer you certain products and services that are deemed unsuitable for retail investors. We may not be able to assist you if you would like to receive further advice, purchase new investments, make new subscriptions, receive information or advice on new products or switch out existing investments and/or carry out any other transactions when or after the Opt-In Withdrawal becomes effective. For the avoidance of doubt, we will not be liable to you under any circumstances for any losses that you may suffer as a result of you opting out from being treated as an Accredited Investor.

No, investments made using SqSave are not covered by the SDIC because we and our brand operator, PIVOT, are not a bank. Banks have SDIC protection because if the bank fails, your money is at risk of loss. In contrast, your monies and investments with SqSave are held separately by trusted and fully licensed custodians in Singapore; Tiger Brokers (Singapore) Pte. Ltd., State Street Bank and Trust Company and United Overseas Bank Limited. As such, your monies and investments are safeguarded in the event that anything happens to SqSave’s brand operator, PIVOT.

Getting Started

The minimum age to open a SqSave account is 18 years old.

If you are a Singaporean/Singapore PR, you will need to upload your NRIC during account opening.

If you are a foreigner, your passport is required. Documents to prove a valid address such as a utility bill is required if you are residing outside Singapore.

There is no minimum sum required to open a SqSave account.

Aside from US citizens and US tax residents, almost anyone can invest with SqSave, subject to our client due diligence processes.

Go to www.sqsave.com, complete the SqSave Risk Profiler or decide your own risk profile. Submit an account online. We will email you an activation link once your account is approved.

Fret not. Simply play our proprietary SqSave Risk Profiler game to assess your risk profile.

We require your personal information for verification purposes and to comply with the regulations pertaining to applicable laws. Your information is needed for our machine learning AI to analyze and construct the most suitable portfolio based on your risk profile.

Log into your account at www.sqsave.com and set up at least one investment.

Depending on the investment you set up, SqSave may recommend the amount of savings required. Notwithstanding, you can decide to invest whatever amount you are comfortable with. Our system will generate a unique reference code and bank transfer instructions.

When SqSave receives your money transfer to fund your chosen investment, SqSave will email you that it has received your funds and will execute the necessary transactions based on the latest updated portfolio. This is because SqSave's machine learning AI predicted portfolio generated for you may have changed between the first recommendation and the time SqSave received your investment funds. The transaction orders will be sent to our broker-dealer for execution on the relevant market day, and failing which, on the next available market day.

There is no minimum balance to maintain and you are able to withdraw/redeem your investment(s) at any time.

No. You can withdraw/redeem your investment(s) anytime.

No. You can invest any amount you prefer. You can also deposit funds monthly or at any time. Our recommended amount is based on your investment and certain assumption. Ultimately, SqSave is here to assist, and you have full discretion as to how much you wish to invest.

Yes, the CKA is needed in our client screening process.

For Singapore citizens and permanent residents, your tax identification number is your NRIC number.

For non-Singapore citizen and permanent residents, you can find your tax identication number on your tax returns.

SqSave accepts online bank transfers. For regular savings, you can set up a recurring monthly, quarterly, or annual transfer to MoneyBox via your personal online banking facility. Add us to your payee list in your online bank account, then enter your desired recurring deposit amount and one of the above frequencies. Click here for further instructions.

Investment Management

Yes, our SqSave Digital Asset Allocation System has screened a select pool of ETFs which cover developed and emerging equities, fixed income, commodities and currencies.

Based on the investor's risk profile and entry timing, each investor will have a unique portfolio asset allocation composed of a selection from among the selected pool of ETFs.

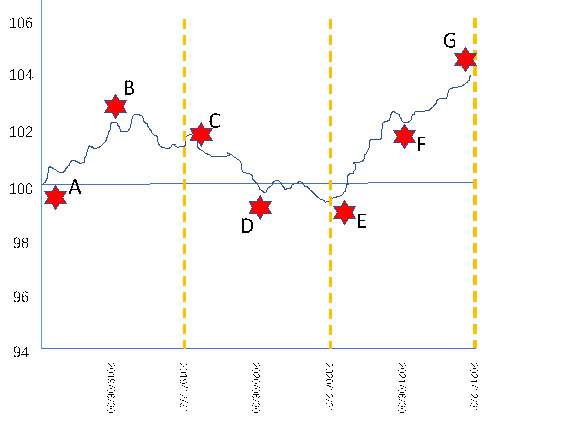

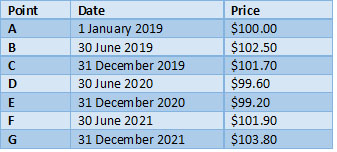

For each portfolio set up by you, our SqSave Digital Asset Allocation System (“DAAS”) will generate an indicative NAV (that measures the value of your portfolio adjusted for inflow and outflow of investment money). The indicative NAV is a unit value method to distinguish the different cost entry whenever investment money is topped up/withdrawn during the calendar year.

Any dividends received will be credited to the cash allocation component of your investment portfolio, and will be reinvested at the next rebalancing.

Yes. Every SqSave portfolio that is recommended for you has a specific reference benchmark. The reference benchmark is based on an asset allocation that is within the probable asset class allocation ranges of your recommended portfolio. We assess the performance of your recommended portfolio by comparing the Sharpe Ratio and Max Drawdown with that of the reference benchmark. For an understanding of the Sharpe Ratio and Max Drawdown, please refer to the relevant section in our FAQ.

If your portfolio underperforms the adjusted high-water mark, any underperformance is tracked and has to be recovered by any subsequent outperformance before a performance fee can be accrued.

If there is already a performance fee accrual during the calendar year, the accrual will be reduced to reflect any subsequent underperformance, although this will not be reduced below zero. To be clear, where there is outperformance over the full calendar year which results in a performance fee being charged, and this is followed by underperformance in subsequent calendar years, there will be no refund of prior year performance fees.

As can be seen from the above illustration, the benchmark hurdle is applied to the high-water mark to calculate an adjusted high-water mark, which the net asset value must exceed before there can be an accrual of performance fees. Note that you may be subject to different performance fee accruals depending on holding periods/withdrawal dates.

Where this occurs and there is positive cumulative net excess return at the calendar year end, then a performance fee will be charged and the high-water mark/adjusted high-water mark will be reset to the net asset value (adjusted for cash top-ups and cash withdrawals) on the last calendar day of the year.

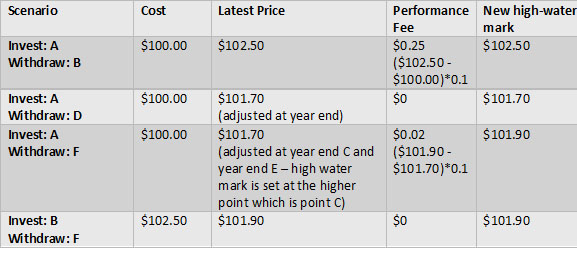

Our SqSave portfolios have consistently delivered respectable returns since their inception over five years ago. Click here for the current Performance Report.

In our simulations and back-testing, the SqSave portfolios behaved very well in terms of riding the volatile markets. The Sharpe Ratio outperformed all the top performing funds and the Maximum Drawdown was well controlled by comparison.

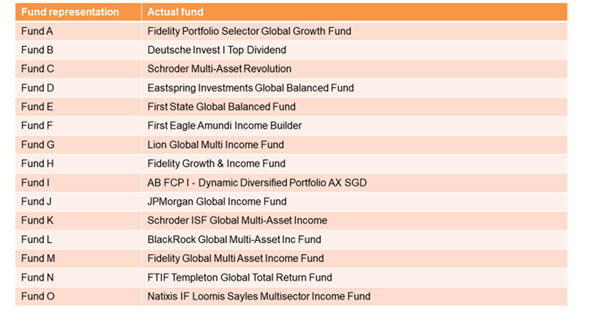

List of top performing funds used in the comparisons

Deposit and Withdrawal

Can I transfer money between my SqCash and (i) personal bank account (ii) my SqSave investment goal?

You can transfer money from/to your SqCash to/from your personal bank account at any time. Likewise, you can transfer money from/to your SqCash to/from your chosen investment goal at any time.

The unique reference code is tied to the specific investment goal you created. Funds received without the unique reference code will be parked in SqCash. You can proceed to transfer funds from SqCash to your chosen investment goal as desired.

Alternatively, please contact our customer service team at clientservices@sqsave.com for assistance.

No. You can only top-up with the same currency that you used when you funded the goal for the first time. Similarly for withdrawal, you can only withdraw in the same currency as the goal.

Top-up the total amount you would like to fund into your goals into SqCash (without quoting any reference code). Thereafter, go to My Account > + Deposit and allocate the desired amount to each and every goal.

You can transfer money into your SqSave account from a bank account that is in your name via:

(i) Internet bank transfer (GIRO)

(ii) FAST transfer

(iii) Telegraphic transfer (subjected to bank charges)

SqSave is not able to accept money from third-party sources.

SquirSqSaverelSave does not charge any fees for transferring money in or out of your SqSave account.

If you deposit/withdraw in SGD to/from your Global ETF Portfolio, there will be a 40 basis point currency conversion charge by our broker, Tiger Brokers (Singapore) Pte. Ltd. embedded in the FX rate.

If you deposit/withdraw in USD or any non-SGD currency to/from your Global ETF Portfolio, there are bank charges for sending and receiving Telegraphic Transfers ("TT") which you have to bear.

Yes, you can transfer funds from a joint bank account as long as you are one of the account holders.

It takes about 2-3 business days for your SqSave account to be funded, unless there are other factors involved.

Withdrawal of funds will require about 2-5 business days before the funds are credited into your bank account.

We currently accept Singapore dollars only.

Just like other SqSave portfolios you set up, you can set up a recurring monthly, quarterly, or annual transfer via your personal online banking facility. Add us to your payee list in your online bank account, then enter your desired recurring deposit amount and one of the above frequencies. Click here for further instructions.

Yes, you can. Simply login to your SqSave account and submit the withdrawal request.

We will facilitate the withdrawal of your portfolio cash balance and/or liquidation of your portfolio assets, in full or in part, whichever applicable, as soon as practicable.

There are no fees, charges or penalties for withdrawal or full closure of your SqSave account. However, all withdrawals are subject to payment of any accrued fees and charges, including performance fees.

Yes, as long as the bank account holder is in your name.

The unique reference code of a particular goal will be displayed when you initiate a deposit into the chosen goal.

Yes, we will send you email notifications for every transfer and withdrawal.

Managing Account

Your mobile number is used as login ID. Please contact our customer service team at clientservices@sqsave.com when you have changed your mobile number. For security purposes, we will require two-factor authentication when authorizing the new mobile number.

We could assist to update your personal particulars. Please contact our customer service team at clientservices@sqsave.com. For security purposes, we may request for supporting documents.

To reset your password, you can click on "forgot password" from the login page.

You may add and delete your bank accounts at My Profile > Manage Bank Account.

To close your account, please contact our customer service team at clientservices@sqsave.com

The default reporting currency is Singapore Dollars (SGD).

You can view and/or download your monthly statement under [My Profile].

Fees and Charges

An ETF typically charges low fees of around 0.15% - 0.25%. In contrast, mutual funds and unit trusts are relatively more expensive, charging fees that range from 1.25 - 2.0%, sometimes more.

There are no fees to open a SqSave account.

The Fees and Charges for the Global ETF portfolios are (i) Annual Management Fee (ii) Performance Fee.

(i) Annual Management Fee

0.50 per cent per annum - calculated and paid daily based on the daily average market value of portfolio assets.

(ii) Performance Fee

10 per cent of the annual absolute USD return with USD highwater mark, calculated based on each portfolio's (goal's) underlying USD value after each calendar year-end, and paid in arrears.

No. SqSave does not charge you any sales, subscription, redemption, custodian, withdrawal penalty or closing fees. All such fees and charges, if any, are passed through to you and imposed by third-parties over whom SqSave has no influence - although SqSave has on a best effort basis to reduce such third-party fees and charges.

Fees are automatically deducted from your portfolio(s). The Annual Management Fee is deducted daily while the Performance Fee is deducted after each calendar year end.

At SqSave, we want to align our interests with you. We only receive a Performance Fee when we generate a positive net excess return for you over the full calendar year, and with a highwater mark. This means we only get the Performance Fee when we really generate a return over the market cycles. We believe it also shows confidence in our long term performance.

Only where there is a positive cumulative net excess return at the calendar year-end or the end of your holding period (if shorter) subject to the highwater mark, will a Performance Fee become payable to us.

The Performance Fee is calculated as a percentage of the absolute return based on the original capital investment received (after conversion into the base USD value of the SqSave account goal). The Performance Fee is calculated once a year, at each calendar year-end.

Our calculations track when your investment capital was first invested and does so for every tranche of investment capital invested subsequently – so that the Performance Fee is applied to each tranche you invested in USD terms, and only if there is an absolute positive performance in USD terms. This approach covers the scenario of any withdrawal (in part or full before the calendar year end) in any capital investment tranche because every such withdrawal will trigger a review of whether a Performance Fee on the amount to be withdrawn is applicable.

The highwater mark is the highest value that your portfolio has reached since its inception.

The Performance Fee calculation is accrued only when the USD highwater mark is exceeded. This ensures that a Performance Fee is charged only when any previous losses have been recovered. The highwater mark for each portfolio will initially be set equal to the USD value of the portfolio when you start.

When you enjoy a positive cumulative net return in USD terms at the end of the calendar year and a Performance Fee becomes payable to us, the USD highwater mark will be reset to the net asset value (after adjusting for any cash top-ups or cash withdrawals during the intervening period) on the last business day of the calendar year. However, if your portfolio in USD terms has not exceeded the USD highwater mark over the full calendar year, no Performance Fee will be charged and the USD highwater mark will remain unchanged from the previous year.

For each portfolio set up by the client, our SqSave Digital Asset Allocation System (“DAAS”) will generate an indicative USD NAV (that measures the value of your portfolio adjusted for inflow and outflow of investment money). The indicative USD NAV is a unit value method to distinguish the different USD cost entry whenever investment money is topped up/withdrawn during the calendar year.

Whenever a withdrawal is made before the calendar year-end and when the calendar year-end arrives, the DAAS will calculate the Latest USD NAV (LNAV) and compare it with the Cost USD NAV (CNAV).

If LNAV > CNAV, then the Performance Fee will be charged. And if so, the LNAV is re-designated as the CNAV to ensure that any future Performance Fee is not duplicated (high-water mark feature). To be clear, there is no pro-ration of the Performance Fee if it is applied before the calendar year-end. .

If LNAV < CNAV, no Performance Fee is applicable. .

Where there is overlapping capital investment tranches involved when calculating the Performance Fee, our DAAS will adopt the “First-In, First-Out” principle.

If your portfolio underperforms the adjusted high-water mark, any underperformance is tracked and has to be recovered by any subsequent outperformance before a performance fee can be accrued.

If there is already a performance fee accrual during the calendar year, the accrual will be reduced to reflect any subsequent underperformance, although this will not be reduced below zero. To be clear, where there is outperformance over the full calendar year which results in a performance fee being charged, and this is followed by underperformance in subsequent calendar years, there will be no refund of prior year performance fees.

Security and Protection

Tiger Brokers (Singapore) Pte. Ltd. ("Tiger") is our appointed broker-dealer and custodian for all SqSave portfolios comprising exchange traded funds (ETFs) listed on US stock exchanges. Hence, all investment assets are technically held and owned by Tiger in a clients' account maintained for PIVOT Fintech Pte. Ltd. (SqSave's legal operator) on behalf of all SqSave clients. As account holder, PIVOT Fintech Pte. Ltd. is designated as a first level beneficiary of the assets by Tiger. As a client and investor of SqSave, you are recorded as one of the beneficiaries on our Portfolio Accounting ledger. Therefore, you are the ultimate owner of all invested assets in your SqSave Portfolios, which we hold on your behalf within the Tiger account.

For deposits made to a MoneyBox portfolio, your invested assets are securely held by a Singapore licenced custodian bank. The custodian maintains the accounts for the underlying Unit Trust Fund (UTF) represented in your MoneyBox portfolio. These UTF accounts ultimately pool together all underlying investors' assets, including those invested under SqSave's legal operator's name on your behalf. Therefore, just like your SqSave ETF portfolios, you are the ultimate owner of all assets you invest in MoneyBox portfolio.

To ensure that we never touch your money, we use custodian banks that hold your money and assets. Your monies and/or investment assets are kept entirely separate from PIVOT Fintech's (SqSave's legal operator) operating finances and assets.

Your investment assets are held by Tiger Brokers (Singapore) Pte. Ltd. as a Singapore licenced custodian.

Your SqCash deposited monies are held by United Overseas Bank Limited in Singapore (as a fully licenced Bank and custodian) in a clients' Trust account under PIVOT Fintech's name for you, together with all other clients' monies.

Therefore, you will always have full access and claim to your cash and invested assets if SqSave or its legal operator closes down, gets acquired, goes public, or whatever happens.

We have a secure server infrastructure hosted on Google Cloud Platform with 24/7 intrusion detection and other security measures. Our systems are audited and tested by third-parties to guard against cyberattacks with regular security code reviews and penetration testing.

Yes, we do. As a SqSave client, you must set up two-factor authentication (2-FA) when creating your account. When you log in from a new device or update your account, 2-FA will require you to enter a One-Time-Password (OTP) sent via SMS.

International Tax Compliance

FATCA is a USA law to enforce US tax laws on US persons using non-US accounts. Under FATCA, financial institutions in Singapore are to carry out reviewing procedures and disclose financial account information of account holders who are US Persons to the Inland Revenue Authority of Singapore (IRAS). You may refer to the US IRS for more information on FATCA.

The Common Reporting Standards (CRS) is an international agreement endorsed by the Organisation for Economic Co-operation and Development (OECD) for automatic exchange of financial account information in tax matters to deter an detect tax evasion through the use of offshore financial accounts. You may refer to the OECD or IRAS for more information on Common Reporting Standards (CRS).

The CRS requires financial institutions of participating jurisdictions to identify their account holders who are tax residents of other reportable jurisdictions. Relevant account information of these account holders would be reported to the local tax authorities, who would in turn exchange the information with the tax authorities of the participating jurisdictions where the account holders are tax residents.

You may refer to the Rules Governing Tax Residence published by the different jurisdictions. Alternatively, check with the tax authority of the jurisdiction which you think you may be a tax resident or consult a tax adviser.

Under the Singapore FATCA and CRS regulations, we are required to establish the tax residency status of all our customers. However, for accounts opened by individuals who are only Singapore tax residents, we are not required to report your information to the IRAS.

We may ask you for a copy of your passport or other government issued documentation to verify your identity or confirm your self-declared tax residency.

If there is any change in the information you have provided to us, you should inform us immediately so that we can discuss with you whether any other action is required. If you do not provide the requested certification, we may be required to report your details based on information available in our records to the relevant tax authority.

We are committed to being fully FATCA-CRS compliant. Hence, we will not be able to open new accounts or serve customers who choose not to comply with requests for documentation to establish status under FATCA-CRS.

Gift-a-Portfolio

In many cultures, it is common to give presents or even monetary gifts on special occasions. Sometimes, it is hard to think of a suitable gift. Will the recipient like it? Or does the recipient already have the gift I am giving?

SqSave's AI-driven investment portfolios are an excellent gift idea.

Compared to traditional gifts, an investment portfolio can grow with time. Instead of a gift that will suffer wear and tear over time, SqSave's Gift-a-Portfolio will grow with time and help encourage greater planning for the future by investing early.

You can Gift-a-Portfolio from as little as ONE Dollar! With such a small sum to start, you don't have to wait for a special occasion!

It's meaningful to nudge someone to start saving early. Be different! Instead of giving monetary gifts on festive occasions, Gift-a-Portfolio with SqSave!

Gift-a-Portfolio to Anyone, Anywhere, Anytime!

The Gift-a-Portfolio is managed by SqSave's AI machine learning system 24/7. It is hassle free for the recipient as there are no day-to-day decisions to make. All the hard work is done by SqSave.

You are gifting a global SqSave investment portfolio which comprises Exchange Traded Funds (ETFs) diversified across multiple asset classes.

Yes. You decide what type of SqSave portfolios to gift by choosing the risk setting. SqSave will create and invest in the latest portfolio at the time your recipient claims and accepts your gift. This means your recipient enjoys the power of our SqSave AI investment engine which is updated 24/7.

Yes. SqSave is not a trading engine, but an asset allocation service. We take a medium to long term view of at least one year. You can decide to set a minimum investment period for your Gift-a-Portfolio. One year is a good start although a longer period will allow the SqSave investment more time to ride out market volatility.

As SqSave clients need to be at least 18 years old, you should Gift-a-Portfolio to the parent or legal guardian of the intended recipient.

There is no cost for you to send a Gift-a-Portfolio. Unless otherwise specified or provided for in the case of any marketing promotions, the recipient will be levied the SqSave fees and charges upon acceptance of your gift like any other SqSave client investment.

Upon confirmation that your Gift-a-Portfolio is rejected by your intended recipient, the Gift-a-Portfolio amount will be refunded into your SqCash component of your SqSave account, usually within 3 to 4 business days.

Yes. Gift-a-Portfolio has a 14-calendar day period starting from the send confirmation and the end of which the intended recipient must confirm acceptance. If acceptance is not confirmed by the end of the 14-calendar day period, the Gift-a-Portfolio is deemed to be rejected and will be refunded to you as the giver into your SqCash component of your SqSave account.

Yes. You as Giver, will receive confirmations both via SMS to your mobile number as well as to your designated account email upon your recipient's acceptance of your gift.

You can Gift-a-Portfolio to as many recipients as you like, one submission at a time!

No. The Minimum Investment Period will be locked in after your recipient accepts your Gift-a-Portfolio.

Your recipient will be free to do what they wish with the gifted investments after the minimum investment period expires, including ability to do full withdrawal, shift to another investment with a different risk setting or transfer to his/her SqCash component of the SqSave account.

MoneyBox

MoneyBox is our cash management solution offering enhanced returns versus bank savings and retail fixed deposit accounts. It offers higher yet safe returns by presently investing in a combination of specially selected unit trust funds. You can deposit any amount without restrictions or withdrawal penalties. It can also be held conveniently until you're ready to shift into other SqSave portfolios created for longer term needs.

It's currently comprised of an allocation of 70% UOB United SGD Fund Class B Acc and 30% UOB United SGD Money Market Fund Class B. The Funds and allocations are reviewed and assessed annually with changes made if warranted to maintain or enhance risk adjusted returns.

No, you are free to invest in MoneyBox as long as you wish, without any obligation to invest in another portfolio for your SqSave account.

It currently takes about 2-3 business days for deposits to appear in your SqSave account (barring unforeseen factors), depending on the timing of your deposit. Faster processing is offered for SqCash transfers before 11:30am on any business day and before 10pm prior to next business days. Withdrawals currently typically take 3-5 business days to reach your bank account, barring unexpected occurrences.

We pool your deposits with other MoneyBox investors to get preferential access to institutional fund classes that are currently utilised. These classes offer lower underlying management fees versus those charged to retail investors.

MoneyBox management fees were revised from 1st July 2024 to 0.15% p.a. but are currently WAIVED in lieu of the Money Promotion until 31st Dec 2024.

This fee will be reviewed annually, and clients will be informed with sufficient notice if and when a decision is made to amend this fee in the future.

There are no minimum lock-in periods or other restrictions for your MoneyBox investment. This cash management solution offers an attractive return versus alternative options such as bank savings and retail fixed deposit accounts. These alternatives typically offer not only lower fixed returns but also commonly require relatively high initial fixed minimum deposits and subsequent top-ups. They offer higher rates on a tiered basis (albeit still lower than MoneyBox), with progressively rising minimum deposit thresholds. Some banks may offer promotional returns tied to minimum credit card spending levels, but these may also be subject to lock-up periods with fee penalties for early withdrawal. MoneyBox imposes no such lock-ups or withdrawal fees.

No. Your SqSave portfolios fees are charged on an individual basis while MoneyBox imposes a 0.15% annual management fee (i.e. waived in lieu of the Money Promotion until 31st Dec 2024).

Just like other SqSave portfolios you set up, you can set up a recurring monthly, quarterly, or annual transfer to MoneyBox via your personal online banking facility. Add us to your payee list in your online bank account, then enter your desired recurring deposit amount and one of the above frequencies. Click here for further instructions.

No, investments made in MoneyBox are not covered by the SDIC because SqSave and our brand operator, PIVOT, are not a bank. Banks have SDIC protection because if the bank fails, your money is at risk of loss. In contrast, your monies and investments in MoneyBox are held separately by our trusted and fully licensed custodians in Singapore; State Street Bank and Trust Company and United Overseas Bank Limited. As such, your monies and investments are safeguarded in the event that anything happens to SqSave’s brand operator, PIVOT.

MoneyBox Promotion 3

The MoneyBox Promotion 3 is an opportunity for investors (new and existing SqSave clients) to earn a 4% annualized return from now until 30 Jun 2025 (“Qualifying Return Period”). This applies to all MoneyBox portfolio deposits made during the period of 1 Apr 2025 to 30 Jun 2025 ("Promotion Period").

All existing and new SqSave clients with a valid SqSave account are eligible to participate in this Promotion.

Annualised returns of 4% will be calculated on all clients’ MoneyBox deposits received (including multiple top-ups) during the Promotion Period.

Yes, you can make partial or full withdrawals from your MoneyBox portfolio anytime during or after the Promotion Period. However, only your net remaining eligible MoneyBox deposit value AFTER any withdrawals made during the Qualifying Return Period will qualify for the 4% p.a. return. You will still earn prevailing MoneyBox net asset value returns on deposit amounts that you subsequently withdraw during the Qualifying Return Period.

You will receive a SqSave Top-up added into your MoneyBox portfolio within fifteen business days after 30 Jun 2025 . This Top-up , reflected in your subsequent monthly account statement, will be the difference between 4% p.a. and your actual MoneyBox p.a. return on eligible deposits you made within Qualifying Return Period.

- Open an SqSave account (if not already created) by registering at this Link

- Create a Moneybox portfolio in your Sqsave Account Login.

- Deposit monies into your MoneyBox portfolio during the Promotion Period to qualify for the 4% annualized return.

Yes, you can make multiple top-ups. Each top-up will be considered on its own in the calculation of the total eligible 4% p.a. returns value during the Qualifying Return Period.

For reference, the latest one-year MoneyBox return as of 28 Feb 2025 was 3.86% (net of fees charged by the underlying Unit Trust funds issuer).

If you make a full withdrawal of eligible deposits from your MoneyBox Portfolio before the end of Qualifying Return Period, you will not be entitled to the 4% p.a. returns. You will, however, still earn prevailing MoneyBox net asset value returns on eligible deposits up until your withdrawal date.

No, the 4% p.a. Promotional Rate is not guaranteed and should not be assumed to be. SqSave is offering the 4% annualised rate as an incentive.

Yes, SqSave may decide to make changes to the Promotional Rate at any time, without prior notice, but we will notify you of any such changes so as to give you an opportunity to withdraw from your MoneyBox investment if you are not satisfied with such changes.

DoGood

DoGood is a social investing idea developed by PIVOT Fintech Pte. Ltd. (201716150D), a Singapore incorporated company with registered address at 60 Paya Lebar Road #11-25 Singapore 409051 (“PIVOT”).

PIVOT is a Licenced Fund Management Company regulated by the Monetary Authority of Singapore (“MAS”) and operates a digital AI-driven investment system called “SqSave”.

DoGood is a crowd investing service to benefit a specified cause or Beneficiary with the aim of growing cash donations received by investing globally using SqSave's AI-driven investment engine over a given time period.

DoGood is a micro philanthropic initiative where you can gift investment portfolios to help someone build a financial nest egg for their future.

There is a need to offer cash donations that grow with time, and which can meet future needs.

Currently, donations are primarily made in cash. Often, the beneficiaries who receive cash donations need guidance on how to use the money wisely. Many who receive more cash than is needed do not know how to safekeep the excess cash or save for the future. Cash donations may not match needs, especially in the years ahead.

SqSave DoGood was created and designed to meet future financial needs especially for low-income families where there may be someone who will not be able to look after oneself when the parents pass on, with few or no relatives who can step in.

SqSave started DoGood to make it easy for anyone anywhere to invest anytime for someone deserving and who can benefit from the proceeds in the future.

Cash donations address current needs. SqSave DoGood addresses future needs.

The typical parties involved are:

- PIVOT is the investment manager.

- Sponsor: the party that identifies and recommends a cause or potential Beneficiary. The Sponsor is familiar with the Beneficiary's situation and longer-term needs and will partner PIVOT to benefit the Beneficiary.

- Beneficiary: the party that is screened and accepted formally by SqSave to be included in DoGood. The Beneficiary has longer term needs which can be supplemented by long term investments managed by PIVOT.

- Guardian: the party that acts for and on behalf of the DoGood Beneficiary if the Beneficiary is deemed legally unable to represent oneself. The Guardian is to act in the interests of the Beneficiary if the Beneficiary is underaged, of unsound mind, mentally incapacitated or physically disabled, and shall be the legal representative of the Beneficiary where necessary.

- SqSave or a Sponsor identifies a cause or potential Beneficiary.

- SqSave will screen the potential Beneficiary and/or Guardian for suitability in terms of current means, future means and future needs.

- If found suitable, the Sponsor, potential Beneficiary and/or Guardian is briefed about DoGood and all sign a DoGood Beneficiary Agreement.

- Once adopted by DoGood, the cause or Beneficiary's story is published on DoGood's online page as a menu feature in SqSave's website homepage. This page will outline the background, current situation and future needs, which encourages prospective donors to support the cause or Beneficiary's future needs. This is done by first opening a SqSave account and then gifting a DoGood Investment using your available SqCash balance.

DoGood focuses on building a nest egg for future needs. For example, DoGood is suitable for situations where there is a low-income family with a child suffering from Down Syndrome or other dilapidating conditions. Such afflictions may include cerebral palsy or other intellectual and/or physical disabilities that limit self-care or require additional care in the future adult years (when the current caregivers may no longer be able or pass away).

DoGood will screen causes recommended by Sponsors and will select Beneficiaries with priority given to low-income families.

SqSave will do a background check on history, current situation and future needs, including available family support and resources. SqSave will also assess current and future sources of financial assistance available. Generally, SqSave's DoGood eligibility for onboarding, among other factors, is a cap on per capita household income of SGD1,000 per month, with exclusions considered for household members deemed as removed or not relevant.

A Guardian is nominated by the immediate family of the Beneficiary.

DoGood is powered by the SqSave AI-driven investment engine which uses AI to invest globally and to manage risks 24/7 by diversifying across multiple investment assets based on statistical probabilities of future risks versus returns – which is humanly impossible.

The default setting is mid-risk or “Growth”. SqSave consults with the Beneficiary and/or Guardian/Sponsor before making the final decision.

Yes, the default is set at 5 years. However, SqSave will consult with the Beneficiary and/or Guardian/Sponsor before making the final decision.

- You must first open a SqSave account and then transfer intended DoGood investment monies to your SqCash balance.

- Within your SqSave account login, click the [DoGood] button, then select the cause or Beneficiary you wish to DoGood for by clicking the [Co-Invest] button.

- Enter the investment contribution amount and submit.

That's it.

Currently, there are none.

DoGood is essentially a SqSave Gift-a-Portfolio sent to a specified cause or Beneficiary. Once you DoGood for a Beneficiary, the legal ownership of DoGood investment monies is transferred to the Beneficiary.

As the Beneficiary becomes the legal owner of the DoGood investment, the reports are sent to the Beneficiary or to the appointed Guardian on behalf of the Beneficiary. The DoGooder will see a list of causes or Beneficiaries that have been adopted.

When the MIP ends, the investment is unlocked and the Beneficiary and/or Guardian as the case may be, can:

- Leave all or any of the proceeds to remain invested

- Withdraw all or any of the proceeds

- Top-up the existing investment

The Guardian will take over and hand control to the legally appointed administrator of the Beneficiary's estate, whether legally nominated previously for the Beneficiary, or by the State post.

CashBox

CashBox is our cash management solution offering enhanced returns versus bank savings and retail fixed deposit accounts. It offers higher yet safe returns by currently investing in a specially selected Fullerton Fund Management Company Ltd (Fullerton) fund. You can deposit any amount without restrictions or withdrawal penalties. It can also be held conveniently until you're ready to shift into other SqSave goals created for longer term needs.

Presently, it is 100% allocated to the Fullerton SGD Cash Fund- Class A (SGD). The Fund and allocation are reviewed and assessed annually with changes made if warranted to maintain or enhance risk adjusted returns.

No, you are free to invest in CashBox as long as you wish, without any obligation to invest in another goal for your SqSave account.

It currently takes about 2-3 business days for deposits to appear in your SqSave account (barring unforeseen factors), depending on the timing of your deposit. Faster processing is offered for SqCash transfers before 11:30am on any business day and before 10pm prior to next business days. Withdrawals currently typically take 3-4 business days to reach your bank account, barring unexpected occurrences.

SqSave management fees are currently set at 0.10% annually. This fee will be reviewed annually, and clients will be informed with sufficient notice if and when a decision is made to amend this fee.

There is no minimum lock-in period or other restriction for your CashBox investment. This cash management solution offers an attractive return versus alternative options such as bank savings and retail fixed deposit accounts. These alternatives typically offer not only lower fixed returns but also commonly require relatively high initial fixed minimum deposits and subsequent top-ups. They offer higher fixed payout rates on a tiered basis (albeit still lower than CashBox), with progressively rising minimum deposit thresholds. Some banks may offer promotional returns tied to minimum credit card spending levels, but these may also be subject to lock-up periods with fee penalties for early withdrawal. CashBox imposes no such lock-ups or withdrawal fees.

No. Your SqSave portfolios' fees are charged on an individual basis while CashBox will impose a minimal 0.10% annual management fee.

Just like other SqSave portfolios you set up, you can set up a recurring monthly, quarterly, or annual transfer to CashBox via your personal online banking facility. Add us to your payee list in your online bank account, then enter your desired recurring deposit amount and one of the above frequencies. Click here for further instructions.

No, investments made in CashBox are not covered by the SDIC because SqSave and our brand operator, PIVOT, are not a bank. Banks have SDIC protection because if the bank fails, your money is at risk of loss. In contrast, your monies and investments in CashBox are held separately by our trusted and fully licensed custodians in Singapore; State Street Bank and Trust Company and United Overseas Bank Limited. As such, your monies and investments are safeguarded in the event that anything happens to SqSave’s brand operator, PIVOT.

Last updated on 27 March 2025.