LATEST! APRIL SQSAVE PERFORMANCE: UP +7.3% TO +8.6%

Apr 30, 2021

Following our first quarter 2021 performance update, SqSave is pleased to see that our Tactical Asset Allocation (TAA) adjustments are delivering good results!

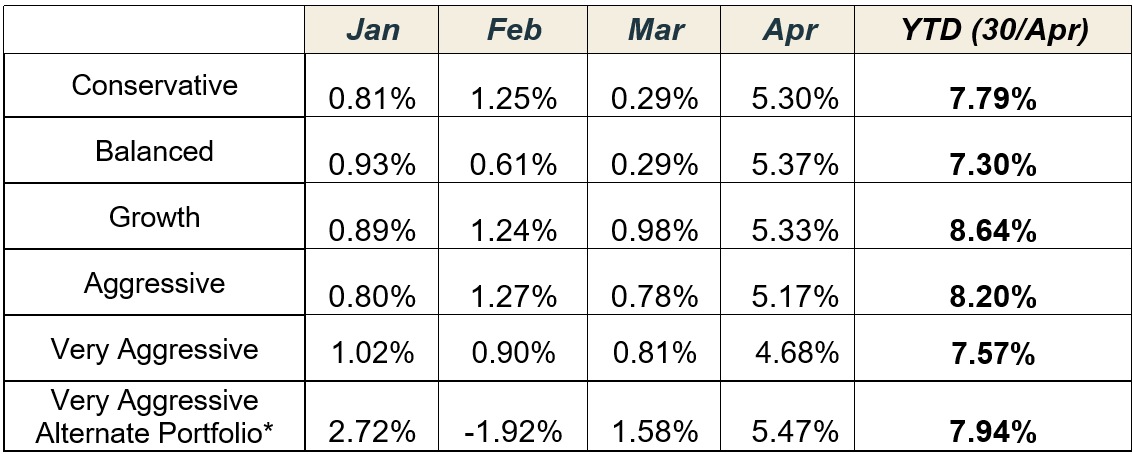

For YTD end-April 2021, our reference SqSave portfolios are up 7.3% to 8.6%.

Our actual portfolio performances* are highly consistent with our back-tested (using long-historical data) simulated results. While four months is a short period, we are confident our SqSave portfolios are well positioned for the months ahead.

SqSave Latest Performance in 2021 (SGD terms)*

Source: SqSave, Saxo Capital Markets

Figures are all inclusive of ETF expense ratios and net of SqSave management fees.

* This portfolio is tailor-made, for investors contributing a minimum initial SGD15,000 investment capital to a single goal.

Regards,

Your SqSave Quantitative AI Team

Victor Lye BBM CFA CFP®, Founder & CEO

Yuan Baosheng PhD, Computational Finance Strategist

* SqSave uses AI to design and manage diversified investment portfolios for each investor. Because SqSave is not an investment fund, there is no single return measure. Instead, every SqSave investor has his/her own investment performance as each investor is managed separately by our SqSave AI. As investors can withdraw and top-up any time, investment returns will be affected by individual investor decisions. Hence, SqSave uses reference portfolios which are actual portfolios managed on an ongoing basis, without any interference with withdrawals or top-ups, to measure investment performance.

Disclaimer

The contents herein are intended for informational purposes only and do not constitute an offer to sell or the solicitation of any offer to buy or sell any securities to any person in any jurisdiction. No reliance should be placed on the information or opinions herein or accuracy or completeness, for any purpose whatsoever. No representation, warranty or undertaking, express or implied, is given as to the information or opinions herein or accuracy or completeness, and no liability is accepted as to the foregoing. Past performance is not necessarily indicative of future results. All investments carry risk and all investment decisions of an individual remain the responsibility of that individual. All investors are advised to fully understand all risks associated with any kind of investing they choose to do. Hypothetical or simulated performance is not indicative of future results. Unless specifically noted otherwise, all return examples provided in our websites and publications are based on hypothetical or simulated investing. We make no representations or warranties that any investor will, or is likely to, achieve profits similar to those shown, because hypothetical or simulated performance is not necessarily indicative of future results.

More Articles more

SQSAVE PORTFOLIOS ARE UP +5.7% TO +7.0% IN FIRST QUARTER 2021

Team SqSave

At SqSave, we use data-driven Artificial Intelligence (AI) and Machine Learning (ML) techniques to optimize portfolio returns within projected risk parameters.

Read more

MY SQSAVE PORTFOLIO: +27% in 22 months (+14% per annum)

Team SqSave

As at end-Mar 2021, my SqSave portfolio is up +27% since June 2019 (or 14% p.a)… Here, you can see that my portfolio which started in June 2019 with just SGD 15,000 is now worth almost SGD 19,000.

Read more

Stay Invested & Reap Better Returns

Team SqSave

After years in investments, I realised that there was a limit to my capability. There is only so much information I can process within a given time. Yet, the world of investing was getting more complex.

Read more