Feb 2022 Update

SqSave ONE Dollar Reference Portfolios

Feb 5, 2022

Performance down in Jan 2022, but looking good since inception

As SqSave offers global portfolios from as low as ONE Dollar, we showcase the ONE Dollar portfolios below.

We track two actual ONE Dollar SqSave portfolios which started in May 2020.

SqSave Portfolios*

May 2020 to 31 Jan 2022

| Risk Setting | May 2020 | 31 Dec 2020 | % Return | 31 Dec 2021 | % Return | YTD 31 Jan 2022 | % Return | % Return (May 2020 to Jan 2022) |

|---|---|---|---|---|---|---|---|---|

| Conservative | $1.00 | $1.06 | +6% | $1.19 | +12.3% | $1.16 | -2.5% | +16% |

| Very Aggressive | $1.00 | $1.12 | +12% | $1.31 | +17.0% | $1.20 | -8.4% | +20% |

* Figures are inclusive of ETF expense ratios and net of SqSave management fees. SqSave uses AI to design and manage diversified investment portfolios for each investor. Because SqSave is not an investment fund, there is no single return measure. Instead, every SqSave investor has his/her own investment performance as each investor is managed separately by our SqSave AI. As investors can withdraw and top-up any time, investment returns will be affected by individual investor decisions. Hence, SqSave uses reference portfolios which are actual portfolios managed on an ongoing basis, without any interference with withdrawals or top-ups, to measure investment performance.

Asset Allocation shifted into Gold…

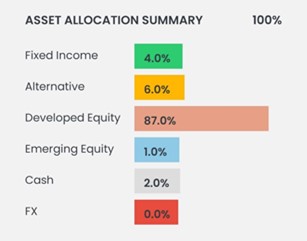

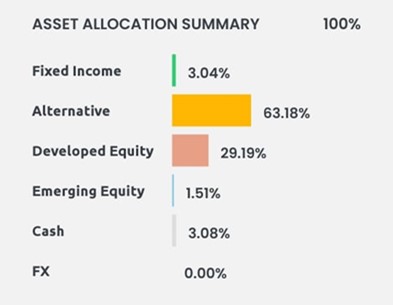

In this update, we compare the asset allocation as at 31 Dec 2021 and as at 31 Jan 2022 – for the Conservative Reference Portfolio.

Conservative Reference Portfolio

31 Dec 2021

31 Jan 2022

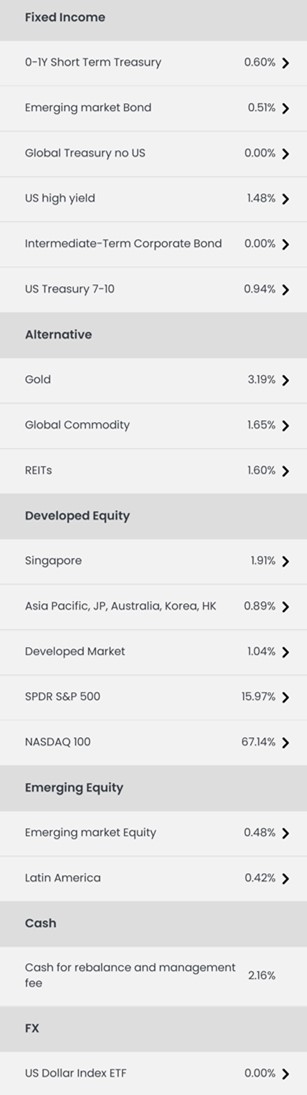

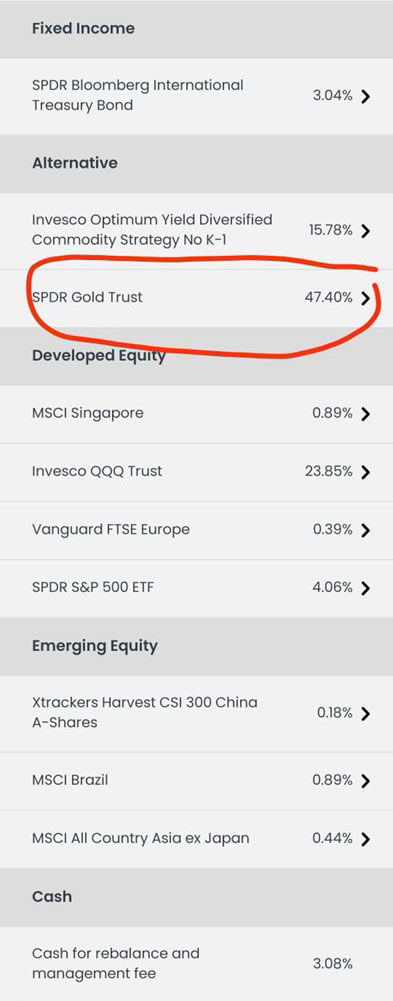

Note the significant increase in Alternative asset class and the drastic drop in Developed Equity. Even as the Fixed Income asset allocation remains somewhat similar at 3% to 4%, SqSave AI has reduced the number of Fixed Income assets from 6 in Dec 2021 to just one in Jan 2022. Instead, Gold has jumped significantly from just 3.2% in Dec 2021 to over 47% in Jan 2022.

…broken down into the following investments

31 Dec 2021

31 Jan 2022

What is SqSave thinking?

The last time SqSave had such a high Gold exposure was in Nov 2019. At that time, it was puzzling and exhaustive rounds of review were done to rule out human or data error.

It became clearer by Feb 2020 when market volatility increased significantly because of the rapid Covid-19 spread and impact on economic activity globally. As it turned out, the larger than expected Gold holdings helped SqSave’s reference portfolios weather the Covid-19 market crash in Feb 2020 until markets generally recovered in April 2020.

Our quantitative investment team believes that the SqSave reference portfolios will outperform when the current short-term correction ends.

With SqSave AI, it is possible to Invest Smarter! Sign-up at www.sqsave.com today!

Regards

Your SqSave AI Team

Disclaimer

The contents herein are intended for informational purposes only and do not constitute an offer to sell or the solicitation of any offer to buy or sell any securities to any person in any jurisdiction. No reliance should be placed on the information or opinions herein or accuracy or completeness, for any purpose whatsoever. No representation, warranty or undertaking, express or implied, is given as to the information or opinions herein or accuracy or completeness, and no liability is accepted as to the foregoing. Past performance is not necessarily indicative of future results. All investments carry risk and all investment decisions of an individual remain the responsibility of that individual. All investors are advised to fully understand all risks associated with any kind of investing they choose to do. Hypothetical or simulated performance is not indicative of future results. Unless specifically noted otherwise, all return examples provided in our websites and publications are based on hypothetical or simulated investing. We make no representations or warranties that any investor will, or is likely to, achieve profits similar to those shown, because hypothetical or simulated performance is not necessarily indicative of future results.

More Articles more

SqSave Reference Portfolios riding out short term volatility

Team SqSave

Volatile start to 2022 for both equity and bond markets

Read more

5 Investing Insights & Strategies From Chinese New Year Games

Team SqSave

Gambling is a huge part of the Chinese New Year festivities. Pick up some investment knowledge while enjoying these popular CNY games!

Read more

3 Smart Ways to Grow Your Child’s HongBao Money

Team SqSave

Financial literacy and saving for a rainy day is a life skill that you, as parents, should start teaching your young children.

Read more