Applying Serious Gaming

to Improve Risk Profiling Analytics

Victor Lye, CFA CFP®, Founder & CEO

Introduction

For too long, investing fundamentals have been muddied by unprofessional sales practices and top-down organisational incentives to push products. The end-consumer pays too much for something unsuitable. Despite best efforts by regulators, product pushing still prevails today – because the consumer unwittingly accepts it.

Playing on human greed and talking “returns”, the post-war baby boomers have chased returns between sporadic market crashes. As a result, many buy high and sell low.

Until the recent confluence of four democratizing drivers of (i) massive mobile computing power; (ii) ubiquitous digital connectivity; (iii) low cost cloud data storage; and (iv) social networking, the power has been top-down, driven by human greed and fear. Now, it should be bottom-up, driven by real-time data. Data brings artificial intelligence to life – and SqSave applies this to investing.

In this White Paper, we share how SqSave breaks new ground with gamification of risk profiling to restore some order to the muddied world of personal investing.

Risk Profiling in Practice

To protect consumers, reputable financial markets require risk profiling in the sales process. “Risk profile” is a catch-all term to identify investor factors and traits to identify suitable investments. Yet, risk profiling methods are mostly geared to sell a specific product [1].

Questionnaire-based risk profiling is the root problem. They are unreliable - explaining less than 15% of the variation in risky assets between investors [2]. Poorly designed with loaded questions that steer the consumer towards buying a product, there is no consensus or validation of what an adequate risk profile is. Therefore, it is an open question if investment products sold thereof are suitable [3].

When one asks why and from whom did you buy a financial product? The typical replies such as “I was told it’s good for me” or “from someone I know” are no surprise. It is a concern that many cannot describe the features and benefits of what they had bought, or rather, what they had been sold by a salesperson driven by sales targets and incentives.

The influence of the human salesperson in investor decisions is significant. A study found that risk tolerance questions covering time horizon, financial knowledge, income, net worth, age, gender and occupation could explain only 13% of why the investor portfolios were deemed suitable. However, the explanation rose to 32% when the human salesperson was included [2]. The evidence suggests that the salesperson influences the investor’s decisions more than the investor’s own objective considerations! Given the fees earned by salespeople, that can’t be good for the consumer.

How can we improve the odds in favour of the end-consumer?

Despite clear evidence that today’s human-biased risk profiling practices are inadequate, there is little innovation to improve.

What is a Risk Profile?

First, we need to understand the fundamentals of risk profiling.

Risk capacity refers to objective ability to take on risk. It depends on the investor’s investment horizon, liquidity needs, income and wealth, among other factors.

Risk aversion refers to subjective psychological traits and emotions which drives willingness to take on risk of financial loss. Such emotional factors are difficult to test in passive risk profiling methods.

Together, risk capacity and risk aversion make up the “risk profile.” Investments are deemed suitable only if the risks are in line with the individual’s risk capacity and risk aversion.

Emotions in Risk Profiling

Unlike machines, people don’t necessarily do what they say [1]. The prevalent risk profiling questionnaire method does not assess investor behaviour adequately. That’s why behavioural finance research has grown because people don’t seem to behave according to classical theory assumptions of human rationality [4]. For example, people chase returns without any seeming awareness of the risks involved. It looks like they want risk for its own sake!

Studies have shown that individuals make quick decisions about risks guided primarily by emotions or intuition rather than rational considerations [5]. Further research discovered that the individual’s own risk aversion remained stable even throughout a stressful financial crisis but found an unstable component in the “perception of riskiness” [6]. Researchers found that investment markets are perceived as riskier than before when the crisis worsens and as less risky when markets recover [7]. Thus, people tend to buy high and sell low.

Modern Portfolio Theory & Behavioural Finance

At SqSave, we adopt the transparent and Nobel-prize winning Modern Portfolio Theory (“MPT”) as our underlying investment philosophy [8]. MPT posits that investors invest in a combination of risky assets classes, are inherently risk averse and accept more risk only if higher expected returns will outweigh the higher risk. Allocation across different risky assets is determined by the investor’s risk aversion. Further developments based on MPT assumes that investors face constraints and do not act solely to risk aversion (or tolerance) but also to risk capacity [9].

MPT critics challenge its underlying assumption that humans are rational wealth-maximisers. Indeed, behavioural finance established by Daniel Kahneman and Amos Tversky’s “Prospect Theory” showed that humans behave irrationally by seeking long shots over near-certain gains on the one hand and on the other, protect against unlikely losses while taking large risks to claw back large losses [10].

MPT prescribes rationally how markets operate while Behavioural Finance describes how irrationally people behave. Both investment management tools can complement each other.

Recognising this, SqSave incorporates “irrational” behaviour in its risk profiling process and “rational” portfolio design using MPT.

Implications for Better Risk Profiling

A questionnaire-based approach offers only one dimension of responses to questions already crafted. It presupposes that respondents understand the questions technically, culturally and contextually.

There must be a better practical way to identify objective traits and subjective biases in each person. Such a method must incorporate risk-reward trade-offs. There is no absolute necessity that the risk-reward scale should reflect the real investing world but should reflect the inherent “irrational” personal risk-reward bias.

As research has shown, there is a tendency that the risk perception will be skewed contextually with emotion, whether the choice to make is to take a bungee jump or to invest in global markets [11]. After all, behavioural economics is not confined to the narrow act of investing.

Applying Serious Gaming into Risk Profiling

Subjective risk aversion is hard to assess. We need to innovate beyond standardized questionnaires to identify individual risk-reward traits more reliably. At SqSave, we apply Serious Gaming to enhance our Risk Profiling analytics. “Serious Gaming” is the discipline of game design for a primary purpose other than pure entertainment. Series Gaming is increasingly applied in education, science or health. We believe it has great potential in finance, starting with risk profiling at SqSave.

SqSave Risk Profiler™

We apply Serious Gaming in our proprietary SqSave Risk Profiler™ - which incorporates both objective risk capacity and subjective risk tolerance components of your “Risk Profile”.

SqSave Risk Profiler™ poses risk-reward dilemmas in a sequence of random outcomes based on relative potential gains and losses. By using behavioural analytics and gamification, we assess an individual’s risk profile based on actual personal choices made in every risk-reward trade-off.

There are two main parts to the inaugural version of our SqSave Risk Profiler™

- Risk Capacity Assessment

We screen 5 key objective components, namely:

- Age

- Time Horizon

- Investment Knowledge

- Investment Decision Reliance

- Income Stability

These frame the analytic algorithms for the individual and across all respondents in aggregate based on (a) each objective factor; and (b) a combination of some and all the objective factors.

- Risk Aversion Assessment

Risk-reward choices are posed. Our analytic algorithms track the stage, the sequence and the context of each risk-reward decision made.

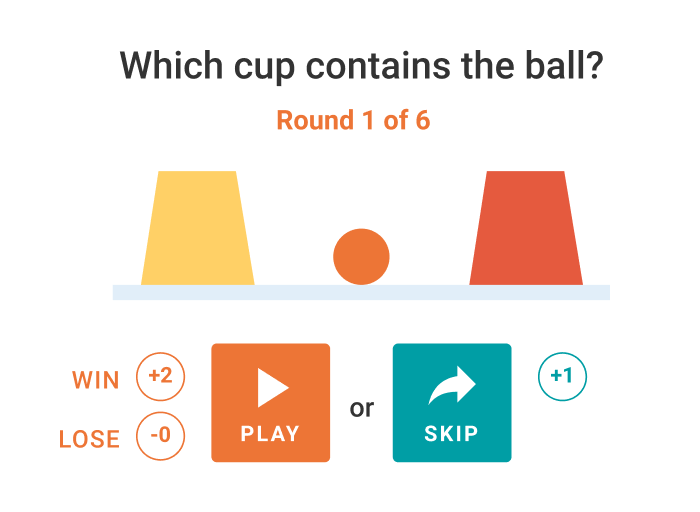

For acceptance and execution, our SqSave Risk Profiler™ is introduced as a “Guess which cup contains the ball” basic version (see Figure 1). The respondent must guess between two cups over six rounds of play in our inaugural game version. For each round, the first decision is whether to “Play” or “Skip” – based on reward and penalty rules defined for “guessing right”, “guessing wrong” and for “skipping the round”. The rules may change, and attention is required. The game results translate into a real reward which can be claimed by the respondent.

Our inaugural game is based on expected returns which prescribes rational behaviour. Yet, we have observed snaps of Behavioural Finance at work when respondents seemingly choose to take risks. Our SqSave Risk Profiler™ can track the individual behaviour against the “crowd” and across the objective risk capacity data to normalise and identify the underlying risk behaviour for application to our MPT portfolio design driven by machine learning AI.

We see tremendous potential in applying machine learning AI techniques to our Serious Gaming approach to identify an investor’s risk profile as we accumulate more data with time.

In future game versions, we will introduce the “time” element to capture reaction and decision times, as well as the overall time to complete the game. Another behavioural feature that we may apply is the variability of odds to proxy knowledge-driven behaviour. We can introduce potentially gender-biased games with time constraints after our inaugural version breaks new ground and gains acceptance as an innovative way of identifying inherent risk-reward behaviour.

Conclusion

MPT prescribes how markets operate while Behavioral Finance describes how humans behave. As SqSave, we incorporate both MPT and Behavioral Finance to design, implement and manage investment portfolios for our clients.

Risk profiling is the cornerstone upon which financial advice and investment recommendations are built. Yet, the prevalent questionnaire-based risk profiling has seen little innovation to account for inadequacies found by financial behaviour research. Such questionnaires are not empirically validated nor have scientific significance to serve investor interests first.

We believe that applying Serious Gaming into our proprietary SqSave Risk Profiler™ is a constructive step beyond the current risk profiling inadequacies to try and discover personal risk-reward behaviour for application to contextual needs such as global investing. We see tremendous potential in developing new and better ways to capture one’s innate behaviour through applied Serious Gaming techniques not just in investing, but also in risk protection (e.g. insurance), health, lending and rewards.

There is validity for our gamified risk profiling approach as suggested by studies of the 2007–08 financial crisis when stress and emotions ran high. The studies found that risk attitudes have a generally stable component over time but will shift with emotional stress. With more data gathered through wider demographic use of our SqSave Risk Profiler™, we will be able to index and track periods of heightened or dampened risk perceptions, across different objective and time-based frames.

[1] Davies, G.B., and P. Brooks. 2014. “Risk Tolerance: Essential, Behavioural and Misunderstood.” Journal of Risk Management in Financial Institutions, vol. 2: 110–113.

[2] Foerster, S., J.T. Linnainmaa, B.T. Melzer, and A. Previtero. 2014. “Retail Financial Advice: Does One Size Fit All?” NBER Working Paper No. 20712.

[3] Rice, D.F. 2005. “Variance in Risk Tolerance Measurement—Toward a Uniform Solution.” PhD Thesis, Golden Gate University.

[4] In 2002, Daniel Kahneman won the Nobel Prize for Economics for behavioural finance work that was done with his colleague, Amos Tversky in the 1970s. [5] Loewenstein, G.F., E.U. Weber, C.K. Hsee, and N. Welch. 2001. “Risk as Feelings.” Psychological Bulletin, vol. 127, no. 2: 267–286.

[6] Burns, W.J., E. Peters, and P. Slovic. 2012. “Risk Perception and the Economic Crisis: A Longitudinal Study of the Trajectory of Perceived Risk.” Risk Analysis, vol. 32, no. 4: 659–677.

[7] Weber, M., E.U. Weber, and A. Nosic. 2013. “Who Takes Risk When and Why?” Review of Finance, vol. 17, no. 3: 847–883.

[8] Harry Markowitz’s mean variance optimization was developed in the 1950s for which he was awarded the Nobel Prize in Economics in 1990.

[9] Sharpe, W.F. 1964. “Capital Asset Prices: A Theory of Market Equilibrium under Conditions of Risk.” Journal of Finance, vol. 19: 425–442.

[10] Daniel Kahneman and Amos Tversky, “Prospect Theory: An Analysis of Decisions under Risk,” Econometrica, 47 (1979), pp. 313-327.

[11] Tversky, A., and D. Kahnemann. 1981. “The Framing of Decisions and the Psychology of Choice.” Science, vol. 211: 453–458.

More Articles more

What You Should Know About Unit Trusts

April 18, 2019 | Victor Lye, CFA CFP®

Not everyone has the same gung-ho risk attitude. Yet there is a fear of losing out when you hear boasts from people who say how much money they made from investing. Read more

Why Replace The Human Investment Manager?

May 21, 2019 | Victor Lye, CFA CFP®

When investors ask me what I do, I cheekily tell them that I intend to replace their human investment manager. Read more

Smart Investing with Global Diversification at SqSave

Jun 13, 2019 | Victor Lye, CFA CFP®

Internet social media has shifted the

way news or facts are delivered and

perceived – with profound implications

for the way we should invest.

Read more