Risk Management Still Critical - As It Always Has @ SqSave

Nov 1, 2020

Markets are getting choppy…

In the past two weeks, the stock market has become choppy. Headlines scream about the largest fall since whenever. That’s obvious, right? When you compare a market fall versus a previous high, it’s always a good headline to get eyeballs. But isn’t that 20/20 hindsight?

…but let’s stay focused and calm

I know Halloween is increasingly popular in the developed east, and we did not get too hung up (no pun intended) when the 7th Month Ghost Festival came around – due to Covid-19 restrictions – but there is no need to scare ourselves into panic. Don’t forget – the major US markets are only several percentage points away from recent all-time highs.

As we enter the final countdown towards the USA Presidential election, COVID-19 is forcing us to choose between science and blind hope. You would have thought the choice is obvious. But remember, we’re human! We’re emotional.

While hope is a great mental medication, it is also important to set expectations in the ballpark of reality! That is where I believe the application of AI is useful in our world where data now is the new electricity.

USA leading the uncertainties…

Yes, the USA reported a whopping 33% jump in GDP – but don’t let that fool you. This sharp jump came off a record GDP collapse.

The USA faces more challenges ahead because Covid-19 is arguably poorly managed there. In the USA, there are 23 million receiving some sort of unemployment benefits.

For now, much will depend on the outcome of the USA elections, which itself is worrying given the potential for civil unrest in a sharply polarized nation. Here, the test of true leadership is without doubt, the ability to rally and unite in the face of crisis. We will have a clearer picture in a few weeks and months, not days. But the next few days will keep many of us on edge, trying to see which way the wind blows.

…but the problem is global

Across the globe, many more – especially the travel and hospitality, retail and informal sectors. My heart goes out to all affected, especially the lower income and self-employed / gig workers.

What do smart investors do?

As an investor, we need the economic fundamentals to go well. But as a shrewd investor, we need to anticipate and be positioned early. Not when the going is food, but when the going is bad. Not when everyone is bullish, but when gloom and doom set in. Right now, the mood is such that I want to remind ourselves not to be carried by the herd instinct, but to see through the fog.

There are no new lessons to share. But the same old ones, time and time again.

As a first example, I resurrect my old blog dated 9th March 2020 entitled, “Covid-19: Has Fear Run Ahead of Markets?” This was written at a time when I had no clue how the market would pan out. But at that time, I could sense the gloom and doom. So I felt to write about my past lessons to provide a compass for smart investors.

As it turned out, the “Covid Crash” which began on 19th Feb 2020 until 23rd Mar 2020 became a baptism of fire for SqSave. At least, we could see how SqSave navigated the Covid Crash.

Using the first SqSave portfolio which was invested in June 2019, we could track how SqSave walked through an actual market crash. The results were shared in my blog, “How My SqSave Portfolio Behaved Through the Covid-19 March 2020 Market Crash”.

The Investment Outlook

Shhh! To tell you the truth, it remains the same.

Huh? Well, if you are a trader, then you tend to take a short-term view. You will need to make daily or frequent decisions to:

- buy (mostly when markets are high);

- sell (mostly reluctantly as any market moves up causes you to think you might see more gains – “100% imaginary” – read my 7th Apr 2020 blog to understand why); or

- hold on for dear life until pessimism forces you to sell, mostly when it is already low.

As a smart investor, you look beyond what we already know.

Investment markets need to believe there is a global recovery. That will depend largely on:

- Global management of Covid-19

- Job creation and economic stimulus

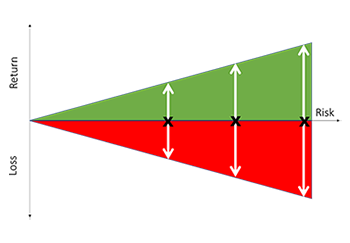

What is clear is that both will take time. And time is exactly what a smart investor should take advantage of. As I said in my last blog, is there “The Best Time to Invest?” – just start investing (not trade) and do so with regular top-ups. Choose your risk setting so that you are prepared to ride the inevitable market volatility. Remember, market volatility contributes to potential investment returns. Focus on investing for more than one year. If you are prepared to ride out the bumps over a time horizon of two to three years, you can invest with confidence.

Conclusion

At SqSave, we have made it possible for you to start with any amount, even ONE Dollar! You spend even more for one meal!

I have designed SqSave to do all the investing for you. All you have to decide is how much to deposit and your risk setting. No special knowledge needed or trading decisions. We do all the work. Enjoy low fees compared to traditional investment products. And yes, you can withdraw anytime.

All you have to do is open a SqSave account and let us do the smart investing for you. Connect to us at www.sqsave.com or download our mobile app from the Apple or Google app stores.

Regards

Victor Lye CFA CFP®

Founder & CEO, SqSave

Disclaimer

The contents herein are intended for informational purposes only and do not constitute an offer to sell or the solicitation of any offer to buy or sell any securities to any person in any jurisdiction. No reliance should be placed on the information or opinions herein or accuracy or completeness, for any purpose whatsoever. No representation, warranty or undertaking, express or implied, is given as to the information or opinions herein or accuracy or completeness, and no liability is accepted as to the foregoing. Past performance is not necessarily indicative of future results. All investments carry risk and all investment decisions of an individual remain the responsibility of that individual. All investors are advised to fully understand all risks associated with any kind of investing they choose to do. Hypothetical or simulated performance is not indicative of future results. Unless specifically noted otherwise, all return examples provided in our websites and publications are based on hypothetical or simulated investing. We make no representations or warranties that any investor will, or is likely to, achieve profits similar to those shown, because hypothetical or simulated performance is not necessarily indicative of future results.

More Articles more

The Best Time to Invest?

Team SqSave

Sorry to burst your bubble. There is no such thing as the best time to invest, unless you are a historian.

Read more

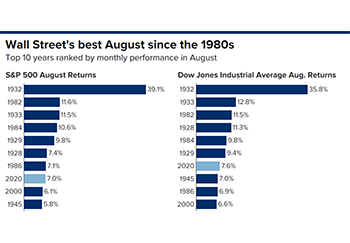

Market Update – 1 Sep 2020

Team SqSave

August 2020 has seen a recovery. While DJIA remains around 4% below its pre-Covid high, the S&P500 has finally broken through and setting new record highs.

Read more

Anyone Can Enjoy Smart Investing – Starting From One Dollar

Team SqSave

A one dollar global portfolio? Yes! SqSave is designed to help anyone invest with low cost, using the power of AI and global diversification.

Read more