HOW SQSAVE AI RISK-MANAGED PORTFOLIOS PERFORMED OVER TIME

Compare with your existing investments & consider our AI-investing approach

1 April 2022

This is not an April Fool’s Joke!

Unlike other well-advertised competitors, SqSave has focused on its 100% AI system to deliver value to our clients.

We believe good risk-adjusted returns - over the medium to long term – is of better value to you. Instead of fancy advertising splashed across various walls and screens, we will let our investment results speak for us.

We show actual client portfolios set up in the SqSave system since its beta version in 2019. We will present actual live portfolios for the standard labelled risk classes, namely1:

- Conservative

- Balanced

- Growth

- Aggressive

- Very Aggressive

For each risk class, we will show portfolios created at different points in time – and show the latest investment returns. In this way, you can get a sense of the returns over time. We believe that investments need time to ride out the inevitable volatility. In our investment analytics, we recommend investing for at least one year.

CONSERVATIVE

The earliest Conservative portfolio shown here was created on Valentine’s Day in 2020. This was 5 days before the Covid market crash on 19 Feb 2020. What timing! Even then, the portfolio navigated the Covid crash well enough to show an annualised return of 8.6% or a total return of 19.2% (after deducting management fees). That’s pretty good for a Conservative portfolio. The same money in a bank would have earned less than 1% over 2 years!

The Conservative portfolio created slightly over one year ago on 4 Jan 2021 shows an annualised return of 13.6%. Wonder how 13.6% p.a. compares to your low-risk investment somewhere else.

The latest Conservative portfolio shown here was set up on 11 Jan 2022. In just over 2 months, it has gained 5%! We do not wish to highlight short term returns, but it does give us a chance to share how our AI works. Read our 3 March 2022 blog “Insights into SqSave AI’s Dynamic Asset Allocation” here.

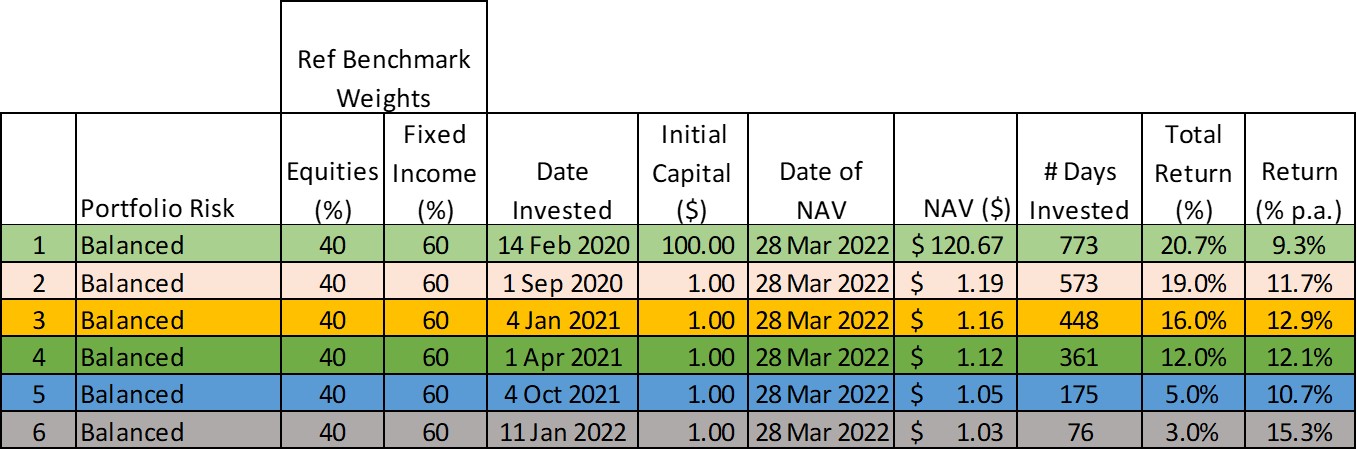

BALANCED

The Balanced portfolio set up on Valentine’s Day 2020 shows a total return of 21% and 9.3% per annum.

Compare the AI-driven SqSave returns achieved for the Balanced portfolios created after 14 Feb 2020 with your existing investments.

The SqSave Balanced risk portfolio created about one year ago on 1 April 2021 has earned a total of 12% while the Balanced risk portfolio created just over 2 months ago on 11 Jan 2022 has achieved 3% returns so far – despite the heightened market volatility since Dec 2021!

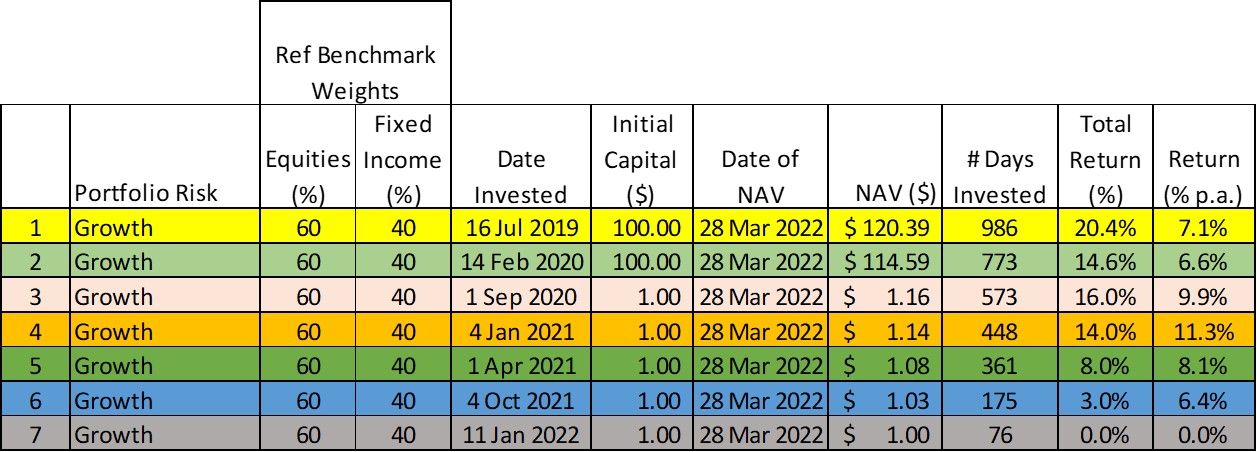

GROWTH

The earliest Growth portfolio was created on 16 July 2019, almost 3 years ago. This was a beta testing period. The same portfolio continues today with no additional deposits or withdrawals by the client. Hence, the returns are not distorted by the timing of deposits and withdrawals by the client. The performance is purely derived from the SqSave AI’s asset allocation decisions. This Growth portfolio has generated 20% over 3 years or 7.1% annualised.

The Growth portfolio created one year ago on 1 April 2021 shows an 8% return.

Notably, the Growth portfolio created on 11 Jan 2022 is flat.

Yes, the Conservative and Balanced portfolios (set up on the same 11 Jan 2022 date), were able to get positive returns in just over 2 months since inception. But the Growth portfolio is considered to have done well by avoiding big losses after 2 months of high market volatility.

Why? The Growth portfolio is a higher risk setting than Conservative and Balanced. Hence, the SqSave AI allows greater volatility exposure for the Growth portfolios. It is more likely that in short term bull phases, higher risk portfolios such as Growth will do better than the lower risk settings such as Conservative and Balanced. But in short term bear phases, the Growth is expected to lag the lower risk Conservative and Balanced portfolios. This is exactly what we are observing now.

AGGRESSIVE

The Aggressive portfolio set up on 14 Feb 2020 shows a total return of 19.2% and annualised 8.6% return. The Aggressive portfolio set up one year ago shows a total return of 9%.

Notably, the Aggressive portfolio set up in Jan 2022 is showing a negative 2% return. This is expected as higher risk portfolios swing more on the up and on the down. It is also worth noting that the Aggressive portfolio set up 6 months ago is doing better, at 3% total return. This underscores our investment belief that you should stay invested to ride out volatility. To understand that returns come from being exposed to volatility and time invested in the markets, read our blog “Stay Invested & Reap Better Returns” here.

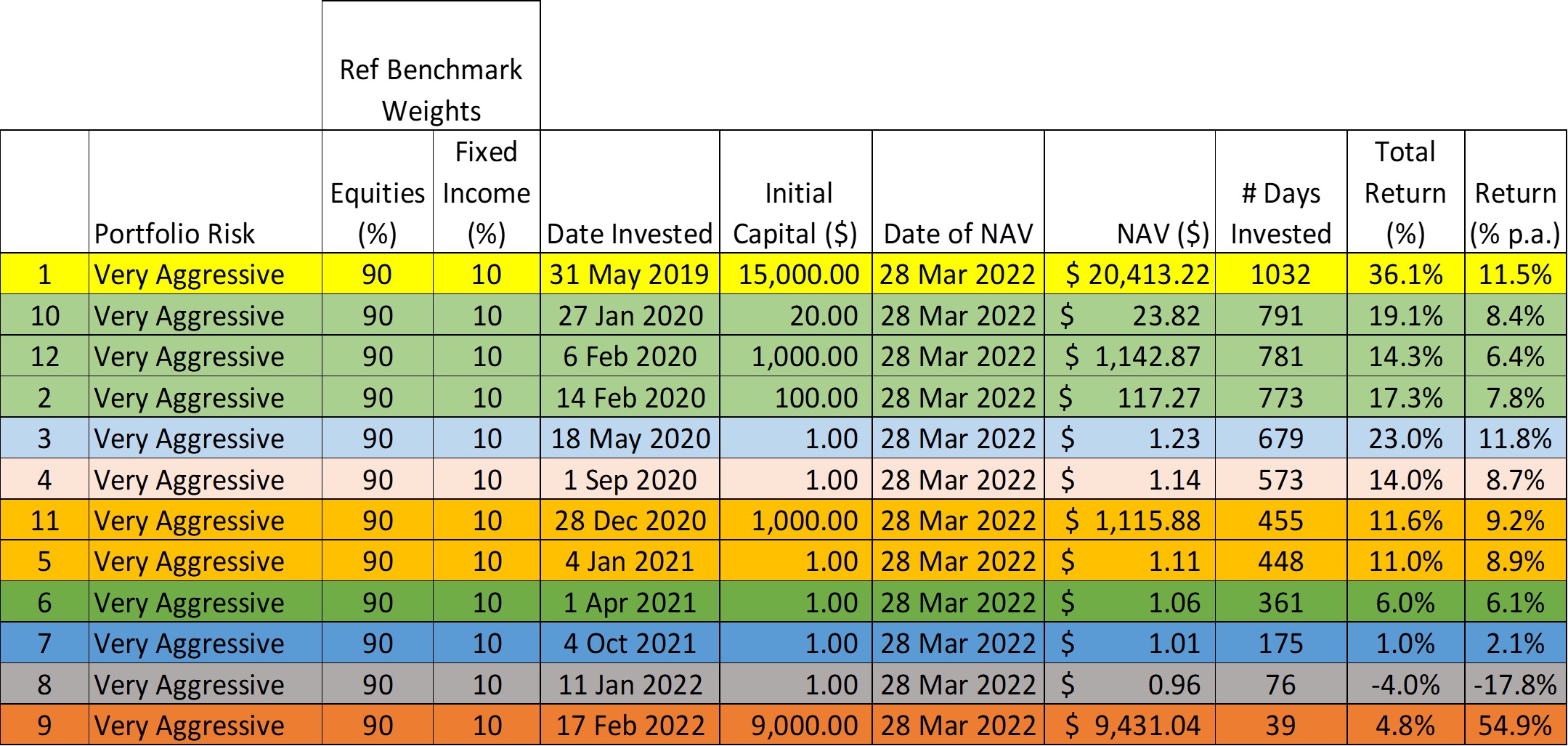

VERY AGGRESSIVE

We show many more Very Aggressive portfolios here.

Why? It is interesting to observe that most clients prefer to pick higher risk portfolios. It underscores our investment belief that risk is a psychological moving target. We explain why we need to assess the underlying psychology and why traditional risk profiling methods are biased – read our whitepaper “Applying Serious Gaming to Improve Risk Profiling Analytics” here.

Our earliest Very Aggressive portfolio was set up in June 2019 during beta testing of our SqSave algorithms. As it turned out, we continued the portfolio without any additional deposits or withdrawals to avoid distorting the performance. This is one of the SqSave Reference portfolios we track and it has achieved a whopping 36% total return and an annualised return of 11.5%. This was higher before the recent market correction which began in Dec 2021. As expected, higher risk portfolios will be hit more during periods of bearishness.

For the Very Aggressive portfolio set up slightly over 2 years ago on Valentine’s Day 2020 – 5 days before the Covid market crash happened – the total return is 17.3% and 7.8% annualised. Again, the return was much higher before the recent market correction.

At this point, it is worth sharing that such returns are unrealised returns. Until you actually exit your investment (sell), these are just numbers. You will get realised returns when you actually exit or sell. These are best done without stress and emotions. Read our blog about “Getting It Right: Realised and Unrealised Gains/Losses” here.

As the most experienced and the most embarrassed investors will tell you, we are human after all. We tend to “Buy HIGH & Sell LOW”. And when we do, we don’t boast about it!

COMPARE OUR RESULTS & LET THEM SPEAK FOR SQSAVE’S AI INVESTING APPROACH

We have shared how our different risk-managed SqSave portfolios have performed. This is a time of heightened volatility. It is during such times that we must be realistic about how investment returns behave based on the risk settings we have chosen.

It is important to be as cold and clear as possible in understanding how realistic our expected investment returns are.

Investment returns are not guaranteed. They are just a number until we exit or sell the investment. It is important to avoid “timing the markets” and to invest “time in the markets”. We need to expose to risk in order to get a chance of reaping returns. How we do it matters.

With our SqSave AI machine learning system, we have reduced the human emotion in investing. You can too.

Simply compare your human-driven returns with our AI-driven results. And don’t just pick your best memory or result. Look at it in totality across time and across all – for objectivity and realism.

But it is difficult. After all, we’re human. But with SqSave AI, a new choice awaits you.

Our AI-driven results speak for themselves. Our institutional grade quantitative AI algorithms make “Smart Investing for Anyone, Anywhere, Anytime” possible. And yes, for you too!

Regards

SqSave Quantitative AI Team

Disclaimer

The contents herein are intended for informational purposes only and do not constitute an offer to sell or the solicitation of any offer to buy or sell any securities to any person in any jurisdiction. No reliance should be placed on the information or opinions herein or accuracy or completeness, for any purpose whatsoever. No representation, warranty or undertaking, express or implied, is given as to the information or opinions herein or accuracy or completeness, and no liability is accepted as to the foregoing. Past performance is not necessarily indicative of future results. All investments carry risk and all investment decisions of an individual remain the responsibility of that individual. All investors are advised to fully understand all risks associated with any kind of investing they choose to do. Hypothetical or simulated performance is not indicative of future results. Unless specifically noted otherwise, all return examples provided in our websites and publications are based on hypothetical or simulated investing. We make no representations or warranties that any investor will, or is likely to, achieve profits similar to those shown, because hypothetical or simulated performance is not necessarily indicative of future results.

1 Note that these portfolios are actual client portfolios. These are not the Reference Portfolios for which SqSave tracks and reports investment performance from time to time.

More Articles more

COMPARE AI-DRIVEN vs HUMAN-DRIVEN INVESTMENT DECISIONS

Team SqSave

The recent market correction since Dec 2021 into Jan/Feb 2022 revealed how our investment AI system managed downside risks across our lowest risk to highest risk portfolios.

Read more

SqSave Conservative Portfolio up +3.65% for the month of Feb & 0.10% YTD

Team SqSave

In our 12 Feb 2022 blog, “SqSave AI seems to know something’s happening”, we shared our quant AI team’s observation of SqSave AI switching boldly out of Fixed Income instruments into Gold and Commodities – particularly for the lower risk Conservative & Balanced reference portfolios.

Read more

Insights Into SqSave AI’s Dynamic Asset Allocation

Team SqSave

In this blog, we share insights into SqSave AI which helped our low-risk reference portfolio achieve +3.24 per cent growth in the month of February 2022!

Read more