ADOPT A CALM AND DISCIPLINED INVESTING APPROACH

18 Jan 2023

It’s funny to see human psychology confused about investing and gambling.

When markets are rising, the FOMO (Fear of Missing Out) factor kicks in. Suddenly, everyone is keen to get a piece of the action. Much like how we chance upon a snaking queue – and tend to join the queue - thinking it must be really good food since so many people are willing to queue. But we seldom move to the front – fearing we will lose our place in the queue. Often, the queue was not for good food. Not even for bad food. Turns out the queue was for the toilet! We just didn’t have enough information to figure it out – until it was too late or when we finally got closer to the front of the queue to see the truth for ourselves! For many, their investing experience is just like that. This shouldn’t be!

At SqSave, we use a disciplined quantitative approach to invest globally, using diversification as the way to manage the ups and downs of investment markets. We are indeed learning in hindsight – the insights of our AI-driven dynamic asset allocation system.

“Time in the Markets”, Not “Time the Markets”

Sometimes, we have to grin and bear it as markets get choppy and returns are bad. Yet, we must remember that investing is not a short-term activity. Unlike short-term trading or speculating, investing requires a commitment to invest time in the markets – and not to time the markets.

In 2022, we faced a situation where equities and bonds were going down. All the classical theories did not work. Yet, we remained calm and focused on our data-driven approach. Remember that investment values are marked to market – and reflect only a number, until we decide to capitulate due to fear. Then, the number becomes a real loss.

Too often, people follow the greed and fear follow the crowd syndrome – and end up as poor investors, buying high and selling low. Stay the course and be committed to investing over a time period to ride out the inevitable highs and lows. Do not give in to trading or speculative behaviour.

What do latest data suggest?

As of mid-Jan 2023, data from major economies suggest a shift to cautious optimism that inflation may be tapering due to a pullback in energy and commodity prices. We will need more data to assess if inflation is indeed receding.

Central banks around the world have been aggressively raising interest rates to tame rising inflation. Rising interest rates threaten the stuttering global economy stalked by the volatile energy and commodities markets caused by Russia’s invasion of Ukraine.

Inflation has increased wage pressure and labour unrest. While core inflation has receded recently, the USA jobs market remains buoyant with nonfarm payrolls rising by 223,000 in December 2022. Unemployment fell to 3.5% and average hourly earnings rose 4.6% from a year ago. Likewise, the UK labour market is tight with pressure for higher wages in the face of double-digit inflation.

The US Federal Reserve and Bank of England are likely to continue raising interest rates to stave off cost-push inflation becoming entrenched.

The latest IMF forecast is that global inflation will dip to 6.5% in 2023, down from 8.8% in 2022.

China coming back into the game…

China’s reopening will ease inflation by helping supply chains function more efficiently and add to global demand in the coming months. Yet China’s population has fallen for the first time in 60 years, with India set to become the world’s most populous economy. China used to drive 40% of global growth, but not anymore. With a falling population, China will grow at a smaller rate. As it is, China registered below-average growth for the first time in 40 years in 2022.

If China stays the course with its current Covid-19 reopening agenda, the country will reach the IMF’s growth projections of 4.4% by the end of the year.

India calling…

Data suggests that India is relatively insulated from global economic slowdowns compared to other emerging markets. India has a large domestic market and is relatively less exposed to international trade flows. According to the World Bank, India will grow 6.6% in the 2023-24 fiscal year, a tad lower than the 6.9% in 2022.

India’s external position is stronger than before, with its current-account deficit adequately financed by improving foreign direct investment inflows and a large stash of international reserves.

Possible to see a bottoming out in 2023…

The IMF had downgraded its global growth forecast three times since October 2021. Now, the IMF sees a bottoming out and higher economic growth in 2024.

All said, we think the global economic growth outlook may not be as pessimistic as six months ago. Therefore, inflationary pressures may remain and interest rate hikes are not over.

Nonetheless, the markets seemed to have taken the knock in 2022 with some prospect of bouncing along in 2023. It remains to be seen if a slower rate hiking cycle with slower inflation will see investment markets recovering. The global semiconductor shortage has eased, and we think global supply may resume into the rest of 2023.

The hope that policymakers may be able to end the cycle of interest rate hikes, limiting potential damage to the global economy, would offer a boost to stock markets that took a hammering in 2022.

Best time to invest is when there is fear!

Investing during a crisis or when markets have fallen sharply – have almost always led to significant gains over a one-to-three-year investment time horizon.

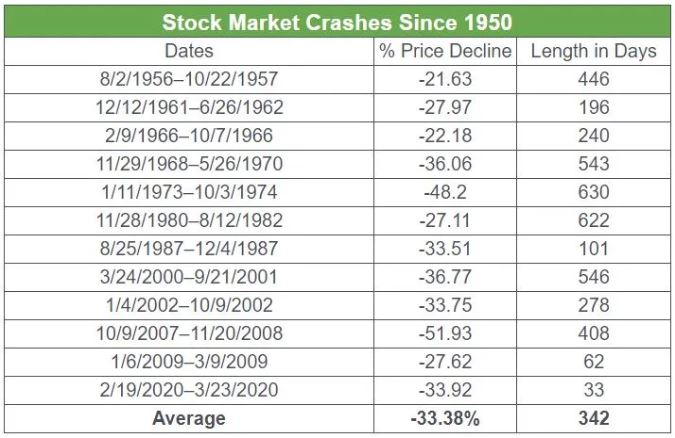

All you have to do is to review the past market crashes, corrections or bear markets. All these gave way to significant gains in the years after.

Source: Hartford Funds

For those who are younger, you can easily check the Covid market crash in Feb 2020 – when everyone was frightened, and investment markets tanked. Those who sold or stayed on the sidelines missed out badly when markets recovered.

The average bear market see falls of 33% from peak to trough typically lasting over eleven months. What’s worth noting is that investment market recoveries are even longer at an average of two and half years.

In 2022, the S&P 500 fell 25% at its lowest in Oct 2022 to be called a bear market. For calendar year 2022, the S&P 500 ended 19% lower.

Rather than try to call the bottom, the data suggests that investors should be investing when markets are down, and do so regularly over the chosen medium to longer investment time horizon. Probability and latest data seem to indicate the time is now.

So stay calm and be disciplined when investing.

Yours sincerely

Victor Lye, BBM CFA CFP®

Founder & CEO

SqSave Investment Team

Disclaimer

The contents herein are intended for informational purposes only and do not constitute an offer to sell or the solicitation of any offer to buy or sell any securities to any person in any jurisdiction. No reliance should be placed on the information or opinions herein or accuracy or completeness, for any purpose whatsoever. No representation, warranty or undertaking, express or implied, is given as to the information or opinions herein or accuracy or completeness, and no liability is accepted as to the foregoing. Past performance is not necessarily indicative of future results. All investments carry risk and all investment decisions of an individual remain the responsibility of that individual. All investors are advised to fully understand all risks associated with any kind of investing they choose to do. Hypothetical or simulated performance is not indicative of future results. Unless specifically noted otherwise, all return examples provided in our websites and publications are based on hypothetical or simulated investing. We make no representations or warranties that any investor will, or is likely to, achieve profits similar to those shown, because hypothetical or simulated performance is not necessarily indicative of future results.

More Articles more

Majority of SqSave’s Portfolios Outperformed Peers over Past 2-Years!

Team SqSave

As we approach the end of calendar 2022, we highlight how our SqSave algorithms have managed the lower risk portfolios under heightened market volatility.

Read more

2023 MARKET OUTLOOK

Team SqSave

We are dealing with extended anxiety in recent months. So far this year, the S&P 500 was down over 25% percent at its lowest closing level on 12 Oct 2022.

Read more

SqSave Outperforms Benchmarks over Past 1Y & 2Y Periods

Team SqSave

On a longer-term trailing 1 and 2-year basis, SqSave’s returns have mostly outpaced their benchmarks. In particular, our low to mid-risk portfolios have outperformed their benchmarks by 22.4%, 18.3%, and 10.4%, respectively. Following yet another month of wild market gyrations, SqSave’s reference portfolios managed to recoup some of their year-to-date downbeat performance.

Read more